Previous Session Recap

Trading volume at PSX floor increased by 8.13 million shares or 4.30% on DoD basis, whereas the benchmark KSE100 index opened at 42,299.19, posted a day high of 42,429.49 and a day low of 41,790.81 points during last trading session while session suspended at 41,898.70 points with net change of -400.49 points and net trading volume of 127.11 million shares. Daily trading volume of KSE100 listed companies also dropped by 10.05 million shares or 7.32% on DoD basis.

Foreign Investors remained in net selling positions of 19.29 million shares and net value of Foreign Inflow dropped by 0.38 million US Dollars. Categorically, Foreign Individuals and Foreign Corporate remained in net selling positions of 0.0035 and 19.66 million shares but Overseas Pakistani investors remained in net buying positions of 0.37 million shares.. While on the other side Local Individuals and Banks remained in net buying positions of 25.28 and 0.84 million shares but Local Companies, NBFCs, Mutual Fund, Brokers and Insurance Companies remained in net selling positions of 1.65, 0.03, 1.76, 2.06 and 0.54 million shares respectively.

Analytical Review

Virus anxiety weighs on Asian stocks, boosts safe-haven bid

Asian stocks slipped while gold and bonds were in demand on Thursday as worries about the spread of a new virus from China sent investors heading for safety. The Federal Reserve kept interest rates unchanged on Wednesday, as expected, although bank Chairman Jerome Powell’s comments about a low inflation outlook added to U.S. government bonds’ appeal. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.8% to an almost seven-week low. Japan's Nikkei .N225 fell 1%. Hong Kong's Hang Seng .HSI extended Wednesday's drop and Taiwan's benchmark index .TWII opened 1.5% lower in its first session since the Lunar New Year break.

Economic Coordination Committee defers gas tariff increase, waives Karkey’s port charges

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday deferred decision on gas price increase for further consultations and waived about Rs195 million port charges to the Turkish firm Karkey as part of a $1.2 billion dispute settlement. The meeting, presided by PM’s Finance Adviser Dr Abdul Hafeez Shaikh discussed the proposal for up to 15 per cent gas price increase and noted that some changes were required to minimise the burden on domestic consumers in line with Prime Minister’s guidelines. An official said the increased gas rates for domestic consumers during the high-consumption winter season would not go well from a political perspective.

SECP moves to strengthen AML/CFT framework

The Securities and Exchange Commission of Pakistan (SECP) on Wednesday proposed amendments in the Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) Regulations, 2018 to comply with the Financial Action Task Force (FATF) recommendations. The draft amendments provide clarity on verification for beneficial ownership, close associates and family members of politically-exposed persons (PEPs). The proposed amendments elaborate on the risk-based approach requiring regulated persons (RPs) to conduct risk assessment in alignment with the country’s latest National Risk Assessment (NRA) framework. The RPs include securities brokers, futures brokers, insurers, takaful operators, non-banking finance companies and modarabas.

Number of tax filers rises by 40pc as deadline looms

The Federal Board of Revenue (FBR) has received nearly 40 per cent more income tax returns for the tax year 2019 compared to the preceding year ahead of the Jan 31 deadline. The board received 2.285 million tax returns until January 29 as against 1.635m returns filed in the tax year 2018. The last date for filing of income tax returns for tax year 2019 was extended four times consecutively to facilitate individuals to file their returns. For the tax year 2018, FBR had received 2.7m returns — the highest number in FBR’s history.

ECC sanctions Rs350m for PSM for partial settlement of SSGC liabilities

The Economic Coordination Committee (ECC) of the Cabinet on Monday has approved release of Rs.350 million for Pakistan Steel Mills for partial settlement of the Sui-Southern Gas Company (SSGC) liabilities. The ECC, which was chaired by Adviser to the Prime Minister on Finance and Revenue Dr. Abdul Hafeez Shaikh, has considered six points’ agenda. On the summary moved by the Ministry of Industries and Production for the payment of outstanding liabilities of Pakistan Steel Mills against Sui-Southern Gas Company for the non- payment of Gas bills, the ECC approved the release of Rs350 million for the partial settlement of the SSGC liability.

Asian stocks slipped while gold and bonds were in demand on Thursday as worries about the spread of a new virus from China sent investors heading for safety. The Federal Reserve kept interest rates unchanged on Wednesday, as expected, although bank Chairman Jerome Powell’s comments about a low inflation outlook added to U.S. government bonds’ appeal. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.8% to an almost seven-week low. Japan's Nikkei .N225 fell 1%. Hong Kong's Hang Seng .HSI extended Wednesday's drop and Taiwan's benchmark index .TWII opened 1.5% lower in its first session since the Lunar New Year break.

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday deferred decision on gas price increase for further consultations and waived about Rs195 million port charges to the Turkish firm Karkey as part of a $1.2 billion dispute settlement. The meeting, presided by PM’s Finance Adviser Dr Abdul Hafeez Shaikh discussed the proposal for up to 15 per cent gas price increase and noted that some changes were required to minimise the burden on domestic consumers in line with Prime Minister’s guidelines. An official said the increased gas rates for domestic consumers during the high-consumption winter season would not go well from a political perspective.

The Securities and Exchange Commission of Pakistan (SECP) on Wednesday proposed amendments in the Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) Regulations, 2018 to comply with the Financial Action Task Force (FATF) recommendations. The draft amendments provide clarity on verification for beneficial ownership, close associates and family members of politically-exposed persons (PEPs). The proposed amendments elaborate on the risk-based approach requiring regulated persons (RPs) to conduct risk assessment in alignment with the country’s latest National Risk Assessment (NRA) framework. The RPs include securities brokers, futures brokers, insurers, takaful operators, non-banking finance companies and modarabas.

