Previous Session Recap

Trading volume at PSX floor dropped by 33.92 million shares or 15.59% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,730.05, posted a day high of 42,841.15 and a day low of 42,516.35 during last trading session. The session suspended at 42,544.47 with net change of -201.31 and net trading volume of 75.61 million shares. Daily trading volume of KSE100 listed companies dropped by 31.32 million shares or 29.29% on DoD basis.

Foreign Investors remain in net selling positions of 3.94 million shares and net value of Foreign Inflow dropped by 1.87 million US Dollars. Categorically Foreign Corporate remained in net selling positions of 5.05 million shares but Overseas Pakistanis remained in net buying positions of 1.10 million shares. While on the other side Local Individuals, Banks, Mutual Fund and Insurance Companies remained in net buying positions of 6.93, 0.41, 3.73 and 0.67 million shares respectively but Local Companies, NBFCs and Brokers remained in net selling positions of 2.36, 2.40 and 3.18 million shares.

Analytical Review

Asian shares, dollar becalmed awaiting trade news

Asian share markets were left in limbo on Wednesday as optimism over the U.S.-Mexico trade deal was quickly replaced by caution ahead of a looming deadline on tariffs with China. A flat finish on Wall Street and a dearth of major economic data across the region pointed to a quiet session ahead. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS edged up just 0.02 percent in early trade. Japan's Nikkei .N225 rose 0.3 percent, while EMini futures for the S&P 500 ESc1 added 0.11 percent.Wall Street offered little in the way of direction. The Dow .DJI ended Tuesday up a bare 0.06 percent, while the S&P 500 .SPX gained 0.03 percent and the Nasdaq .IXIC 0.15 percent.

LPG price hike triggers countrywide protests

Hundreds of rickshaw drivers held a series of protest demonstrations in the country against the rise in the prices of Liquefied Petroleum Gas (LPG). The price has seen a phenomenal increase in recent days and jumped from Rs120 to Rs 180 per kg thus triggering the protest. The protesters blocked main roads of the cities and blockade kept the vehicular traffic suspended for many hours. LPG, known as poor man's fuel is being sold above Rs150 per kg in Karachi, Rs180 in Lahore and twin cities while more than Rs210 in far flung and hilly areas. The gas refuel shops were found charging up to Rs200 to fill one kg gas. The 11.8 kg domestic cylinder was being sold between Rs1800-2000.

WB extends support to Pakistan

World Bank on Tuesday has extended its support to Government of Pakistan for implementation of the agenda for economic growth and social development being pursued by the new government. Hartwig Schafer South Asia Regional Vice President of World Bank made these remarks in a meeting with Minister for Finance, Revenue and Economic Affairs Asad Umar. Finance Minister welcomed the Vice President and stated that World Bank had been long standing development partner of Pakistan and had offered significant support to the Government over the years. He outlined that achievement of economic stabilisation is an important objective for government. The vice president also emphasized the importance of Human Capital Development, Macroeconomic Stabilisation and Inclusive Growth for Pakistan; and reaffirmed World Bank's support to Pakistan in these areas.

Pak-Turk trade volume can be raised to $10b: Envoy

Turkish Ambassador Ihsan Mustafa Yurdakul stressed that Pakistan and Turkey should aim to increase annual trade volume up to $10 billion that was achievable with stronger efforts from both sides. The bilateral trade between Turkey and Pakistan in terms of per capita was just around $2 which was quite negligible given the market size of 300 million people of both countries; the Ambassador said this while addressing business community at Islamabad Chamber of Commerce and Industry. He was accompanied by Demir Ahmet Sahin, Commercial Counsellor of Turkey. The Turkish Ambassador said that CPEC was a great project for Pakistan; however, the investors of Turkey were not fully aware information about business prospects in CPEC.

ECC to discuss fertilizer today

Economic Coordination Committee (ECC) of the Cabinet on Wednesday (today) will review fertilizer availability position in the country and discuss possibility of import of the commodity. Finance Minister, Asad Umar, as Chairman National Assembly Standing Committee on Industries and Production had urged the Ministry of Industries and Production (MoI&P) to import 0.1 million tons of urea and flood the market aimed at forcing local producers to bring down their prices.

