Previous Session Recap

Trading volume at PSX floor dropped by 75.68 million shares or 32.14% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 41,710.35, posted a day high of 42,077.66 and a day low of 41,542.49 during last trading session. The session suspended at 41,997.85 with net change of 279.86 and net trading volume of 97.00 million shares. Daily trading volume of KSE100 listed companies dropped by 7.01 million shares or 6.74% on DoD basis.

Foreign Investors remained in net selling position of 7.62 million shares and net value of Foreign Inflow dropped by 5.92 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 6.09 and 1.54 million shares. While on the other side Local Individuals, Local Companies, Banks and Mutual Fund remained in net buying positions of 1.26, 1.69, 0.17 and 10.10 million shares but NBFCs, Brokers and Insurance Companies remained in net selling positions of 0.44, 5.17 and 1.72 million shares respectively.

Analytical Review

Asian shares stay near nine-month lows as trade frictions weigh

Asian shares remained near nine-month lows on Friday despite small gains on Wall Street overnight, as ongoing concerns over global trade frictions dampened sentiment, though a move to ease foreign investment curbs in China could boost markets there. MSCI’s broadest index of Asia-Pacific shares outside Japan was flat, Australian shares were 0.1 percent higher, while Japan’s Nikkei stock index was down 0.2 percent. Stocks on Wall Street posted small gains on Thursday, helped by financial and technology shares, but broader market sentiment remained subdued on lingering concerns over U.S.-driven trade tensions. The Dow Jones Industrial Average rose 98.46 points, or 0.41 percent, to 24,216.05, the S&P 500 gained 16.68 points, or 0.62 percent, to 2,716.31, and the Nasdaq Composite added 58.60 points, or 0.79 percent, to 7,503.68.

Rs200b receivables threaten OGDCL stability

The receivables of Oil and Gas Development Company (OGDCL) from various government entities have reached to Rs200 billion and if the trend was not changed it may hurt the company present stable position. The total receivables of OGDCL are Rs200 billion with Power Holding Private Limited and SNGPL have to pay Rs106 billion, said OGDCL MD Zahid Mir while briefing Senate Standing Committee on Petroleum here. The committee meeting which was chaired Senator Mohsin Aziz also considered matter of non installation of RO plants by the companies involved in exploration of oil and gas in District Sanghar, Sindh. Zahid Mir said that SNGPL owes Rs36 billion to OGDCL while Power Holding Private Limited has to pay Rs70 billion to the company.

PHMA for early clearing of current refunds

With a view to avoid the lapse of funds under the Export Package, the Pakistan Hosiery Manufacturers and Exporters Association has asked the caretaker government to clear all the sales tax refunds of exporters approved by the last government for the current fiscal year, which is going to end on June 30. PHMA Chairman Dr Khurram Anwar Khawaja said that the outgoing government in its last days had approved around Rs50 billion to clear refunds of exporters for the ongoing current financial year which would be lapsed after June 30th if not spent. He stated that billions of rupees against the previous drawback of local taxes and levies are pending with government, causing liquidity problems to the exporters in keeping their export commitment, which must be released before the end of fiscal year 2017-18 on June 30 to streamline cash flow.

Pakistan, OECD agree to strengthen cooperation

Pakistan and Organisation for Economic Cooperation and Development (OECD) will further strengthen their cooperation in various areas including tax related matters and sharing of experiences in social and economic development. The OECD will extend technical assistance to Pakistan in its efforts for undertaking broad based tax reforms. These views were expressed during the bilateral meeting between Federal Minister for Finance and Revenue Dr Shamshad Akhtar and OECD Secretary General Angel Gurria, which was held at the OECD Headquarters in Paris.

