Previous Session Recap

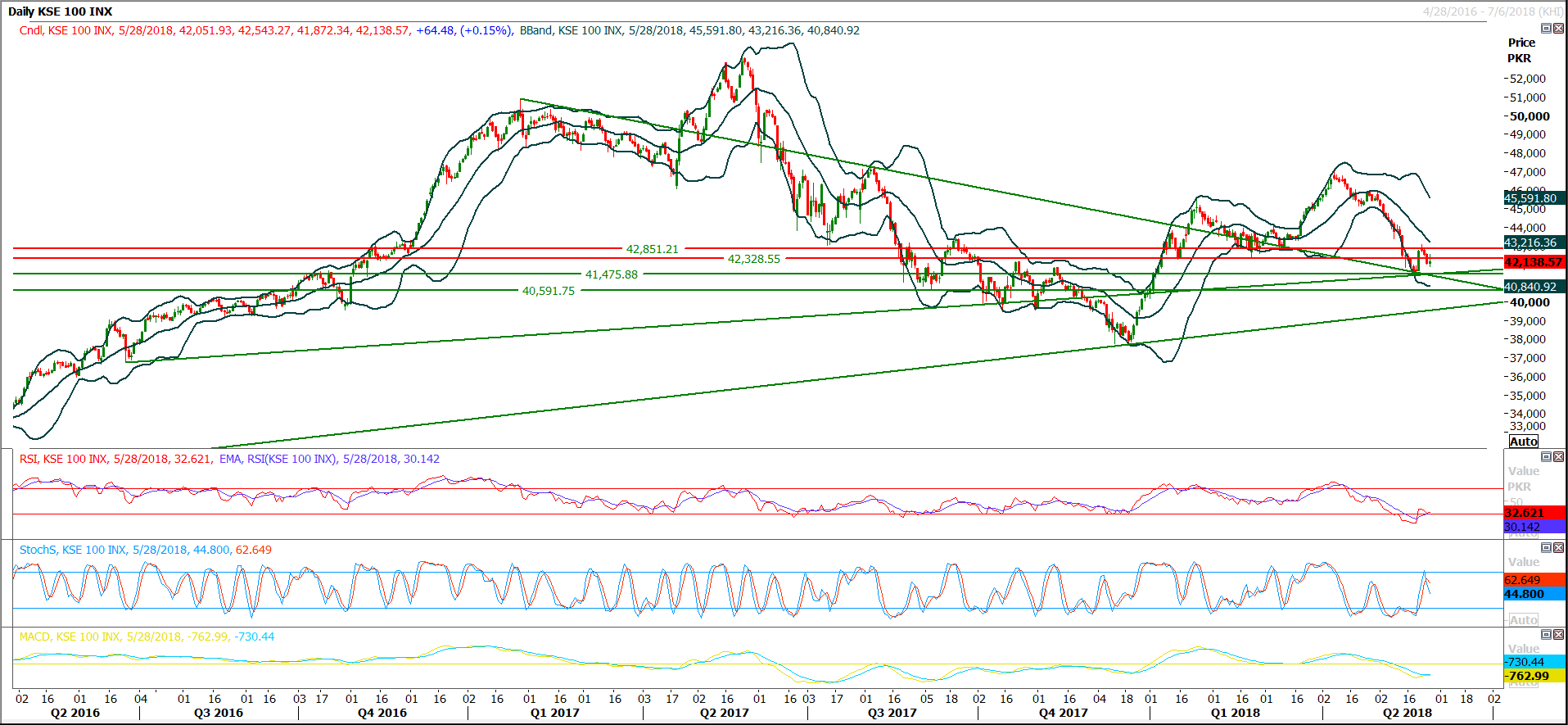

Trading volume at PSX floor increased by 26.66 million shares or 27.05% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,051.93, posted a day high of 42,543.27 and a day low of 41,872.34 during last trading session. The session suspended at 42,138.57 with net change of 64.48 and net trading volume of 85.25 million shares. Daily trading volume of KSE100 listed companies increased by 22.15 million shares or 35.10% on DoD basis.

