Previous Session Recap

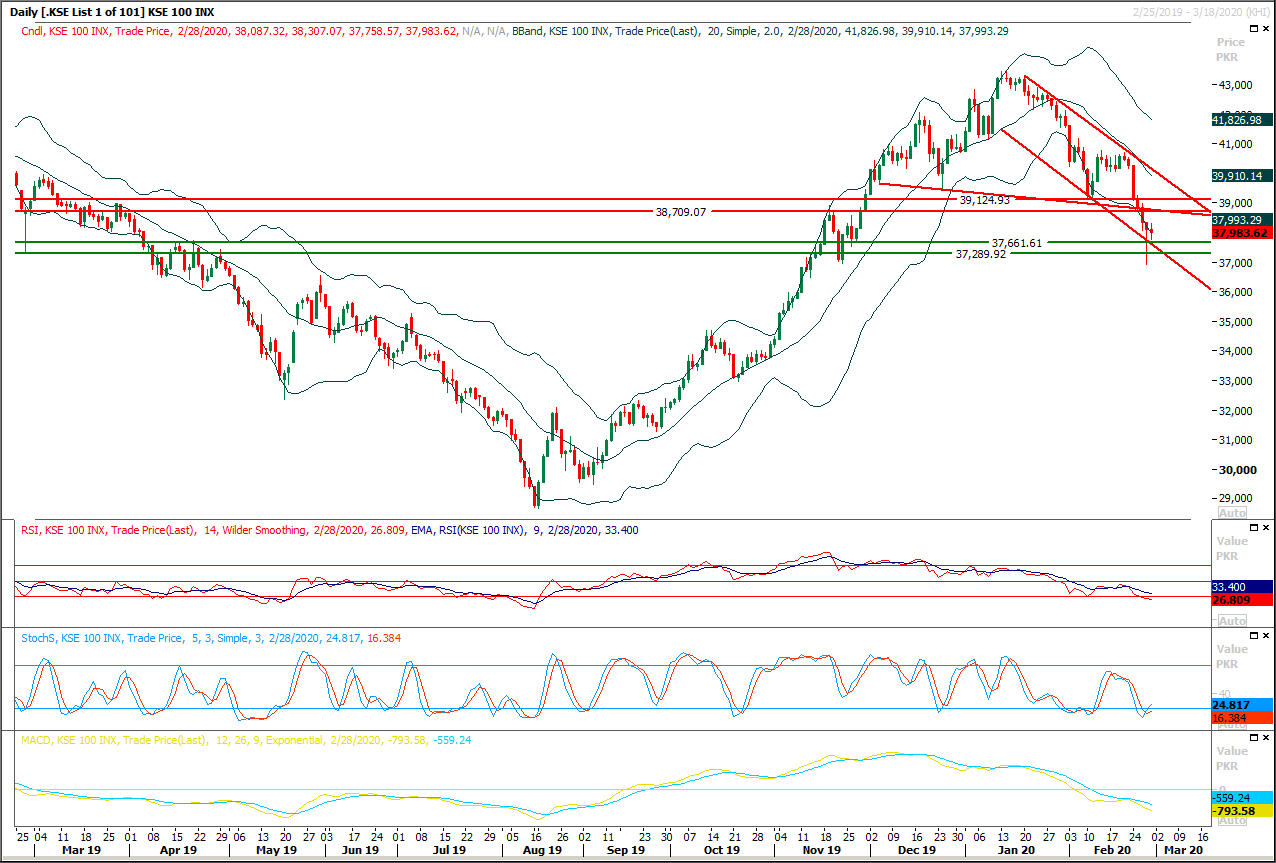

Trading volume at PSX floor dropped by -47.07 million shares or 18.88% on DoD basis, whereas the benchmark KSE100 index opened at 38,051.27, posted a day high of 38,307.07 and a day low of 37,758.57 points during last trading session while session suspended at 37,983.62 points with net change of -103.70 points and net trading volume of 163.20 million shares. Daily trading volume of KSE100 listed companies also dropped by 25.57 million shares or 12.62% on DoD basis.

Foreign Investors remained in net selling positions of 14.26 million shares and value of Foreign Inflow dropped by 6.18 million US Dollars. Categorically, Foreign Individuals remained in net long positions of 0.057 million shares but Foreign Corporate and Overseas Pakistani remained in net selling positions of 13.24 and 1.07 million shares respectively. While on the other side Local Companies, Mutual Fund, Brokers and Insurance Companies remained in net long positions of 5.89, 10.02, 3.21 and 9.71 million shares but Local Individuals, Banks and NBFCs remained in net selling positions of 14.86, 2.42 and 0.012 million shares respectively.

