Previous Session Recap

Trading volume at PSX floor increased by 40.24 million shares or 20.19% on DoD basis, whereas the KSE100 Index opened at 40235.08, posted a day high of 40463.66 and a day low of 40031.34 during last trading session. The session suspended at 40371.31 with net change of 224.58 and net trading volume of 94.2 million shares. Daily trading volume of KSE100 listed companies dropped by 13.07 million shares or 12.19% on DoD basis.

Foreign Investors remained in net selling position of 3.58 million share but net value of Foreign Inflow increased by 0.56 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net selling positions of 2.38 and 1.22 million shares. While on the other side Local Companies and Banks remained in net selling positions of 5.25 and 37.84 million shares but Local Individuals, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 8.2, 1.42, 32.47 and 3.4 million shares respectively.

Analytical Review

Asian markets were ending 2017 in a party mood on Friday after a year in which a concerted pick-up in global growth boosted corporate profits and commodity prices, while benign inflation kept central banks from taking away the monetary punch bowl. MSCI’s broadest index of Asia-Pacific shares outside Japan inched up 0.2 percent as three straight weeks of gains left it within a whisker of decade peaks. The index has been on an upward trajectory for pretty much all of 2017, putting it 33 percent higher for the year so far. Hong Kong led the charge with gains of 36 percent for the year, while South Korea notched up 22 percent and India 27 percent. Japan’s Nikkei and the S&P 500 are both ahead by almost 20 percent, while the Dow has risen by a quarter. In Europe, the German DAX has gained nearly 14 percent, though the UK FTSE has lagged a little with a rise of 7 percent.

The National Electric Power Regulatory Authority (NEPRA) Thursday approved Rs 3.11 per unit reduction in power tariff for ex-Wapda distribution companies for the month of November under the head of monthly fuel adjustment formula. In a public hearing on a petition filed by Central Power Purchasing Agency (CPPA-G), the Nepra decided that a relief of Rs3.11 per unit or Rs 25 billion shall be passed on to consumers for the month of November. The hearing was chaired by Chairman Nepra Tariq Sadozai. In his comments, Chairman NEPRA raised question over the use of expensive generation plants and said that the closure of cheap power plants and running of expensive power plants is multiplying problems. The CPPA had filed a petition requesting a decrease of Rs1.47 per unit on account of fuel adjustment. CPPA had also requested to make old adjustment of Rs 15.77 billion in tariff but NEPRA rejected it which led to Rs 3.11 per unit reduction in tariff .

Minister of State for Finance, Rana Muhammad Afzal Khan Thursday said the government was devising a strategy to go after the tax-evaders and initially 10,000 people have been identified on the basis of data, saying they would be brought under tax net from next month. These potential taxpayers have been identified in different fields including education, property and other services sectors, Rana Afzal said in his first-ever interaction with a group of media persons after assuming the charges of State Minister for Finance. He said that on the basis of data obtained by the government, first batch of 10,000 potential taxpayers would be served notices in the beginning of next month (January). The minister said that in order to broaden tax net, an amnesty scheme was also under consideration to facilitate Pakistanis bring back their money from abroad. However, he was of the view that this scheme would be executed after thorough consideration.

The total liquid foreign reserves held by the country stood at $20,189.0 million on December 22. The weekly break-up of the foreign reserves position released on Thursday showed that foreign reserves held by the State Bank of Pakistan stood at $14,133.3 million and net foreign reserves held by commercial banks are $6,055.7 million. During the week ending 22nd December, SBP’s reserves decreased by $199 million to $14,133 million, due to external debt and other official payments.

Peshawar High Court (PHC) has suspended the third slab of cigarette brands introduced by Federal Board of Revenue (FBR) to control the illicit trade of cigarettes in the market. The court provided the interim relief to the petitioner. The petitioner pleaded before the court that Pakistan is the only country identified by the researchers where tax on the high sellable brands has been reduced by 33 percent against the World health Organization (WHO) Framework Convention on Tobacco Control. The petitioner said the recent changes brought in the Federal Excise Act 2005 and implemented in the Finance Act 2017 resulted in reduction in prices of brands instead of making them expensive.

It recommended to stay cautious while trading today as market is exptected to remain volatile.