Foreign Investors remained in net selling position of 9.36 million shares but net value of Foreign Inflow dropped by 8.44 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying position of 0.09 and 1.15 million shares but Foreign Corporate investors remained in net selling positions of 10.61 million shares. While on the other side Local Individuals, Banks, NBFCs, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 2.27, 0.83, 1.41, 2.48, 2.71 and 1.93 million shares but Local Companies remained in net selling positions of 3.78 million shares respectively.

Analytical Review

Shares fall on Italian turmoil, euro, oil at multi-week lows

Asian shares fell on Tuesday and the euro slipped back to 6-1/2 month lows as early elections loomed in Italy, but a revival in diplomatic talks with North Korea and a retreat in oil prices from recent highs supported sentiment. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dipped 0.3 percent after three consecutive sessions of gains. Japan's Nikkei .N225 skidded 0.8 percent while South Korean .KS11 shares slipped 0.5 percent. Australia's benchmark index was a touch firmer. Liquidity is expected to be relatively thin with market holidays in Singapore, Malaysia, Indonesia and Thailand. “The market has turned its focus to the continuing political situation in Italy,” said Nick Twidale, Sydney-based analyst at Rakuten Securities Australia.

Govt borrowed $9.6 billion in 10 months

Pakistan has borrowed $9.6 billion from external sources only in ten months of the current fiscal year increasing the overall debt of the country that has already surged to $91.8 billion. Pakistan has received $1.6 billion in new foreign loans during the month of April only, as major part of the borrowing $1.2 billion was through the commercial banks. The government has already breached the limit of annual foreign borrowing of $8 billion, as the borrowing recorded at $9.6 billion in ten months (July to April) of the 2017-18. Keeping in view the current trend, the government is all set to break the previous year's record of borrowing around $10 billion in a single year. Last year, the government had borrowed $10.2 billion from external sources as against the target of $8 billion.

FBR starts audit of industrial units in Gujranwala division

Special teams of Federal Board of Revenue (FBR) have started audit of 3600 industrial units in Gujranwala division's all the six Sialkot, Narowal, Gujrat, Mandi Bahauddin, Hafizabad and Gujranwala districts. According to senior FBR officials, the FBR has issued special notices with the newly designed parameters of their audit to these industrial units besides seeking their complete records, in this regard. The 3600 industrial units were selected for special audit throw the special draw system of the FBR, the officials added.

China's loans aim to develop Pakistani economy

China's loans to Pakistan essentially aim to drive Pakistan's economic development, and thus the loans should be offered in a way that aligns with the local economy and helps restructure the South Asian economy and boost its manufacturing and exports. Pakistan expects to obtain $1 billion to $2 billion of fresh Chinese loans to help it avoid a balance-of-payments crisis. Some observers hope China's economic assistance will help the country avoid having to go to the IMF for a bailout, but the key issue is the sustainability of China's financial help, according to an article published by China's leading newspaper Global Times on Monday. China will not be stingy in offering help to Pakistan to strengthen its infrastructure, but China's bank loan is a market-driven commercial decision in line with international practices. The main point is Pakistan's debt repayment ability.

Drive against FPCCI condemned

The business community Monday strongly condemning the false campaign launched by a group defeated in series of annual elections of Federation of Pakistan Chambers of Commerce and Industry (FPCCI) and reposed their trust in the leadership of United Business Group (UBG). In a joint statement issued here, FPCCI former presidents Ilyas Balor, Mian Muhammad Idrees, Zubair Tufail, Roaf Alam, Patron-in-Chief of UBG SM Munir, and its central chairman Iftikhar Ali Malik, trade leaders including Ishtiaq Baig, Sheikh Riazuddin, Khalid Towab and others said the malicious campaign launched by some elements is baseless and an attempt to sabotage the interests of the community.

