Previous Session Recap

Trading volume at PSX floor dropped by 48.87 million shares or 26.61% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,564.34, posted a day high of 42,615.50 and a day low of 42,159.29 during last trading session. The session suspended at 42,249.44 with net change of -295.03 and net trading volume of 58.72 million shares. Daily trading volume of KSE100 listed companies dropped by 16.89 million shares or 22.34% on DoD basis.

Foreign Investors remain in net selling positions of 2.31 million shares and net value of Foreign Inflow dropped by 3.80 million US Dollars. Categorically Foreign Individuals and Corporate remained in net selling positions of 0.09 and 3.39 million shares but Overseas Pakistanis investors remained in net buying positions of 1.17 million shares. While on the other side Local Individuals and Banks remained in net selling positions of 4.20 and 0.11 million shares respectively but Local Companies, NBFCs, Mutual Fund, Brokers and Insurance Companies remained in net buying positions of 0.37, 1.21, 2.61, 1.08 and 0.66 million shares.

Analytical Review

Asia stocks rise as trade optimism extends Wall Street's bull run

Asian stocks rose on Thursday as Wall Street hit record highs in the hope that the current North American Free Trade Agreement (NAFTA) negotiations will lead to a further easing of global trade tensions. MSCI’s broadest index of Asia-Pacific shares outside Japan nudged up 0.1 percent. Australian stocks added 0.15 percent, and Japan’s Nikkei rose to a three-month high, last trading up 0.45 percent. South Korea’s KOSPI was little changed. U.S. shares extended their rally on Wednesday, with the S&P 500 and the Nasdaq hitting record highs for a fourth straight session as technology stocks pushed indexes higher and promising NAFTA negotiations boosted investor confidence.

ECC defers gas price increase

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday has formed different committees to work upon the reasons and formulate their suggestions to overcome liabilities of the power sector that surged to Rs1188 billion. The ECC, which met under the chairmanship of Finance Minister Asad Umar, has discussed different summaries. The top economic decisions making body of the country, ECC, has deferred the summary of increasing gas prices. The two state-owned natural gas companies SNGPL and SSGCL have recently demanded of the government to increase the gas prices to reduce their liabilities. Oil and Gas Regulatory Authority (Ogra) had recommended increasing gas prices to the caretaker government but they refused and are now urging the PTI government to implement its recommendations. However, the PTI led federal government deferred the anti-people decision till next meeting.

World Bank ready to support reform plans

World Bank on Tuesday has said it was ready to support the reform plans of the new government in Pakistan that are needed to stabilize the economy and accelerate growth to end poverty and boost prosperity. The commitment was made by the World Bank's newly appointed Vice President for the South Asia Region, Hartwig Schafer, when he met with the government and key counterparts to discuss Pakistan's development priorities and reform agenda. "The visit gave me an opportunity to learn more about how we support millions of people in Pakistan, especially the youth, through investments in health, nutrition, education, skills and the digital economy," said Schafer.

Nepra okays 36 paisa per unit hike

The National Electric Power Regulatory Authority (Nepra) on Wednesday allowed the Ex-Wapda power distribution companies (Discos) to increase the power tariff by Rs 0.36 per unit on account of fuel adjustment for the month of July 2018. The decision was taken in public hearing conducted by Nepra on the petition filed by the Central Power Purchasing Agency (CPPA). In its petition the CPPA had sought an increase ad sought 63 paisa per unit increase in tariffs for the Discos, however the regulator allowed only Rs 0.36 per unit. The increase of Rs0.36 per unit will put the burden of Rs 4.5 billion to power consumers. The increase will not apply on lifeline and K electric consumers. This is third consecutive increase in electricity rates during the last three months. The power regulator had increased power tariff by Rs1.25 per unit for May 2018, Rs0.50 per unit for month of June and Rs0.36 for the month of July.

