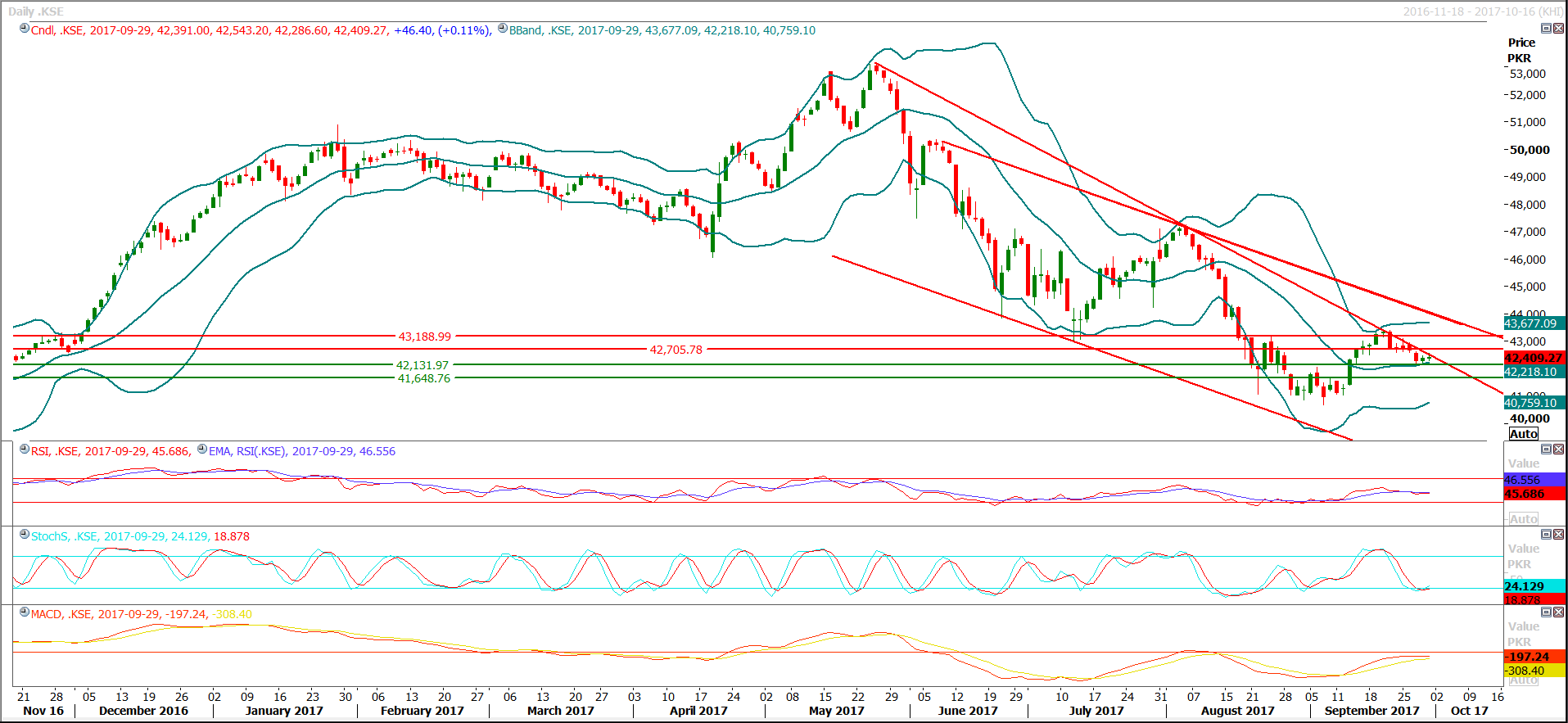

Trading volume at PSX floor increased by 32.57 million shares or 23.2%, DoD basis, whereas, the benchmark KSE100 Index opened at 42391, posted a day high of 42543.20 and a day low of 42286.60 during the last trading session. The session suspended at 42409.27 with a net change of 46.4 points and net trading volume of 92.31 million shares. Daily trading volume of KSE100 listed companies increased by 32.26 million shares or 53.73%, DoD basis.

