PSX Trading Activity Overview:

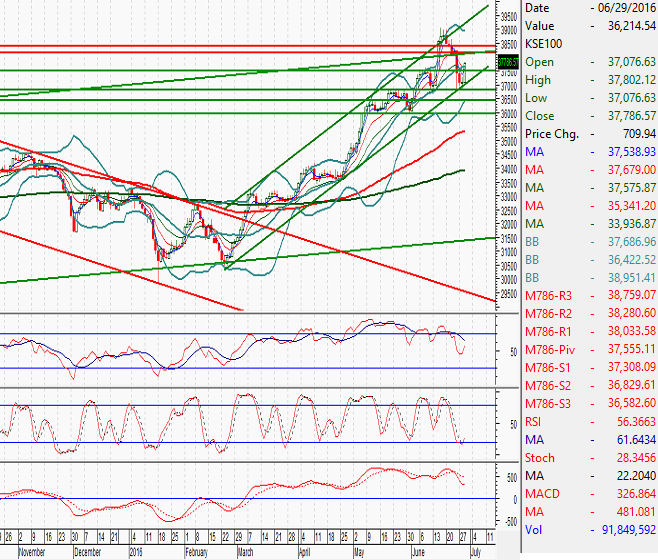

The Bench Mark KSE100 Index Opened at 37076.63 and posted day high of 37802.12 while day low remain same as opening level during last trading session while session suspended at 37786.57 points with net change of 709.94 points and trading volume of 91.85 million shares. Daily trading volume of KSE100 listed companies dropped by 2.28 million shares or 2.42% on DOD bases. Market Capitalization of KSE100, ALLSHR and KSE30 Indices increased by 37.69, 150.24 and 28.56 billion Rs on DOD bases.

Foreign Investors remain in net selling of 1.18 million shares but net value of Foreign Inflow increased by 0.33 million US Dollars. Categorically Foreign Corporates and Overseas Pakistanis remain in net selling of 0.4 and 0.89 million shares respectively but Foreign Individuals remain in net buying of 0.11 million shares. While on the other hand Local Individuals, Banks and Brokers remain in net selling of 1.86, 17.38 and 0.95 million shares but Local Companies and Mutual Funds remain in net buying of 14.33 and 8.12 million shares respectively.

LUCK, MCB and HBL remain top three index movers and they have pushed KSE100 index in positive zone by 60.02, 46.38 and 42.15 points with net price change of 24.63, 5.53 and 3.39 Rs/share respectively. While FML, JGICL and IBFL remain top three index shakers and they have tried to drag Index in negative zone by -61.90, -1.85 and -0.30 points with net price change of -17.44, -2.50 and -1.01 Rs/share respectively.

Foreign Investors remain in net selling of 1.18 million shares but net value of Foreign Inflow increased by 0.33 million US Dollars. Categorically Foreign Corporates and Overseas Pakistanis remain in net selling of 0.4 and 0.89 million shares respectively but Foreign Individuals remain in net buying of 0.11 million shares. While on the other hand Local Individuals, Banks and Brokers remain in net selling of 1.86, 17.38 and 0.95 million shares but Local Companies and Mutual Funds remain in net buying of 14.33 and 8.12 million shares respectively.

LUCK, MCB and HBL remain top three index movers and they have pushed KSE100 index in positive zone by 60.02, 46.38 and 42.15 points with net price change of 24.63, 5.53 and 3.39 Rs/share respectively. While FML, JGICL and IBFL remain top three index shakers and they have tried to drag Index in negative zone by -61.90, -1.85 and -0.30 points with net price change of -17.44, -2.50 and -1.01 Rs/share respectively.

PSX Daily Technical Overview

The Bench Mark KSE100 Index is moving in an upward price channel on daily chart and right now its moving back after getting support from rising/supportive trend line of said channel during last trading session, futher more it have created a daily moring shooting star on charts which can push it further upward but it have strong resistant regions around 38033 and 38141 points from its daily correction levels along with a horizontal resistance. In coming days PSX would be closed for EID holidays therefore its not recommended to initiate new buying at its floor is not recommended keeping in view political situitation of Pakistan.

PSX Weekly Technical Overview

KSE100 Index have completed fifth wave of its bullish Elliot Wave on weekly chart now market have started its correction or ABC formation which could drag index towards a correction of 61.8% of this bullish trend. A minimum correction towards 34696 is required on technical bases if this bullish momentum needs to be continued.

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.