Asian shares fell on Tuesday and the euro slipped back to 6-1/2 month lows as early elections loomed in Italy, but a revival in diplomatic talks with North Korea and a retreat in oil prices from recent highs supported sentiment. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dipped 0.3 percent after three consecutive sessions of gains. Japan's Nikkei .N225 skidded 0.8 percent while South Korean .KS11 shares slipped 0.5 percent. Australia's benchmark index was a touch firmer. Liquidity is expected to be relatively thin with market holidays in Singapore, Malaysia, Indonesia and Thailand. “The market has turned its focus to the continuing political situation in Italy,” said Nick Twidale, Sydney-based analyst at Rakuten Securities Australia.

Pakistan has borrowed $9.6 billion from external sources only in ten months of the current fiscal year increasing the overall debt of the country that has already surged to $91.8 billion. Pakistan has received $1.6 billion in new foreign loans during the month of April only, as major part of the borrowing $1.2 billion was through the commercial banks. The government has already breached the limit of annual foreign borrowing of $8 billion, as the borrowing recorded at $9.6 billion in ten months (July to April) of the 2017-18. Keeping in view the current trend, the government is all set to break the previous year's record of borrowing around $10 billion in a single year. Last year, the government had borrowed $10.2 billion from external sources as against the target of $8 billion.

Special teams of Federal Board of Revenue (FBR) have started audit of 3600 industrial units in Gujranwala division's all the six Sialkot, Narowal, Gujrat, Mandi Bahauddin, Hafizabad and Gujranwala districts. According to senior FBR officials, the FBR has issued special notices with the newly designed parameters of their audit to these industrial units besides seeking their complete records, in this regard. The 3600 industrial units were selected for special audit throw the special draw system of the FBR, the officials added.

China's loans to Pakistan essentially aim to drive Pakistan's economic development, and thus the loans should be offered in a way that aligns with the local economy and helps restructure the South Asian economy and boost its manufacturing and exports. Pakistan expects to obtain $1 billion to $2 billion of fresh Chinese loans to help it avoid a balance-of-payments crisis. Some observers hope China's economic assistance will help the country avoid having to go to the IMF for a bailout, but the key issue is the sustainability of China's financial help, according to an article published by China's leading newspaper Global Times on Monday. China will not be stingy in offering help to Pakistan to strengthen its infrastructure, but China's bank loan is a market-driven commercial decision in line with international practices. The main point is Pakistan's debt repayment ability.

The business community Monday strongly condemning the false campaign launched by a group defeated in series of annual elections of Federation of Pakistan Chambers of Commerce and Industry (FPCCI) and reposed their trust in the leadership of United Business Group (UBG). In a joint statement issued here, FPCCI former presidents Ilyas Balor, Mian Muhammad Idrees, Zubair Tufail, Roaf Alam, Patron-in-Chief of UBG SM Munir, and its central chairman Iftikhar Ali Malik, trade leaders including Ishtiaq Baig, Sheikh Riazuddin, Khalid Towab and others said the malicious campaign launched by some elements is baseless and an attempt to sabotage the interests of the community.

Technical Analysis

The Benchmark KSE100 Index have again reached back to its supportive regions where two trend lines and a horizontal supportive regions are standing to provide support against current bearish run. But this time some extra ordinary pressure could be witnessed on this point because index is moving back in bearish direction after a breath in. Intraday and daily momentum indicators are in bearish mode because hourly and daily stochastic have generated bearish crossovers while daily and hourly MAORSI are standing at edge of a bearish crossover. But weekly stochastic is trying to generate a hope for bulls by creating a bullish crossover and its being supported by an expected weekly triple bottom at a supportive region. If this week index would not become able close below 41,400 points then this bullish expectation would be strengthened. For current trading session index have supportive regions at 41,860 and 41,450 points, while resistant regions are standing at 42,330 and 42,860 points. It’s recommended to wait for a clear breakout of either side before initiating trades for short or mid terms, but for current trading session its recommended to sell on strength.

Market is expected to remain volatile therefore it'ss recommended to stay cautious while trading today.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.