Previous Session Recap

Trading volume at PSX floor increased by 2.05 million shares or 1.85% on DoD basis, whereas, the benchmark KSE100 Index opened at 40060.49, posted a day high of 40125.75 and a day low of 39564.27 durinig last trading session. The session suspended at 39634.13 with net change of -398.04 and net trading volume of 68.94 million shares. Daily trading volume of KSE100 listed companies dropped by 5.38 million shares or 7.24% on DoD basis.

Foreign Investors remained in net selling position of 2.72 million shares and net value of Foreign Inflow dropped by 3.89 million shares. Categorically, Foreign Corporate Investors remained in net selling position of 3.43 million shares but Overseas Pakistanis remained in net buying of 0.71 million shares. While on the other side Local Individuals, Banks, NBFCs and Mutual Funds remained in net buying position of 9.2, 0.98, 0.12 and 2.61 million shares respectively but Local Companies, Brokers and Insurance Companies remained in net selling position of 4.63, 5.00 and 1.14 million shares respectively.

Analytical Review

The dollar held firm on Wednesday after Wall Street shot to record peaks amid signs of progress on U.S. tax cuts, while Bitcoin topped $10,000 on more exchanges as appetite for digital currencies showed no sign of fading. Asian share markets were not as jubilant, held back by caution over the latest missile test by North Korea and concerns at recent softness in Chinese shares. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up just a fraction, while China's blue chip index .CSI300 eased 0.5 percent. Among the better performers, Japan's Nikkei .N225 added 0.4 percent, while Australia's main index rose 0.7 percent. The prospects for a U.S. tax cut seemed to improve after Senate Republicans rammed forward their bill in a partisan committee vote that set up a full vote by the Senate as soon as Thursday, although details of the measure remained unsettled. Republican leaders conceded that they have yet to round up the votes needed for passage in the Senate, where they hold a narrow 52-48 majority.

KARACHI: China Financial Futures Exchange Director You Hang said on Tuesday investors will soon have the opportunity to invest in a Pakistan exchange-traded fund (ETF) in China. An ETF is a derivative product that represents a basket of underlying assets, such as stocks. It is traded on a stock exchange just like an ordinary share. Speaking at the second Mergers and Acquisitions Conference organised by TerraBiz, Mr You said Chinese shareholders in the PSX want to introduce derivative products in the national equity market. “Not only do we want to bring ETFs here in Pakistan, we also want to introduce Pakistan ETF into the Chinese market,” he said, adding that few futures products are currently available on the PSX. China Financial Futures Exchange is part of the consortium that recently acquired a 40 per cent stake in the PSX.

Total investment envisioned under the China-Pakistan Economic Corridor (CPEC) has increased to $60 billion, Radio Pakistan, the state-run radio service, reported on Tuesday while quoting the deputy chairman of the Planning Commission, Sartaj Aziz. Aziz made the remarks after speaking to a delegation of Chinese journalists in Islamabad, whom he told that Pakistan has evolved a liberal investment policy to attract foreign investment in the country. CPEC has become a regional project which offers immense investment opportunities, he said; adding that China and other countries can invest in industrial zones to be established in Pakistan. The deputy chairman, who also enjoys the status of a federal minister, said that CPEC is enabling the shifting of Chinese industries to Pakistan. "Pakistan will be able to export a number of goods to China under the growing cooperation in the agriculture sector," he said.

Thar Coal block-II power project is progressing satisfactorily and approximately 60 percent progress has been achieved in both mining and power projects . This was informed by Sindh Engro Coal Mining Company (SECMC) Chief Shamsuddin Ahmed Shaikh. The 660MW project is scheduled to be completed by June 2019; however, keeping in view fast pace of work in the site, it is expected that the project will start producing electricity by early 2019. In a statement, the SECMC chief said that at Thar , there were three aquifers or underground water streams and top or dune sand aquifer was discontinued and partly potable which could be used for drinking purposes wherever potable. "Luckily we have not encountered this aquifer and hence not disturbed. We have promised our neighbors similar or more volume of similar or better quality of water if this aquifer is at all disturbed," he said. adding that second or coal roof aquifer is at 120 meters depth and the last one is at 180 meters named as Coal Floor aquifer.

The unemployment rate in Pakistan has been increasing in the last four years, and according to financial experts, it has actually reached to over 30 percent as the present government had failed to increase jobs in any field, however, the government claimed that it is 13 percent . According to a survey report , the unemployment rate measures the number of people actively looking for a job as a percentage of the labour force and due to lack of planning, the government had failed to provide jobs to the people, especially the youth and educated persons. Although the government claimed that the unemployment rate is decreasing but the unemployment rate was in fact increasing in real terms.

