Previous Session Recap

Trading volume at PSX floor increased by 0.43 million shares or 0.62% on DoD basis, whereas the benchmark KSE100 index opened at 32,035.61, posted a day high of 32,060.58 and a day low of 31,780.92 points during last trading session while session suspended at 31,839.11 points with net change of -99.37 points and net trading volume of 55.15 million shares. Daily trading volume of KSE100 listed companies increased by 1.35 million shares or 2.51% on DoD basis.

Foreign Investors remained in net long positions of 1.22 million shares but net value of Foreign Inflow dropped by 0.19 million US Dollars. Categorically, Foreign Individuals remained in net selling positions of 0.09 million shares but Foreign Corporate and Overseas Pakistani investors remained in net long positions of 0.88 and 0.43 million shares. While on the other side Local Individuals, Companies, NBFCs and Brokers remained in net long positions of 2.37, 0.48, 0.005 and 0.27 million shares but Banks, Mutual Funds and Insurance Companies remained in net selling positions of 0.08, 2.43 and 2.04 million shares respectively.

Analytical Review

Trump hits China with more tariffs, says Xi moving too slowly on trade

WASHINGTON (Reuters) - U.S. President Donald Trump vowed to impose a 10% tariff on $300 billion of Chinese imports from Sept. 1, sharply raising the stakes in a bruising trade war with China and jolting global financial markets. The announcement on Thursday extends Trump’s trade tariffs to nearly all China’s imports into the United States and marks an abrupt end to a temporary truce in a trade row that has hurt world growth and disrupted global supply chains. Trump also threatened to raise tariffs further if China’s President Xi Jinping fails to move more quickly to strike a trade deal. “I think President Xi ... wants to make a deal, but frankly, he’s not going fast enough,” Trump said. Trump made the announcement in a series of Twitter posts after his top trade negotiators briefed him on a lack of progress in U.S.-China talks in Shanghai this week.

IMF, LCCI high-ups discuss Pakistan’s economic issues

Resident Representative of International Monetary Fund (IMF) Ms Teresa Daban Sanchez called on Lahore Chamber of Commerce & Industry (LCCI) President Almas Hyder on Thursday. LCCI Senior Vice President Khawaja Shahzad Nasir, Vice President Faheem-ur-Rehman Saigal, Amjad Ali Jawa, Mian Zahid Javed, Haris Atiq, Shahzad Aslam and Atif Ikram were also present. Economy of Pakistan, revenue collection, inflation, markup, trade deficit, agriculture sector and various other issues came under discussion during two hours long meeting. Ms Teresa Daban Sanchez said that Pakistan needed to carryout essential reforms for overcoming these crises. “Lack of consistent policies create challenges”, she said, adding, more was needed to put the economy on right track.

July CPI inflation up 2.3 percent MoM

Consumers Price Index (CPI) on monthly basis has registered an increase of 2.3 percent as it jumped from 246.82 points to 252.46 points in July 2019 against June 2019 while CPI on yearly basis went up by 10.34 percent as it jumped to 252.46 points in July 2019 against 228.80 points in July 2018. According to the CPI data released here on Thursday by Pakistan Bureau of Statistics (PBS), the CPI general inflation increased by 10.34 percent on year-on-year basis in July 2019 as compared to an increase of 8.9% in the previous month and 5.8% in July 2018.

Forex reserves up $199 million

The total liquid foreign exchange reserves held by the country rose by some $199 million to $15.062 billion at the end of last week. During the week ending July 26, 2019, the State Bank of Pakistan's foreign exchange reserves increased by $155 million to $7.767 billion due to official government inflows. Pakistan has recently raised some $500 million from a consortium of banks and these inflows were part of this loan. In addition, reserves held by banks increased by $44 million to $7.295 billion at the end of last week.

Eight socio-economic projects to be completed under CPEC

Punjab Government has proposed eight projects worth Rs5.6 billion in education, health, and agriculture sectors to be included in the China Pakistan Economic Corridor (CPEC) socio-economic development framework. Under the framework, five new schools would be established in the province at Tehsil levels at a cost of Rs800 million which would be equipped with smart classrooms including smart interactive white boards, multimedia equipment, computer equipment, table computer for learning, teaching furniture projects and printers. Once launched, the project is estimated to be completed within one year, sources in Punjab Planning and Development Board said.

