Trading volume at PSX floor dropped by 73.84 million shares or 41.71%, DoD basis, whereas, the benchmark KSE100 Index opened at 42641.75, posted day high of 42641.75 and a day low of 41820.23 points during the last trading session while the session suspended at 41974.22 points with a net change of -667.53 points and a net trading volume of 53.37 million shares. Daily trading volume of KSE100 listed companies dropped by 52.93 million shares or 49.79% DoD basis.

Foreign Investors remained in a net selling position of 0.29 million shares and the net value of Foreign Inflow dropped by 0.62 million US Dollars. Categorically, Foreign Individual and Corporate Investors remained in net selling positions of 0.08 and 0.73 million shares but Overseas Pakistanis remained in a net buying position of 0.52 million shares. While on the other side, Local Individuals, Banks and Brokers remained in net selling positions of 3.53, 0.38 and 2.7 million shares, respectively. However, Local companies and Mutual Funds remained in net buying positions of 4.67 and 1.65 million shares.

U.S. stock futures and Asian share markets tumbled on Tuesday, while the yen jumped to four-month highs against the dollar after North Korea fired a missile over northern Japan, setting up a tense start to trading for markets in the region. S&P mini futures ESc1 fell as much as 0.85 percent on the news before paring losses to trade 0.5 percent below its close on Monday, when it was little changed. Japan’s Nikkei .N225 fell 0.7 percent to four-month low while South Korea’s Kospi .KS11 shed 0.5 percent, helping to drag down MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS 0.3 percent. North Korea fired a missile early on Tuesday that flew over Japan and landed in the Pacific waters off the northern region of Hokkaido, South Korea and Japan said, in a sharp escalation of tensions on the Korean peninsula.

Prime Minister Shahid Khaqan Abbasi has scotched speculation of devaluation of the rupee, saying his government is instead looking to curb imports through tariffs and help boost local production. "Devaluation is our option, theoretically, even though it should incentivize exports but in reality it doesn't," Abbasi said in an interview with Bloomberg News, a New York-based international news agency, at the former house of Quaid-e-Azam Muhammad Ali Jinnah in Karachi. "So at this moment as I said devaluation is not on the table." Pakistan's current account gap more than doubled to $12.1 billion in the year ended June while its trade deficit surged to a record $33 billion as imports climbed, Bloomberg News said in the dispatch.

The Habib Bank Limited (HBL) on Monday has decided to close down its operation in New York after New York State Department of Financial Services (NYDFS) imposed penalty of up to $629,625,000 on HBL. The NYDFS has imposed fine for violation of the compliance programme and the bank had not complied with the US anti-money laundering laws. The US authorities moved against the HBL after finding deficiencies in the risk management and Bank Secrecy Act/Anti-Money Laundering compliance programme at HBL’s New York branch. “HBL has voluntarily decided to close its operations in New York in an orderly manner and DFS has allowed HBL to submit a voluntary application for orderly winding down of its New York branch. Steps to formalise this will commence shortly,” according to a letter written by the HBL to Pakistan Stock Exchange (PSX) to intimate its members.

The government has decided to maintain the rates of petroleum products in the forthcoming month of September. Credible sources disclosed that there was no possibility of changing the petroleum products in the month of September. They stated that Oil and Gas Regulatory Authority (OGRA) would definitely send its summary but government would keep the rates unchanged. On the other hand, petroleum prices had decreased in international market.

The Punjab Revenue Authority (PRA) has achieved the target of collecting record amount of Rs82.8 billion in fiscal year 2016-17, registering a growth of more than 35 percent. This was stated by PRA Chairman Raheel Ahmed Siddiqui while speaking at the 13th, 14th and 15th balloting of Amanat Scheme (Restaurant Invoice Monitoring System) held under the aegis of PRA. Punjab Minister for Special Education Chauhdry Shafique Ahmed was the chief guest on the occasion. The PRA chairman said that it gave him a great sense of achievement in informing that the authority in a very short span of almost five years had made significant impact on enhancing the tax revenues for Punjab and a fine example of this is the continuous success in achievement of its assigned targets. He said the tax base in the corresponding period has also increased to 40,000 which is more than double the number of registered taxpayers when compared with the figures of 2014-15.

