Previous Session Recap

The Bench Mark KSE100 Index Opened at 50230.54 with a negative gap of 34 points, posted day high of 50886.80 and day low of 49900.63 during last trading session while session suspended at 49964 with net change of 49964 with net change of -228.36 points and net trading volume of 384.50 million shares. Daily trading volume of KSE100 listed companies increased by 181.69 million shares or 89.59% on DOD bases.

Foreign Investors remain in net buying of 5.87 million shares and net value of Foreign Inflow increased by 1.86 million US Dollars. Categorically Foreign Corporate and Overseas Pakistani Investors remain in net buying of 2.33 and 3.58 million shares respectively but Foreign Individuals remain in net selling of 0.035 million shares. While on the other side Local Individuals, NBFCs and Mutual Funds remain in net buying of 23.56, 6.04 and 9.87 million shares respectively but Local Companie, Banks and Brokers remain in net selling of 34.88, 5.3 and 3.12 million shares respectively.

Analytical Review

Asian stock markets and U.S. stock futures retreated on Monday after President Donald Trump introduced immigration curbs that sparked criticism at home and abroad and added to global fears of increasingly unpredictable U.S. policies. Trump on Friday put a 120-day hold on allowing refugees into the country, an indefinite ban on refugees from Syria and a 90-day bar on citizens from Iran, Iraq, Libya, Somalia, Sudan, Syria and Yemen. The executive order led to the detention and deportation of hundreds of people arriving at U.S. airports, huge protests in many U.S. cities and a raft of legal challenges amid confusion over its implementation. Trump defended the move as vital for U.S. security, but his critics have said his action violated U.S. law and the Constitution. MSCI broadest index of Asia-Pacific shares outside Japan and Japanese Nikkei both slid 0.5 percent early on Monday.

Predicting an inflation rate lower than the target, the State Bank of Pakistan (SBP) has decided to maintain the main policy interest rate at 5.75 per cent. The monetary policy has been unchanged since May 2016, Ashraf Mahmood Wathra, the bank governor, said on Saturday, citing stable economic indicators in the first half of the current fiscal year. This was due to a smooth supply of perishable items, a stable exchange rate, and absorption of the impact of higher international oil prices, he said. Current trends suggest that the actual inflation would be lower than the target rate of 6 per cent in FY17.

The employees of Pakistan Steel Mills (PSM) have opposed a government proposal to lease out the largest industrial unit of country for 30 years and urged that those who brought this national asset to its knees be held accountable. In a letter sent to the ministries of finance, privatisation and industries, the PSM Workers Union (CBA) also questioned a suggestion for the imposition of regulatory and anti-dumping duties or a ban on steel imports for the future private operator, wondering why such protections were never granted to the PSM while it was in public hands, despite repeated requests.

National Electric Power Regulatory Authority (Nepra) has been accused of overburdening KE consumers, forcing them to pay an additional Rs 62 billion. Well-informed sources in Nepra told Business Recorder that these revelations have been made in a letter written by Secretary Water and Power, Younus Dagha to Chairman Nepra, Brigadier Tariq Saddozai (retired).

The National Assembly’s Standing Committee on Finance on Thursday approved Companies Bill 2016 after a heated debate. Key committee members belonging to the PML-N, including chairman Qaiser Ahmed Sheikh, asked officials technical questions that left them speechless. They criticised the Securities and Exchange Commission of Pakistan (SECP) for not taking the recommendations of the NA body seriously. Companies Bill 2016 became controversial after the government promulgated it as an ordinance. However, a resolution in the Senate abolished it.

Technical Analysis

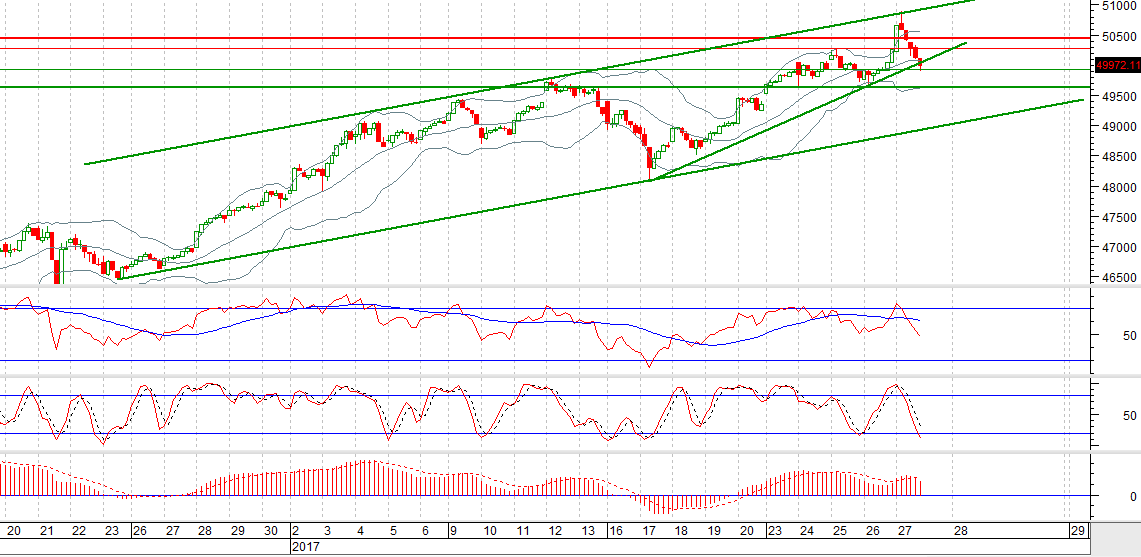

The Bench Mark KSE100 Index is moving in an upward price channel on hourly chart and right now its coming back after getting resistance from resistant trend line of said channel at 50883 points, by posting high of 50886 points Index have retested its resistant region but could not close above that level and dropped back for correction. After penetrating its major resistance of 50,000 points index have fallen back below that level for weekly closing and right now it is in correction mode as daily and weekly Stochastic have generated bearish crossovers and these would push Index to remain under pressure for a correction towards 49624 points and 49460 points. Major supportive regions for Index during coming sessions would be 49500 and 49090 points from where it can bounce back after completing its fourth wave of Elliot Wave. So trading with strict stop loss is recommended before start of Fifth wave.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.