Previous Session Recap

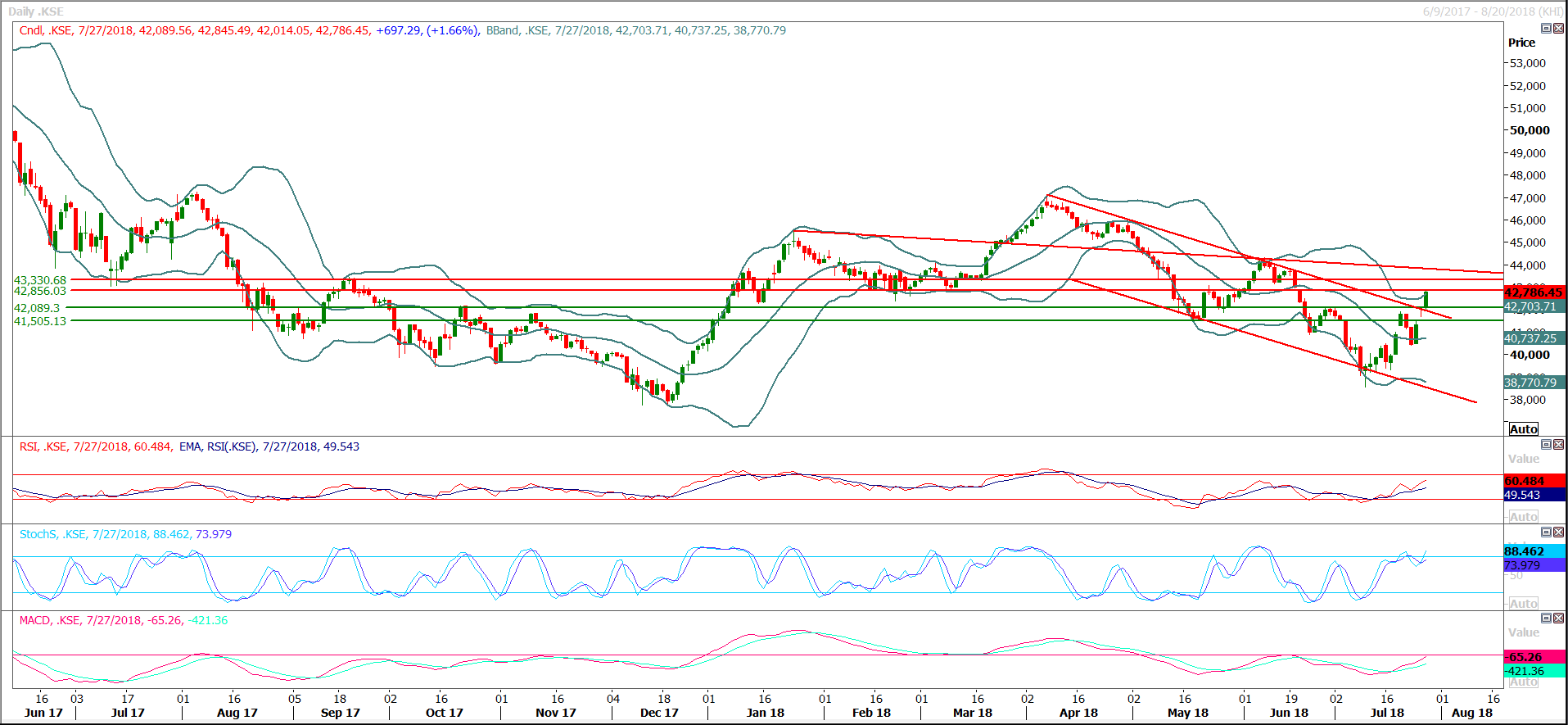

Trading volume at PSX floor increased by 131.17 million shares or 51.57% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,089.56, posted a day high of 42,845.49 and a day low of 42,014.05 during last trading session. The session suspended at 42,786.45 with net change of 697.29 and net trading volume of 187.53 million shares. Daily trading volume of KSE100 listed companies increased by 57.67 million shares or 44.41% on DoD basis.

Foreign Investors remained in net selling position of 11.21 million shares but net value of Foreign Inflow dropped by 0.20 million US Dollars. Categorically, Foreign Individuals and Corporate remained in net selling positions of 0.13 and 11.62 million shares but Overseas Pakistanis investors remained in net buying positions of 0.54 million shares. While on the other side Local Individuals, Local Companies, and Insurance Companies remained in net buying positions of 23.65, 3.39 and 5.25 million shares but Banks, NBFCs, Mutual Fund and Brokers remained in net selling positions of 5.51, 0.70, 9.33 and 3.99 million shares respectively.