Analytical Review

Asian stock markets reverse losses on global policy stimulus hopes

Asian shares steadied from early losses on Monday as investors placed their hopes on a coordinated global monetary policy response to weather the damaging economic impact of the coronavirus epidemic.Pandemic fears pushed markets off a precipice last week, wiping more than $5 trillion from global share value as stocks cratered to their steepest slump in more than a decade. The sheer scale of losses prompted financial markets to price in policy responses from the U.S. Federal Reserve to the Bank of Japan and the Reserve Bank of Australia. Futures now imply a full 50 basis point cut by the Fed in March <0#FF:> while Australian markets <0#YIB:>are pricing in a quarter-point cut at the RBA’s Tuesday meeting. Also helping calm market nerves, Bank of Japan Governor Haruhiko Kuroda said on Monday the central bank would take necessary steps to stabilise financial markets.

Petroleum levy increased by up to 106pc

Facing a revenue shortfall of over Rs480 billion in the first eight months of the current financial year, the government has increased by up to 106 per cent the rate of petroleum levy on various oil products to raise an additional revenue of Rs10bn per month, or at least Rs40bn by June 30. Documents seen by Dawn suggest the ministry of finance increased the petroleum levy on high speed diesel (HSD) by Rs7.03 to Rs25.05 per litre for March, from Rs18 per litre in February. This is estimated to generate an additional revenue of Rs4.6bn per month. Sources said that based on existing tax rates, the Oil and Gas Regulatory Authority (Ogra) had worked out a reduction of Rs12.04 per litre (9.5pc) in the ex-depot price of HSD, but the finance ministry persuaded the prime minister to reduce its price by Rs5, or just 3.9pc. With a 9.5pc cut, the HSD price would have gone up to Rs115.2 from Rs122.25 per litre fixed by the government.

Nepra urges prime minister to declare power emergency

The National Electric Power Regulatory Authority (Nepra) has asked the prime minister to declare a national power emergency and take drastic steps for scaling down about Rs1.93 trillion circular debt which, according to the regulator, is significantly higher than reported by the power division. In a recent presentation to the prime minister, the regulator reported that circular debt had increased by about Rs492bn during the fiscal year 2018-19 at a monthly average of about Rs41-42bn, as opposed to Rs10-12bn per month being reported by the power division. In a press release issued two weeks ago, the power division put the overall circular debt, including fresh payables and old stock parked in the PHPL (Power Holding Company Limited) at Rs1.782 trillion as of Dec 31, 2019. Later in a presentation to a Senate Special Committee, the power division reported total payables at Rs1.882tr as of Jan 31, 2020, including PHPL debts of Rs807bn.

UAE, GCC markets decline; Kuwait suspends trading

The Dubai bourse hit a 14-month low with all its blue-chip stocks witnessing sell-off on Sunday. The UAE and other Gulf stock markets lost massively on Sunday, the first trading day of the week, due to increased worry about the growing number of coronavirus patients in the region and worldwide.The Dubai Financial Market and Abu Dhabi Securities Exchange plunged 4.7 per cent and 3.6 per cent, respectively, by mid-day on Sunday. The Dubai bourse hit a 14-month low with all its blue-chip stocks witnessing sell-off on Sunday. Barring Al Salam Sudan, all the shares on the Dubai fell. The Abu Dhabi index’s 3.6 per cent is its biggest intraday fall since January 2016. First Abu Dhabi Bank declined 4.3 per cent, while Abu Dhabi Commercial Bank dived 8 per cent. Only three stocks on the Abu Dhabi bourse were up by mid-day trading while all the remaining listed companies were down. The central bank of the UAE on Saturday advised banks to reschedule loans and reduce fees and commissions as part of measures to mitigate the economic effects of the coronavirus outbreak.

Efforts on to promote IT exports, encourage IT companies

Ministry of Information Technology and Telecommunication is making special efforts to promote IT exports and encourage IT companies. IT & IT enabled services (ITes) export remittances have surged to $550.503 million at a growth rate of 24.71% during the first six months of FY 2019-20 (July-December), in comparison to $441.435 million during same period in FY 2018-19, according to performance report of Pakistan Software Export Board (PSEB), an organization under Ministry of IT and Telecommunication. The number of PSEB registered IT & ITes companies has risen to 2163 as of 30th December 2019 compared to 1873 valid registrations as of December 2018 at growth rate of 15.5 %. PSEB facilitated 5 IT companies for attending Canada Pakistan ICT Forum, held in Toronto, Canada from September 23-27, 2019 besides facilitating participation of 20 IT companies in Pakistan Tech Summit 2019 in Norway on September 25 last year. PSEB organized participation of Pakistan’s IT companies participation at China Hi-Tech Fair 2019 held at Shenzhen, China on Nov 14-17 2019. It also facilitated participation of Pakistan’s IT companies in Arabnet 2019, Riyadh, Saudi Arabia on December 10-11 last year.