Marble sector wants soft loans

Small and Medium Enterprises Development Authority (Smeda) organised one-day workshop for the stakeholders of marble and granite sector. The workshop, organised under Research/Feasibility Study on Cluster Based Mineral Sector Transformation Plan, discusses the issues faced by the marble and granite sector of KP/FATA and the required interventions. Planning Commission of Pakistan Project Director Riaz Ahmed Sahito chaired the proceedings of workshop. 26 businessmen from mining, processing and trading sector participated in the workshop. During the workshop the participants were briefed in detailed about the project.

Asian stocks rose on Thursday as Wall Street hit record highs in the hope that the current North American Free Trade Agreement (NAFTA) negotiations will lead to a further easing of global trade tensions. MSCI’s broadest index of Asia-Pacific shares outside Japan nudged up 0.1 percent. Australian stocks added 0.15 percent, and Japan’s Nikkei rose to a three-month high, last trading up 0.45 percent. South Korea’s KOSPI was little changed. U.S. shares extended their rally on Wednesday, with the S&P 500 and the Nasdaq hitting record highs for a fourth straight session as technology stocks pushed indexes higher and promising NAFTA negotiations boosted investor confidence.

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday has formed different committees to work upon the reasons and formulate their suggestions to overcome liabilities of the power sector that surged to Rs1188 billion. The ECC, which met under the chairmanship of Finance Minister Asad Umar, has discussed different summaries. The top economic decisions making body of the country, ECC, has deferred the summary of increasing gas prices. The two state-owned natural gas companies SNGPL and SSGCL have recently demanded of the government to increase the gas prices to reduce their liabilities. Oil and Gas Regulatory Authority (Ogra) had recommended increasing gas prices to the caretaker government but they refused and are now urging the PTI government to implement its recommendations. However, the PTI led federal government deferred the anti-people decision till next meeting.

World Bank on Tuesday has said it was ready to support the reform plans of the new government in Pakistan that are needed to stabilize the economy and accelerate growth to end poverty and boost prosperity. The commitment was made by the World Bank's newly appointed Vice President for the South Asia Region, Hartwig Schafer, when he met with the government and key counterparts to discuss Pakistan's development priorities and reform agenda. "The visit gave me an opportunity to learn more about how we support millions of people in Pakistan, especially the youth, through investments in health, nutrition, education, skills and the digital economy," said Schafer.

The National Electric Power Regulatory Authority (Nepra) on Wednesday allowed the Ex-Wapda power distribution companies (Discos) to increase the power tariff by Rs 0.36 per unit on account of fuel adjustment for the month of July 2018. The decision was taken in public hearing conducted by Nepra on the petition filed by the Central Power Purchasing Agency (CPPA). In its petition the CPPA had sought an increase ad sought 63 paisa per unit increase in tariffs for the Discos, however the regulator allowed only Rs 0.36 per unit. The increase of Rs0.36 per unit will put the burden of Rs 4.5 billion to power consumers. The increase will not apply on lifeline and K electric consumers. This is third consecutive increase in electricity rates during the last three months. The power regulator had increased power tariff by Rs1.25 per unit for May 2018, Rs0.50 per unit for month of June and Rs0.36 for the month of July.

Small and Medium Enterprises Development Authority (Smeda) organised one-day workshop for the stakeholders of marble and granite sector. The workshop, organised under Research/Feasibility Study on Cluster Based Mineral Sector Transformation Plan, discusses the issues faced by the marble and granite sector of KP/FATA and the required interventions. Planning Commission of Pakistan Project Director Riaz Ahmed Sahito chaired the proceedings of workshop. 26 businessmen from mining, processing and trading sector participated in the workshop. During the workshop the participants were briefed in detailed about the project.

PSO, TRG, DGKC and EPCL would try to lead the negative momentum during current trading session.

