Previous Session Recap

Trading volume at PSX floor dropped by 51.6 million shares or 14.89%, DoD basis. Whereas, the KSE100 Index opened at 45747.46, posted a day high of 46464.38 and a day low of 45474.46 points during the last trading session, while the session suspended at 46332.31 with a net change of 857.85 points and a net trading volume of 167.31 million shares. Daily trading volume of KSE100 listed companies dropped by 20.57 million shares or 10.95%, DoD basis.

Foreign Investors remained in a net selling position of 17.19 million shares but net value of Foreign Inflow increased by 1.75 million US Dollars. Categorically, Foreign Corporate and overseas Pakistani investors remained in net selling positions of 9.25 and 7.98 million shares but Foreign Individuals remained in a net buying position of 0.043 million shares. While on the other side, Local Individuals, Banks, Mutual Funds and Brokers remained in net selling positions of 8.58, 14.43, 8.83 and 15.93 million shares respectively, but Local Companies and NBFCs remain in net selling positions of 2.17 and 0.61 million shares.

Analytical Review

The dollar shuddered to its lows for the year on Thursday as a drumbeat of hawkish comments from major central banks signalled the era of easy money might be coming to an end for more than just the United States. Support for the dollar eroded as investors realised the U.S. Federal Reserve might not be the only game in town when it came to higher interest rates. In Britain, Bank of England Governor Mark Carney surprised many by conceding a hike was likely to be needed as the economy came closer to running at full capacity. The Bank of Canada went further, with two top policymakers suggesting they might tighten as early as July.

Pakistan Tehreek-i-Insaf (PTI) chairman Imran Khan threatened on Wednesday to launch a mass movement if the Pakistan Muslim League-Nawaz tried to create hurdles in the implementation of the decision of the Joint Investigation Team (JIT) probing money laundering charges against the Sharif family. Talking to reporters after presiding over a party meeting at his Banigala residence, the PTI chief took exception to last week’s press conference of Prime Minister Nawaz Sharif in London in which he had reportedly stated that the people of Pakistan would not accept any adverse decision of the JIT.

Federal Board of Revenue (FBR) Chairman Dr Irshad on Wednesday said that the new tax reforms would have no effects on existing tax payers but would increase tax network. He expressed these remarks while addressing a gathering at ground breaking ceremony of the district taxation office (DTO) in district Charsadda. The FBR chairman said that the teaching of Chinese language has been made compulsory in all training institutes of FBR in view of the China Pakistan Economic Corridor (CPEC) initiative which he said was certainly a game changer as far as development in the country was concerned.

The Federation of Pakistan Chamber of Commerce and Industry (FPCCI) on Wednesday said that textile sector needs immediate attention of the government. The sector is the largest urban employment provider and largest foreign exchange earner, which deserves resolution of the problems which has taken toll on exports, it said. Energy crisis, refund claims, input costs, the burden of the taxes, lack of enabling rules and other issues have increased the cost of doing business for this important sector, said FPCCI Regional Committee on Industries Chairman Atif Ikram Sheikh. He said, “Current scenario is depressing as our production is restricted, exports are shrinking and we stand at a disadvantage as far as economy and government’s support is concerned.” In this situation, the textile millers have no option but to start protests, which reflects the gravity of the situation while sending the negative signals, he noted.

The Pakistan Economy Watch (PEW) on Wednesday said that the government seems uninterested in the economic revival as it has focused all its attention on the politics since it came to power. The government continue to avoid reforms and unpopular decisions since years and it is unlikely that it will do something in the election year, said PEW President Dr Murtaza Mughal. The Government and opposition are not concerned with the economic revival, they are pushing their own agenda which is leading country towards a default, he added. He said that the trade deficit in the first 11 months has surpassed $30 billion but the government has not done little to prevent the economic meltdown. The government or other political parties have yet to suggest a concrete framework of policies to improve overall growth rate and to ensure that all regions and segments of society reap the fruits of a booming economy, he added.

Today DSL , EFERT, ENGRO and PSO may lead the market in positive direction.

Technical Analysis

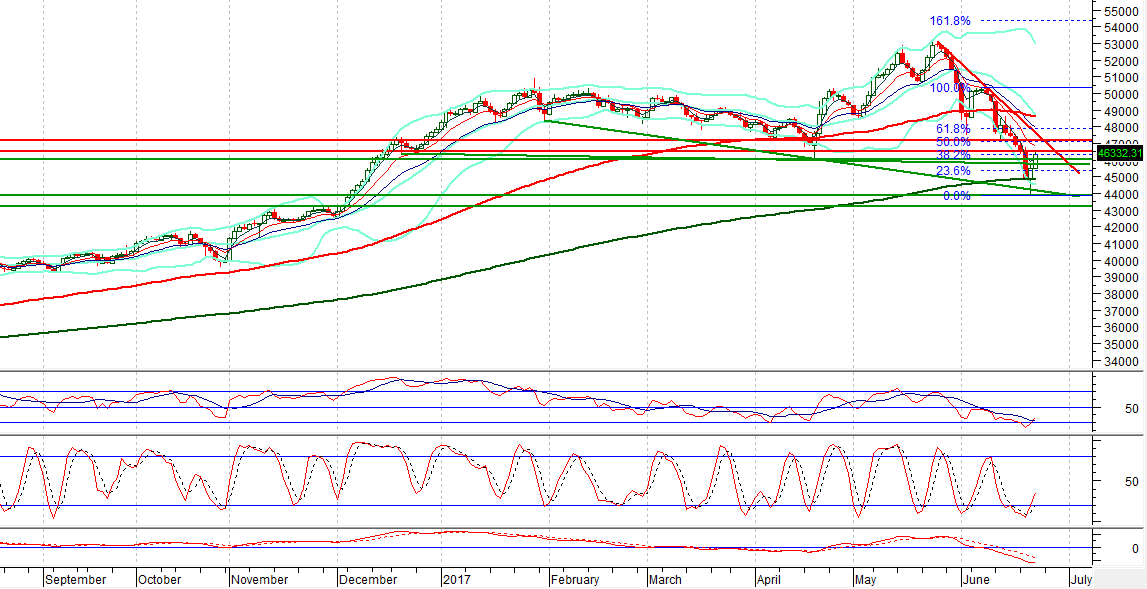

The Benchmark KSE100 index bounced back for a correction after finding support at its 100% expansion of the last correction. Stochastic and MAORSI have generated bullish crossovers on daily chart and bullish morning star is formatted on daily chart as well. However, the index is still capped by a horizontal resistance at its 50% correction and is also capped by resistant trend line. Major resistances ahead are at 47200 and 47900 which could push the index back, as they fall on 50% and 61.8% correction of latest bearish rally. Index would not be considered in bullish mode until it closes above 48000. As of now it has generated a hammer on weekly chart, against strong weekly bearish engulfing which would try to reduce selling pressure from technical side, for current trading session trading with strict stop loss is recommended as if index would not become able to close above its corrections then a new low could be witnessed in coming trading sessions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.