Previous Session Recap

Trading volume at PSX floor dropped by 78.28 million shares or 28.93% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 4444724.44, posted a day high of 44855.77 and a day low of 44337.72 during last trading session. The session suspended at 44457.30 with net change of -93.83 and net trading volume of 87.13 million shares. Daily trading volume of KSE100 listed companies dropped by 43.85 million shares or 33.48% on DoD basis.

Foreign Investors remained in net selling position of 1.38 million shares and net value of Foreign inflow dropped by 3.44 million US Dollars. Categorically, Foreign Corporate investors remained in net selling position of 3.74 million shares but Overseas Pakistanis remained in net buying position of 2.37 million shares. While on the other side Local Individuals, Banks, NBFCs and Brokers remained in net selling positions of 11.48, 13.20, 0.22 and 13.99 million shares respectively but Local Companies, Mutual Funds and Insurance Companies remained in net buying positions of 20.06, 17.42 and 2.03 million shares respectively.

Analytical Review

Asian stocks retreated from record peaks on Tuesday after a selloff in Apple shares knocked Wall Street, while the dollar found support as U.S. bond yields climbed to near four-year highs. MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.3 percent after rising to a record high the previous day. Australian stocks shed 0.65 percent, South Korea’s KOSPI lost 0.3 percent and Japan’s Nikkei dropped 0.5 percent. The bearish sentiment in Asia followed a softer lead from Wall Street, which has led a global equities rally over the past year thanks to strong world growth fuelling higher corporate earnings and stock valuations. On Monday, U.S. stocks pulled back from record highs, with the Dow and the S&P 500 indexes marking their biggest one-day percentage declines in about five months, weighed down by a slide in Apple shares.

Bahrain-based Ithmaar Bank plans to add more than 100 branches in Pakistan this year through its subsidiary Faysal Bank, to capitalise on the country’s low penetration rate of banking services, a senior executive said. Ithmaar Bank owns 66 per cent of Faysal Bank, whose contribution to the Islamic retail bank’s overall balance sheet would likely grow to more than half as a result of the expansion, Ithmaar Deputy Chief Executive Abdul Hakeem al-Mutawa told Reuters on Monday. “We are planning to be over 500 branches this coming year and are aggressive in this,” al-Mutawa said in an interview. “Banking penetration is around less than 20pc in Pakistan, so there are good opportunities to grow.”

The government has started endeavors to privatize many big institutions to make these profitable, a meeting of National Assembly Standing Committee on Privatization was informed on Monday. The meeting was presided over by Syed Imran Ahmed Shah while officials of the industries admitted before the committee that thousands employees become jobless due to privatization of institutions . It was also revealed in the meeting that despite privatization of PTCL, Etisalat, a Dubai based company has not yet provided Rs 80 billion to the government after privatization of PTCL. It was further told that the company was using delaying tactics contrary to the contract while despite serving final notice to the company, the prices of thirty three properties could not be determined. The government has claimed that dues of worth Rs 15 billion of Pakistan Steel Mills (PSM) will be paid in the same year without selling a single marla of PSM land while issues between SNGPL and National Bank would be finalized soon.

Pakistan and Turkey have mutually agreed on extending their bilateral relations and work collectively on different sectors particularly in power sector. Matters related to mutual cooperation in different areas were discussed in a meeting between Federal Minister for Power Division Sardar Awais Ahmad Khan Leghari and Ambassador of Turkey in Pakistan Mustafa Yardakul held here Monday, said a press release. The ambassador not only appreciated the endeavors of the incumbent government towards enhancing and accelerating the bilateral relations with Turkey , but also admired the significant contribution made by power division. He said power sector was the fast growing sector in Pakistan and its progress had been considered as praiseworthy. Federal minister Awais leghari said, “We have always focused on strengthening bilateral relations .

State Minister for Ports and Shipping Chaudhry Jaffer Iqbal on Monday said a new berth would be constructed at Gwadar port within one year, providing a larger anchoring space to accommodate three additional big ships. The 900-metre-long berth will offer a vertical front from the Gwadar coastline into Arabian Sea to facilitate the loading and unloading of cargo from the vessels, the State Minister told APP here. Jaffer said Gwadar port was functional and the process of transhipping and re-stuffing of vessels was already being carried out. He said work on construction of a 15-kilometre-long road from Zero Point in Gwadar to Coastal Highway was underway, along with laying of railway track side by side. He said a 12-kilometre-long air strip at the new Gwadar International Airport would be completed in one year, allowing landing of larger aircraft including A-380. The minister said a coal-fired plant would also be set up within a year period which would provide electricity to industrial zone.