Asian share markets were left in limbo on Wednesday as optimism over the U.S.-Mexico trade deal was quickly replaced by caution ahead of a looming deadline on tariffs with China. A flat finish on Wall Street and a dearth of major economic data across the region pointed to a quiet session ahead. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS edged up just 0.02 percent in early trade. Japan's Nikkei .N225 rose 0.3 percent, while EMini futures for the S&P 500 ESc1 added 0.11 percent.Wall Street offered little in the way of direction. The Dow .DJI ended Tuesday up a bare 0.06 percent, while the S&P 500 .SPX gained 0.03 percent and the Nasdaq .IXIC 0.15 percent.

Hundreds of rickshaw drivers held a series of protest demonstrations in the country against the rise in the prices of Liquefied Petroleum Gas (LPG). The price has seen a phenomenal increase in recent days and jumped from Rs120 to Rs 180 per kg thus triggering the protest. The protesters blocked main roads of the cities and blockade kept the vehicular traffic suspended for many hours. LPG, known as poor man's fuel is being sold above Rs150 per kg in Karachi, Rs180 in Lahore and twin cities while more than Rs210 in far flung and hilly areas. The gas refuel shops were found charging up to Rs200 to fill one kg gas. The 11.8 kg domestic cylinder was being sold between Rs1800-2000.

World Bank on Tuesday has extended its support to Government of Pakistan for implementation of the agenda for economic growth and social development being pursued by the new government. Hartwig Schafer South Asia Regional Vice President of World Bank made these remarks in a meeting with Minister for Finance, Revenue and Economic Affairs Asad Umar. Finance Minister welcomed the Vice President and stated that World Bank had been long standing development partner of Pakistan and had offered significant support to the Government over the years. He outlined that achievement of economic stabilisation is an important objective for government. The vice president also emphasized the importance of Human Capital Development, Macroeconomic Stabilisation and Inclusive Growth for Pakistan; and reaffirmed World Bank's support to Pakistan in these areas.

Turkish Ambassador Ihsan Mustafa Yurdakul stressed that Pakistan and Turkey should aim to increase annual trade volume up to $10 billion that was achievable with stronger efforts from both sides. The bilateral trade between Turkey and Pakistan in terms of per capita was just around $2 which was quite negligible given the market size of 300 million people of both countries; the Ambassador said this while addressing business community at Islamabad Chamber of Commerce and Industry. He was accompanied by Demir Ahmet Sahin, Commercial Counsellor of Turkey. The Turkish Ambassador said that CPEC was a great project for Pakistan; however, the investors of Turkey were not fully aware information about business prospects in CPEC.

Economic Coordination Committee (ECC) of the Cabinet on Wednesday (today) will review fertilizer availability position in the country and discuss possibility of import of the commodity. Finance Minister, Asad Umar, as Chairman National Assembly Standing Committee on Industries and Production had urged the Ministry of Industries and Production (MoI&P) to import 0.1 million tons of urea and flood the market aimed at forcing local producers to bring down their prices.

ATRL, SNGP, DGKC and EPCL would try to lead the negative momentum during current trading session.