WASHINGTON (Reuters) - U.S. President Donald Trump vowed to impose a 10% tariff on $300 billion of Chinese imports from Sept. 1, sharply raising the stakes in a bruising trade war with China and jolting global financial markets. The announcement on Thursday extends Trump’s trade tariffs to nearly all China’s imports into the United States and marks an abrupt end to a temporary truce in a trade row that has hurt world growth and disrupted global supply chains. Trump also threatened to raise tariffs further if China’s President Xi Jinping fails to move more quickly to strike a trade deal. “I think President Xi ... wants to make a deal, but frankly, he’s not going fast enough,” Trump said. Trump made the announcement in a series of Twitter posts after his top trade negotiators briefed him on a lack of progress in U.S.-China talks in Shanghai this week.

Resident Representative of International Monetary Fund (IMF) Ms Teresa Daban Sanchez called on Lahore Chamber of Commerce & Industry (LCCI) President Almas Hyder on Thursday. LCCI Senior Vice President Khawaja Shahzad Nasir, Vice President Faheem-ur-Rehman Saigal, Amjad Ali Jawa, Mian Zahid Javed, Haris Atiq, Shahzad Aslam and Atif Ikram were also present. Economy of Pakistan, revenue collection, inflation, markup, trade deficit, agriculture sector and various other issues came under discussion during two hours long meeting. Ms Teresa Daban Sanchez said that Pakistan needed to carryout essential reforms for overcoming these crises. “Lack of consistent policies create challenges”, she said, adding, more was needed to put the economy on right track.

Consumers Price Index (CPI) on monthly basis has registered an increase of 2.3 percent as it jumped from 246.82 points to 252.46 points in July 2019 against June 2019 while CPI on yearly basis went up by 10.34 percent as it jumped to 252.46 points in July 2019 against 228.80 points in July 2018. According to the CPI data released here on Thursday by Pakistan Bureau of Statistics (PBS), the CPI general inflation increased by 10.34 percent on year-on-year basis in July 2019 as compared to an increase of 8.9% in the previous month and 5.8% in July 2018.

The total liquid foreign exchange reserves held by the country rose by some $199 million to $15.062 billion at the end of last week. During the week ending July 26, 2019, the State Bank of Pakistan's foreign exchange reserves increased by $155 million to $7.767 billion due to official government inflows. Pakistan has recently raised some $500 million from a consortium of banks and these inflows were part of this loan. In addition, reserves held by banks increased by $44 million to $7.295 billion at the end of last week.

Punjab Government has proposed eight projects worth Rs5.6 billion in education, health, and agriculture sectors to be included in the China Pakistan Economic Corridor (CPEC) socio-economic development framework. Under the framework, five new schools would be established in the province at Tehsil levels at a cost of Rs800 million which would be equipped with smart classrooms including smart interactive white boards, multimedia equipment, computer equipment, table computer for learning, teaching furniture projects and printers. Once launched, the project is estimated to be completed within one year, sources in Punjab Planning and Development Board said.

Market is expected to remain volatile during current trading session.

