Previous Session Recap

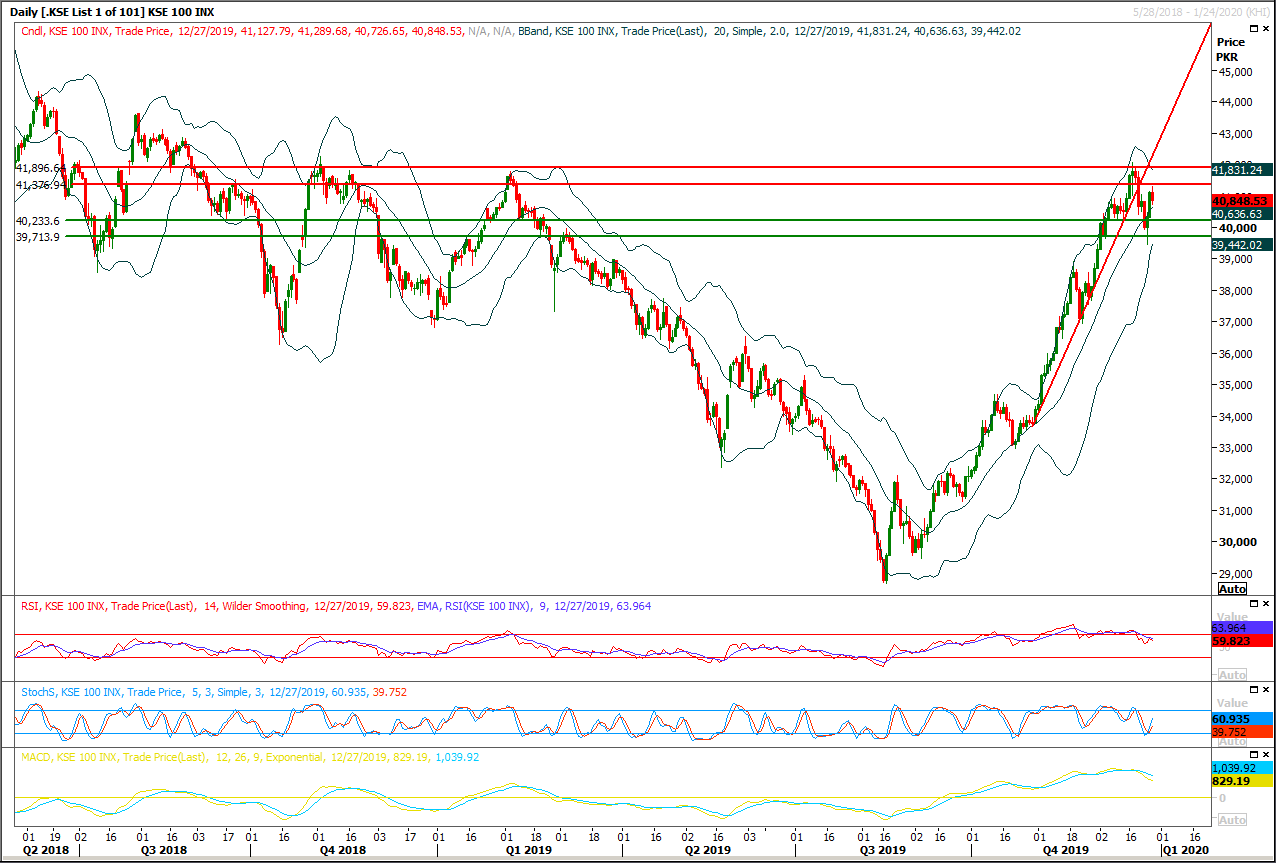

Trading volume at PSX floor Increased by 30.75 million shares or 12.98% on DoD basis, whereas the benchmark KSE100 index opened at 41,127.79, posted a day high of 41,289.68 and a day low of 40,726.65 points during last trading session while session suspended at 40,848.53 points with net change of 279.26 points and net trading volume of 147.67 million shares. Daily trading volume of KSE100 listed companies increased by 15.65 million shares or 11.86% on DoD basis.

Foreign Investors remained in net selling positions of 0.40 million shares and value of Foreign Inflow dropped by 0.57 million US Dollars. Categorically, Foreign Individuals and Foreign Corporate remained in net selling positions of 0.16 and 1.85 million shares but Overseas Pakistanis remained in net buying positions of 1.60 million shares. While on the other side Local Companies, Mutual Fund and Brokers remained in net selling positions of 6.72, 2.93 and 27.89 million shares but Local Individuals, Banks, NBFCs and Insurance Companies remained in net buying positions of 32.32, 0.0015, 2.41 and 1.63 million shares respectively.

