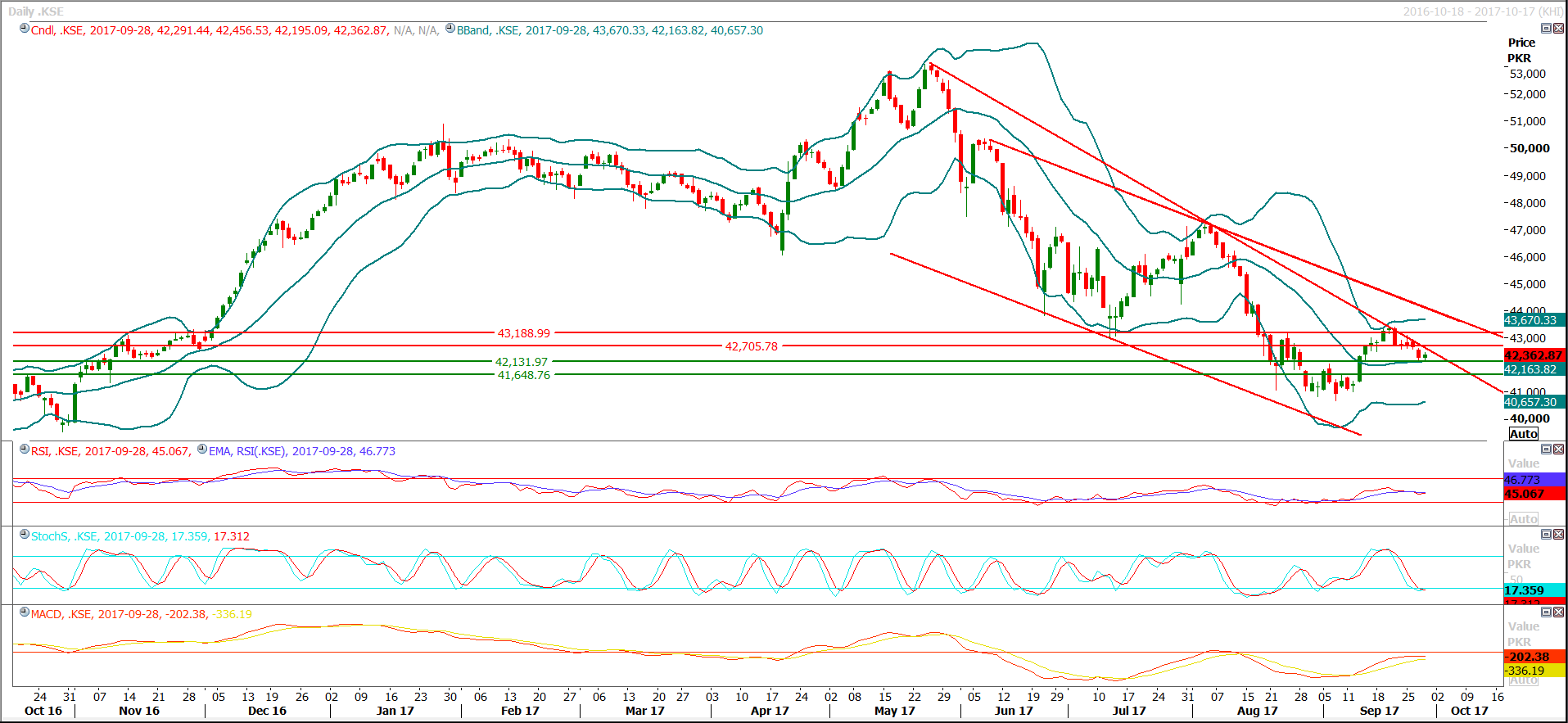

Trading volume at PSX floor dropped by 6.39 million shares or 4.35%, whereas, the benchmark KSE100 Index opened at 42291.44, posted a day high of 42456.53 and a day low of 42195.09 during the last trading session. The session suspended at 42362.87 with a net change of 72.72 and net trading volume of 60.05 million shares. Daily trading volume of KSE100 listed companies dropped by 7.94 million shares or 11.68%, DoD basis.

