Previous Session Recap

Trading volume at PSX floor dropped by -9.48 million shares or 4.77% on DoD basis, whereas the benchmark KSE100 index opened at 42,539.23, posted a day high of 42,539.23 and a day low of 42,153.29 points during last trading session while session suspended at 42,299.19 points with net change of -240.04 points and net trading volume of 137.16 million shares. Daily trading volume of KSE100 listed companies also increased by 10.77 million shares or 8.52% on DoD basis.

Foreign Investors remained in net selling positions of 10.79 million shares and net value of Foreign Inflow dropped by 3.87 million US Dollars. Categorically, Foreign Individuals, Foreign Corporate and Overseas Pakistani investors remained in net selling positions of 0.06, 6.50 and 4.23 million shares. While on the other side Local Individuals, Companies, Banks and NFCs remained in net selling positions of 21.54, 3.69, 2.85 and 0.02 million shares but Mutual Fund, Brokers and Insurance Companies remained in net buying positions of 6.76, 29.68 and 1.98 million shares respectively.

Analytical Review

Asian shares turn red as Hong Kong tumbles on China virus

Asian shares erased earlier gains on Wednesday, swinging into negative territory as a spike in new Chinese virus cases sent Hong Kong stocks tumbling and fueled fears about the economic impact of the outbreak. MSCI’s broadest index of Asia-Pacific shares outside Japan skidded 0.52%. Hong Kong shares fell 2.8% on their first session after a two-and-a-half trading day break for Lunar New Year, led by declines in financial services, real estate, and consumer goods companies. However, Australian shares rose 0.57%, while Japan’s Nikkei stock index advanced 0.4%, partly because investors in these markets have already had a chance to react to the virus outbreak, which has claimed more than 100 lives. Oil futures built on gains in Asia after OPEC sources said the cartel wants to extend crude output cuts by three months to June, easing concern about excess supplies.

PM Khan orders speedy completion of CPEC projects

Prime Minister Imran Khan on Tuesday said the ongoing development projects under the China-Pakistan Economic Corridor (CPEC) should be completed on a fast-track basis and directed to give final shape to the consultation process of the future plans on priority. Lauding the time-tested friendship with the northern neighbour, he said China had always supported Pakistan during the difficult times and CPEC was a manifestation of the multi-dimensional partnership between the two countries. He also observed that Chinese experiences in the social sector, especially for the eradication of poverty and promotion of agriculture, must be fully explored, Prime Minister Office Media Wing in a press release said.

Senate committee clears Geographical Indications Bill

The Senate Standing Committee on Commerce on Tuesday approved the much-awaited Geographical Indications (GI) Bill which aims to protect commercial heritage of the country’s products. The Senate committee — led by its chairman Senator Mirza Muhammad Afridi — will now present the bill before the Upper House of the parliament for its consent. The Bill will then be forwarded to the National Assembly for its deliberations. The law was pending for the last 19 years due to differences between large lobbies leading to failure of market place regulation. The Ministry of Commerce has been working on the GI law since 2000. The draft has been vetted many times by the authorities concerned but no action was taken by the previous government. In the absence of this law, international brands continue selling Pakistan-origin goods causing loss to government exchequer.

Pakistan has made significant progress to get off FATF grey list: SBP chief

The State Bank said on Tuesday that Pakistan had made significant progress to get off the grey list of the Financial Action Task Force (FATF) while the central bank had been making all-out efforts to curb money laundering and terror financing. Announcing the monetary policy with unchanged interest rate of 13.25 per cent, State Bank of Pakistan (SBP) Governor Dr Reza Baqir said that the last two reviews in May and September showed that Pakistan had made significant progress in most of the 27 points raised by the FATF. However, he said, the FATF was the final authority to decide if the progress was enough to pull Pakistan out of the grey list, adding that the country would have to continue making progress in this direction. The State Bank, he said, had been constantly playing a role in curbing money laundering and terror financing which was in favour of the country.