Deficit limits development budget to Rs752b

With two days to end the fiscal year, the government has released only Rs752.14 billion so far under its Public Sector Development Programme (PSDP) 2017-18 out of total allocations of Rs1,001 billion, which is 25 percent less than the total budget. The drastic cut in development budget of various schemes and projects was made in a bid to cover the growing budget deficit. According to sources in Planning Commission, federal ministries could get a small share of only Rs186.35 billion out of Rs302 billion set aside by the government for the year. Whereas for special areas an amount of Rs 66.14 billion was released out of Rs 71 billion.

Asian shares remained near nine-month lows on Friday despite small gains on Wall Street overnight, as ongoing concerns over global trade frictions dampened sentiment, though a move to ease foreign investment curbs in China could boost markets there. MSCI’s broadest index of Asia-Pacific shares outside Japan was flat, Australian shares were 0.1 percent higher, while Japan’s Nikkei stock index was down 0.2 percent. Stocks on Wall Street posted small gains on Thursday, helped by financial and technology shares, but broader market sentiment remained subdued on lingering concerns over U.S.-driven trade tensions. The Dow Jones Industrial Average rose 98.46 points, or 0.41 percent, to 24,216.05, the S&P 500 gained 16.68 points, or 0.62 percent, to 2,716.31, and the Nasdaq Composite added 58.60 points, or 0.79 percent, to 7,503.68.

The receivables of Oil and Gas Development Company (OGDCL) from various government entities have reached to Rs200 billion and if the trend was not changed it may hurt the company present stable position. The total receivables of OGDCL are Rs200 billion with Power Holding Private Limited and SNGPL have to pay Rs106 billion, said OGDCL MD Zahid Mir while briefing Senate Standing Committee on Petroleum here. The committee meeting which was chaired Senator Mohsin Aziz also considered matter of non installation of RO plants by the companies involved in exploration of oil and gas in District Sanghar, Sindh. Zahid Mir said that SNGPL owes Rs36 billion to OGDCL while Power Holding Private Limited has to pay Rs70 billion to the company.

With a view to avoid the lapse of funds under the Export Package, the Pakistan Hosiery Manufacturers and Exporters Association has asked the caretaker government to clear all the sales tax refunds of exporters approved by the last government for the current fiscal year, which is going to end on June 30. PHMA Chairman Dr Khurram Anwar Khawaja said that the outgoing government in its last days had approved around Rs50 billion to clear refunds of exporters for the ongoing current financial year which would be lapsed after June 30th if not spent. He stated that billions of rupees against the previous drawback of local taxes and levies are pending with government, causing liquidity problems to the exporters in keeping their export commitment, which must be released before the end of fiscal year 2017-18 on June 30 to streamline cash flow.

Pakistan and Organisation for Economic Cooperation and Development (OECD) will further strengthen their cooperation in various areas including tax related matters and sharing of experiences in social and economic development. The OECD will extend technical assistance to Pakistan in its efforts for undertaking broad based tax reforms. These views were expressed during the bilateral meeting between Federal Minister for Finance and Revenue Dr Shamshad Akhtar and OECD Secretary General Angel Gurria, which was held at the OECD Headquarters in Paris.

With two days to end the fiscal year, the government has released only Rs752.14 billion so far under its Public Sector Development Programme (PSDP) 2017-18 out of total allocations of Rs1,001 billion, which is 25 percent less than the total budget. The drastic cut in development budget of various schemes and projects was made in a bid to cover the growing budget deficit. According to sources in Planning Commission, federal ministries could get a small share of only Rs186.35 billion out of Rs302 billion set aside by the government for the year. Whereas for special areas an amount of Rs 66.14 billion was released out of Rs 71 billion.

Market is expected to remain volatile therefore it's recommended to stay cautious while trading today.

