Previous Session Recap

Trading volume at PSX floor increased by 54.46 million shares or 31.98% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 45,470.35, posted a day high of 45,671.76 and a day low of 45,458.25 during last trading session. The session suspended at 45,542.78 with net change of 81.91 and net trading volume of 98.49 million shares. Daily trading volume of KSE100 listed companies increased by 11.70 million shares or 13.48% on DoD basis.

Foreign Investors remained in net selling position of 0.42 million shares and net value of Foreign Inflow dropped by 1.61 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis Investors remained in net selling positions of 0.05 and 0.37 million shares. While on the other side Local Companies, NBFCs, Brokers and Insurance Companies remained in net buying positions of 15.58, 0.66, 30.95 and 21.14 million shares but Local Individuals, Banks and Mutual Funds remained in net selling positions of 21.95, 15.75 and 10.39 million shares respectively.

Analytical Review

Asian shares edge higher as tensions ease, earnings rise

Asian shares rose again on Monday as tensions in the Korean Peninsula eased and first-quarter earnings shone, although some investors pondered whether this sunny outlook could dim in the near future.MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS climbed 0.1 percent following a jump of more than 1 percent on Friday. The index is poised to end the month rather flat after two consecutive losses. South Korea's KOSPI index .KS11 gained 0.5 percent and is set to end April more than 2 percent higher on record profits from Samsung (005930.KS) and after a spectacularly successful inter-Korean summit. Australia's benchmark index added 0.2 percent while New Zealand shares .NZ50 were a touch softer. Liquidity was lacking on Monday with Japan, China and India taking a holiday and much of Asia closed on Tuesday.

Rs600bn overruns in current fiscal year

Despite the government’s claims to have kept a tight control on current expenditures, Finance Minister Dr Miftah Ismail is actually seeking post-facto approval of parliament for Rs599.4 billion supplementary grants for expenditure overruns and re-appropriations, sometimes for unexplained causes and princely uses. The supplementary grants for current fiscal year have spiked by 93 per cent from last year’s Rs310.5bn budget overruns and have occurred after former finance minister Ishaq Dar had to leave the country for ‘medical reasons’ amid a political crisis. According to budget documents placed before parliament, the finance minister has sought Rs599.4bn for appropriation through supplementary grants, some of them of technical nature, but a major chunk — Rs415bn worth of expenditure overruns — would have an additional burden on the budget. Parliament is required to approve these expenditures as fait accompli because the amount is considered to have been already spent.

Apex chamber threatens court action for stuck up refunds

If the government fails to pay huge outstanding amount against refunds, the trade and industry will be left with no choice but to approach Supreme Court of Pakistan, Federation of Pakistan Chambers of Commerce and Industry (FPCCI) President Ghazanfar Bilour warned on Saturday. Addressing a post-budget press conference at the Federation House, Bilour said refunds have become a serious issue since a huge outstanding payment against sales tax and income tax is pending with the Federal Board of Revenue (FBR). Since the budget proposals unveiled by the Finance Minister Miftah Ismail a day earlier in the National Assembly carried no concrete measures for the payment of outstanding refunds we are left with no choice but to approach the Supreme Court, he maintained.

Cotton growers urged to use certified seeds

Agriculture experts have advised the growers to complete the cultivation of cotton by the end of May for getting bumper yield. Spokesman for agriculture department told here on Sunday that although best time for cotton cultivation is before mid of May, however, farmers can complete its cultivation before end of May. He said that farmers should use certified cotton seeds for cultivation of cotton over maximum space because its production not only plays a pivotal role in meeting the food and cloth requirements of the people but it also helps growers in mitigating their financial issues. –APP

Govt earns Rs235bn from telecom in six months

The government generated Rs235.5 billion revenue from the telecom sector during the first half of this fiscal year. Not only the heavy taxes on users of telecom services, the duty on rising imports of mobile phones also earned huge amount for the government during the period. The Economic Survey 2017-18, released recently, stated that imports of the telecom sector rose 13.8 per cent during first eight months of the outgoing fiscal year over the corresponding period last year. The country spent over half a billion dollars on the imports of mobile phones during July-February period. However, the benefit due to expansion in telecom sector is much higher for the government than the import bill.

