Previous Session Recap

Trading volume at PSX floor increased by 48.5 million shares or 19.55% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 45,157.83, posted a day high of 45,506.11 and a day low of 45,155.51 during last trading session. The session suspended at 45,489.62 with net change of 316.63 and net trading volume of 163.04 million shares. Daily trading volume of KSE100 listed companies increased by 20.37 million shares or 14.28% on DoD basis.

Foreign Investors remained in net buying position of 10.54 million shares and net value of Foreign Inflow increased by 9.36 million shares during last trading session. Categorically, Foreign Individual, Corporate and Overseas Pakistani investors remained in net buying positions of 0.11, 5.43 and 5.0 million shares respectively. While on the other side Local Individuals and Banks remained in net buying positions of 16.5 and 1.44 million shares but Local Companies, NBFCs, Mutual Funds, Brokers and Insurance Companies remained in net selling positions of 7.44, 5.08, 9.66, 1.35 and 6.17 million shares respectively.

Analytical Review

Eager for calming news, investors look to earnings

Nervous stock investors are hoping an unusually U.S. strong earnings season can restore some of the optimism that characterized equity markets last year. Imploding technology stocks and fears of a trade war have pummeled the market in recent days. Given the surge in volatility this year, there is no guarantee that worst is over. Analysts predict strong results when reporting season starts up next month, with first-quarter S&P 500 profit growth on track to be the highest in seven years, according to Thomson Reuters data. That follows a blockbuster fourth-quarter period, and recent corporate tax cuts that boosted forecasts for all of 2018. A robust earnings period would bring back the focus on fundamentals and possibly put a floor under prices, supporting views that the 9-year-old bull market will go on, strategists said.

EPC contract signed for Jamshoro Coal Power Project

The Engineering Procurement and Construction (EPC) Contract for first unit having capacity of 660MW (out of two units of 660MW each) and 5 years O&M Contract of 1320MW Jamshoro Coal Fired Power Project was Thursday signed between Jamshoro Power Company Limited (Genco-I) and the Siemens-HEI (Harbin Electric International) joint venture. The contract was signed in the presence of the secretary, Ministry of Energy (Power Division), Chief Executive Officer of Genco Holding Company, the Commercial Counsellor of the Embassy of People's Republic of China and other officials from Ministry, GHCL / Gencos, Asian Development Bank, Siemens, Harbin Electric International, Project Consultants Mott Mcdonald, etc. The signed Lot is being funded by the Asian Development Bank, and each unit will be completed within 42 months. EPC Contract price for Lot-I (unit 1 of 660MW and balance of plant) signed Thursday is $562 million. This will be the first supercritical coal fired power project in public sector to be installed at Jamshoro, Sindh. EPC contract price of Lot-II (unit 2 of 660MW and expansion of balance of plant) is $313million which will be signed in next phase once financing arrangement is finalized.

Foreign reserves decline to $17.94b

Total liquid foreign reserves of the country have decreased to $17.948 billion, says the State Bank of Pakistan (SBP). According to a SBP's weekly statement, the foreign reserves held by the State Bank on March 22 were 11,776.1 million dollars and the net foreign reserves with commercial banks amounted to 6,172.3 million. During the week ending March 22, SBP's reserves decreased by $168 million to $11,776 million due to payments on account of external debt servicing.

CDWP approves 33 projects of Rs50.5b

Central Development Working Party (CDWP) Thursday deferred up-gradation of existing mainline-I (Karachi to Torkham) and establishment of dry port near Havelian and approved 33 other projects worth Rs50.5 billion and two projects worth Rs22.5 billion were referred to Ecnec for further proceeding. The CDWP meeting was held under the chairmanship of Planning Commission Deputy Chairman Sartaj Aziz whereas PC Secretary Shoaib Ahmed Siddiqui accompanied the deputy chairman. Senior officials from federal and provincial governments participated in the meeting. The projects presented for approval include energy, health, education, manpower, governance, physical planning and housing, transport and communications, water resources and mass media. In addition, two position papers were presented in the meetings. The major projects of the agenda are up-gradation of Pakistan Railway's existing Mainline-I (ML-I) and establishment of a dry port near Havelian (Phase-I), however the projects were deferred till the next meeting of the CDWP.