Technical Analysis

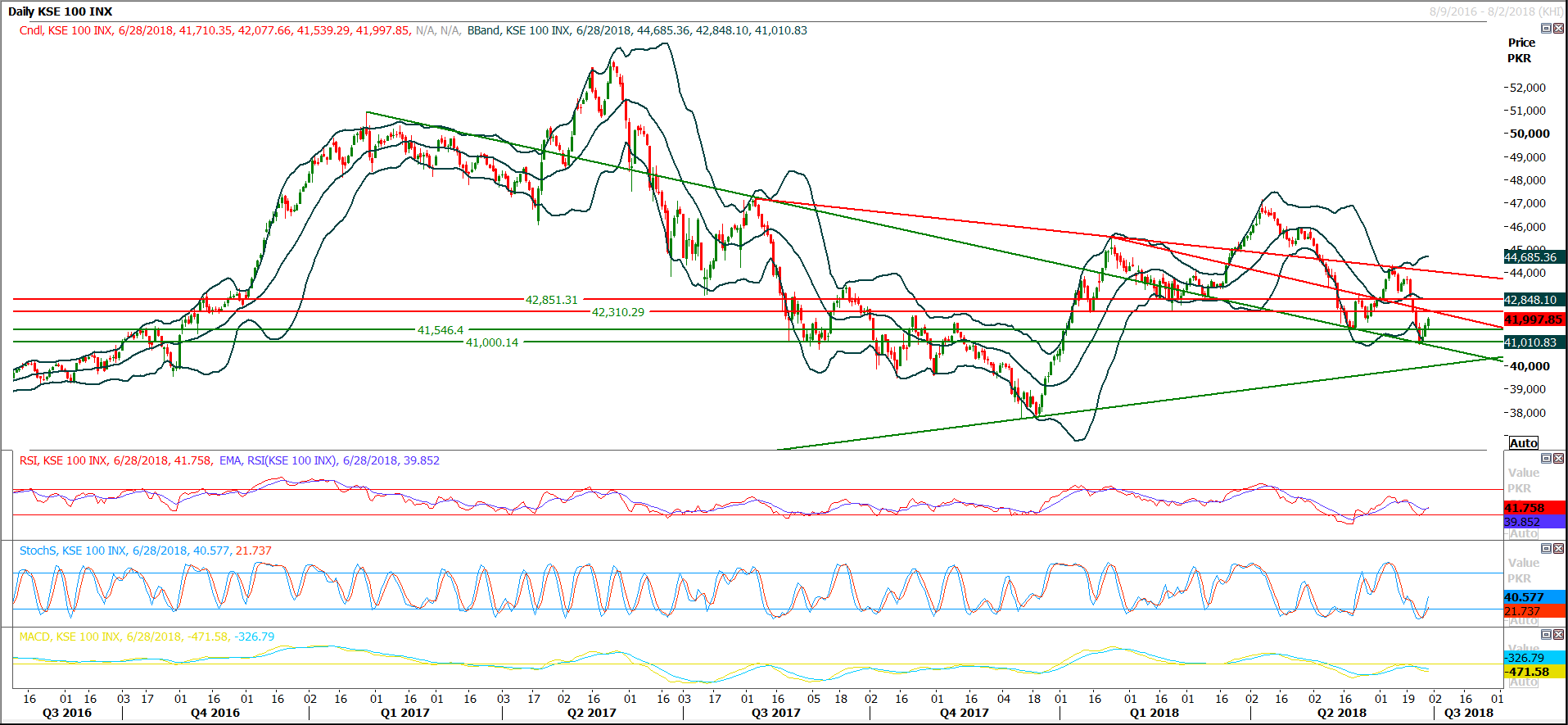

The Benchmark KSE100 Index is trying to bounce back after finding support on a descending trend line on daily chart since last two trading sessions but weekly momentum indicators have just started bearish move this week. As of now index is capped by a horizontal resistance at 42,062 along with a descending trend line at 42,400 points and at those points 38% and 50% correction of last bearish rally are also completing therefore it needs a very cautious approach while trading around these regions. On the supportive side index have supportive regions around 41,000 and 40,500 points. Index seems to dive again after these regions therefore its recommended to initiate selling on strength with strict stop loss during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.