Previous Session Recap

Trading volume at PSX floor increased by 23.80 million shares or 10.59% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 45,752.81, posted a day high of 45,835.07 and a day low of 45,443.39 during last trading session. The session suspended at 45,488.86 with net change of -53.92 and net trading volume of 155.95 million shares. Daily trading volume of KSE100 listed companies increased by 57.47 million shares or 58.35% on DoD basis.

Foreign Investors remained in net selling position of 10.83 million shares and net value of Foreign Inflow increased by 6.10 million US Dollars. Categorically, Foreign Individuals, Foreign Corporate and Overseas Pakistanis Investors remained in net buying positions of 0.08, 6.09 and 4.66 million shares. While on the other side Local Companies, and Mutual Fund remained in net buying positions of 17.53 and 10.91 million shares but Local Individuals, Banks, Brokers and Insurance Companies remained in net selling positions of 4.76, 9.67, 17.76 and 9.77 million shares respectively.

Analytical Review

Asian shares steady, dollar near four-month high before Fed decision

Asian equities held steady on Wednesday, while the dollar traded near a four-month high as investors await the Federal Reserve’s upcoming policy statement for clues on the future pace of U.S. monetary tightening.MSCI’s broadest index of Asia-Pacific shares outside Japan was little changed, while Japan’s Nikkei eased 0.2 percent and South Korea’s KOSPI slipped 0.3 percent. Stephen Innes, head of trading in Asia-Pacific for Oanda in Singapore, said that in addition to focusing on the Fed’s policy statement, equity investors may be turning cautious on the outlook for corporate profits, given potential cost pressures from recent rises in oil prices. Market participants may be starting to wonder that “perhaps this is as good as it’s going to get,” Innes said, referring to corporate profits. On Wall Street, the S&P 500 gained 0.25 percent on Tuesday on positive comments by U.S. Trade Representative Robert Lighthizer on China, and Mexico’s economy minister on the renegotiation of the North American Free Trade Agreement. Apple’s shares rose about 4 percent after the closing bell. The company beat revenue and profit expectations in its March quarter, with its shares ending the regular session up 2.3 percent.

IMF help inevitable if trade deficit not curtailed: Miftah

Federal Finance Minister Dr Miftah Ismail has said that the country would have to go to IMF for financial assistance if the government fails to curtail trade deficit . He was addressing a post-budget seminar organised by the Southern Regional Committee of the Institute of Chartered Accountants of Pakistan (ICAP) here at a local hotel. President ICAP Riaz A Rehman Chamdia and chairman Fiscal Laws Committee ICAP Ashfaq Tola also spoke on the occasion. However, Dr Miftah Ismail said that there would be no need to resort to IMF programme due to the measures taken by the incumbent government. “I am leaving the goods in order by May and if the next government (caretaker) keeps the things as normal by June we will not be required to go to IMF”. “What IMF wants us to do if we do that then there would be no need for the programme. We need to correct our financial affairs by increasing exports and reducing imports,” he emphasised.

Non-tax revenues target cut by Rs208b

The federal government has reduced the non-tax revenues target by Rs208 billion for the next fiscal year (FY2019), as Pakistan has excluded the Coalition Support Fund (CSF) receipts from the United States from budget estimates. The government has targeted to generate Rs771.9 billion from the non-tax revenues during FY2019 as against budgeted estimates of Rs979.9 billion of the outgoing fiscal. Meanwhile, the government has also revised downwards its non-tax collection target to Rs845.2 billion for the current fiscal year from the budgeted estimates of Rs979.9 billion. The government has estimated not to receive CSF amount during ongoing as well in upcoming year, which resulted in reducing the target of non-tax revenues. The break-up of Rs771.9 billion showed that government would receive Rs236.9 billion as income from property and enterprise, Rs305.8 billion from receipts from civil administration and Rs229.2 billion from miscellaneous receipts during FY2019.

Water shortage in Tarbela dam exceeds official estimates

Water shortage is exceeding official estimates amid Tarbela Dam hitting dead level for the second time in a fortnight. The development will be a serious challenge for Kharif crops in Sindh and Balochistan. Officials said the existing water resource at Tarbela dam was heading towards dead level in two days and there were no immediate signs of improving river flows in the catchment of Northern parts of the country. They said conservation level at two reservoirs — Tarbela and Mangla — had reached dead level almost a month ago and mostly remained so until mid-April. They said current storage at Tarbela was around 4-feet that would exhaust within two days at the current rate of discharges of 40,000 cusec compared to 35,000 cusec of inflows. In fact, the discharges were reduced to 40,000 cusec on Monday from previous level of 45,000 cusec because of precarious circumstances.