Water shortage could affect Kharif crops

Owing to 50 percent less snow fall in the catchments and worsening water availability situation in the country Kharif crops could face severe condition with an estimated 31 percent shortage during the early season. During Kharif season the dependence will be on monsoon season as the snow fall was 50 percent less and rivers are likely to receive 11 MAF less water, said spokesman for Indus River System Authority (IRSA), Khalid Rana while briefing the newsmen here after the advisory committee meeting. The authority's committee met here with Sher Zaman Khan in the chair. Provincial Members Irsa, officials of the Wapda, metrological department and respective provincial irrigation departments attended the meeting and anticipated that Indus system will face 35 percent water shortage during the early Kharif season(April 1st-June10) and 20 percent onward June 10th till the end of the season.

Market is expected to remain volatile therfore its recommended to stay cautious while trading today.

Nervous stock investors are hoping an unusually U.S. strong earnings season can restore some of the optimism that characterized equity markets last year. Imploding technology stocks and fears of a trade war have pummeled the market in recent days. Given the surge in volatility this year, there is no guarantee that worst is over. Analysts predict strong results when reporting season starts up next month, with first-quarter S&P 500 profit growth on track to be the highest in seven years, according to Thomson Reuters data. That follows a blockbuster fourth-quarter period, and recent corporate tax cuts that boosted forecasts for all of 2018. A robust earnings period would bring back the focus on fundamentals and possibly put a floor under prices, supporting views that the 9-year-old bull market will go on, strategists said.

The Engineering Procurement and Construction (EPC) Contract for first unit having capacity of 660MW (out of two units of 660MW each) and 5 years O&M Contract of 1320MW Jamshoro Coal Fired Power Project was Thursday signed between Jamshoro Power Company Limited (Genco-I) and the Siemens-HEI (Harbin Electric International) joint venture. The contract was signed in the presence of the secretary, Ministry of Energy (Power Division), Chief Executive Officer of Genco Holding Company, the Commercial Counsellor of the Embassy of People's Republic of China and other officials from Ministry, GHCL / Gencos, Asian Development Bank, Siemens, Harbin Electric International, Project Consultants Mott Mcdonald, etc. The signed Lot is being funded by the Asian Development Bank, and each unit will be completed within 42 months. EPC Contract price for Lot-I (unit 1 of 660MW and balance of plant) signed Thursday is $562 million. This will be the first supercritical coal fired power project in public sector to be installed at Jamshoro, Sindh. EPC contract price of Lot-II (unit 2 of 660MW and expansion of balance of plant) is $313million which will be signed in next phase once financing arrangement is finalized.

Total liquid foreign reserves of the country have decreased to $17.948 billion, says the State Bank of Pakistan (SBP). According to a SBP's weekly statement, the foreign reserves held by the State Bank on March 22 were 11,776.1 million dollars and the net foreign reserves with commercial banks amounted to 6,172.3 million. During the week ending March 22, SBP's reserves decreased by $168 million to $11,776 million due to payments on account of external debt servicing.

Central Development Working Party (CDWP) Thursday deferred up-gradation of existing mainline-I (Karachi to Torkham) and establishment of dry port near Havelian and approved 33 other projects worth Rs50.5 billion and two projects worth Rs22.5 billion were referred to Ecnec for further proceeding. The CDWP meeting was held under the chairmanship of Planning Commission Deputy Chairman Sartaj Aziz whereas PC Secretary Shoaib Ahmed Siddiqui accompanied the deputy chairman. Senior officials from federal and provincial governments participated in the meeting. The projects presented for approval include energy, health, education, manpower, governance, physical planning and housing, transport and communications, water resources and mass media. In addition, two position papers were presented in the meetings. The major projects of the agenda are up-gradation of Pakistan Railway's existing Mainline-I (ML-I) and establishment of a dry port near Havelian (Phase-I), however the projects were deferred till the next meeting of the CDWP.

Owing to 50 percent less snow fall in the catchments and worsening water availability situation in the country Kharif crops could face severe condition with an estimated 31 percent shortage during the early season. During Kharif season the dependence will be on monsoon season as the snow fall was 50 percent less and rivers are likely to receive 11 MAF less water, said spokesman for Indus River System Authority (IRSA), Khalid Rana while briefing the newsmen here after the advisory committee meeting. The authority's committee met here with Sher Zaman Khan in the chair. Provincial Members Irsa, officials of the Wapda, metrological department and respective provincial irrigation departments attended the meeting and anticipated that Indus system will face 35 percent water shortage during the early Kharif season(April 1st-June10) and 20 percent onward June 10th till the end of the season.