Its recommended to practice caution as market is expected to remain volatile.

Technical Analysis

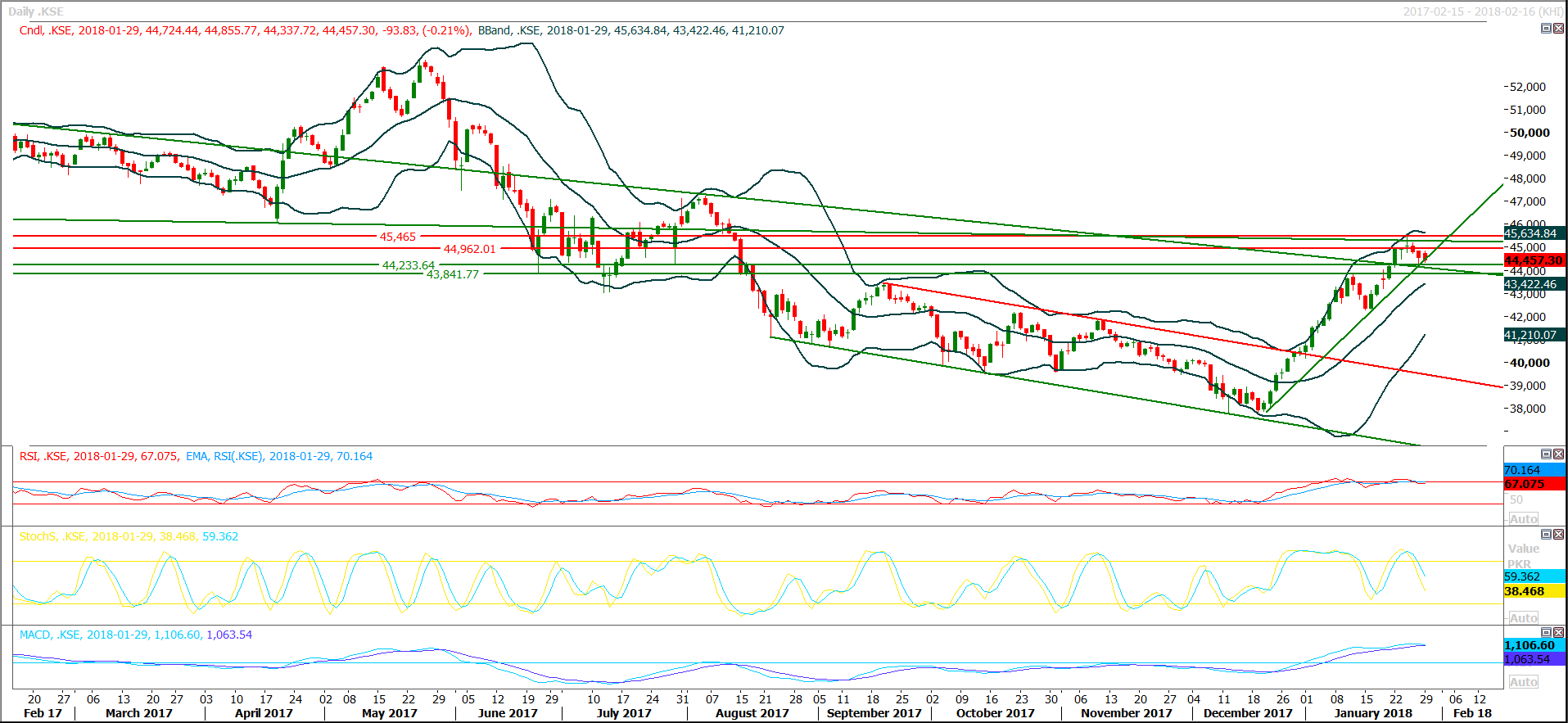

The Benchmark KSE100 Index have a supportive region ahead where a trend line which was a strong resistant in past and this time its reacting as a strong support. As of right now index have strong supports around 44121 and 43841 points while resistant regions are standing at 44960 and 45465. Daily Stochastic and MAORSI have generated bearish crossovers and these are signs of start of a correction while on weekly chart a hammer have occured on very crucial level which is also a reversal pattern therefore its recommended to excercise caution while trading during current trading session. Its recommended to initiate selling on strength or book profits on spikes during current trading session. If index would slip below 44121 during current trading session then a sharp decline could be withnessed in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.