Asian shares steadied from early losses on Monday as investors placed their hopes on a coordinated global monetary policy response to weather the damaging economic impact of the coronavirus epidemic.Pandemic fears pushed markets off a precipice last week, wiping more than $5 trillion from global share value as stocks cratered to their steepest slump in more than a decade. The sheer scale of losses prompted financial markets to price in policy responses from the U.S. Federal Reserve to the Bank of Japan and the Reserve Bank of Australia. Futures now imply a full 50 basis point cut by the Fed in March <0#FF:> while Australian markets <0#YIB:>are pricing in a quarter-point cut at the RBA’s Tuesday meeting. Also helping calm market nerves, Bank of Japan Governor Haruhiko Kuroda said on Monday the central bank would take necessary steps to stabilise financial markets.

Facing a revenue shortfall of over Rs480 billion in the first eight months of the current financial year, the government has increased by up to 106 per cent the rate of petroleum levy on various oil products to raise an additional revenue of Rs10bn per month, or at least Rs40bn by June 30. Documents seen by Dawn suggest the ministry of finance increased the petroleum levy on high speed diesel (HSD) by Rs7.03 to Rs25.05 per litre for March, from Rs18 per litre in February. This is estimated to generate an additional revenue of Rs4.6bn per month. Sources said that based on existing tax rates, the Oil and Gas Regulatory Authority (Ogra) had worked out a reduction of Rs12.04 per litre (9.5pc) in the ex-depot price of HSD, but the finance ministry persuaded the prime minister to reduce its price by Rs5, or just 3.9pc. With a 9.5pc cut, the HSD price would have gone up to Rs115.2 from Rs122.25 per litre fixed by the government.

The National Electric Power Regulatory Authority (Nepra) has asked the prime minister to declare a national power emergency and take drastic steps for scaling down about Rs1.93 trillion circular debt which, according to the regulator, is significantly higher than reported by the power division. In a recent presentation to the prime minister, the regulator reported that circular debt had increased by about Rs492bn during the fiscal year 2018-19 at a monthly average of about Rs41-42bn, as opposed to Rs10-12bn per month being reported by the power division. In a press release issued two weeks ago, the power division put the overall circular debt, including fresh payables and old stock parked in the PHPL (Power Holding Company Limited) at Rs1.782 trillion as of Dec 31, 2019. Later in a presentation to a Senate Special Committee, the power division reported total payables at Rs1.882tr as of Jan 31, 2020, including PHPL debts of Rs807bn.

The Dubai bourse hit a 14-month low with all its blue-chip stocks witnessing sell-off on Sunday. The UAE and other Gulf stock markets lost massively on Sunday, the first trading day of the week, due to increased worry about the growing number of coronavirus patients in the region and worldwide.The Dubai Financial Market and Abu Dhabi Securities Exchange plunged 4.7 per cent and 3.6 per cent, respectively, by mid-day on Sunday. The Dubai bourse hit a 14-month low with all its blue-chip stocks witnessing sell-off on Sunday. Barring Al Salam Sudan, all the shares on the Dubai fell. The Abu Dhabi index’s 3.6 per cent is its biggest intraday fall since January 2016. First Abu Dhabi Bank declined 4.3 per cent, while Abu Dhabi Commercial Bank dived 8 per cent. Only three stocks on the Abu Dhabi bourse were up by mid-day trading while all the remaining listed companies were down. The central bank of the UAE on Saturday advised banks to reschedule loans and reduce fees and commissions as part of measures to mitigate the economic effects of the coronavirus outbreak.

Ministry of Information Technology and Telecommunication is making special efforts to promote IT exports and encourage IT companies. IT & IT enabled services (ITes) export remittances have surged to $550.503 million at a growth rate of 24.71% during the first six months of FY 2019-20 (July-December), in comparison to $441.435 million during same period in FY 2018-19, according to performance report of Pakistan Software Export Board (PSEB), an organization under Ministry of IT and Telecommunication. The number of PSEB registered IT & ITes companies has risen to 2163 as of 30th December 2019 compared to 1873 valid registrations as of December 2018 at growth rate of 15.5 %. PSEB facilitated 5 IT companies for attending Canada Pakistan ICT Forum, held in Toronto, Canada from September 23-27, 2019 besides facilitating participation of 20 IT companies in Pakistan Tech Summit 2019 in Norway on September 25 last year. PSEB organized participation of Pakistan’s IT companies participation at China Hi-Tech Fair 2019 held at Shenzhen, China on Nov 14-17 2019. It also facilitated participation of Pakistan’s IT companies in Arabnet 2019, Riyadh, Saudi Arabia on December 10-11 last year.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index is trying to find support at 37,000 points for a short term basis after generating an evening shooting star on monthly chart. As of now it's expected that index would try to take an intraday spike to retest its resistant region which fall on supportive trend line of its descending wedge. Initially index seems to target 38,700 points where it would face major resistant but breakout above that region would call for 39,000 points and 39,150 points. It's recommended to trade with strict stop loss and swing trading could be beneficial between 37,000 points and 39,200 points. Overall momentum would remain bearish and index would continue its bearish journey after a small correction therefore it's recommended to avoid initiating long positions for longer run.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.