Previous Session Recap

Trading volume at PSX floor dropped by 39.65 million shares or 27.17% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 40,985.03, posted a day high of 41,026.98 and a day low of 40,710.70 during last trading session. The session suspended at 40,929.44 with net change of -69.15 and net trading volume of 71.48 million shares. Daily trading volume of KSE100 listed companies dropped by 27.26 million shares or 27.61% on DoD basis.

Foreign Investors remain in net selling positions of 4.94 million shares and net value of Foreign Inflow dropped by 3.03 million US Dollars. Categorically Foreign Corporate remained in net selling positions of 5.25 million shares but Overseas Pakistanis investors remained in net buying positions of 0.31 million shares. While on the other side Local Individuals, Banks and Mutual Fund remained in net buying positions of 12.00, 4.90 and 1.06 million shares respectively but Local Companies, NBFCs, Brokers and Insurance Companies remained in net selling positions of 3.70, 0.67, 540 and 1.41 million shares.

Analytical Review

Global stocks, Canadian dollar up on NAFTA deal, safe-haven assets hit

A pact between the United States and Canada to rescue the trilateral North American Free Trade Agreement with Mexico drove up global stock markets and the Canadian dollar on Monday, while weighing on safe-haven assets. The newly named United States-Mexico-Canada Agreement (USMCA) announced on Sunday preserves a $1.2 trillion open-trade zone that was on the brink of collapse after nearly a quarter century. “It is good news not only for NAFTA and North America in general, but a lot of market participants are really viewing this as a positive for future negotiations, especially with China,” said Lindsey Bell, investment strategist at CFRA Research in New York. In currencies, the British pound rose against the U.S. dollar after Bloomberg reported that the British government was proposing a compromise on the Irish border issue in Brexit talks. The Dow Jones Industrial Average .DJI rose 192.9 points, or 0.73 percent, to 26,651.21, the S&P 500 .SPX gained 10.61 points, or 0.36 percent, to 2,924.59 and the Nasdaq Composite .IXIC dropped 9.05 points, or 0.11 percent, to 8,037.30.

IMF delegation meets FBR, finance ministry officials

International Monetary Fund (IMF) delegation on Monday held a meeting with the Federal Board of Revenue (FBR) and Ministry of Finance officials. During the third round of talks, the FBR and Ministry of Finance officials briefed the visiting delegation over details regarding tax revenues. IMF asked the officers to ensure consolidated measures to make all non-filers accountable under tax net. IMF had termed current economic condition ‘unsatisfactory’, during the previous two rounds of talks. State Bank of Pakistan (SBP) governor and Federal Board of Revenue (FBR) chairman will also hold separate meetings with IMF’s delegation.

Chinese Group offers to establish vocational university in Pakistan

China’s St Fulin Group has offered to set up a vocational university in Pakistan to meet the ever-increasing demand of the skilled labour for the projects being completed under China Pakistan Economic Corridor (CPEC) framework. “At present, we are discussing the details with the officials concerned in Pakistan and the embassy of Pakistan in Beijing and hoped for a positive response and cooperation,” Scarlet, CPO of St Fulin Group Monday said. “China is the best in the vocational education in the world rather even in some areas it is better than Germany and Japan and we are ready to impart quality training to Pakistani students in their country,” she told APP in an interview.

Rate of local LPG goes further up

The upward journey of LPG, the fuel of poor, prices is continuing as the government on Monday increased the rates of indigenous LPG gas cylinder of 11.8kg by Rs59.8 or 3.7 percent. OGRA has increased the price of LPG by Rs59.8 over previous month and set the new price of Rs 1673.24 for the domestic cylinder that would be effective from today (Tuesday), said a notification issued by the Oil and Gas Regulatory Authority (OGRA) here.

Pakistan’s economy moving in right direction

American businessmen have said that Pakistan’s business climate is moving in the right direction but the pace of economic reforms should be accelerated. They have expressed the commitment to push for improved economic engagement between the two countries aimed at resolving tensions and to achieve shared goals. The commitments were made during meetings between FPCCI’s delegation, led by its President Ghazanfar Bilour, and US businessmen that included Esperranza G Jelalian, president of US-Pakistan Business Council.

A pact between the United States and Canada to rescue the trilateral North American Free Trade Agreement with Mexico drove up global stock markets and the Canadian dollar on Monday, while weighing on safe-haven assets. The newly named United States-Mexico-Canada Agreement (USMCA) announced on Sunday preserves a $1.2 trillion open-trade zone that was on the brink of collapse after nearly a quarter century. “It is good news not only for NAFTA and North America in general, but a lot of market participants are really viewing this as a positive for future negotiations, especially with China,” said Lindsey Bell, investment strategist at CFRA Research in New York. In currencies, the British pound rose against the U.S. dollar after Bloomberg reported that the British government was proposing a compromise on the Irish border issue in Brexit talks. The Dow Jones Industrial Average .DJI rose 192.9 points, or 0.73 percent, to 26,651.21, the S&P 500 .SPX gained 10.61 points, or 0.36 percent, to 2,924.59 and the Nasdaq Composite .IXIC dropped 9.05 points, or 0.11 percent, to 8,037.30.

International Monetary Fund (IMF) delegation on Monday held a meeting with the Federal Board of Revenue (FBR) and Ministry of Finance officials. During the third round of talks, the FBR and Ministry of Finance officials briefed the visiting delegation over details regarding tax revenues. IMF asked the officers to ensure consolidated measures to make all non-filers accountable under tax net. IMF had termed current economic condition ‘unsatisfactory’, during the previous two rounds of talks. State Bank of Pakistan (SBP) governor and Federal Board of Revenue (FBR) chairman will also hold separate meetings with IMF’s delegation.

