Trading volume at PSX floor increased by 26.97 million shares. Whereas, the benchmark KSE100 Index opened at 41974.22, posted a day high of 41972.22 and day low of 41064.24 points during the last trading session while the session suspended at 41233.08 with a net change of -741.14 points and a net trading volume of 69.64 million shares. Daily trading volume of KSE100 listed companies increased by 16.27 million shares or 30.49%, DoD basis.

Foreign Investors remained in a net selling position of 2.85 million shares and the net value of Foreign Inflow dropped by 1.73 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net selling positions of 0.83 and 2.03 million shares, respectively. While on the other side, Local Individuals and Mutual Funds remained in net selling positions of 0.54 and 3.84 million shares but Local Companies, Banks and Brokers remained in net buying positions of 5.32, 2.44 and 0.87 million shares, respectively.

The dollar rebounded from a 2-1/2-year low on Wednesday as concerns about North Korea’s firing of a missile over Japan ebbed, but Asian stocks were muted despite Wall Street’s higher close. The dollar index .DXY, which tracks the greenback against a basket of six major peers, edged up 0.1 percent to 92.34. The dollar rose 0.15 percent to 109.825 yen JPY=D4. On Tuesday, after slumping to a 4-1/2-month low versus the safe haven currency, the greenback closed up 0.5 percent. The yen tends to benefit during times of geo-political or financial stress as Japan is the world’s biggest creditor nation and there is an assumption that Japanese investors will repatriate funds in a crisis. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was flat in early trade. South Korea's KOSPI share index .KS11 and Australian shares both inched up 0.1 percent. Japan's Nikkei .N225 rose 0.5 percent as the yen weakened. In commodities, gasoline hit a near-two-year high after Hurricane Harvey shut down nearly a fifth of the U.S’s refining capacity, and more closures are expected.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was flat in early trade. South Korea's KOSPI share index .KS11 and Australian shares both inched up 0.1 percent. Japan's Nikkei .N225 rose 0.5 percent as the yen weakened. In commodities, gasoline hit a near-two-year high after Hurricane Harvey shut down nearly a fifth of the U.S’s refining capacity, and more closures are expected.

Foreign Minister Khawaja Asif on Tuesday warned that Pakistan will not allow India to modify terms of Indus Water Treaty 1961 unilaterally, urging World Bank to play a constructive role in the resolution of the issue. He was addressing a seminar titled Indus Water Treaty: Issues and Recommendations organized by Institute of Strategic Studies in Islamabad (ISSI). The seminar was attended by water experts, diplomats and students. Pakistan and India are adversaries and perhaps and if we analyze the situation under the present circumstances we will remain adversaries for decades or centuries

The Economic Co-ordination Committee (ECC) of the Cabinet has decided to release two months salary amounting to Rs 760 million to Pakistan Steel Mills (PSM) employees. Sources said that the first meeting of the ECC presided over by Prime Minister Shahid Khaqan Abbasi has dropped Ministry of Petroleums proposal to increase the profit margin of oil marketing companies (OMCs) and included Ministry of Industries proposal at the last hour to release salary to PSM employees.

The federal cabinet was briefed by the Finance Division on overall economic situation of the country, including challenges to balance of payment due to soaring trade deficit and decrease in remittance. Sources said that cabinet meeting chaired by Prime Minister Shahid Khaqan Abbasi on Tuesday deferred some agenda items to take a detailed briefing on economic situation. The meeting also approved amendments to the Rules of Business, 1973 with the objective to clarify the subjects allocated to the new ministries and divisions, especially to Power Division and Water Resources Division created by Abbasi soon after assuming the office.

The market is expected to remain volatile today. We advise traders to exercise caution, buying on gains and booking gains on strength is recommended.

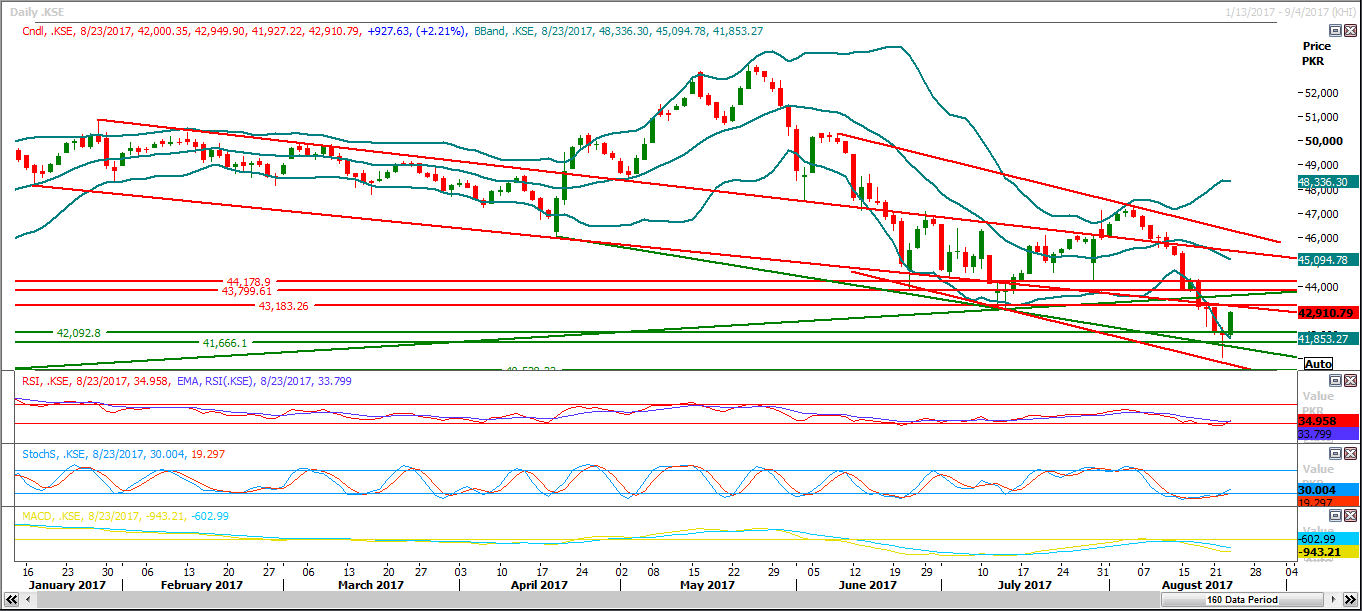

The Benchmark KSE-100 Index is moving in a Bearish trajectory, in line with our expectations. However, a short term reversal maybe on the cards if the Index finds support around a major level at 40611. This level has proved to be a reversal point thrice in the recent Bear run, and we foresee the Index posting a relief rally as Stochastic (14,1,3) and RSI (14) explore the depths of their oversold regions. The forecasted upside move may find resistance ahead at 41990 and at the 9 days moving average currently placed at 42375. However, if the Index is unable to sustain 40611, then new lows in the uncharted territory for the year, are on the cards. Traders are advised to practice a strict stop loss at 40490.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.