Previous Session Recap

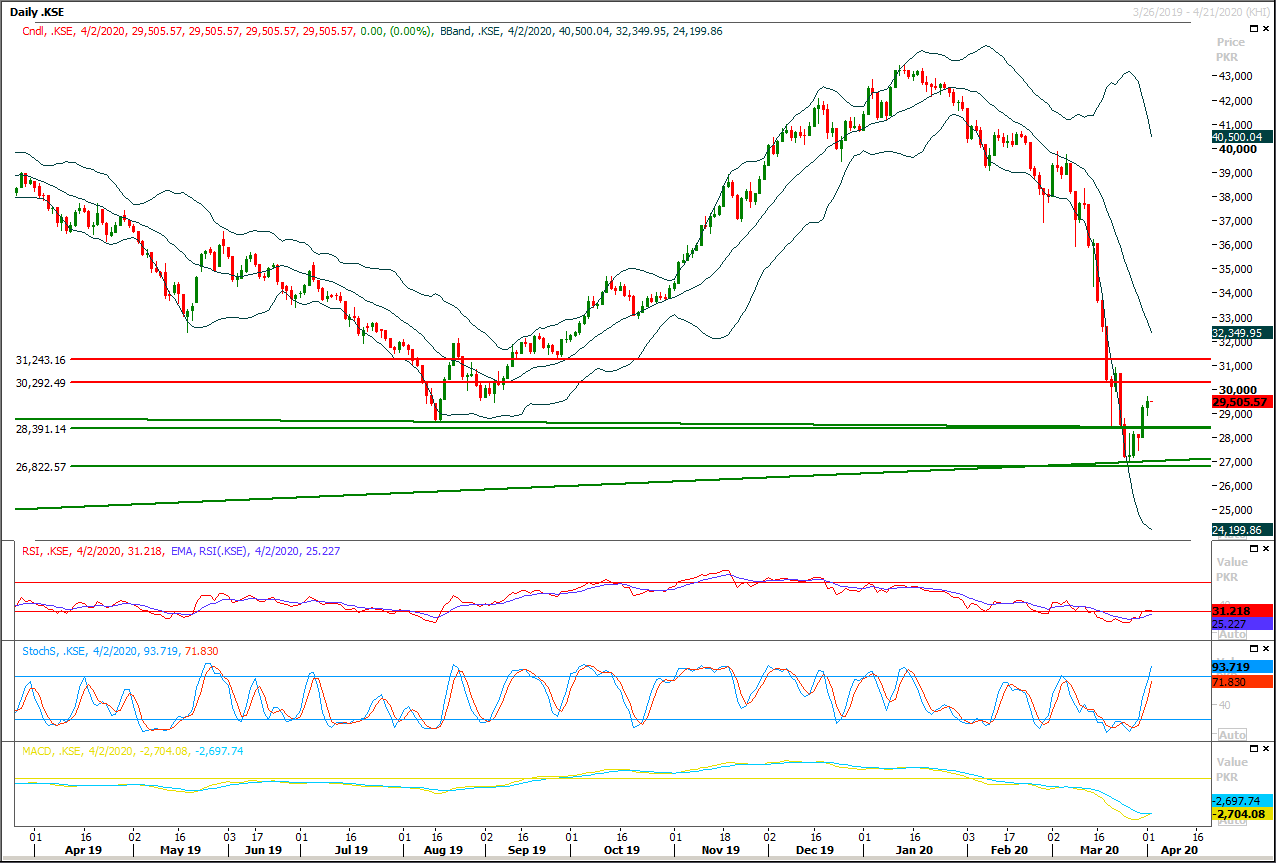

Trading volume at PSX floor dropped by 28.37 million shares or 12.77% on DoD basis, whereas the benchmark KSE100 index opened at 29,231.63, posted a day high of 29,691.23 and a day low of 28,902.08 points during last trading session while session suspended at 29,505.57 points with net change of 273.94 points and net trading volume of 157.08 million shares. Daily trading volume of KSE100 listed companies also dropped by 29.07 million shares or 15.62% on DoD basis.