Aptma flays increase in power tariff for export-oriented industry

All Pakistan Textile Mills Association (APTMA) Punjab Chairman Adil Bashir has urged Prime Minister Imran Khan and relevant authorities to review the decision of add-ons/surcharges increasing power tariff to 70 per cent retrospectively for the export-oriented industry. Addressing a press conference at APTMA Punjab office on Tuesday, he feared that the decision could lead to closure of mills that would render hundreds and thousands of workers jobless. Flanked by other office bearers, Adil Bashir lamented that the ministry had unilaterally increased power tariff to 13 cents per kWh to cover inefficiencies and make matters worse by imposing it from January 2019 in defiance of PM’s commitment, Cabinet and ECC decisions. He said that industries would not be able to pay huge amount which would result in bankruptcies and unemployment. He said Pakistani exports would not be able to compete with China, Bangladesh and India where power tariffs were 7-9 cents.

Asian shares erased earlier gains on Wednesday, swinging into negative territory as a spike in new Chinese virus cases sent Hong Kong stocks tumbling and fueled fears about the economic impact of the outbreak. MSCI’s broadest index of Asia-Pacific shares outside Japan skidded 0.52%. Hong Kong shares fell 2.8% on their first session after a two-and-a-half trading day break for Lunar New Year, led by declines in financial services, real estate, and consumer goods companies. However, Australian shares rose 0.57%, while Japan’s Nikkei stock index advanced 0.4%, partly because investors in these markets have already had a chance to react to the virus outbreak, which has claimed more than 100 lives. Oil futures built on gains in Asia after OPEC sources said the cartel wants to extend crude output cuts by three months to June, easing concern about excess supplies.

Prime Minister Imran Khan on Tuesday said the ongoing development projects under the China-Pakistan Economic Corridor (CPEC) should be completed on a fast-track basis and directed to give final shape to the consultation process of the future plans on priority. Lauding the time-tested friendship with the northern neighbour, he said China had always supported Pakistan during the difficult times and CPEC was a manifestation of the multi-dimensional partnership between the two countries. He also observed that Chinese experiences in the social sector, especially for the eradication of poverty and promotion of agriculture, must be fully explored, Prime Minister Office Media Wing in a press release said.

The Senate Standing Committee on Commerce on Tuesday approved the much-awaited Geographical Indications (GI) Bill which aims to protect commercial heritage of the country’s products. The Senate committee — led by its chairman Senator Mirza Muhammad Afridi — will now present the bill before the Upper House of the parliament for its consent. The Bill will then be forwarded to the National Assembly for its deliberations. The law was pending for the last 19 years due to differences between large lobbies leading to failure of market place regulation. The Ministry of Commerce has been working on the GI law since 2000. The draft has been vetted many times by the authorities concerned but no action was taken by the previous government. In the absence of this law, international brands continue selling Pakistan-origin goods causing loss to government exchequer.

The State Bank said on Tuesday that Pakistan had made significant progress to get off the grey list of the Financial Action Task Force (FATF) while the central bank had been making all-out efforts to curb money laundering and terror financing. Announcing the monetary policy with unchanged interest rate of 13.25 per cent, State Bank of Pakistan (SBP) Governor Dr Reza Baqir said that the last two reviews in May and September showed that Pakistan had made significant progress in most of the 27 points raised by the FATF. However, he said, the FATF was the final authority to decide if the progress was enough to pull Pakistan out of the grey list, adding that the country would have to continue making progress in this direction. The State Bank, he said, had been constantly playing a role in curbing money laundering and terror financing which was in favour of the country.

All Pakistan Textile Mills Association (APTMA) Punjab Chairman Adil Bashir has urged Prime Minister Imran Khan and relevant authorities to review the decision of add-ons/surcharges increasing power tariff to 70 per cent retrospectively for the export-oriented industry. Addressing a press conference at APTMA Punjab office on Tuesday, he feared that the decision could lead to closure of mills that would render hundreds and thousands of workers jobless. Flanked by other office bearers, Adil Bashir lamented that the ministry had unilaterally increased power tariff to 13 cents per kWh to cover inefficiencies and make matters worse by imposing it from January 2019 in defiance of PM’s commitment, Cabinet and ECC decisions. He said that industries would not be able to pay huge amount which would result in bankruptcies and unemployment. He said Pakistani exports would not be able to compete with China, Bangladesh and India where power tariffs were 7-9 cents.

Market is expected to remain volatile during current trading session.

