Previous Session Recap

Trading volume at PSX floor dropped by 129.4 million shares or 57.24% on DoD basis, whereas the benchmark KSE100 Index opened at 37067.98, posted a day high of 38046.98 and day low of 37046.21 points during last trading session while session suspended at with net change of 929.09 points and trading volume of 63.47 million shares. Daily trading volume of KSE100 listed companies dropped by 100.75 million shares or 61.35% on DoD basis.

Foreign Investors remained in net selling positions of 0.69 million shares and net value of Foreign Inflow dropped by 0.46 million US Dollars during last trading session. Categorically, Foreign Corporate and Overseas Pakistanis remained in net selling positions of 0.15 and 0.54 million shares. While on the other side Local Individuals, Companies Banks and Brokers remained in net selling positions of 1.73, 3.97, 0.76 and 1.93 million shares respectively but Mutual Funds and Insurance Companies remained in net buying positions of 8.39 and 0.1 million shares.

Analytical Review

Asian shares blindsided by dismal China data

Asian shares turned tail on the first trading day of the new year as more disappointing economic data from China darkened the mood and erased early gains in U.S. stock futures. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS skidded 1.1 percent as a private survey showed China manufacturing activity contracted for the first time in 19 months. The Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) for December fell to 49.7, from 50.2 in November, and followed a raft of soft trade data from the Asian region. The Shanghai blue chip index .CSI300 quickly shed 1 percent and South Korea .KS11 fell 0.8 percent. Japan's Nikkei .N225 was closed for a holiday. E-Mini future for the S&P 500 ESc1 lost their early gains to be down 0.2 percent.

CPEC adds 300MW to national grid

The China Pakistan Economic Corridor (CPEC) has contributed 300MW of clean wind energy to the national grid through its four early harvest wind power projects. According to sources from embassy of China in Pakistan, the four wind projects that had been completed under CPEC and are connected with the national grid include Dawood wind power project (50 MW), Sachal Energy wind farm (50MW), three gorges second wind farm project (100MW), and UEP wind farm project (100MW). Dawood wind power project is a prioritized or early harvest project under CPEC, which installs 33 wind turbine generators with the capacity of 1.5MW per unit and total capacity is 49.5MW on 1,720 acres of land in the coastal area of Gharo wind corridor in Bhanbore, District Thatta, Sindh.

ECC reviews demand, supply of urea

The Economic Coordination Committee (ECC) of the Cabinet on Tuesday directed the Ministry of Industries and Production to chalk out a plan for continuous and smooth operation of urea plants in the country throughout the year. The ECC, which was chaired by Finance Minister Asad Umar, has reviewed the demand and supply situation of urea in the country. The ECC has asked the Ministry of Industries and Production to chalk out a plan for continuous and smooth operation of urea plants in the country. The exercise, ECC observed would help ensure availability of sufficient stocks of the fertilizer to meet demand of the farmers’ community.

Profit rates on saving schemes raised by up to 2.74pc

In line with a continuous hike in the central bank’s interest rates, the Central Directorate of National Savings (CDNS) on Tuesday increased profit margins on all national savings schemes by up to 2.74 per cent. The new rates would be applicable to deposits and investments made with effect from January 1, 2019. This is the 5th increase in returns on national savings since June 30 last year. According to notifications seen by Dawn, the CDNS, working under the ministry of finance, increased the rate of Defence Saving Certificate (DSC) to 12.47pc from 10.03pc. It stood at 8.10pc on June 30.

SECP hits back at FIA for midnight raid

Securities and Exchange Commission of Pakistan (SECP) Policy Board Chairman Khalid Mirza has criticised the government as well as the the Federal Investigation Agency(FIA) for conducting a raid on the SECP head office. “Such practice may be justified for those entities that may hide records or facts, but conducting a midnight raid at a regulatory body was an illegal act by the FIA. Will FIA or NAB conduct a midnight raid at any court or a ministry?” Mirza asked in a statement issued from abroad. Mirza, who is in the US on a personal visit, also said that the policy board will conduct an inquiry into the matter.

Asian shares turned tail on the first trading day of the new year as more disappointing economic data from China darkened the mood and erased early gains in U.S. stock futures. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS skidded 1.1 percent as a private survey showed China manufacturing activity contracted for the first time in 19 months. The Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) for December fell to 49.7, from 50.2 in November, and followed a raft of soft trade data from the Asian region. The Shanghai blue chip index .CSI300 quickly shed 1 percent and South Korea .KS11 fell 0.8 percent. Japan's Nikkei .N225 was closed for a holiday. E-Mini future for the S&P 500 ESc1 lost their early gains to be down 0.2 percent.

The China Pakistan Economic Corridor (CPEC) has contributed 300MW of clean wind energy to the national grid through its four early harvest wind power projects. According to sources from embassy of China in Pakistan, the four wind projects that had been completed under CPEC and are connected with the national grid include Dawood wind power project (50 MW), Sachal Energy wind farm (50MW), three gorges second wind farm project (100MW), and UEP wind farm project (100MW). Dawood wind power project is a prioritized or early harvest project under CPEC, which installs 33 wind turbine generators with the capacity of 1.5MW per unit and total capacity is 49.5MW on 1,720 acres of land in the coastal area of Gharo wind corridor in Bhanbore, District Thatta, Sindh.

The Economic Coordination Committee (ECC) of the Cabinet on Tuesday directed the Ministry of Industries and Production to chalk out a plan for continuous and smooth operation of urea plants in the country throughout the year. The ECC, which was chaired by Finance Minister Asad Umar, has reviewed the demand and supply situation of urea in the country. The ECC has asked the Ministry of Industries and Production to chalk out a plan for continuous and smooth operation of urea plants in the country. The exercise, ECC observed would help ensure availability of sufficient stocks of the fertilizer to meet demand of the farmers’ community.

