Previous Session Recap

Trading volume at the PSX floor dropped by 6.88 million shares or 1.67%, DoD basis. Whereas, the KSE100 index opened at 50484.37 with a negative gap of 107.20 points, posted a day high of 50645.33 and a day low of 48361.19 during the last trading session while the session suspended at 48780.81 with net change of -1810.76 points and a net trading volume of 197.08 million shares. Daily trading volume of KSE100 listed companies dropped by 77.28 million shares or 28.17%, DoD basis.

Foreign Investors remained in a net buying position of 6.16 million shares but Foreign Inflow dropped by 16.51 million US Dollars. Categorically, Foreign Individual and Overseas Pakistani investors remained in net buying positions of 0.02 and 13.05 million shares, however, Foreign Corporate investors remained in a net selling position of 6.91 million shares. While on the other side, Local Individuals remained in a net buying position of 32.52 million shares but Local Companies, Banks, Mutual Funds and Brokers remained in net selling positions of 10.51, 6.74, 13.59 and 12.18 million shares, respectively.

Analytical Review

Asian stocks edged up on Friday and the dollar bounced from recent lows as upbeat data on U.S. manufacturing and employment and buoyant European factory growth boosted investor optimism. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS ticked up 0.1 percent, while Japanese Nikkei .N225 gained 1 percent to top the psychologically important 20,000-point level for the first time since August 2015. "Market sentiment is very good. The strength in Wall Street shares will be a tailwind for the Nikkei as well," said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management. MSCI ACWI .MIWD00000PUS, an index of 46 stock markets in the world, hit a record high, having gained 0.6 percent on Thursday.

The National Electric Power Regulatory Authority (Nepra) on Thursday directed all distribution companies of the Water and Power Development Authority (Wapda) to refund Rs1.96 per unit to consumers this month, after overcharging them in April. According to a notification, the regulator did not accept a petition by the Central Power Purchasing Agency (CPPA) that had sought a slash of Rs1.75 per unit to adjust for lower fuel prices, than had been estimated, in April. The regulator noted that the actual pool fuel charge for the month of April was Rs5.78 per unit against the reference fuel cost component of Rs7.63 per unit. The refund amount was calculated to be Rs1.96 per unit after adding a couple of other heads.

Inflation remained five per cent in May compared to 4.8pc in the preceding month because of an increase in the prices of petroleum and perishable products. Inflation rose 0.2pc month-on-month in May compared to a 1.3pc increase in the previous month and 0.2pc in May 2016, according to figures released by the Pakistan Bureau of Statistics (PBS) on Thursday. Main inflation is measured through the Consumer Price Index (CPI), which tracks prices of around 480 commodities every month in urban centres across the country.

Exports to European Union (EU) from Pakistan have increased from 4.25 billion Euros in 2013 to 6.28 billion Euros in 2016, showing growth of 47 percent. This was stated by Commerce Minister Khurram Dastagir Khan in a statement issued here on Thursday. Terming it as a significant improvement, the minister applauded the EU and said that the trade incentives extended to Pakistan under the GSP Plus by EU have played a positive role in boosting Pakistan’s exports and in stabilising the elected government of Pakistan. “The president of Pakistan, today in his speech in the joint session of both the houses of the parliament, also praised the positive role of European Union (EU)”, said Dastagir.

Pakistan Petroleum Limited (PPL) has achieved a breakthrough by increasing sales gas from Kandhkot Gas Field (KGF) to 230 MMscfd ahead of time and is ready to ramp it up further to 250 MMscfd when required. The field was earlier supplying an average of 180 MMscfd gas to Guddu Thermal Power Station. PPL has been making consistent efforts, especially during the last nine months since its commitment to government, to tap optimal potential of Kandhkot through fast-track development drilling, revamping of compressors and debottlenecking of production facilities.

The total liquid foreign reserves held by the country stood at $21,770.4 million on 26 May, 2017. This was announced by the State Bank of Pakistan (SBP) here on Thursday. The foreign reserves held by the State Bank of Pakistan are $16,921.9 million, net foreign reserves held by commercial banks are $4,848.5 million and total liquid foreign reserves are $21,770.4 million. During the week ending 26 May, 2017, the reserves of SBP increased by $709 million to $16,922 million due to official inflows.

The Market is expected to remain volatile today. We advise Traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

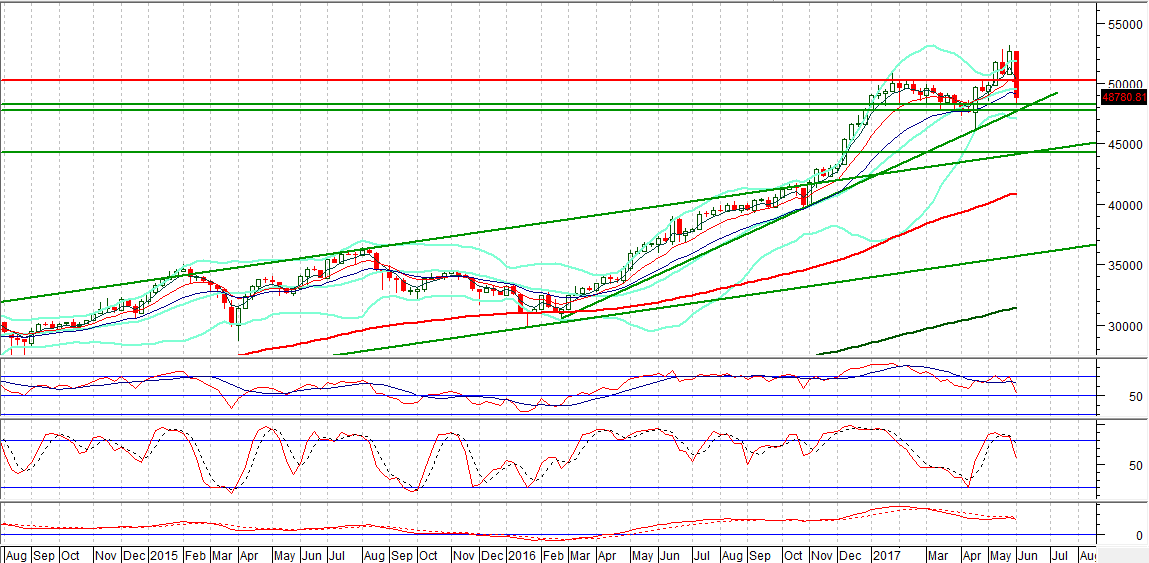

The Benchmark KSE100 Index dropped drastically after breaking out of its hourly wedge and found support at a horizontal supportive region, during the last trading session. However, for the current trading session, the supportive regions lie ahead at 48200 from a horizontal supportive region and at 47760 where a crossover of supportive trend line and a horizontal line is taking place on the weekly chart. 47760 could be the game changer for KSE100 index as sustaining this level may result in the index bouncing back for a correction of its bearish rally. On the other side, failure to sustain the said level may call for a further drop towards 46384. The current trading session is very important for the KSE100 index as failure to bounce back today may lead to a bearish engulfing on the weekly chart, which will be a negative sign for bulls. Trading with strict stop loss is recommended and a cautious trading approach is required for the current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.