Technical Analysis

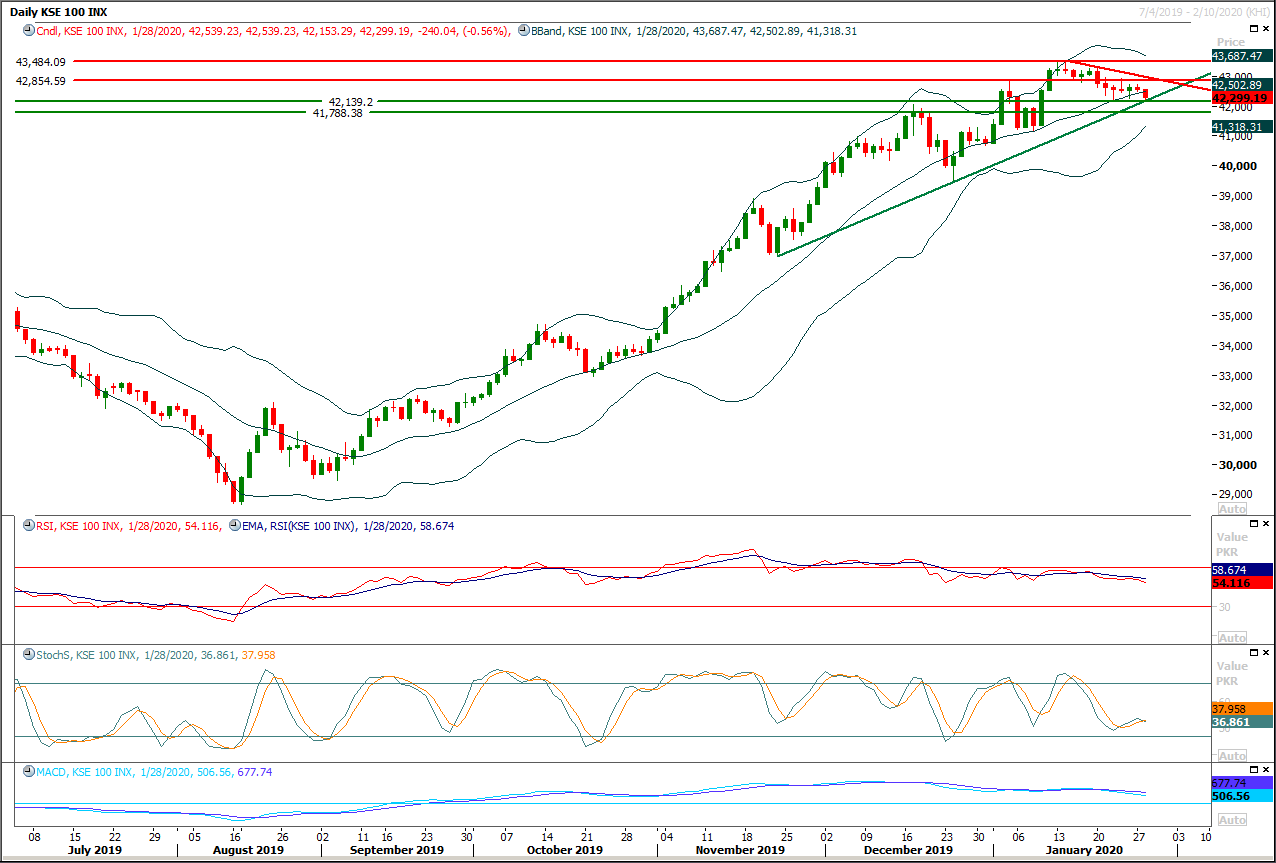

The Benchmark KSE100 index is trying to find some ground at a rising trend line on daily chart but it's expected that index would some serious pressure today if it would not succeed in penetration above 42,500 points on hourly closing basis. An intraday spike could be witnessed towards 42,500 points where index would face rejection and some fresh selling volumes would pop up. It's recommended to stay on sell side with strict stop loss of 42,860 points and add further short positions if index would succeed in sliding below 42,100 points on closing basis either on daily or hourly chart. Daily momentum indicators are trying to generate bearish crossovers and these would got confirmation by index sliding below 42,100 points. A new bearish rally could be witnessed in coming days if index would succeed in closing below 42,000 points.

While on flip side in case of breakout above 42,500 points index would try to target 42,860 points but it would remain bearish until unless it would succeed in closing above 42,860 or 43,000 points on daily chart.

While on flip side in case of breakout above 42,500 points index would try to target 42,860 points but it would remain bearish until unless it would succeed in closing above 42,860 or 43,000 points on daily chart.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.