Technical Analysis

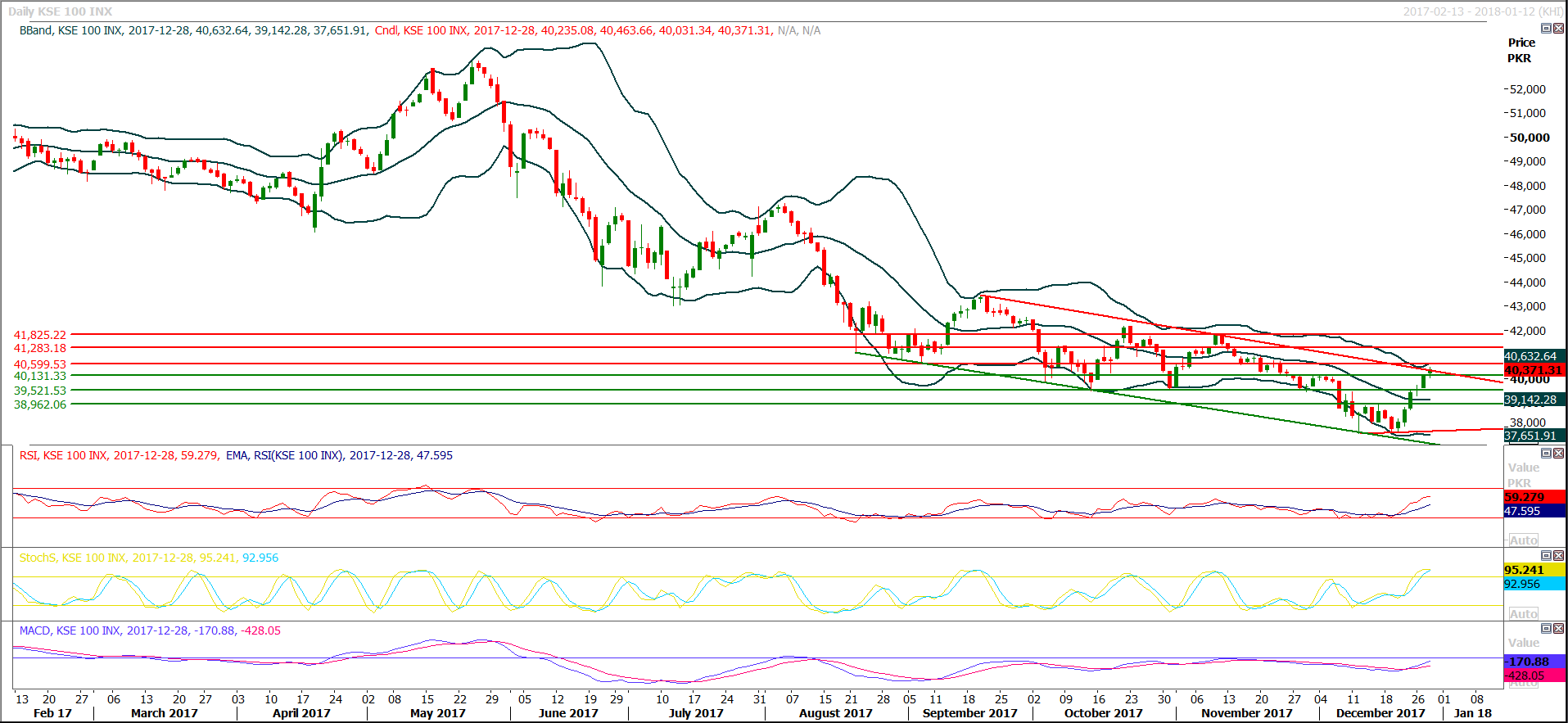

The Benchmark KSE100 Index have tried to penetrate resistant trend line of its bearish trend channel on intraday basis druing last trading session but closed exactly at that trend line therefore it needs to be very cautious while trading during current trading session. Its expected that index would open with a positive gap above 40400 which would provided strength for a rally towards 40590 which is resistance for current trading session. Today's closing above 40590 would clear market trend for 42800 points and also would create a hammer on monthly chart which would vanish impact of bearish trend on mid term basis. Its recommended to adopt swing trading strategy for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.