Previous Session Recap

The Bench Mark KSE100 Index Opened at 47526.46 with a gap of 101.83 points, posted day high of 47713.34 and day low of 47495.66 points during last trading session. The session suspended at 47666.66 with net change of 242.03 points and net trading volume of 197.64 million shares. Daily trading volume of KSE100 Index Increased by 56.79 million shares or 40.32% on DOD bases. The Bench Mark KSE100 Index has gained 14850.35 points or 45.25% on Year till Date bases in 2016.

Foreign Investors remained in net selling position of 1.02 million shares and net value of Foreign Inflow dropped by 7.92 million US Dollars. Categorically Foreign Individual and Corporate Investors remained in net selling position of 0.13 and 12.61 million shares but Overseas Pakistanis remained in net buying position of 11.72 million shares. While on the other side Local Individuals, Companies and NBFCs remained in net buying position of 6.33, 12.1 and 0.8 million shares respectively. Local Banks, Mutual Funds and Brokers remain in net selling of 5.95, 7.82 and 1.46 million shares respectively during last trading session.

Analytical Review

Asian stocks and the dollar were off to a subdued start on Friday as investors took profits on the last trading day of 2016, while the euro briefly spiked in thin trade. The euro EUR=EBS jumped as much as 2 percent early on Friday, its biggest intraday gain since Nov. 8, before settling back down to trade 0.6 percent higher at $1.0559. It is a really thin market today, and suddenly, offers disappeared and short-term players pushed the euro higher and took out stops. That is all, said Kaneo Ogino, director at foreign exchange research firm Global-info Co in Tokyo. The common currency is still down 2.8 percent for the year. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was little changed early on Friday. In a year marked by major political surprises, including Brexit and the unexpected election of political novice Donald Trump to U.S. President in November, Asia ex-Japan stocks are poised to post a 3.3 percent gain.

Following the decision of Opec and non-Opec countries to cut crude oil production that led to increase in crude oil prices internationally, the Oil and Gas Regulatory Authority (OGRA) has calculated an increase of up to Rs 6.93 per litre in local fuel prices for the month of January 2017. The summary of calculations by OGRA has been forwarded to the Ministry of Petroleum as well as the Ministry of Finance that shows an increase in all the major oil prices, effective from January 1, 2017.

Following in the footsteps of Water and Power Ministry, Pakistan State Oil (PSO) has knocked on the doors of Prime Minister House for immediate allocation of Rs 30 billion to meet its payment obligations and avoid any untoward situation, well-informed sources in Finance Ministry told Business Recorder. PSO total overdue receivables have risen to Rs 224.4 billion as of December 27, 2016. PSO, the leading public sector company, supplies furnace oil to the power sector despite a continuous default against payment commitments.

Punjab Chief Minister Shahbaz Sharif addressed the heads of Chinese companies in textile sector and members of a delegation from Punjab through video conference in Beijing from Lahore on Wednesday and invited Chinese to invest in Quaid-e-Azam Apparel Park. It was decided in the meeting to speedily implement Quaid-e-Azam Apparel Park. Speaking on the occasion, Shahbaz Sharif said that Quaid-e-Azam Apparel Park project is of vital importance for the uplift of textile and garments sector and it will have to be completed with speed, standard and transparency.

China on Friday said the China-Pakistan Economic Corridor (CPEC) is an open initiative of its One Belt One Road project, but it would consider the possibility of other countries joining CPEC through consensus with the Pakistani side. Asked what China makes of the offer made by Lt Gen Aamir Riaz, commander, Southern Command, to India to join the project, Chinese Foreign Ministry spokeswoman Hua Chunying said it is yet to be seen whether India will take it up. I wonder whether the Indian side takes this offer made by the Pakistani general as a goodwill gesture, she told a daily press briefing.

PACE, SSGC and SNGP can lead market in positive direction.

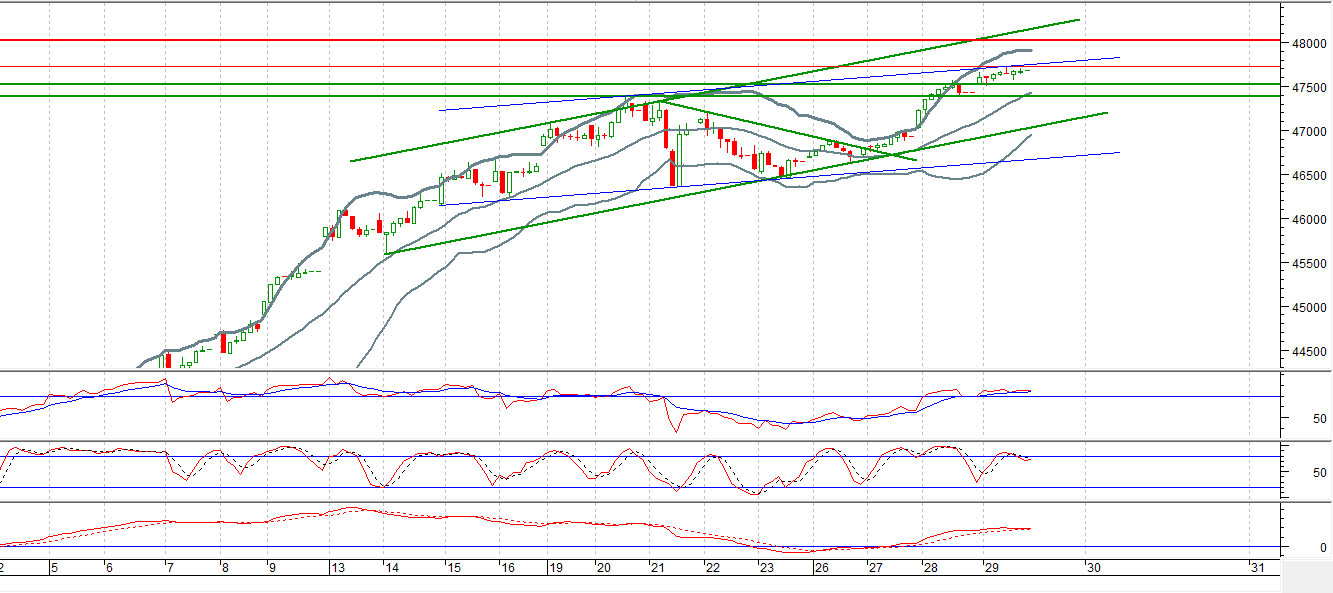

Technical Analysis

The Bench Mark KSE100 index has formed a new bullish trend channel on hourly chart after breakout of its triangle and right now its heading towards 48021, it has a resistant region at 47730 where it can face a slight resistance from 61.8% expansion of its previous correction but after breakout of that level index can target 48021 to complete 100% expansion of said correction. Today is last trading session of 2016 so a very cautious trading strategy is needed as profit taking may be witnessed on PSX to close yearly profits. if Investors will start profit taking then supportive regions for KSE100 index would be 47518 and 47389. Crude Oil pries are inching up which can pump some fresh air in oil sector which may result in shape of a spike in Index.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.