Asian shares rose again on Monday as tensions in the Korean Peninsula eased and first-quarter earnings shone, although some investors pondered whether this sunny outlook could dim in the near future.MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS climbed 0.1 percent following a jump of more than 1 percent on Friday. The index is poised to end the month rather flat after two consecutive losses. South Korea's KOSPI index .KS11 gained 0.5 percent and is set to end April more than 2 percent higher on record profits from Samsung (005930.KS) and after a spectacularly successful inter-Korean summit. Australia's benchmark index added 0.2 percent while New Zealand shares .NZ50 were a touch softer. Liquidity was lacking on Monday with Japan, China and India taking a holiday and much of Asia closed on Tuesday.

Despite the government’s claims to have kept a tight control on current expenditures, Finance Minister Dr Miftah Ismail is actually seeking post-facto approval of parliament for Rs599.4 billion supplementary grants for expenditure overruns and re-appropriations, sometimes for unexplained causes and princely uses. The supplementary grants for current fiscal year have spiked by 93 per cent from last year’s Rs310.5bn budget overruns and have occurred after former finance minister Ishaq Dar had to leave the country for ‘medical reasons’ amid a political crisis. According to budget documents placed before parliament, the finance minister has sought Rs599.4bn for appropriation through supplementary grants, some of them of technical nature, but a major chunk — Rs415bn worth of expenditure overruns — would have an additional burden on the budget. Parliament is required to approve these expenditures as fait accompli because the amount is considered to have been already spent.

If the government fails to pay huge outstanding amount against refunds, the trade and industry will be left with no choice but to approach Supreme Court of Pakistan, Federation of Pakistan Chambers of Commerce and Industry (FPCCI) President Ghazanfar Bilour warned on Saturday. Addressing a post-budget press conference at the Federation House, Bilour said refunds have become a serious issue since a huge outstanding payment against sales tax and income tax is pending with the Federal Board of Revenue (FBR). Since the budget proposals unveiled by the Finance Minister Miftah Ismail a day earlier in the National Assembly carried no concrete measures for the payment of outstanding refunds we are left with no choice but to approach the Supreme Court, he maintained.

Agriculture experts have advised the growers to complete the cultivation of cotton by the end of May for getting bumper yield. Spokesman for agriculture department told here on Sunday that although best time for cotton cultivation is before mid of May, however, farmers can complete its cultivation before end of May. He said that farmers should use certified cotton seeds for cultivation of cotton over maximum space because its production not only plays a pivotal role in meeting the food and cloth requirements of the people but it also helps growers in mitigating their financial issues. –APP

The government generated Rs235.5 billion revenue from the telecom sector during the first half of this fiscal year. Not only the heavy taxes on users of telecom services, the duty on rising imports of mobile phones also earned huge amount for the government during the period. The Economic Survey 2017-18, released recently, stated that imports of the telecom sector rose 13.8 per cent during first eight months of the outgoing fiscal year over the corresponding period last year. The country spent over half a billion dollars on the imports of mobile phones during July-February period. However, the benefit due to expansion in telecom sector is much higher for the government than the import bill.

Market is expected to remain volatile therefore it'ss recommended to stay cautious while trading today.