Analytical Review

Asia cautious ahead of central bank, data fest

Asian share markets drifted lower on Monday while currencies kept to familiar ranges ahead of a busy week peppered with central bank meetings, corporate results and updates on U.S. inflation and payrolls. Technology and energy shares led Japan's Nikkei .N225 down 0.4 percent in early trade, while tech also featured in South Korea's .KS11 0.2 percent decline. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS eased 0.03 percent. SPONSORED The week ahead features quarterly earnings from more than 140 S&P 500 companies, including Apple Inc (AAPL.O). Disappointing results from Intel Corp (INTC.O) and Twitter Inc (TWTR.N) soured the mood on the Nasdaq .IXIC on Friday, though the S&P 500 <.SPX) and Dow .DJI still ended firmer for the week.

MEPCO recovered Rs175.45b in 2017-18

Multan Electric Power Company (MEPCO) has recovered over Rs175.45b from the consumers in line with billing with the recovery ratio of 100 per cent during current fiscal year 2017-2018. The company recovered more than Rs166.47 billion from private consumers with recovery ratio of 99.86pc while over Rs8.98 billion were recovered from different government departments with recovery ratio of 96.42pc. MEPCO recovered Rs38.77b from Multan circle during July 2017 to June 30, 2018, over Rs13.45b from DG Khan circle, Rs4.53b from Vehari circle , Rs22.50b from Bahawalpur circle, Rs23.13b from Sahiwal circle and Rs18.94b from Rahim Yar Khan circle.

Cotton cultivated over 2.69m hectares during current season

Cotton crop had been cultivated over 2.69 million hectares of land across the crop producing areas of the country to produce 14 million cotton bales fixed during the current sowing season to fulfill the domestic requirements as well as for exporting. The crop sowing had registered about 1 percent increase across the crop producing areas of the country as compared the cultivation of corresponding period of last season, said Cotton Commissioner in the Ministry of National Food Security and Research Dr Khalid Abdullah. Talking to APP, here he said that cotton sowing targets were fixed at 2.95 million hectares in order to produce over 14 million cotton bales during the crop season 2018-19 in order to fulfill the domestic requirements as well as for exporting.

Basmati rice export witnesses 19pc growth

About 520,759 metric tons of basmati rice worth US$ 540.231 million were exported during the period from July-June, 2017-18 as against the exports of 496,263 metric tons valuing US$ 453.441 million of Corresponding period of last year. During the period under review, the exports of basmati rice witnessed 19.14 percent growth when the quantity was compared with the same period of last year, according the data of Pakistan Bureau of Statistics. Meanwhile about 4.106 million tons of rice worth US$ 2.073 billion had been exported during 12 months of last financial year as compared the exports of 3.523 million tons valuing US$ 1.606 billion of the corresponding period of last years, registering 26.78 percent growth during the period under review.

Balloki power plant ready to yield 1223 MW

Work on Regasified Liquefied Natural Gas (RLNG) based Balloki Power plant has been completed which will provide 1223 MW electricity to the national grid. National Power Parks Management Company Limited (NPPMCL), Harbin Electric International Company Limited (HEI) and GE Sunday announced the completion of the Balloki power plant , following the successful conclusion of all commissioning works and performance-related tests. Rashid Mahmood, CEO of NPPMCL said: “I am proud to announce that the Balloki project is now able to supply up to 1,223 megawatts (MW) of uninterrupted power to the national grid, the equivalent electricity needed to supply up to 2.5 million Pakistani homes. This is the second regasified liquefied natural gas (RLNG) power project developed by NPPMCL – the first being the Haveli Bahadur Shah (HBS) power plant , which entered full-fledged combined cycle commercial operations in May 2018. Together, the HBS and Balloki plants have already added over 5.5 billion kilowatt hours of power to the national grid while in the commissioning phase and they will continue to deliver efficient, low cost power for up to 30 years, making a meaningful difference in the lives of the people of Pakistan.”

Asian share markets drifted lower on Monday while currencies kept to familiar ranges ahead of a busy week peppered with central bank meetings, corporate results and updates on U.S. inflation and payrolls. Technology and energy shares led Japan's Nikkei .N225 down 0.4 percent in early trade, while tech also featured in South Korea's .KS11 0.2 percent decline. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS eased 0.03 percent. SPONSORED The week ahead features quarterly earnings from more than 140 S&P 500 companies, including Apple Inc (AAPL.O). Disappointing results from Intel Corp (INTC.O) and Twitter Inc (TWTR.N) soured the mood on the Nasdaq .IXIC on Friday, though the S&P 500 <.SPX) and Dow .DJI still ended firmer for the week.

