Previous Session Recap

Trading volume at PSX floor dropped by 22.74 million shares or 16.31%, DoD basis, whereas, the benchmark KSE100 Index opened at 39662.80, posted a day high of 40558.97 and a day low of 39660.13 during the last trading session. The session suspended at 40453.64 with a net change of 836.45 and net trading volume of 63.51 million shares. Daily trading volume of KSE100 listed companies dropped by 30 million shares or 32.08%,DoD basis.

Foreign Investors remained in a net selling position of 6.99 million shares and net value of Foreign Inflow dropped by 4.53 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling positions of 0.06, 6.39 and 0.54 million shares respectively. While on the other side Local Individuals and NBFCs remained in net selling positions of 5.88 and 3.62 million shares but Local Companies, Banks, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 3.88, 1.38, 0.2, 10.05 and 0.98 million shares respectively.

Analytical Review

Asian shares advanced on Thursday after the U.S. Federal Reserve expressed optimism about the economy, virtually cementing the case for a year-end rate hike as investors awaited the formal nomination of the next head of the central bank. The White House plans to nominate current Fed Governor Jerome Powell as the next chair when Janet Yellen’s term expires in February, a source familiar with the matter said on Wednesday. Powell’s nomination is expected later on Thursday and would need to be confirmed by the Senate. Rising expectations that President Donald Trump will tap Powell, who is seen as more dovish on interest rates, have pressured U.S. Treasury yields and the dollar this week. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS added 0.1 percent in early trading, moving back toward a 10-year peak scaled in the previous session. Japan's Nikkei stock index .N225 was up 0.2 percent, probing fresh 21-year highs and on track to gain 2.3 percent in a holiday-shortened week. Japanese markets will be closed for a national holiday on Friday.

Annual consumer price inflation inched down to 3.8 percent in October as compared to 3.9 percent in the previous month and 4.2 percent in October a year earlier, official data showed on Wednesday.Pakistan Bureau of Statistics (PBS) recorded consumer price inflation at 0.7 percent month-on-month in October as compared to an increase of 0.6 percent in the previous month and increase of 0.8 percent in October 2016.

Government is likely to face Rs70 billion in customs duty losses after a sudden change in auto policy that bounds overseas Pakistanis to pay levies on car exports to Pakistan in US dollars, industry officials said. Presidents of the Pak Japan Auto Association Javed Nazi and Pak Japan Business Council Rana Abid Hussain told The News that the Pakistani government allows import of used vehicles under personal baggage, transfer of residency and gift scheme.

The central bank on Wednesday allowed local insurance firms to set rules on dollar-denominated insurance cover for foreign companies, raising prospects of less burning of the country’s foreign reserves at a time of their steep decline.“It has now been decided to allow resident insurance companies, rated at least as "A" by any approved rating agency of Pakistan, to issue US dollar-denominated insurance policies on notional basis to meet the condition of foreign lenders for foreign currency loans or for the projects undertaken in Pakistan as part of bilateral agreement between the government of Pakistan and a foreign country / multilateral agency,” the State bank of Pakistan said.

Textile machinery imports into the country increased by 26.53 percent during the first quarter of current fiscal year (July-September) as compared to the same period of last year, according to Pakistan Bureau of Statistics (PBS). According to the data provided by the PBS, textile machinery worth $146,384 was imported during the first quarter of current year as compared to $115,694 of last year. Construction and mining machinery worth $100,524 were imported during the first quarter of current year as compared to $117,666 of last year.

Today ATRL, ENGRO, KEL and PPL may lead the market in the positive direction.

