Previous Session Recap

Trading volume at PSX floor dropped by 26.69 million shares or 21.51% on DoD basis whereas the Benchmark KSE100 index opened at 40,717.95, posted a day high of 40,781.43 and day low of 40,462.91 during last trading session while session suspended at 40,626.89 with net change of -65.97 points and net trading volume of 53.32 million shares. Daily trading volume of KSE100 listed companies dropped by 23.07 million shares or 30.21% on DoD basis.

Foreign Investors remained in net selling position of 4.54 million shares and net value of Foreign Inflow dropped by 3.88 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani investors remained in net selling position of 3.96 and 0.57 million shares. While on the other side Local Individuals, Local Companies, Banks, and Insurance Companies remained in net buying positions of 2.10, 3.99, 0.55 and 0.55 million shares respectively, but NBFCs, Mutual Fund and Brokers remained in net selling positions of 0.03, 1.70 and 1.03 million shares respectively.

Analytical Review

Wall Street edges down as tech, bank stocks weigh

Wall Street closed slightly lower on Thursday as tech and financial shares slumped, erasing earlier gains stemming from Federal Reserve minutes showing the central bank opened the debate on when to pause further interest rate hikes. All three major U.S. indexes ended the session down a fraction of a percent.The minutes showed almost all Fed members agreeing that another rate increase was “likely to be warranted fairly soon,” but also ticked off a series of issues that had begun weighing on their view of the economy. That release briefly lifted equities to the plus side, but gains faded into the close.

MPs body annoyed at absence of secy, NHA chief

A parliamentary committee on Thursday expressed resentment over the continuous absence of Federal Secretary Communication Shoaib Ahmed Siddique and National Highway Authority Chairman Jawad Rafique Malik from its meetings. A sub-committee was formed by the Senate Standing Committee on Communications when one of its members Senator Pir Sabir Shah alleged that the recently completed Hazara Motorway got ratted on multiple points within few months of its inauguration due to substandard work.

Fiscal consolidation remains a challenge, secy tells Asad

Fiscal consolidation remained a challenge during the first quarter as fiscal deficit increased to 1.4 percent as compared to 1.2 percent of the comparable period last year, the finance secretary told Finance Minister Asad Umar here on Thursday. The Secretary also briefed the meeting about the economic reforms which the Economic Advisory Council has approved. The meeting also discussed the export credit facility offered by Saudi Arabia envisaging the purchase of crude oil and or other petroleum product (s) of up to USD 3.24 billion per annum on a 12 month deferred payment basis.

Ogra seeks POL price hike despite fall in Int’l market

The Oil an Gas Regulatory Authority (Ogra) has recommended an increase of up to 11.46 percent in the prices of different petroleum products, for the month of December, despite the recent 36 percent decrease in crude oil prices in the international market. In a summary forwarded to Petroleum Division and Ministry of Finance, the Ogra has recommended upward revision in the prices almost all the petroleum products, sources told The Nation.

Forex reserves tumble by $230m last week

Pakistan’s foreign exchange reserves had tumbled by around $230 million in last week despite it received one billion dollar from Saudi Arabia recently. Pakistan had received one billion dollar from Saudi Arabia last week, which took the State Bank of Pakistan (SBP)’s reserves to $8.29 billion. However, the reserves had tumbled by around $230 million in last one week. During the week ending 23 November 2018, the SBP’s reserves decreased to US$8.062 billion.

Wall Street closed slightly lower on Thursday as tech and financial shares slumped, erasing earlier gains stemming from Federal Reserve minutes showing the central bank opened the debate on when to pause further interest rate hikes. All three major U.S. indexes ended the session down a fraction of a percent.The minutes showed almost all Fed members agreeing that another rate increase was “likely to be warranted fairly soon,” but also ticked off a series of issues that had begun weighing on their view of the economy. That release briefly lifted equities to the plus side, but gains faded into the close.

A parliamentary committee on Thursday expressed resentment over the continuous absence of Federal Secretary Communication Shoaib Ahmed Siddique and National Highway Authority Chairman Jawad Rafique Malik from its meetings. A sub-committee was formed by the Senate Standing Committee on Communications when one of its members Senator Pir Sabir Shah alleged that the recently completed Hazara Motorway got ratted on multiple points within few months of its inauguration due to substandard work.

Fiscal consolidation remained a challenge during the first quarter as fiscal deficit increased to 1.4 percent as compared to 1.2 percent of the comparable period last year, the finance secretary told Finance Minister Asad Umar here on Thursday. The Secretary also briefed the meeting about the economic reforms which the Economic Advisory Council has approved. The meeting also discussed the export credit facility offered by Saudi Arabia envisaging the purchase of crude oil and or other petroleum product (s) of up to USD 3.24 billion per annum on a 12 month deferred payment basis.

