Previous Session Recap

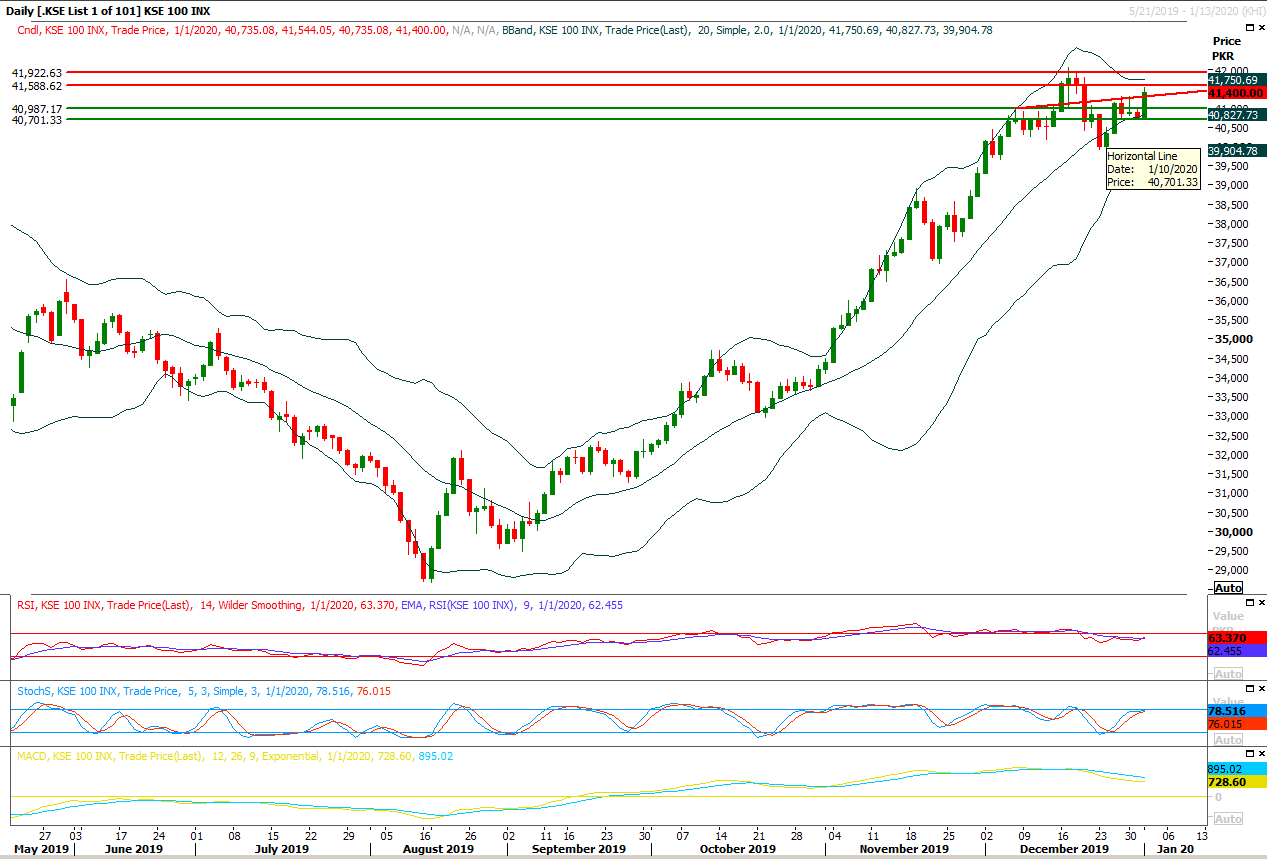

Trading volume at PSX floor increased by 153.62 million shares or 86.73% on DoD basis, whereas the benchmark KSE100 index opened at 40,735.08, posted a day high of 41,544.05 and a day low of 40,735.08 points during last trading session while session suspended at 41,400.00 points with net change of 664.92 points and net trading volume of 238.03 million shares. Daily trading volume of KSE100 listed companies increased by 120.82 million shares or 103.08% on DoD basis.

Foreign Investors remained in net selling positions of 5.55 million shares and value of Foreign Inflow dropped by 1.88 million US Dollars. Categorically, Foreign Individuals remained in net buying positions of 0.005 million shares but Overseas Pakistanis and Foreign Corporate remained in net selling positions of 1.16 and 4.39 million shares. While on the other side Local Individuals, Companies, Brokers and Insurance Companies remained in net selling positions of 26.33, 6.04, 7.28 and 2.58 million shares but Banks, NBFCs and Mutual Fund remained in net buying positions of 8.29, 2.82 and 24.74 million shares respectively.

Analytical Review

Asian shares rise on China's policy easing, trade deal hopes

Asian shares kicked off the new decade higher on Thursday, after global stocks ended the previous one at record highs, and buoyed by Chinese markets after Beijing eased monetary policy to support slowing growth. Investors also cheered news that the United States and China will sign a trade pact soon after a year of volatile negotiations between the world’s two largest economies. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.35% in morning trade after rising 5.6% in December. U.S. President Donald Trump said on Tuesday that Phase 1 of trade deal with China would be signed on Jan. 15 at the White House, though uncertainty surrounds details about the agreement.