Analytical Review

Asian shares down from 18-month top; oil steady after U.S. strikes

A broad gauge of Asian share markets fell on Monday as investors consolidated gains after scaling 18-month highs last week, while oil was steady after the U.S. carried out air strikes on an Iranian-backed Shi’ite Muslim militia group in Iraq and Syria. Around 0145 GMT, MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was 0.09% lower. The index had touched its highest level since June 19, 2018 on Friday, lifted by investor hopes that a U.S.-China trade deal would be signed soon. Chinese blue chips .CSI300 were 0.15% lower, while Australian shares shed 0.56%. Japan's Nikkei stock index .N225 slid 0.51%.Easing trade war worries and reduced uncertainty over the United Kingdom's plans to leave the European Union after British elections returned a strong Conservative majority have offered a lift to global equities this month, helping the broad MSCI Asia index rise more than 6% and putting it on track for its strongest month since January. Kay Van-Petersen, global macro strategist at Saxo Capital Markets, said that limited liquidity near the year-end and easing of U.S.-China trade and Brexit uncertainties has “just left us drifting up higher. So even if there is a pullback... I don’t think it’s going to be significant by any means.”

Govt confident of beating IMF’s inflation projection

The finance ministry has announced that decisive policy implementation has started to address deep-seated problems of economy and reverse its large imbalances, preserving financial stability. In a statement issued on Sunday, the ministry said the International Monetary Fund (IMF) in its first review of Pakistan’s economic performance had acknowledged that the government reforms programme was on track and producing results. Having been satisfied with the economic performance, the IMF recently released $452 million as the second tranche, bringing total disbursements to about $1.45 billion. The IMF report acknowledged that the business climate had improved and market confidence was returning. The assessment confirmed the government had recognised that structural reforms, particularly in the public sector, were key to reviving economic activity and growth, the ministry said.

Locals-diplomats nexus misusing luxury car import facility

As the government is striving hard to fetch more and more taxes by expanding the tax net, it is being cheated out of billions of rupees in duty under a scam involving misuse of the facility of duty-free import of luxury vehicles by some foreign diplomats, representatives of international non-governmental organisations and armed forces personnel of a few countries, according to sources. The Federal Board of Revenue (FBR) has taken up the matter with the Ministry of Foreign Affairs (Mofa), asking it to write a letter to all foreign embassies and international NGOs to ascertain their criteria for importing luxury vehicles for diplomats and other foreign nationals, who are exempt from paying duty while importing vehicles for their use in Pakistan. Through a letter, FBR chairman Shabbar Zaidi has informed Mofa of reports that the facility of duty-free import of vehicles is being “misused” by certain embassies or diplomatic missions by importing more vehicles than they actually require. The ministry has been urged to revisit the existing regime for duty-free import of vehicles by embassies, diplomatic missions and dignitaries.

LCCI hopes economic revival will be top priority of FPCCI’s new leadership

The Lahore Chamber of Commerce & Industry Saturday felicitated Mian Anjum Nisar on a landmark victory in the elections of the Federation of Pakistan Chambers of Commerce & Industry and expressed optimism that economic revival of the country would be top priority of the new leadership. In a statement, LCCI President Irfan Iqbal Sheikh said that newly elected president of the FPCCI has changed history of the business community in true sense of word. “FPCCI leadership would continue to accord top importance to the prompt solution to collective problems and issues being confronted by the business community”, he hoped.

OPEC+ may consider ending oil output cuts in 2020

The Organization of the Petroleum Exporting Counters and its allies, known as OPEC+, may consider wrapping up their oil output reduction in 2020, Russian Energy Minister Alexander Novak said on Friday. “As far as the production cuts are concerned, I repeat once again, this is not an indefinite process. A decision on the exit should be gradually taken in order to keep up market share and so that our companies would be able to provide and implement their future projects,” Novak told Rossiya 24 TV. “I think that we will consider that this year.” Russia’s energy ministry said that Novak was referring to 2020 when talking about a possible decision to wrap up production curbs “this year”. OPEC+ has been capping its output since 2017 in order to balance out the supply and demand on the global oil market as well as prop up oil prices. Novak praised the cooperation between OPEC and non-OPEC producers, saying that global oil markets are currently more or less stable.