China’s St Fulin Group has offered to set up a vocational university in Pakistan to meet the ever-increasing demand of the skilled labour for the projects being completed under China Pakistan Economic Corridor (CPEC) framework. “At present, we are discussing the details with the officials concerned in Pakistan and the embassy of Pakistan in Beijing and hoped for a positive response and cooperation,” Scarlet, CPO of St Fulin Group Monday said. “China is the best in the vocational education in the world rather even in some areas it is better than Germany and Japan and we are ready to impart quality training to Pakistani students in their country,” she told APP in an interview.

The upward journey of LPG, the fuel of poor, prices is continuing as the government on Monday increased the rates of indigenous LPG gas cylinder of 11.8kg by Rs59.8 or 3.7 percent. OGRA has increased the price of LPG by Rs59.8 over previous month and set the new price of Rs 1673.24 for the domestic cylinder that would be effective from today (Tuesday), said a notification issued by the Oil and Gas Regulatory Authority (OGRA) here.

American businessmen have said that Pakistan’s business climate is moving in the right direction but the pace of economic reforms should be accelerated. They have expressed the commitment to push for improved economic engagement between the two countries aimed at resolving tensions and to achieve shared goals. The commitments were made during meetings between FPCCI’s delegation, led by its President Ghazanfar Bilour, and US businessmen that included Esperranza G Jelalian, president of US-Pakistan Business Council.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

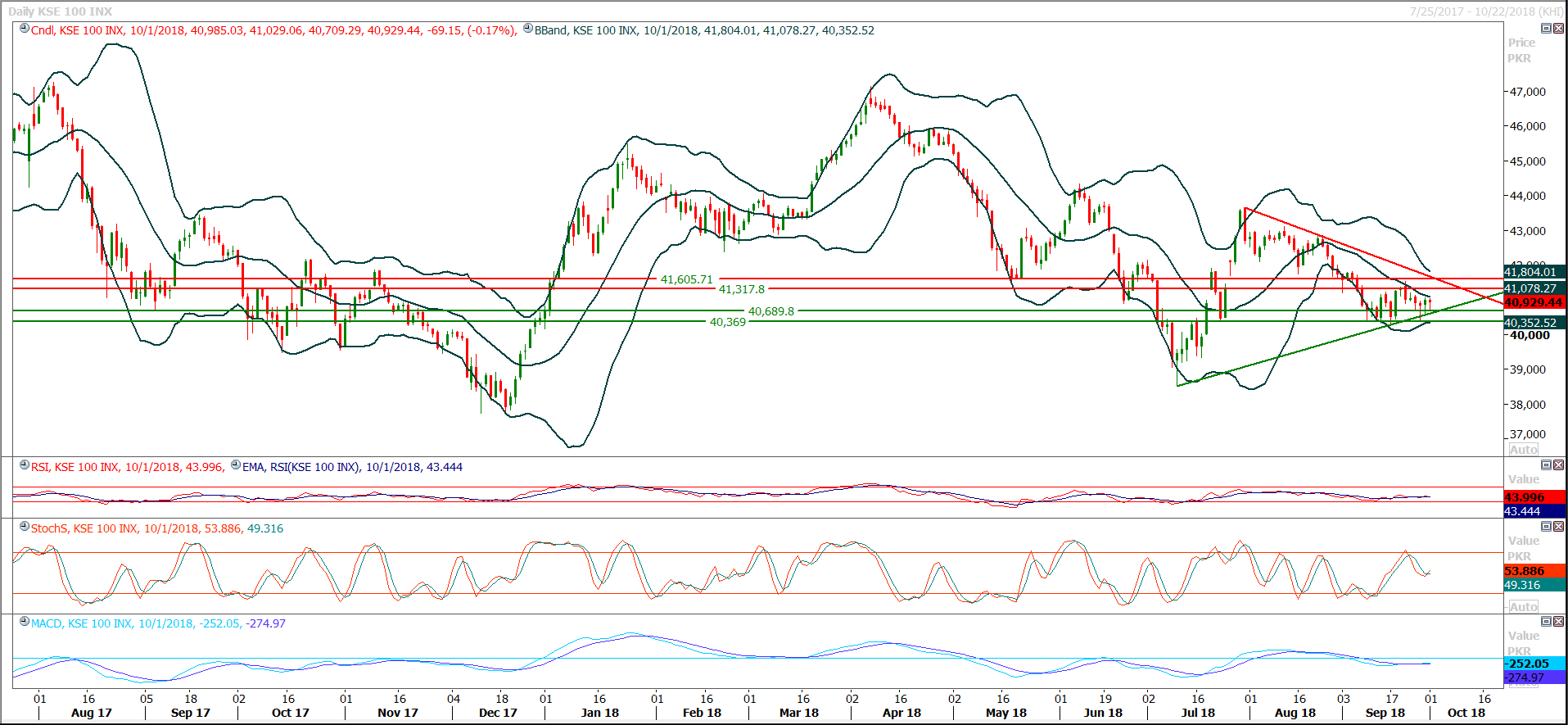

The Benchmark KSE100 index is caged in a triangle on daily chart and it’s also not becoming able to recover above 61.8% correction of last bearish rally which was started from 41,533 and ended up at 40,383 points. As of now daily momentum indicators are mixed and index is showing an uncertain behavior until it close above 41,300 or 40,660 points therefore it’s recommended to stay cautious and adopt swing trading strategy with strict stop loss. Index have formatted a triple top on daily chart and it would become a little bit difficult for index to penetrate 41,110 points in first go therefore for short positions selling below 41,110 with strict stop loss of 41,300 points could be initiated.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.