Foreign Investors remained in net selling positions of 5.94 million shares and value of Foreign Inflow dropped by 4.44 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani remained in net long positions of 0.10 and 1.89 million shares but Foreign Corporate remained in net selling positions of 7.94 million shares respectively. While on the other side Local Individuals and Brokers remained in net selling positions of 5.09 and 4.69 million shares but Local Companies, Banks, NBFCs, Mutual Fund and Insurance Companies remained in net long positions of 2.49, 4.86, 0.17, 5.27 and 3.29 million shares respectively.

Analytical Review

Asian stocks slip as Trump warns of horrors to come

Asian equities fell for a second session on Thursday, after a dire warning about the U.S. coronavirus death toll had investors looking to the safety of dollars and bonds and bracing for more bad news from U.S. jobless figures. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.2%. Japan’s Nikkei extended Wednesday’s heavy drop with a 1.5% fall, and investors are beginning to worry that equities may re-test last month’s lows. Markets in Hong Kong, Sydney, Shanghai and Seoul fell, though futures for the S&P 500 bounced following Wall Street’s 4% plunge overnight. “Difficult days are ahead for our nation,” U.S. President Donald Trump told reporters at the White House on Wednesday. “We’re going to have a couple of weeks, starting pretty much now, but especially a few days from now, that are going to be horrific.”

Huddle in Q Block over shape of industry bailout

The business community on Wednesday asked the government to encourage the State Bank of Pakistan to purchase assets and goods of depressed industries and further reduce the discount rate besides speedy clearance of tax refunds to address liquidity challenges and help mitigate adverse impact of Covid-19 pandemic. At a meeting with a ministerial team, the leading businessmen also advised the government to allow courier services and online businesses to resume their activities and extend maximum support to small and medium enterprises (SMEs) to pass through challenging times. Adviser to the Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh chaired the meeting via video link with the business community. Adviser to PM on Commerce and Industry, Abdul Razzak Dawood also attended.

World Bank okays another $700m for Dasu project

The World Bank’s board of directors has approved a $700 million additional financing for 250km transmission line of the Dasu Hydropower Project to be completed by December 2023. This was announced by the World Bank at a time the government is seeking about $1.2 billion support from the bank through diversion of surplus or unutilised funds from slow-moving projects to meet additional funding requirements to mitigate adverse impacts of coronavirus threat. The board of directors of the World Bank is scheduled to approve about $200 million quick disbursing loan for Pakistan on Thursday.

Inflation rate drops to 10.2pc in March

The Pakistan Bureau of Statistics (PBS) on Wednesday said the inflation rate fell to 10.2 per cent in March from 12.4pc in the previous month owing to decline in prices of essential food items for a second consecutive month. This is for the first time since July last year that inflation measured by the Consumer Price Index (CPI) has seen a downward trend for a second month in a row due to a combination of factors including improvement in supply of eatables and reduction in prices of energy items. The data collected from markets to determine monthly inflation rate shows that many markets remain operational during the first half of March though it will be a big challenge to do a similar exercise in April amid lockdown. In most of the markets across Pakistan, only those shops selling groceries, fruits and vegetables have been allowed to keep the shutters open for a limited time.

After record quarterly fall, oil prices remain under pressure

Crude oil benchmarks opened the month mixed on Wednesday, following their biggest-ever quarterly and monthly losses, overshadowed by fears of global oversupply as data showed a bigger-than-expected rise in inventories in the United States. Brent crude was down by 2.1 percent at $25.81 a barrel, while US West Texas Intermediate crude was up by 0.1 percent at $20.50 a barrel, erasing most of a 1.3 percent gain. US crude inventories rose by 10.5 million barrels last week, far exceeding forecasts for a 4 million barrel build-up, data from industry group the American Petroleum Institute showed.