Technical Analysis

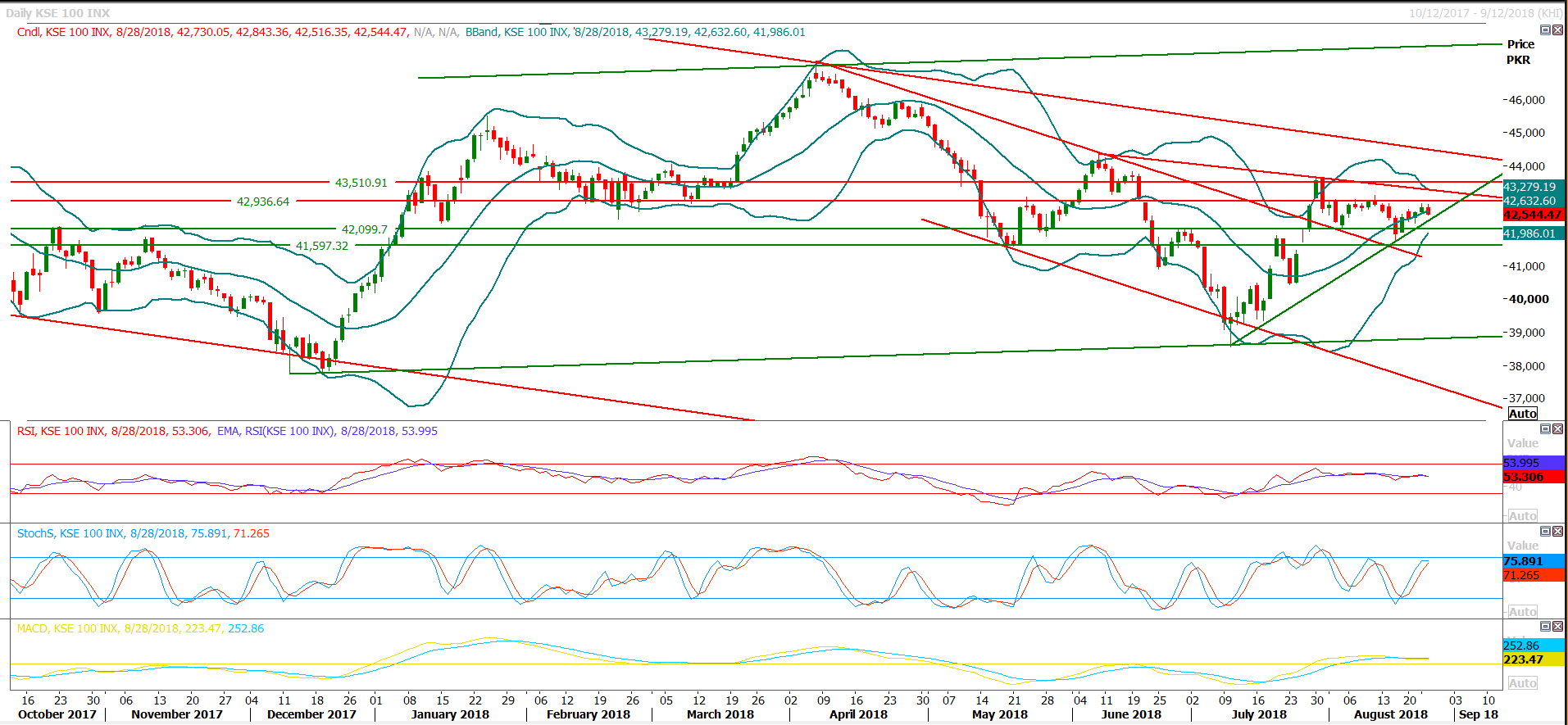

The Benchmark KSE100 Index have failed to penetrate its major resistant region of 42,860 during last trading session and now it’s going to target its supportive region at 42,089 points where it would find some ground from a strong horizontal support. Daily Stochastic and MAORSI have generated bearish crossovers and they would add pressure on index therefore its recommended to avoid initiating long positions and initiating short positions on spike would be preferable and beneficial during current trading session. Initially index would try to find support from 42,330 points but hourly closing below that region would call for 42,089 or 42,000 points. Bollinger Band on daily chart is shrinking and this is indication of an upcoming breakout of either 41,860 points or 43,330 points and a huge wave of volatility would be witnessed once this band would be penetrated on either side therefore strict stop loss on either long or short position would be treated as life line.

ATRL, DGKC, MLCF, FCCL, ISL, SNGP, EPCL and ENGRO would add pressure on index during current trading session as they have same technical formation one the index have on daily chart therefore its recommended to start selling these scripts on strength with strict stop loss on intraday basis.

ATRL, DGKC, MLCF, FCCL, ISL, SNGP, EPCL and ENGRO would add pressure on index during current trading session as they have same technical formation one the index have on daily chart therefore its recommended to start selling these scripts on strength with strict stop loss on intraday basis.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.