Technical Analysis

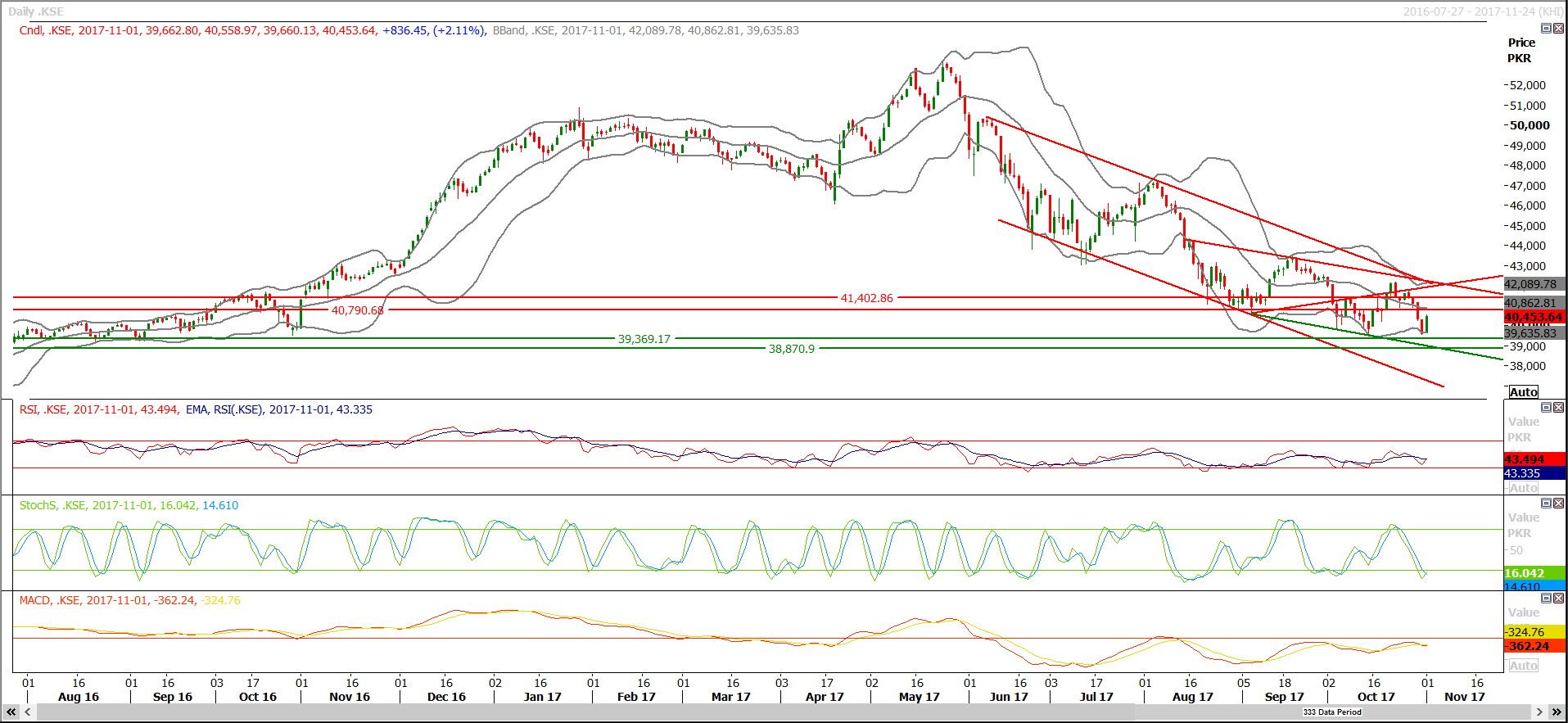

The Benchmark KSE100 Index has bounced back after posting a double bottom on daily chart and Daily Stochastic along with MAORSI have generated bullish crossovers which is an indication for a bullish reversal but the trend might confirm once index closes above 40800 on the daily chart during the current trading session, as index have generated a bullish engulfing on daily chart and it would be confirmed by current session's closing. On the hourly chart 40790-40900 region is a very strong resistance therefore it is expected that index may face resistance from a horizontal resistance along with a 61.8% correction of last bearish rally in this region.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.