Asian equities fell for a second session on Thursday, after a dire warning about the U.S. coronavirus death toll had investors looking to the safety of dollars and bonds and bracing for more bad news from U.S. jobless figures. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.2%. Japan’s Nikkei extended Wednesday’s heavy drop with a 1.5% fall, and investors are beginning to worry that equities may re-test last month’s lows. Markets in Hong Kong, Sydney, Shanghai and Seoul fell, though futures for the S&P 500 bounced following Wall Street’s 4% plunge overnight. “Difficult days are ahead for our nation,” U.S. President Donald Trump told reporters at the White House on Wednesday. “We’re going to have a couple of weeks, starting pretty much now, but especially a few days from now, that are going to be horrific.”

The business community on Wednesday asked the government to encourage the State Bank of Pakistan to purchase assets and goods of depressed industries and further reduce the discount rate besides speedy clearance of tax refunds to address liquidity challenges and help mitigate adverse impact of Covid-19 pandemic. At a meeting with a ministerial team, the leading businessmen also advised the government to allow courier services and online businesses to resume their activities and extend maximum support to small and medium enterprises (SMEs) to pass through challenging times. Adviser to the Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh chaired the meeting via video link with the business community. Adviser to PM on Commerce and Industry, Abdul Razzak Dawood also attended.

The World Bank’s board of directors has approved a $700 million additional financing for 250km transmission line of the Dasu Hydropower Project to be completed by December 2023. This was announced by the World Bank at a time the government is seeking about $1.2 billion support from the bank through diversion of surplus or unutilised funds from slow-moving projects to meet additional funding requirements to mitigate adverse impacts of coronavirus threat. The board of directors of the World Bank is scheduled to approve about $200 million quick disbursing loan for Pakistan on Thursday.

The Pakistan Bureau of Statistics (PBS) on Wednesday said the inflation rate fell to 10.2 per cent in March from 12.4pc in the previous month owing to decline in prices of essential food items for a second consecutive month. This is for the first time since July last year that inflation measured by the Consumer Price Index (CPI) has seen a downward trend for a second month in a row due to a combination of factors including improvement in supply of eatables and reduction in prices of energy items. The data collected from markets to determine monthly inflation rate shows that many markets remain operational during the first half of March though it will be a big challenge to do a similar exercise in April amid lockdown. In most of the markets across Pakistan, only those shops selling groceries, fruits and vegetables have been allowed to keep the shutters open for a limited time.

Crude oil benchmarks opened the month mixed on Wednesday, following their biggest-ever quarterly and monthly losses, overshadowed by fears of global oversupply as data showed a bigger-than-expected rise in inventories in the United States. Brent crude was down by 2.1 percent at $25.81 a barrel, while US West Texas Intermediate crude was up by 0.1 percent at $20.50 a barrel, erasing most of a 1.3 percent gain. US crude inventories rose by 10.5 million barrels last week, far exceeding forecasts for a 4 million barrel build-up, data from industry group the American Petroleum Institute showed.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index have pulled back after getting support from a rising trend line on weekly and monthly charts meanwhile index succeed in closing above its major supportive region of 28,500pts on monthly chart. As of now it's expected that index would try to extend its bullish sentiment towards 29,700pts initially and breakout above that region would call for 30,300pts and 30760pts in coming days. It's recommended to stay cautious and post trailing stop loss on long positions because if index would start sliding downward again then it would move very quickly.

Index would remain bearish until it would not succeed in closing above 32,500pts on weekly chart and in case of facing rejection from its resistant regions index could fall below its previous low to complete 100% expansion of its last weekly correction. Initially index would try to find some ground at 28,500pts in case of bearish pressure but closing below that region would call for 27,000pts.

Index would remain bearish until it would not succeed in closing above 32,500pts on weekly chart and in case of facing rejection from its resistant regions index could fall below its previous low to complete 100% expansion of its last weekly correction. Initially index would try to find some ground at 28,500pts in case of bearish pressure but closing below that region would call for 27,000pts.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.