The Federal Board of Revenue (FBR) has received nearly 40 per cent more income tax returns for the tax year 2019 compared to the preceding year ahead of the Jan 31 deadline. The board received 2.285 million tax returns until January 29 as against 1.635m returns filed in the tax year 2018. The last date for filing of income tax returns for tax year 2019 was extended four times consecutively to facilitate individuals to file their returns. For the tax year 2018, FBR had received 2.7m returns — the highest number in FBR’s history.

The Economic Coordination Committee (ECC) of the Cabinet on Monday has approved release of Rs.350 million for Pakistan Steel Mills for partial settlement of the Sui-Southern Gas Company (SSGC) liabilities. The ECC, which was chaired by Adviser to the Prime Minister on Finance and Revenue Dr. Abdul Hafeez Shaikh, has considered six points’ agenda. On the summary moved by the Ministry of Industries and Production for the payment of outstanding liabilities of Pakistan Steel Mills against Sui-Southern Gas Company for the non- payment of Gas bills, the ECC approved the release of Rs350 million for the partial settlement of the SSGC liability.

Market is expected to remain volatile during current trading session.

Technical Analysis

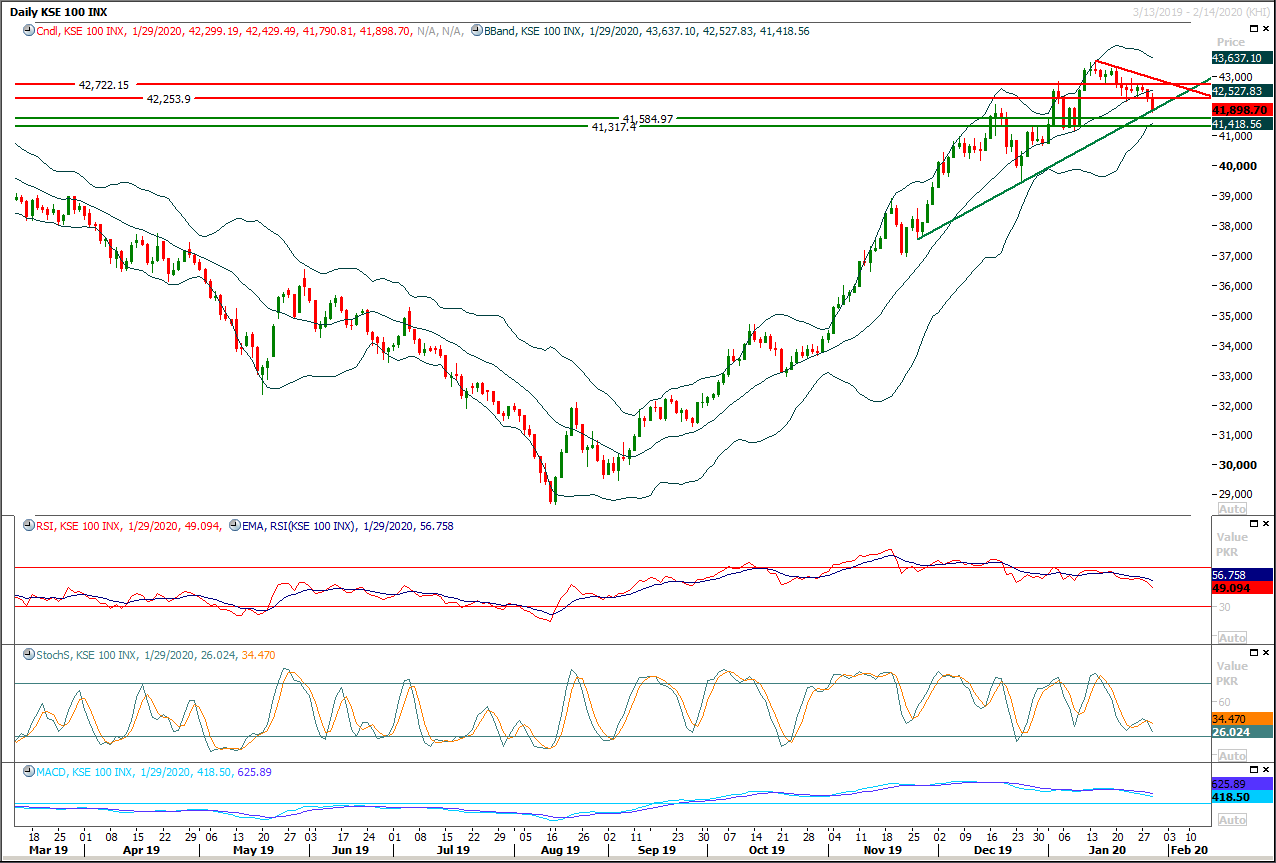

The Benchmark KSE100 index have continued its bearish journey below its major supportive region of 42,000 points during last trading session and now its standing at a supportive trend line and breakout below said trend line would call for 41,500 points and then 41,300 points. Daily momentum indicators are in bearish mode therefore it's expected that index would continue its bearish journey after an intraday spike today. It's recommended to stay cautious till this weekly closing and trade with strict stop loss. Index would remain bearish until it would succeed in closing above 42,500 points again.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.