Multan Electric Power Company (MEPCO) has recovered over Rs175.45b from the consumers in line with billing with the recovery ratio of 100 per cent during current fiscal year 2017-2018. The company recovered more than Rs166.47 billion from private consumers with recovery ratio of 99.86pc while over Rs8.98 billion were recovered from different government departments with recovery ratio of 96.42pc. MEPCO recovered Rs38.77b from Multan circle during July 2017 to June 30, 2018, over Rs13.45b from DG Khan circle, Rs4.53b from Vehari circle , Rs22.50b from Bahawalpur circle, Rs23.13b from Sahiwal circle and Rs18.94b from Rahim Yar Khan circle.

Cotton crop had been cultivated over 2.69 million hectares of land across the crop producing areas of the country to produce 14 million cotton bales fixed during the current sowing season to fulfill the domestic requirements as well as for exporting. The crop sowing had registered about 1 percent increase across the crop producing areas of the country as compared the cultivation of corresponding period of last season, said Cotton Commissioner in the Ministry of National Food Security and Research Dr Khalid Abdullah. Talking to APP, here he said that cotton sowing targets were fixed at 2.95 million hectares in order to produce over 14 million cotton bales during the crop season 2018-19 in order to fulfill the domestic requirements as well as for exporting.

About 520,759 metric tons of basmati rice worth US$ 540.231 million were exported during the period from July-June, 2017-18 as against the exports of 496,263 metric tons valuing US$ 453.441 million of Corresponding period of last year. During the period under review, the exports of basmati rice witnessed 19.14 percent growth when the quantity was compared with the same period of last year, according the data of Pakistan Bureau of Statistics. Meanwhile about 4.106 million tons of rice worth US$ 2.073 billion had been exported during 12 months of last financial year as compared the exports of 3.523 million tons valuing US$ 1.606 billion of the corresponding period of last years, registering 26.78 percent growth during the period under review.

Work on Regasified Liquefied Natural Gas (RLNG) based Balloki Power plant has been completed which will provide 1223 MW electricity to the national grid. National Power Parks Management Company Limited (NPPMCL), Harbin Electric International Company Limited (HEI) and GE Sunday announced the completion of the Balloki power plant , following the successful conclusion of all commissioning works and performance-related tests. Rashid Mahmood, CEO of NPPMCL said: “I am proud to announce that the Balloki project is now able to supply up to 1,223 megawatts (MW) of uninterrupted power to the national grid, the equivalent electricity needed to supply up to 2.5 million Pakistani homes. This is the second regasified liquefied natural gas (RLNG) power project developed by NPPMCL – the first being the Haveli Bahadur Shah (HBS) power plant , which entered full-fledged combined cycle commercial operations in May 2018. Together, the HBS and Balloki plants have already added over 5.5 billion kilowatt hours of power to the national grid while in the commissioning phase and they will continue to deliver efficient, low cost power for up to 30 years, making a meaningful difference in the lives of the people of Pakistan.”

ATRL, PAEL, TRG and DGKC may lead the trend in positive direction while PSO and PPL would try to lead laggards.

Technical Analysis

The Benchmark KSE100 Index had completed 100% expansion of its last 61.8% correction on daily chart and right now it’s being capped by two strong horizontal resistant regions at 42,860 and 43,330 points. Initially KSE100 Index have psychological barrier at 43,000 points as well. While supportive regions are standing at 42,089 points which fall on a descending trend line of a bearish channel and was reacting as a resistant region previously along with 41,500 points which falls on a strong horizontal supportive region. It’s recommended to stay cautious while current trading session because after a spike in first half index would need a correction which may lead for a dip of 500-700 points.

On monthly chart index is formatting a hammer on a very crucial level because if index would not close above 43,330 on monthly basis then a serious downward trend could be witnessed in August. Therefore initiating long term trades on current levels is not recommended. For current trading session ATRL, TRG, PAEL and ISL may lead positive momentum and they would be joined by DGKC and MLCF if both would succeed in closing above 115 and 52 Rs respectively. While PSO and PPL are trying to bounce back in negative zone.

On monthly chart index is formatting a hammer on a very crucial level because if index would not close above 43,330 on monthly basis then a serious downward trend could be witnessed in August. Therefore initiating long term trades on current levels is not recommended. For current trading session ATRL, TRG, PAEL and ISL may lead positive momentum and they would be joined by DGKC and MLCF if both would succeed in closing above 115 and 52 Rs respectively. While PSO and PPL are trying to bounce back in negative zone.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.