Auditor General of Pakistan has observed irregularities worth millions of rupees in the construction of Pakistan Petroleum House Islamabad. In the audit report 2015-16, the auditor general noted that agreement violation, contracts without bidding, changing the specification without the approval of the competent authority, overpayment etc was observed during the audit of the account of the Pakistan Petroleum House Islamabad. The PC-I of the Petroleum House project was approved by the CDWP in 2005 for an amount of Rs255.125 million. The PC-I was revised to Rs452.440 million in 2007 and again revised to Rs857.37 million in 2011. The execution of project was assigned to Pakistan Public Works Department.

The market is expected to remain volatile today. We advise traders to exercise caution, buying on gains and booking gains on strength is recommended.

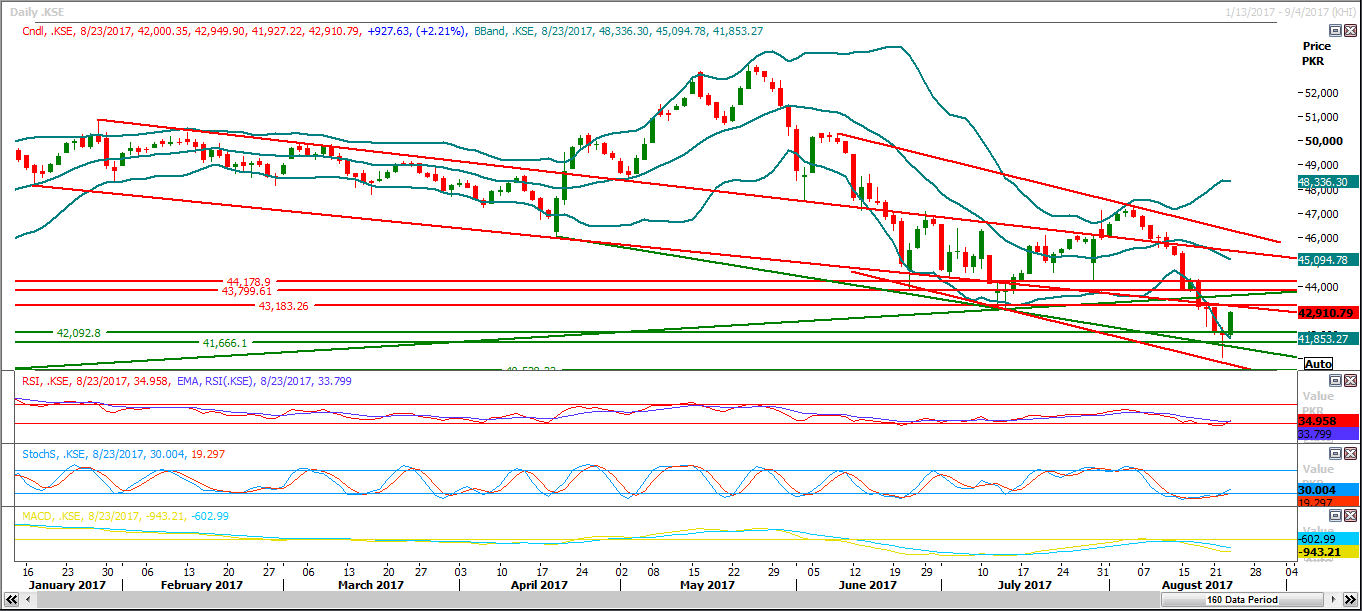

The KSE-100 Index closed below the supportive region at 42008, which may expose it to further negative sentiments despite of RSI and Stochastic giving an oversold reading on the daily chart. Traders are advised to stay cautious in today’s session, as the Index is likely to post a negative move towards its Intraday support placed at 41675, with the major diagonal support at 40680-40600 region. On the flip side, any attempts to recovery may be capped at 42070. However, a break above the said level may lead to 42585-42500 region in the sessions to come. Traders are advised to accumulate between 41675 and 40600.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.