Technical Analysis

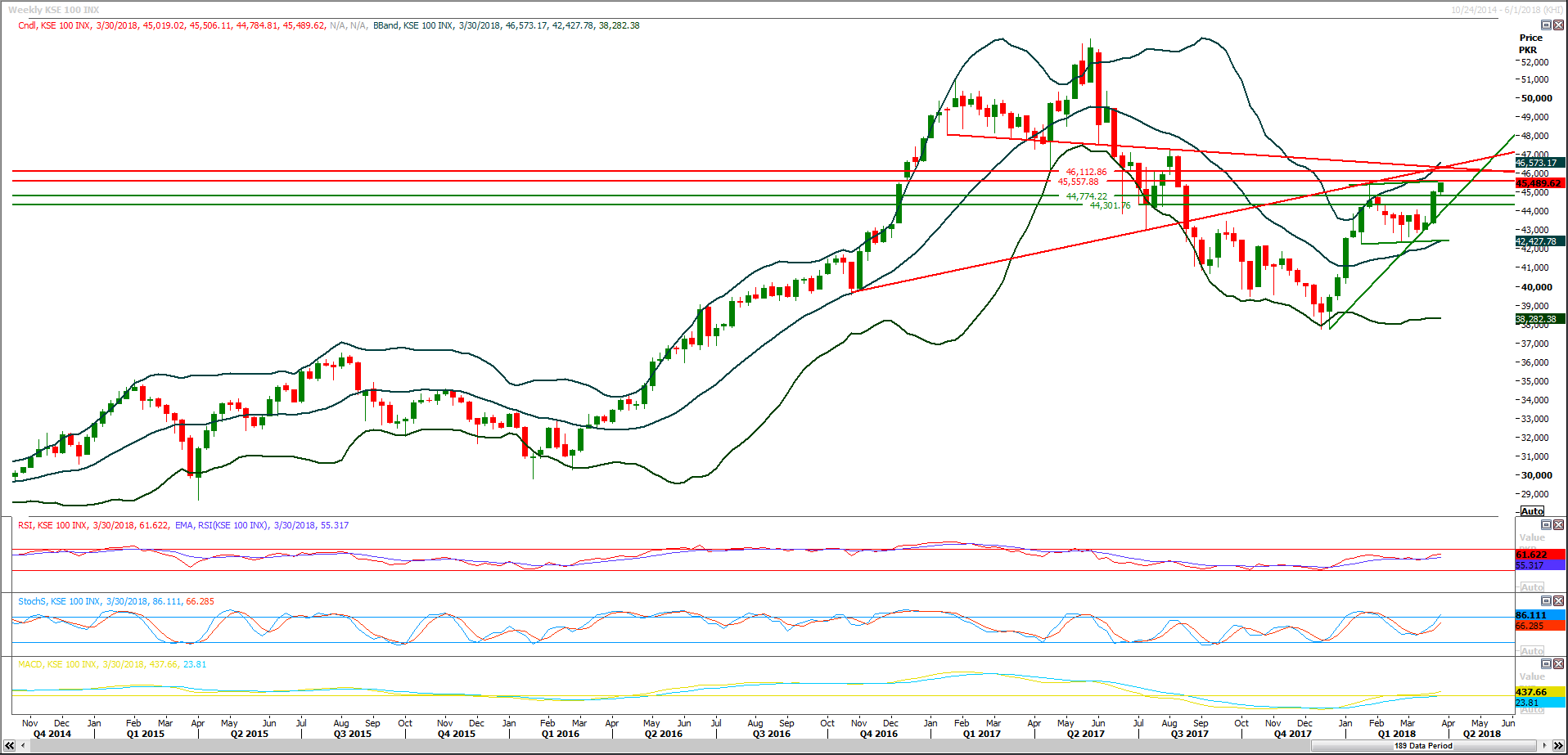

The Benchmark KSE100 Index is standing at critical point because expansion of its daily triangle is completed and now it has resistant regions ahead at 45,557 and 46, 112 points. If index would close above 45,557 points today then short and midterm trends would be changed to bullish and index would start a new bullish rally. Technically, Index has to start a correction from these levels to smoothen its indicators and this correction could last till 43900 and 42800 if started. Selling on strength could be beneficial for current trading session with strict stop loss of 45,557 on closing basis. If index would drop below 45490 points at closing and closed with negative momentum then it would considered a double top on weekly chart which would add pressure on index in coming week. Its recommended to stay cautious while trading today.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.