Foreign Investors remained in net selling position of 3.47 million shares and net value of Foreign Inflow dropped by 1.51 million US Dollars. Categorically, Foreign Corporate investors remained in net selling position of 3.6 million shares but Overseas Pakistanis remained in a net buying position of 0.12 million shares. While on the other side Local Individuals and Brokers remained in a net buying position of 7.46 and 3.35 million shares but Local Companies, Banks, Mutual Funds and Insurance Companies remained in net selling positions of 0.62, 1.75, 5.05 and 0.42 million shares respectively.

Asian shares were firm on Thursday while U.S. bond yields and the dollar held sizable gains made the previous day after President Donald Trump proposed the biggest U.S. tax overhaul in three decades. The dollar also drew support from strong U.S. durable goods orders data that cemented expectations the Federal Reserve is on course to raise interest rates for the third time this year in December. Japan's Nikkei .N225 rose 0.5 percent while MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was little changed in early trade. On Wall Street, small-cap shares, seen as benefiting the most from the proposed tax cuts, soared. Russel 2000 small-cap index notched a record high, rising 1.9 percent for its biggest one-day gain in almost six months. The Dow Jones Industrial Average .DJI rose 0.25 percent while the S&P 500 .SPX gained 0.41 percent.

Asian shares regained some poise on Friday after a tough week in which the gathering risk of a U.S. rate rise lifted Treasury yields toward nine-year highs and boosted borrowing costs across the region. Activity was mainly confined to book-squaring for the end of the month and quarter, and moves in markets were modest at best. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS inched up 0.2 percent, but was still down a sizable 2 percent for the week so far. Japan's Nikkei .N225 was off 0.2 percent, though South Korea .KS11 managed to recoup 0.5 percent. Shanghai shares .SSEC firmed 0.3 percent but were flat on the week. Many markets in the region have been cold-shouldered this week as investors priced in a greater probability of a rate hike from the Federal Reserve in December.

Fearing a devaluation of the rupee, Pakistanis have started piling up dollars in their foreign currency accounts. This has resulted in an increase of $1.2 billion in foreign currency deposits of commercial banks in just four months. Bankers and currency dealers were unanimous in their opinion that the sudden rise in the reserves of commercial banks was because of the conversion of the local currency into dollars.

The representatives of the liquefied natural gas (LPG) stakeholders and the government failed to reach agreement on the product price for consumers as the private sector blamed the government side for not addressing the root causes of shortages and price hikes. Informed sources said the government side led by Hassan Nasir Jami, additional secretary Petroleum Division of the Ministry of Energy proposed a formula under which it believed the LPG price should be set around Rs895 for 11kg domestic cylinders.

The six-lane 19.5km-long Eastbay Expressway in Gwadar will be developed by China Communication Construction Company (CCCC), which will give Rs15 billion interest-free loan, said Minister of State for Ports and Shipping Chaudhry Jaffar Iqbal on Thursday. A memorandum of understanding (MoU) was signed earlier on Sunday. Under the MoU, CCCC will develop the expressway as well as lay down two train tracks which will be connected to the Gwadar Port. The company will develop these projects under the China-Pakistan Economic Corridor (CPEC).

The market is expected to remain volatile today. We advise traders to exercise caution. Buying on dips and booking gains on strength is recommended.

The Benchmark KSE100 index is capped by a resistant trend line along with a horizontal resistant region on the daily chart but daily stochastic is trying to generate a bullish crossover which may push the index in a positive zone if succeeded, but on its path to bullish side it has resistances around 42700 and 43200, therefore buying for mid or short term basis is not recommended until index closes above these two levels. Index might try to remain positive during the current trading session for monthly closing if oil and gas sector support bullish momentum. Selling on strength is recommended around these both resistant regions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.