Technical Analysis

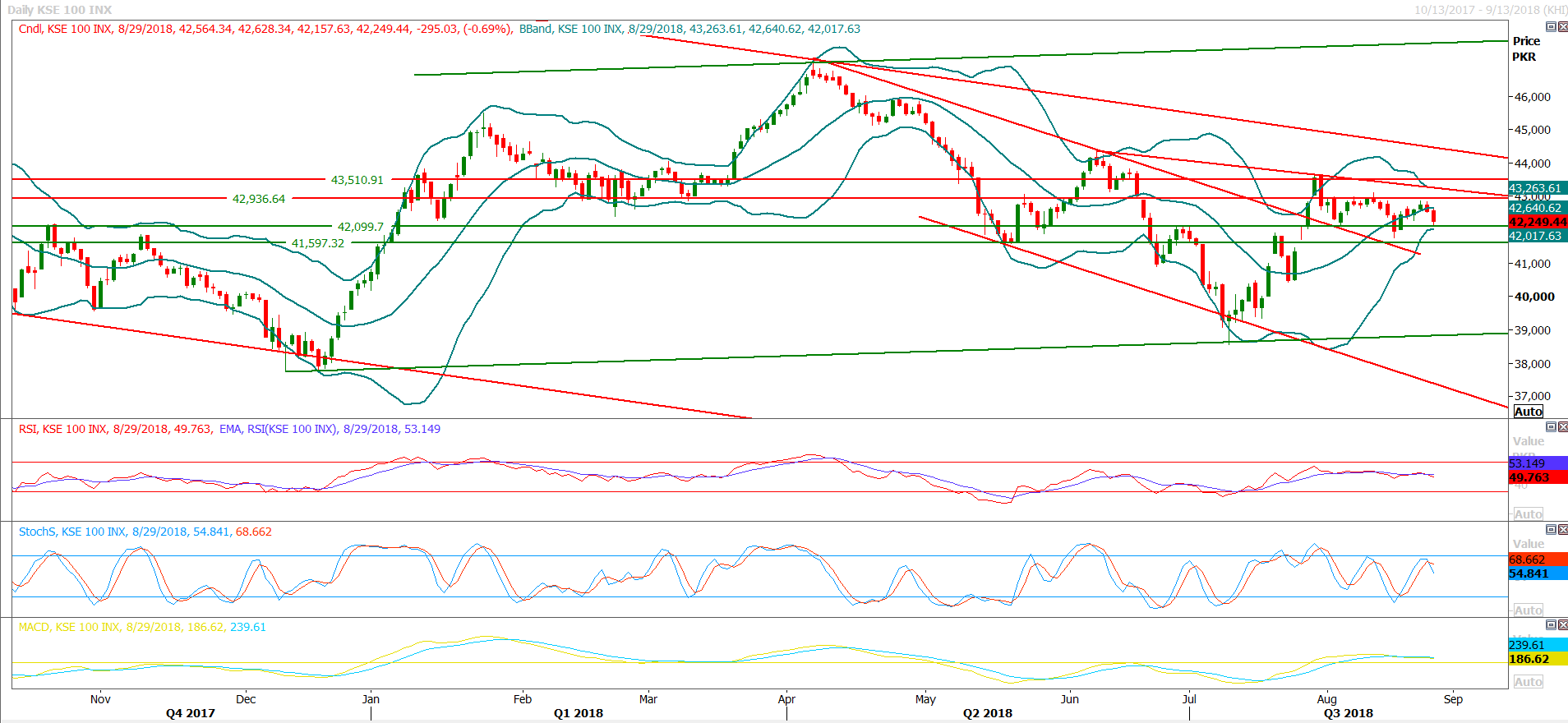

Although the KSE100 index succeeded in achieving support from a horizontal supportive region during the last trading session, the trend will likely remain bearish till the index closes above 43,330pts on the daily chart. We believe if the index does not open below the 42,089pts level, then the KSE100 may witness an intra-day spike. Onwards, the index fall back and test its supportive region. The KSE100’s resistance level stands at 42,460pts and 42,700pts and we recommend a “sell on strength” stance around these levels. Additionally, if the KSE100 were to breach through the 42,089pts level, then we can expect to find support in the 41,960pts and the 41,750pts level. While hourly momentum indicators suggest a bullish run, daily and weekly indicators imply a bearish spell. Moreover, any bullish momentum may be eradicated if the index falls below the 42,000pts level.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.