Previous Session Recap

Trading volume at PSX floor increased by 22.89 million shares or 5.6%, DoD basis, whereas. the KSE100 index opened at 52869.01, posted a day high of 52874.63 and a day low of 52455.44 during last trading session. The session suspended at 52636.87 with a net change of -232.14 points and net trading volume of 116.43 million shares. Daily trading volume of KSE100 listed companies dropped by 26.02 million shares or 18.27%, DoD basis.

Foreign Investors remained in a net buying position of 2.25 million shares but net value of Foreign Inflow dropped by 6.26 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistan Investors remained in net buying positions of 0.82 and 1.47 million shares but Foreign Individuals remained in a net selling position of 0.042 million shares. While on the other side, Local Individuals, NBFCs and Mutual Funds remained in net buying positions of 9.59, 0.3 and 0.13 million shares, respectively. Local Companies, Banks and Brokers remained in net selling positions of 6.86, 2.27 and 5.29 million shares, respectively.

Analytical Review

Asian stocks steadied early on Monday, taking cues from Wall Street shares hovering around record highs, while the pound nursed losses after a poll showed a shrinking lead for Prime Minister Theresa May party in Britain upcoming elections. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS stood little changed. Japanese Nikkei .N225 edged up 0.1 percent and Australian shares were flat. On Friday, the S&P 500 .SPX and Nasdaq .IXIC scraped to record closing highs on strength in consumer shares. [.N] The dollar index against a basket of major currencies was steady at 97.435 .DXY after rising on Friday thanks to upbeat U.S. gross domestic product data. The greenback was little changed at 111.270 yen JPY=, with the safe-haven Japanese currency showing little reaction after North Korea fired what appeared to be a short-range ballistic missile early on Monday.

Pakistan Tanners Association (PTA) Chairman Anjum Zafar has hailed the federal budget for the year 2017-18 wherein all major demands of leather sector have been accepted and incorporated in the budget. He said, “The demand of removal of Custom Duty on import of basic raw materials for the Industry (Raw hides & skins/pickled and wet blue) was accepted as we proposed to ministry of commerce, which was the fundamental need for the Industry to meet the scarcity of raw materials for necessary value addition.”

The cement prices will go up by at least Rs15 per 50kg bag in the country, as the government has proposed to increase Federal Excise Duty (FED) by 25 percent on cement to Rs1.25/kg or Rs1,250/ton. Industry sources said that the net impact on manufacturers’ cost will not be Rs12.5/bag, rather it would be around Rs15/bag as sales tax is levied on top of FED. They said the increase in FED is second consecutive times, as the government had increased the cement price by Re1 per kilogramme in the last federal budget of 2016-17, affecting the common man who had humbles resources for house building. The industry had suggested in its budget proposal that the Federal Board of Revenue (FBR) should phase out the Federal Excise Duty (FED) to encourage cement off take. It said the cement industry was subject to FED at the rate of 5 percent of retail price and General Sales Tax at the rate of 17 percent of maximum retail price. These taxes account for about Rs100 per bag.

The government, in its attempt to document the economy, has increased the rate of taxes in several categories for people who do not file their tax returns. Moreover, the federal government has extended the levy of 17pc sales tax on the import of goods for end use in non-taxable tribal areas. Through the Finance Bill 2017, the government has proposed an amendment to the law to extend the scope of sales tax in Federally Administered Tribal Areas (FATA) as well as Provincially Administered Tribal Areas (PATA).

A number of government departments have dramatically exceeded the amounts allocated to them in the budget for FY2016-17, with certain divisions spending as much as four to eight times the amount allocated to them. Budget documents show there are at least eight departments whose spending exceeded their allocated budget by a large margin. The Food Security and Research Division, for example, was allocated Rs3.7 billion in 2016-17, but ended up spending over Rs29bn, nearly eight times its allocated budget. According to the breakdown of current expenditure, the main head under which additional costs were incurred was Grants, Subsidies and Write-Off Loans.

The Market is expected to remain volatile today. We advise Traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

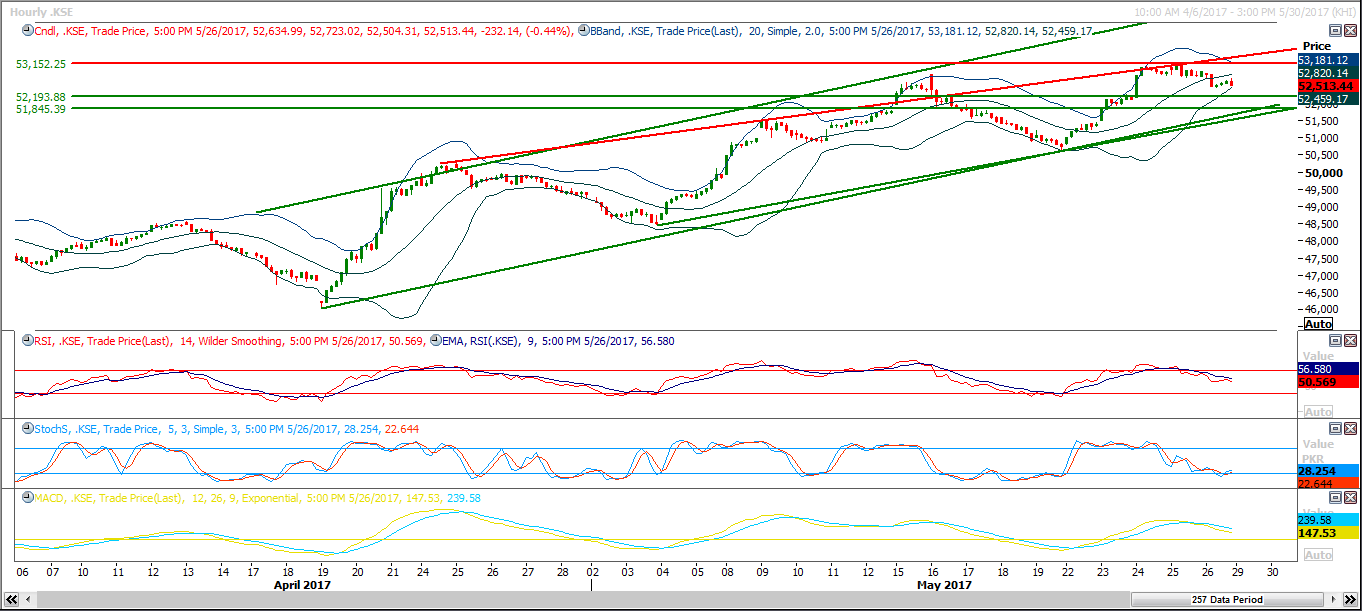

The Benchmark KSE100 Index is capped by a resistant trend line inside a bullish trend channel on hourly chart. The said trend line is accompanied by a horizontal resistance at 61.8% expansion of its last correction at 53088 and 53316. Whereas Supportive region for the index falls at 52330 and 51845 point on intraday basis. Trading with strict stop loss of 52330 is recommended for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.