Foreign Investors remained in a net selling position of 3.79 million shares and a net value of Foreign Inflow dropped by 0.56 million shares. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.13 and 0.11 million shares but Foreign Coporate Investors remained in a net selling position of 4.03 million shares.On the other side Local Individuals, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 0.21, 0.27, 33.99 and 0.88 million shares respectively but Local Companies, Banks and NBFCs remained in net selling positions of 17.49, 13.82 and 0.25 million shares respectively.

The euro took a knock in Asia on Monday as investors kept an anxious eye on an independence vote in Spain’s Catalonia, although surprisingly strong economic news out of China and Japan offered support to equities and commodities. The euro fell 0.3 percent after the violence-marred vote to trade at $1.1773, with liquidity lacking given holidays in China and South Korean markets. Asian shares were faring better than bonds after upbeat economic data from China, Japan and South Korea augured well for a sustained pickup in global growth. MSCI’s broadest index of Asia-Pacific shares outside Japan added 0.28 percent, while E-Mini futures for the S&P 500 rose 0.14 percent. Australia’s main index jumped 1.1 percent, while Japan’s Nikkei inched up 0.2 percent after a survey of manufacturers produced the strongest sentiment reading in a decade. China’s manufacturing activity grew at the fastest pace since 2012 in September as factories cranked up output to take advantage of strong demand and high prices. The official Purchasing Managers’ Index (PMI) released on Saturday rose to 52.4 in September, from 51.7 in August.

The government is developing a plan to address the growing difficulties on the external front in the immediate term, involving regulatory duties on imports of a large number of items, a senior official who is in the know told Dawn on Saturday. “The government is trying to both incentivise exports and reduce imports by coming up with a regime of regulatory duties,” he said. “This is something they are working on and is likely to be announced soon.” Early this year the government announced increased margin requirements to discourage imports, but the plan met with limited success. Then the budget FY18 expanded regulatory duties on a large number of items, as a result of which collections under this head improved.

The cement capacity utilisation in August 2017 was more than 96 percent as the domestic cement dispatches are constantly increasing which is a good sign, indicating that the economy is in good shape. According to the data, in the first two months of this fiscal, the industry dispatched 7.148 million tons cement, showing an overall growth of 20.81 percent over the corresponding period of last fiscal. During this period, the domestic consumption increased by 27.95 percent but exports declined by 13.39 percent. It is worth noting that the domestic cement consumption during July-August of this fiscal increased by 28.51 percent in the North and by 25.41 percent in the Southern part of the country. In contrast, the exports from North declined by only 2.47 percent compared with a decline of 25.41 percent in the South. This should be a matter of concern for the authorities because in the past the South based mills being nearer to sea were leading cement exporters. In August 2017, the domestic cement dispatches in the Northern region was 2.731 million tons against dispatches of 2.495 in August 2016 whereas the dispatches in the Southern region was 0.625 million tons in August 2017 against dispatches of 0.532 million tons in same month last year. Exports from North were 0.307 million tons last month against 0.355 million tons in August 2016.

The urea prices have surged from $254/MT to $290/MT in the international market, marking a growth of over 16 percent in one week. The price hike has been on account of increase in international coal prices and reduction in urea production in China due to plant closures. The international coal prices have also surged from $87/MT last month in Aug 2017 to $93/MT, recording a 7 percent monthly and 41 percent annual growth. Weak demand on the international front along with the unexpected increase in global coal prices have resulted in a drastic rise in urea production costs. This coupled with a few plant closures in China have led to reduction in production levels, thereby decreasing Chinese urea exports.

The Islamabad Chamber of Commerce and Industry hosted a dinner reception in honor of foreign diplomats which was well attended. Ambassadors, High Commissioners and diplomatic representatives of about 50 countries were present while some Additional Foreign Secretaries also graced the occasion. Speaking at the occasion, Khalid Iqbal Malik, President, Islamabad Chamber of Commerce and Industry, said that law and order situation has improved significantly in Pakistan while our economy offered great potential for foreign investors in its various sectors including infrastructure development, energy, oil & gas, natural resources, construction and engineering sectors. He said the CPEC project has created many new avenues of business and investment in Pakistan and it was right time that foreign investors should explore Pakistan for JVs and investment.

TodayKEL, NBP and STPL may lead the market in the positive direction.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.