Ministry justifies defence budget hike

The defence ministry has insisted that increase in the defence budget for the next financial year was necessitated by the challenging security environment. “The critics need to also realise the security environment that Pakistan faces today and economic determinants of security,” the defence ministry said in a rare statement on Monday. The defence spending is proposed to increase to Rs 1.1 trillion (approximately $9.6 billion) in 2018-19. The ministry maintained that the “economy of any country cannot grow without security, peace and stability”.

Asian equities held steady on Wednesday, while the dollar traded near a four-month high as investors await the Federal Reserve’s upcoming policy statement for clues on the future pace of U.S. monetary tightening.MSCI’s broadest index of Asia-Pacific shares outside Japan was little changed, while Japan’s Nikkei eased 0.2 percent and South Korea’s KOSPI slipped 0.3 percent. Stephen Innes, head of trading in Asia-Pacific for Oanda in Singapore, said that in addition to focusing on the Fed’s policy statement, equity investors may be turning cautious on the outlook for corporate profits, given potential cost pressures from recent rises in oil prices. Market participants may be starting to wonder that “perhaps this is as good as it’s going to get,” Innes said, referring to corporate profits. On Wall Street, the S&P 500 gained 0.25 percent on Tuesday on positive comments by U.S. Trade Representative Robert Lighthizer on China, and Mexico’s economy minister on the renegotiation of the North American Free Trade Agreement. Apple’s shares rose about 4 percent after the closing bell. The company beat revenue and profit expectations in its March quarter, with its shares ending the regular session up 2.3 percent.

Federal Finance Minister Dr Miftah Ismail has said that the country would have to go to IMF for financial assistance if the government fails to curtail trade deficit . He was addressing a post-budget seminar organised by the Southern Regional Committee of the Institute of Chartered Accountants of Pakistan (ICAP) here at a local hotel. President ICAP Riaz A Rehman Chamdia and chairman Fiscal Laws Committee ICAP Ashfaq Tola also spoke on the occasion. However, Dr Miftah Ismail said that there would be no need to resort to IMF programme due to the measures taken by the incumbent government. “I am leaving the goods in order by May and if the next government (caretaker) keeps the things as normal by June we will not be required to go to IMF”. “What IMF wants us to do if we do that then there would be no need for the programme. We need to correct our financial affairs by increasing exports and reducing imports,” he emphasised.

The federal government has reduced the non-tax revenues target by Rs208 billion for the next fiscal year (FY2019), as Pakistan has excluded the Coalition Support Fund (CSF) receipts from the United States from budget estimates. The government has targeted to generate Rs771.9 billion from the non-tax revenues during FY2019 as against budgeted estimates of Rs979.9 billion of the outgoing fiscal. Meanwhile, the government has also revised downwards its non-tax collection target to Rs845.2 billion for the current fiscal year from the budgeted estimates of Rs979.9 billion. The government has estimated not to receive CSF amount during ongoing as well in upcoming year, which resulted in reducing the target of non-tax revenues. The break-up of Rs771.9 billion showed that government would receive Rs236.9 billion as income from property and enterprise, Rs305.8 billion from receipts from civil administration and Rs229.2 billion from miscellaneous receipts during FY2019.

Water shortage is exceeding official estimates amid Tarbela Dam hitting dead level for the second time in a fortnight. The development will be a serious challenge for Kharif crops in Sindh and Balochistan. Officials said the existing water resource at Tarbela dam was heading towards dead level in two days and there were no immediate signs of improving river flows in the catchment of Northern parts of the country. They said conservation level at two reservoirs — Tarbela and Mangla — had reached dead level almost a month ago and mostly remained so until mid-April. They said current storage at Tarbela was around 4-feet that would exhaust within two days at the current rate of discharges of 40,000 cusec compared to 35,000 cusec of inflows. In fact, the discharges were reduced to 40,000 cusec on Monday from previous level of 45,000 cusec because of precarious circumstances.

The defence ministry has insisted that increase in the defence budget for the next financial year was necessitated by the challenging security environment. “The critics need to also realise the security environment that Pakistan faces today and economic determinants of security,” the defence ministry said in a rare statement on Monday. The defence spending is proposed to increase to Rs 1.1 trillion (approximately $9.6 billion) in 2018-19. The ministry maintained that the “economy of any country cannot grow without security, peace and stability”.

