Previous Session Recap

Trading volume at PSX floor dropped by 228.69 million shares or 52.97% , DoD basis. Whereas, the KSE100 index opened at 52395.20, posted a day high of 52563.91 and a day low of 52036.34 during the last trading session, while the session suspended at 52138.90 with a net change of -497.97 points and a net trading volume of 63.34 million shares. Daily trading volume of KSE100 listed companies dropped by 53.08 million shares or 45.59%, DoD basis.

Foreign Investors remained in a net selling position of 3.91 million shares and the net value of Foreign Inflow dropped by 6.95 million US Dollars. Categorically, Foreign individuals and Overseas Pakistani investors remained in net buying positions of 0.099 0.41 million shares but Foreign Corporate investors remained in a net selling position of 4.42 million shares. While on the other side, Local Individuals remained in a net selling position of 11.93 million shares but Local Companies, Banks, Mutual Funds and Brokers remained in net buying positions of 9.66, 2.63, 0.29 and 0.26 million shares, respectively.

Analytical Review

The euro came under pressure on Tuesday after a media report that Greece may forego its next bailout payment if creditors cannot strike a debt relief deal, while Asian stocks were shackled by holidays in some regional markets and the United States and UK. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was flat early on Tuesday. Japanese Nikkei .N225 slipped almost 0.1 percent. China, Hong Kong and Taiwan markets are closed for holidays on Tuesday.

Finance Minister Ishaq Dar on Monday said that the government is determined to achieve GDP growth rate of 6 percent in the coming fiscal year 2017-18. He said the government has borrowed only for development projects and not for meeting routine expenditures. He made these remarks while chairing a post-budget meeting at FBR headquarters. The meeting reviewed matters relating to the new budget measures as well as the state of revenue collection for the current fiscal year.

The Securities and Exchange Commission of Pakistan (SECP) has approved certain measures, as proposed by the Pakistan Stock Exchange Limited (PSX), National Clearing Company of Pakistan Limited, international broker dealers and local market participants, for a seamless transition. The MSCI reclassified Pakistan as an Emerging Market (EM) on June 14, 2016, which was to take effect from June 1, 2017. The rebalancing of portfolios by funds tracking MSCI EM Index and MSCI Frontier Index is expected to result in a significant flux of capital in the stock market on the eve of June 1.

Hussain Nawaz, the elder son of Prime Minister Nawaz Sharif, will appear before the joint investigation team (JIT) probing the Panama Papers case for a second time today (Tuesday) after the Supreme Court turned down his objections against two of the body’s members. “We are not going to remove any JIT member on mere conjecture unless something concrete comes up because the prime minister is the one being investigated,” Justice Ejaz Afzal Khan, who heads the three-judge implementation bench of the Supreme Court, observed on Monday.

With only two days left before Pakistan formal inclusion in the MSCI Emerging Market Index, the Pakistan Stock Exchange (PSX) and major brokerages are bracing for what they see as a large inflow of foreign funds. The gross amount of inflows is likely to be five to six times the PSX daily turnover as per the estimates of some market players. The inflow can start from today, but the high tide is expected on Wednesday – possibly in the last hour of trading – as MSCI-tracking passive funds barge their way through the local bourse.

The Market is expected to remain volatile today. We advise Traders to exercise caution. Buying on dips and booking gains on strength is recommended.

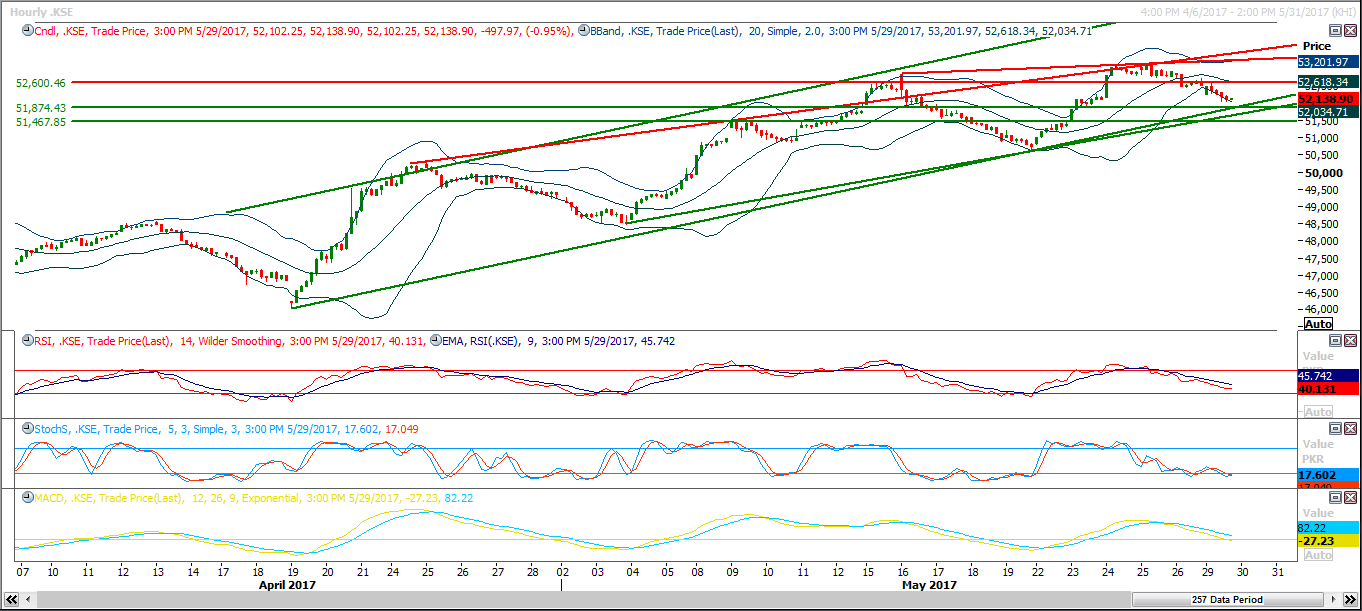

Technical Analysis

The Benchmark KSE100 Index has supportive regions ahead from two supportive trend lines along with a horizontal support at 51870 and 51800 region. It also completed its 50% correction on hourly chart and these levels may push the index back into the positive zone. However, a closing below 51870 is likely to call for 51460. For the current trading session, buying on dips with a strict stop loss at 51800 is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.