A broad gauge of Asian share markets fell on Monday as investors consolidated gains after scaling 18-month highs last week, while oil was steady after the U.S. carried out air strikes on an Iranian-backed Shi’ite Muslim militia group in Iraq and Syria. Around 0145 GMT, MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was 0.09% lower. The index had touched its highest level since June 19, 2018 on Friday, lifted by investor hopes that a U.S.-China trade deal would be signed soon. Chinese blue chips .CSI300 were 0.15% lower, while Australian shares shed 0.56%. Japan's Nikkei stock index .N225 slid 0.51%.Easing trade war worries and reduced uncertainty over the United Kingdom's plans to leave the European Union after British elections returned a strong Conservative majority have offered a lift to global equities this month, helping the broad MSCI Asia index rise more than 6% and putting it on track for its strongest month since January. Kay Van-Petersen, global macro strategist at Saxo Capital Markets, said that limited liquidity near the year-end and easing of U.S.-China trade and Brexit uncertainties has “just left us drifting up higher. So even if there is a pullback... I don’t think it’s going to be significant by any means.”

The finance ministry has announced that decisive policy implementation has started to address deep-seated problems of economy and reverse its large imbalances, preserving financial stability. In a statement issued on Sunday, the ministry said the International Monetary Fund (IMF) in its first review of Pakistan’s economic performance had acknowledged that the government reforms programme was on track and producing results. Having been satisfied with the economic performance, the IMF recently released $452 million as the second tranche, bringing total disbursements to about $1.45 billion. The IMF report acknowledged that the business climate had improved and market confidence was returning. The assessment confirmed the government had recognised that structural reforms, particularly in the public sector, were key to reviving economic activity and growth, the ministry said.

As the government is striving hard to fetch more and more taxes by expanding the tax net, it is being cheated out of billions of rupees in duty under a scam involving misuse of the facility of duty-free import of luxury vehicles by some foreign diplomats, representatives of international non-governmental organisations and armed forces personnel of a few countries, according to sources. The Federal Board of Revenue (FBR) has taken up the matter with the Ministry of Foreign Affairs (Mofa), asking it to write a letter to all foreign embassies and international NGOs to ascertain their criteria for importing luxury vehicles for diplomats and other foreign nationals, who are exempt from paying duty while importing vehicles for their use in Pakistan. Through a letter, FBR chairman Shabbar Zaidi has informed Mofa of reports that the facility of duty-free import of vehicles is being “misused” by certain embassies or diplomatic missions by importing more vehicles than they actually require. The ministry has been urged to revisit the existing regime for duty-free import of vehicles by embassies, diplomatic missions and dignitaries.

The Lahore Chamber of Commerce & Industry Saturday felicitated Mian Anjum Nisar on a landmark victory in the elections of the Federation of Pakistan Chambers of Commerce & Industry and expressed optimism that economic revival of the country would be top priority of the new leadership. In a statement, LCCI President Irfan Iqbal Sheikh said that newly elected president of the FPCCI has changed history of the business community in true sense of word. “FPCCI leadership would continue to accord top importance to the prompt solution to collective problems and issues being confronted by the business community”, he hoped.

The Organization of the Petroleum Exporting Counters and its allies, known as OPEC+, may consider wrapping up their oil output reduction in 2020, Russian Energy Minister Alexander Novak said on Friday. “As far as the production cuts are concerned, I repeat once again, this is not an indefinite process. A decision on the exit should be gradually taken in order to keep up market share and so that our companies would be able to provide and implement their future projects,” Novak told Rossiya 24 TV. “I think that we will consider that this year.” Russia’s energy ministry said that Novak was referring to 2020 when talking about a possible decision to wrap up production curbs “this year”. OPEC+ has been capping its output since 2017 in order to balance out the supply and demand on the global oil market as well as prop up oil prices. Novak praised the cooperation between OPEC and non-OPEC producers, saying that global oil markets are currently more or less stable.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index is being capped by a strong horizontal resistant region at 41,380 points while it already have generated a bearish reversal sign on daily chart but it's recommended to stay cautious until index either close above 41,800 points or below 40,500 points on daily chart. It's expected that index would try to open with a positive gap but later on it would face strong resistance from 41,000 points region and would try to retest its supportive region of 40,500 points. Downward penetration of 40,500 points would call for 40,200 and 39,700 points where index would need some fresh volumes to get strength while on flipside if index would succeed in penetration above 41,000 points then it would try to target 41.380 and 41,900 points in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.