Today PSO, ATRL and PAEL may lead the market in the positive direction.

Technical Analysis

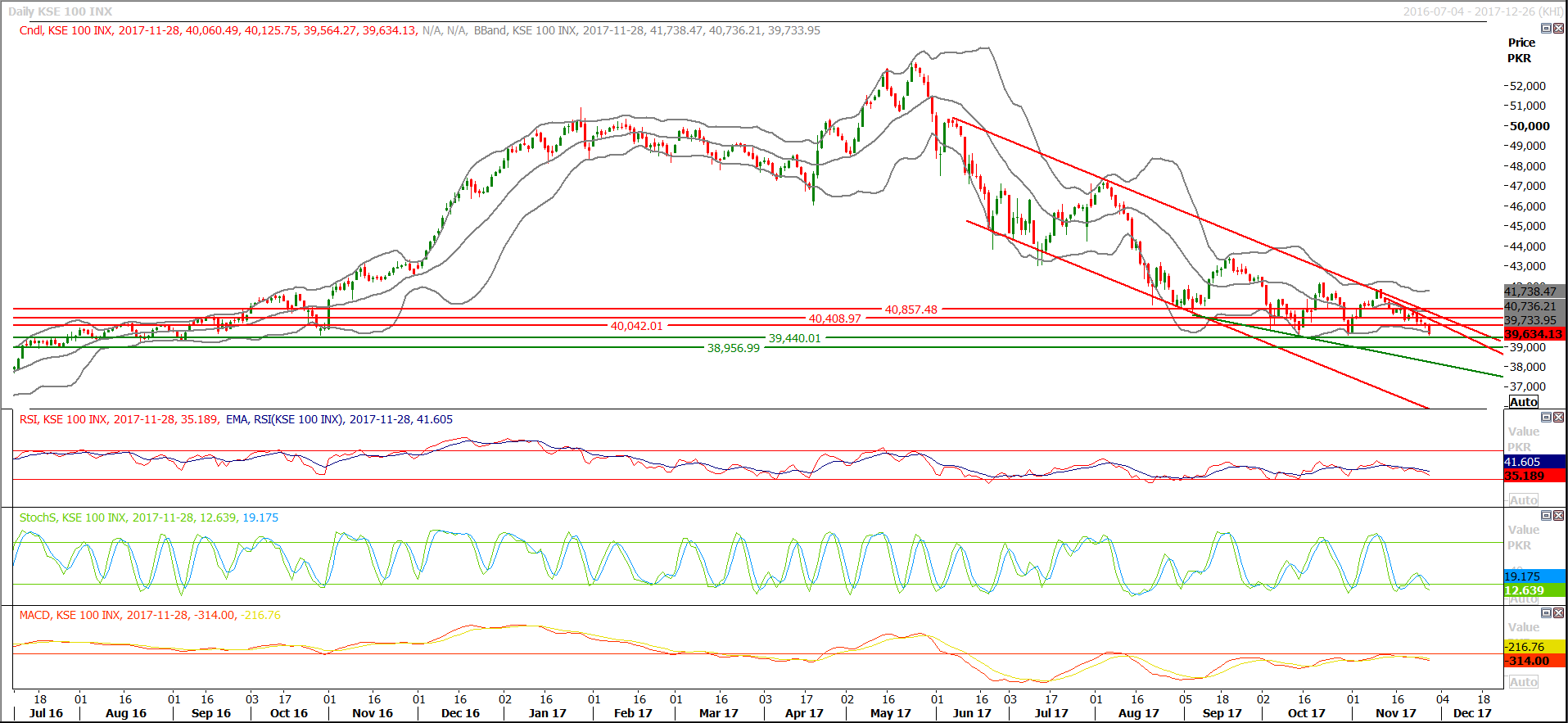

The Benchmark KSE100 Index have penetrated its major supportive region of 39860 in bearish direction and also have closed below that support during last trading session therefore now that region would become first resistance against any reversal. As of right now index have supportive regions at 39400 and 38950 points. Major supportive region which could resist against current bearish trend is standing at 38680 points which is falling at 61.8% correction of its last bullish rally on weekly chart, that rally was started from 29785 and ended up at history high of KSE100 Index at 53127.24. Breakout of that supportive region would call for a new bearish trend which would lead index towards 35650 points on mid term basis. For current trading session its recommended to wait for a dip for new buying and post strict stop loss at 38956.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.