The Oil an Gas Regulatory Authority (Ogra) has recommended an increase of up to 11.46 percent in the prices of different petroleum products, for the month of December, despite the recent 36 percent decrease in crude oil prices in the international market. In a summary forwarded to Petroleum Division and Ministry of Finance, the Ogra has recommended upward revision in the prices almost all the petroleum products, sources told The Nation.

Pakistan’s foreign exchange reserves had tumbled by around $230 million in last week despite it received one billion dollar from Saudi Arabia recently. Pakistan had received one billion dollar from Saudi Arabia last week, which took the State Bank of Pakistan (SBP)’s reserves to $8.29 billion. However, the reserves had tumbled by around $230 million in last one week. During the week ending 23 November 2018, the SBP’s reserves decreased to US$8.062 billion.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

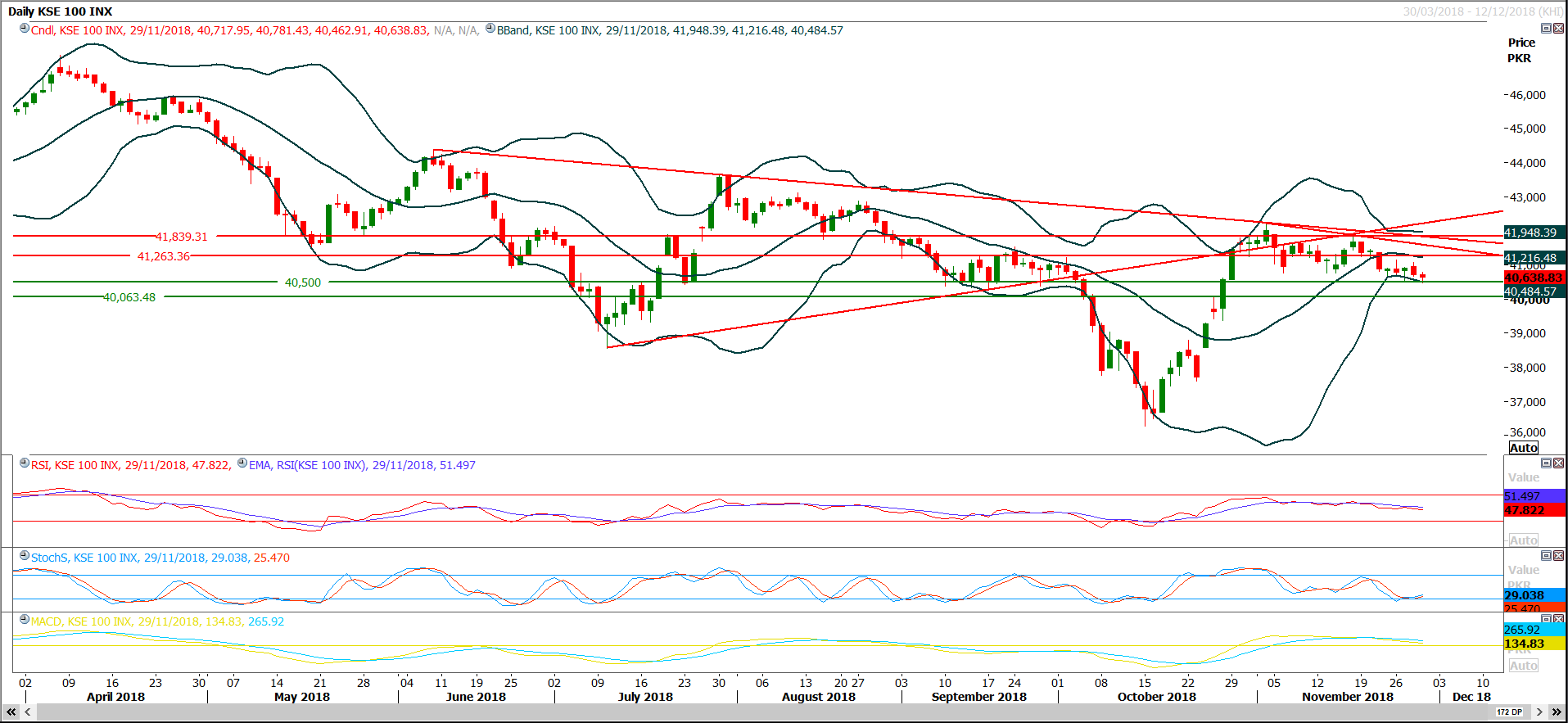

Technical Analysis

The Benchmark KSE100 Index have bounced back after getting support from major supportive region of 40,500 points during last trading session and have created a doji on daily chart, it seems that a battle is going on between bulls and bears since last five trading sessions and index is showing a volatile situation instead of taking a bearish or bullish direction therefore it’s recommended to stay side line during current trading session instead of initiating new positions during current trading session. Daily momentum indicators are mixed while weekly momentum is still bearish and hourly momentum is in continuation mode. It would be better to wait for breakout of either 41,260 or 40,500 points before initiating new positions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.