Technical Analysis

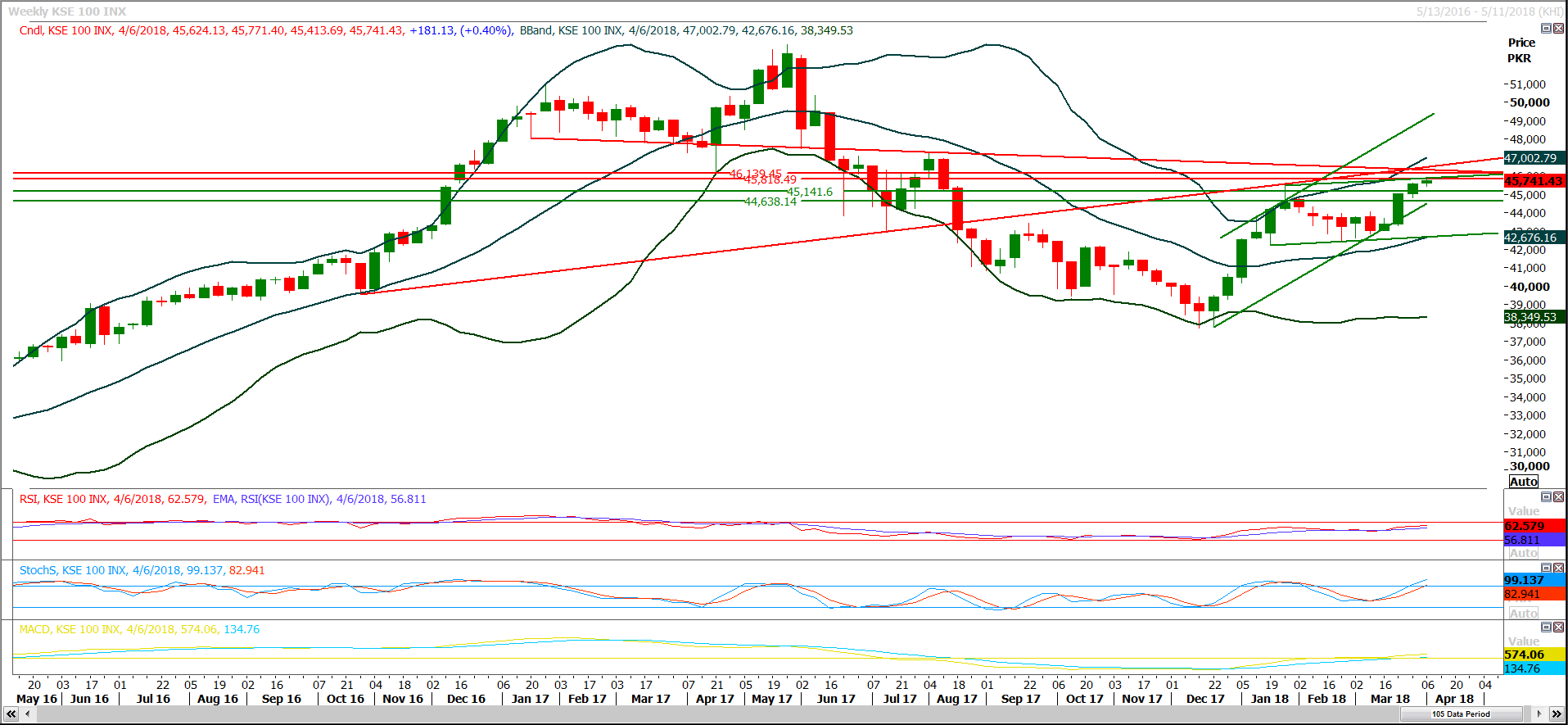

Fibonacci correction have worked again on the Benchmark KSE100 index and have pushed index back in negative zone after completion of 38% correction of last bearish rally on daily chart. Index have slipped below a ascending trend line during last trading session and right now it’s expected that index would try to open with a negative gap and would found some ground near 45,190 and 44,860 points during current trading session. Index has a major supportive region ahead at 44,640 which fall on a descending trend line. Hourly and daily charts are showing a little bit strength but weekly momentum is in negative mode and it’s expected that index may witness a spike during current trading session because hourly Stochastic and MAORSI would try to bottom out today. Its recommended to stay cautious while trading today because a huge volatility is being expected in market a swing move may could be witnessed during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.