Technical Analysis

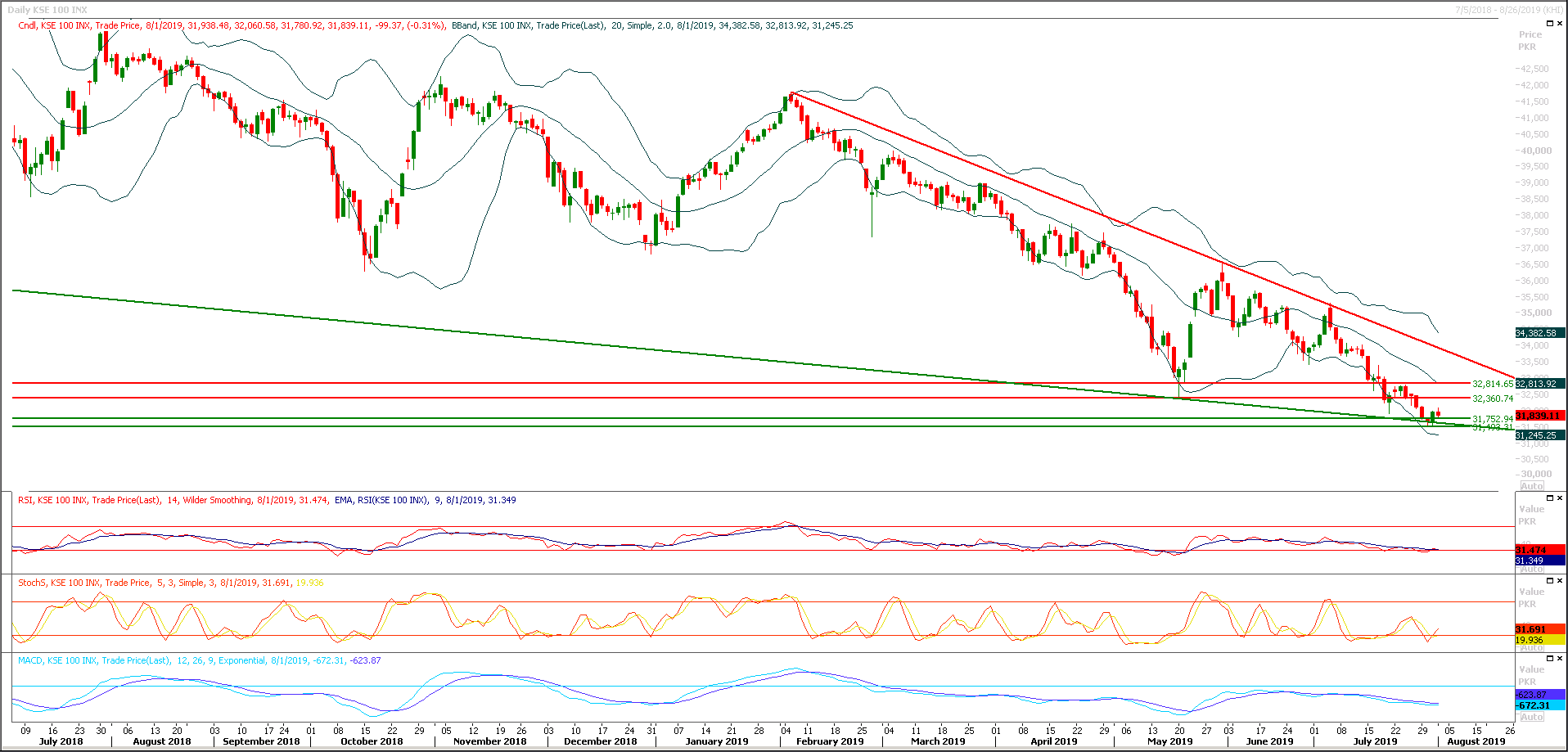

The Benchmark KSE100 index have tried to bounce back after getting supporting from a horizontal supportive region which falls at 31,500 points but it could not succeed in maintaining its bullish momentum and have dropped again after posting a double top on hourly chart. Index have tried to penetrate above its initial resistant region of 32,000 points but momentum could not prevail due to shortage of fresh volume in the market and right now hourly momentum seems exhausting because stochastic and maorsi both have generated bearish crossovers on hourly chart. While daily stochastic have closed with a positive note and it's expected that index would try to retest its resistant regions after a dip and on intraday basis index would try to find supports at 31,700 and 31,500 points while on flipside it would face resistances at 32,063 and 32,500 points. It's recommended to post trailing stop losses on long positions and wait for a clear breakout above 32,000 points to initiate new long position because if index would succeed in sliding below 31,500 points then next supportive region which could resist against any bearish rally are standing at 31,200 and 30,000 points therefore a caution call is being generated until unless index give a clear signal on either side.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.