In line with a continuous hike in the central bank’s interest rates, the Central Directorate of National Savings (CDNS) on Tuesday increased profit margins on all national savings schemes by up to 2.74 per cent. The new rates would be applicable to deposits and investments made with effect from January 1, 2019. This is the 5th increase in returns on national savings since June 30 last year. According to notifications seen by Dawn, the CDNS, working under the ministry of finance, increased the rate of Defence Saving Certificate (DSC) to 12.47pc from 10.03pc. It stood at 8.10pc on June 30.

Securities and Exchange Commission of Pakistan (SECP) Policy Board Chairman Khalid Mirza has criticised the government as well as the the Federal Investigation Agency(FIA) for conducting a raid on the SECP head office. “Such practice may be justified for those entities that may hide records or facts, but conducting a midnight raid at a regulatory body was an illegal act by the FIA. Will FIA or NAB conduct a midnight raid at any court or a ministry?” Mirza asked in a statement issued from abroad. Mirza, who is in the US on a personal visit, also said that the policy board will conduct an inquiry into the matter.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

Technical Analysis

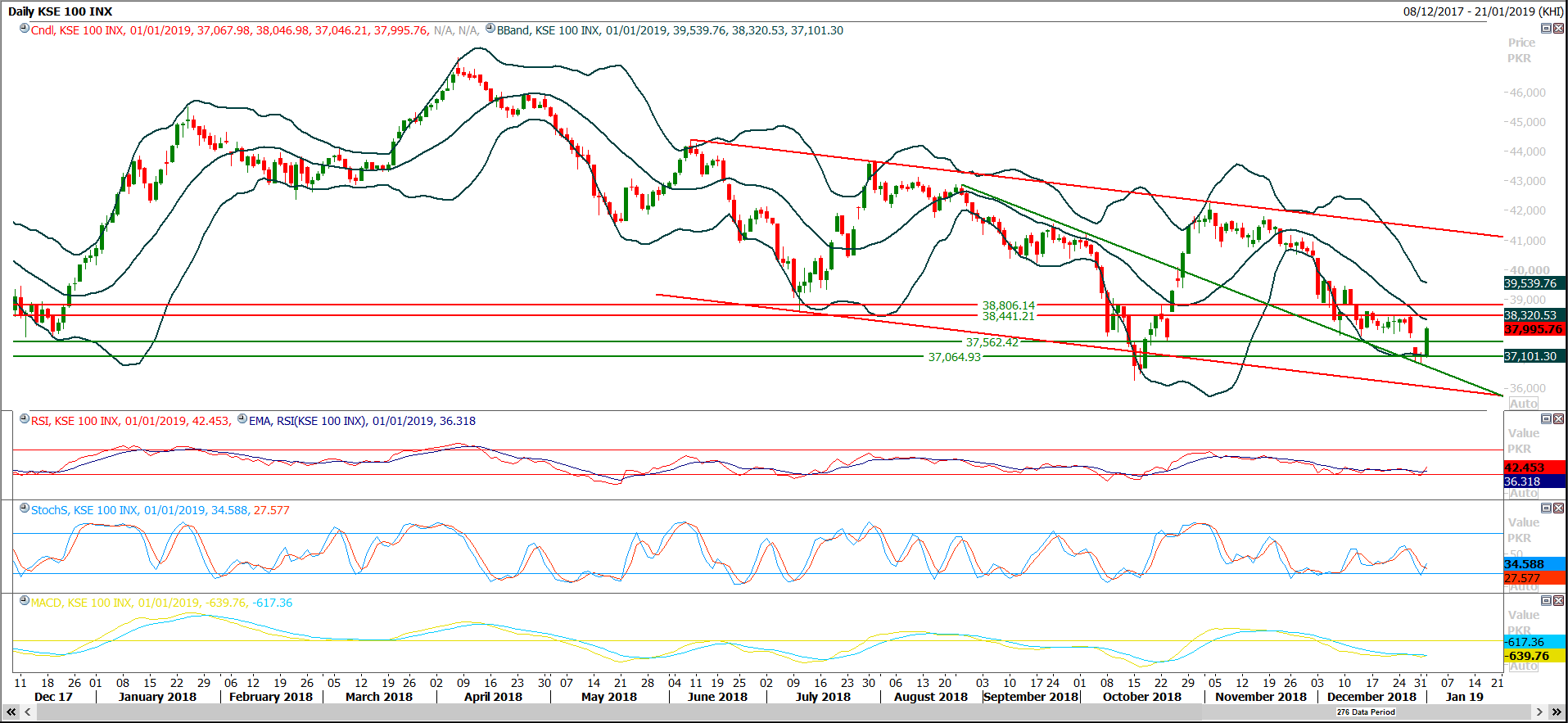

The Benchmark KSE100 Index have bounced back after getting support from a supportive trend line during last two trading sessions and have closed above its first major resistant region of 37,860 points during last trading session while creating a morning star on daily chart. Daily momentum indicators have succeeded in creating bullish crossovers during last trading session while weekly indicators are struggling for that. As of now it’s expected that index would try to continue its current bullish rally towards 38,440 and 38,800 points where it would face strong resistances from horizontal resistant regions. As yesterday’s session have closed with a clear indication of start of a bullish sentiment by creating a morning star so there are chances of formation of a cheat pattern because this kind of evident formations could not be completed usually therefore its recommended to trade cautiously with strict trailing stop losses on long positions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.