Inflation clocks in at 12.63pc in December

Pakistan’s inflation rate slightly eased to 12.63 per cent in December from 12.7pc last month but still scaled the highest level in nine years, the Pakistan Bureau of Statistics (PBS) reported on Wednesday. Inflation, measured by the Consumer Price Index (CPI) lowered 0.34pc over the previous month. The data released shows that higher food prices have been the largest driver in overall inflation in December. It has also been observed that the prices of essential food items are higher in rural areas than in urban areas. Food inflation in urban areas rose by 16.7pc in December on a yearly basis but declined 1.7pc on a monthly basis whereas it increased by 19.7pc in rural areas and declined 1.1pc respectively.

CDWP approves Rs13bn development projects

The Central Development Working Party (CDWP) on Wednesday approved eight projects worth Rs13 billion with the aims of improving livelihoods, transport and communications, urban resources and water management. The committee meeting, chaired by Deputy Chairman Planning Commission Mohammad Jehanzeb Khan, also recommended five projects worth Rs112.20bn to the Executive Committee of National Economic Council (Ecnec) for consideration. The meeting was attended by Secretary Planning Zafar Hasan as well as senior officials from the federal and provincial governments. The CDWP approved a project worth Rs541.09 million for the improvement of livelihood and well-being of female home-based workers in Sindh.

Profit outflow rises to $600m

Repatriation of profits and dividends on foreign direct investment (FDI) in Pakistan increased to $600 million during the first five months of FY20, reflecting enhanced profits of companies having foreign investment. Latest data issued by the State Bank on Wednesday revealed that profits on FDI increased. However, profits on portfolio investment significantly decreased during this period. Profits outflow on FDI during the 5 months were $600m compared to $562m in the same period of last fiscal while the outflow as payment against portfolio investment was $70m compared to $106m of last fiscal year. The data shows that foreign investment in the country produced a better result as profitability was higher than previous fiscal.

PM’s aide directs FBR to raise revenue collection

In the wake of massive shortfalls in revenue collection, Adviser to the Prime Minister on Finance and Revenue Dr Hafeez Shaikh on Wednesday held a detailed meeting with top tax officials and expressed his displeasure over Federal Board of Revenue’s (FBR) performance in the first half of the current fiscal year. During his first visit to the FBR headquarters after assuming charge on April 20, 2019, the adviser asked FBR officials to take extraordinary measures to increase revenue collection to a level close to the revised target of Rs5.23 trillion.

Asian shares kicked off the new decade higher on Thursday, after global stocks ended the previous one at record highs, and buoyed by Chinese markets after Beijing eased monetary policy to support slowing growth. Investors also cheered news that the United States and China will sign a trade pact soon after a year of volatile negotiations between the world’s two largest economies. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.35% in morning trade after rising 5.6% in December. U.S. President Donald Trump said on Tuesday that Phase 1 of trade deal with China would be signed on Jan. 15 at the White House, though uncertainty surrounds details about the agreement.

Pakistan’s inflation rate slightly eased to 12.63 per cent in December from 12.7pc last month but still scaled the highest level in nine years, the Pakistan Bureau of Statistics (PBS) reported on Wednesday. Inflation, measured by the Consumer Price Index (CPI) lowered 0.34pc over the previous month. The data released shows that higher food prices have been the largest driver in overall inflation in December. It has also been observed that the prices of essential food items are higher in rural areas than in urban areas. Food inflation in urban areas rose by 16.7pc in December on a yearly basis but declined 1.7pc on a monthly basis whereas it increased by 19.7pc in rural areas and declined 1.1pc respectively.

The Central Development Working Party (CDWP) on Wednesday approved eight projects worth Rs13 billion with the aims of improving livelihoods, transport and communications, urban resources and water management. The committee meeting, chaired by Deputy Chairman Planning Commission Mohammad Jehanzeb Khan, also recommended five projects worth Rs112.20bn to the Executive Committee of National Economic Council (Ecnec) for consideration. The meeting was attended by Secretary Planning Zafar Hasan as well as senior officials from the federal and provincial governments. The CDWP approved a project worth Rs541.09 million for the improvement of livelihood and well-being of female home-based workers in Sindh.

Repatriation of profits and dividends on foreign direct investment (FDI) in Pakistan increased to $600 million during the first five months of FY20, reflecting enhanced profits of companies having foreign investment. Latest data issued by the State Bank on Wednesday revealed that profits on FDI increased. However, profits on portfolio investment significantly decreased during this period. Profits outflow on FDI during the 5 months were $600m compared to $562m in the same period of last fiscal while the outflow as payment against portfolio investment was $70m compared to $106m of last fiscal year. The data shows that foreign investment in the country produced a better result as profitability was higher than previous fiscal.

In the wake of massive shortfalls in revenue collection, Adviser to the Prime Minister on Finance and Revenue Dr Hafeez Shaikh on Wednesday held a detailed meeting with top tax officials and expressed his displeasure over Federal Board of Revenue’s (FBR) performance in the first half of the current fiscal year. During his first visit to the FBR headquarters after assuming charge on April 20, 2019, the adviser asked FBR officials to take extraordinary measures to increase revenue collection to a level close to the revised target of Rs5.23 trillion.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index have penetrated above a strong resistant trend line during last trading session after bouncing back from a daily double bottom. As of now it's expected that index would try to take a spike towards 41,600 points and breakout above that region would call for 41,900 points. Daily momentum indicators are still in bearish mode there it's recommended to stay cautious because if index would face rejection from its resistant regions then a hard push could be witnessed which would try to lead index below 40,000 points. Current week's closing matters a lot because index have indicated a huge uncertainty on weekly chart during last two weeks and if index would succeed in sliding below 40,000 points in these two days then a major upset would be witnessed in coming two months. It's recommended to post trailing stop loss on long positions and avoid short selling till a clear indication of bearish reversal.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.