Market is expected to remain volatile therefore it'ss recommended to stay cautious while trading today.

Technical Analysis

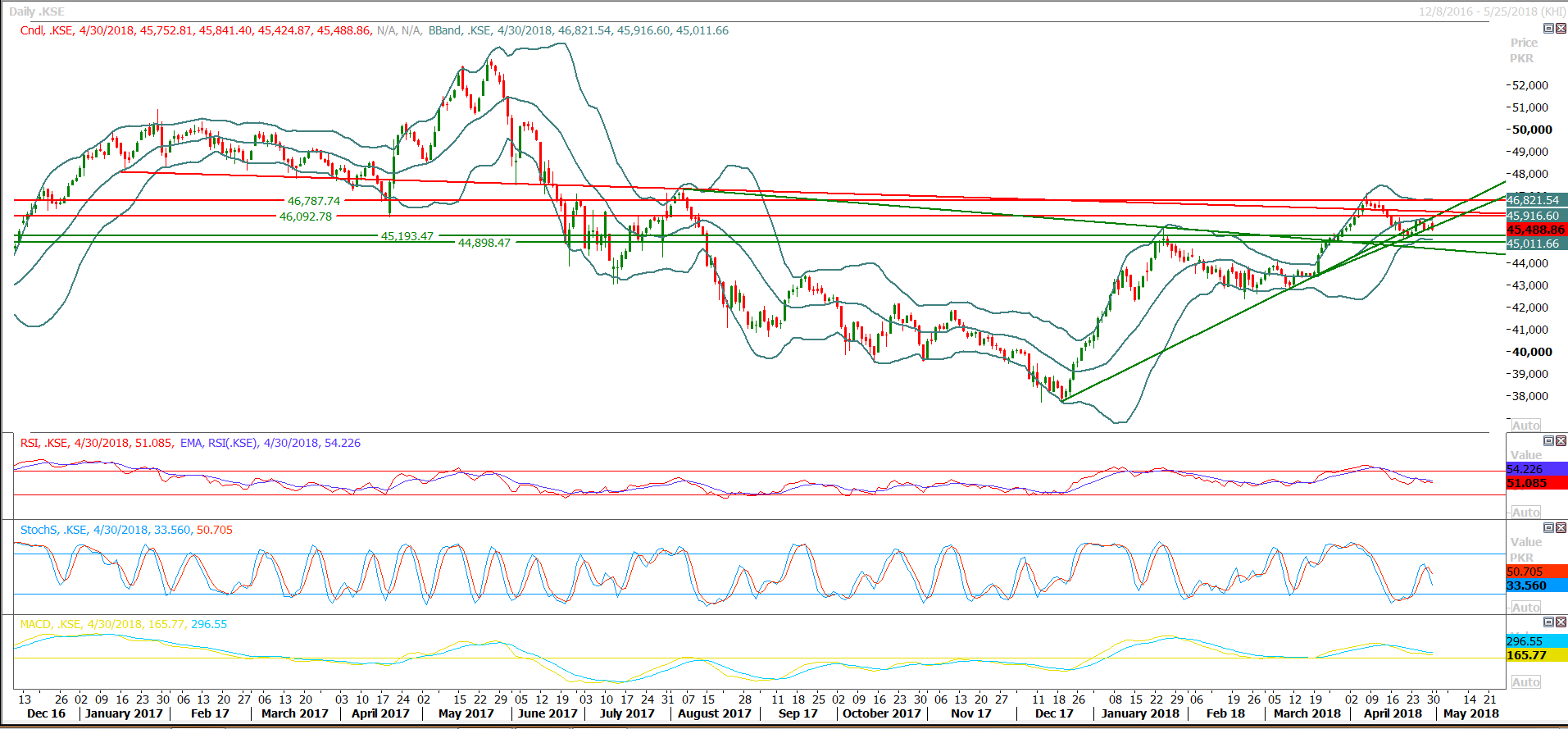

The Benchmark KSE100 Index has changed its daily momentum to bearish direction again after creating a bearish crossover of Stochastic on daily chart. Weekly momentum is in bearish mode already and its adding pressure on index which may lead it towards 45,096 and 44,860. Index have slipped below its major supportive region during last trading session and confirmed its bearish trend by retesting its resistant trend line. For current trading session index have resistant regions around 45,860 and 45,930 points while supportive regions are standing at 45,096 and 44,860 points. It’s expected that index would remain under pressure therefore its recommended to initiate sell on strength.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.