Previous Session Recap

Trading volume at PSX floor dropped by 6.71 million shares or 4.8%, DoD basis, whereas, the benchedmark KSE100 Index opened at 41412.68, posted a day high of 41420.05 and a day low of 40903.70 during the last trading session. The session suspended at 41105.40 with a net change of -304.09 and net trading volume of 79.42 million shares. Daily trading volume of KSE100 listed companies increased by 13.52 million shares or 20.52%,DoD basis.

Foreign Investors remained in a net selling position of 15.38 million shares and net value of Foreign Inflow dropped by 5.2 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani investors remained in net selling positions of 0.22, 5.13 and 10.02 million shares respectively.On the other side Local Individuals, Companies, Mutual Funds and Brokers remained in net selling positions of 10.77, 3.65, 0.99 and 0.65 million shares respectively but banks and other organizations remained in net buying positions of 0.55 and 30.9 million shares.

Analytical Review

Asian shares climbed on Monday and crude oil rose to a 2-year top, while the euro loitered around a 3-month low as the European Central Bank’s decision to extend its stimulus further fattened the dollar’s yield advantage. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS added 0.2 percent. The index is up 3.4 percent so far this month. Japan's Nikkei .N225 nudged 0.2 percent higher, while Seoul shares .KS11 climbed 0.7 percent. Global share markets have been on an uptrend since the start of the year, helped by solid corporate earnings and positive economic data across major countries. The world share index .MIWD00000PUS has surged 17.6 percent so far in 2017.

The government is set to allow another bailout package worth Rs13 billion to the embattled national flag carrier, and will allocate around Rs230bn for the procurement of more than seven million tonnes of wheat during the current season. Sources told Dawn that a meeting of the Economic Coordination Committee (ECC) of the cabinet being called this week will also approve special honoraria for officers working on Sustainable Development Goals (SDGs), besides allowing four-month salaries to employees of the fledgling Pakistan Steel Mills (PSM).

The National Database and Registration Authority (Nadra) is set to revive an agreement with Mastercard which will allow citizens to receive foreign remittances through the 13-digit identification numbers on their computerised national identity cards, according to sources. A memorandum of understanding (MoU) on the issue was cancelled in January by then interior minister Chaudhry Nisar Ali Khan over security reasons.

According to the weekly statement of position of all scheduled banks for the week ended October 13, deposits and other accounts of all scheduled banks stood at Rs11,733.096 billion after a 0.06 per cent decrease over the preceding week’s figure of Rs11,739.87bn. Compared with last year’s corresponding figure of Rs10,301.89bn, the current week’s figure was higher by 13.90pc.

The power sector regulator — National Electric Power Regulatory Authority (Nepra) — appeared to be making a strategic surrender to government pressure by building additional, unreasonable, costs in consumer tariff after its expectations for support from key stakeholders failed. While the government focused more on issuing directives to the regulator to shore up revenues than improving the power companies, the regulator struggled to convince opposition parties, parliamentary bodies and even the legal system to stand by it.

The market is expected to remain volatile today, we advice traders to exercise caution. Buying on dips and booking gain on strength is recommended.

Technical Analysis

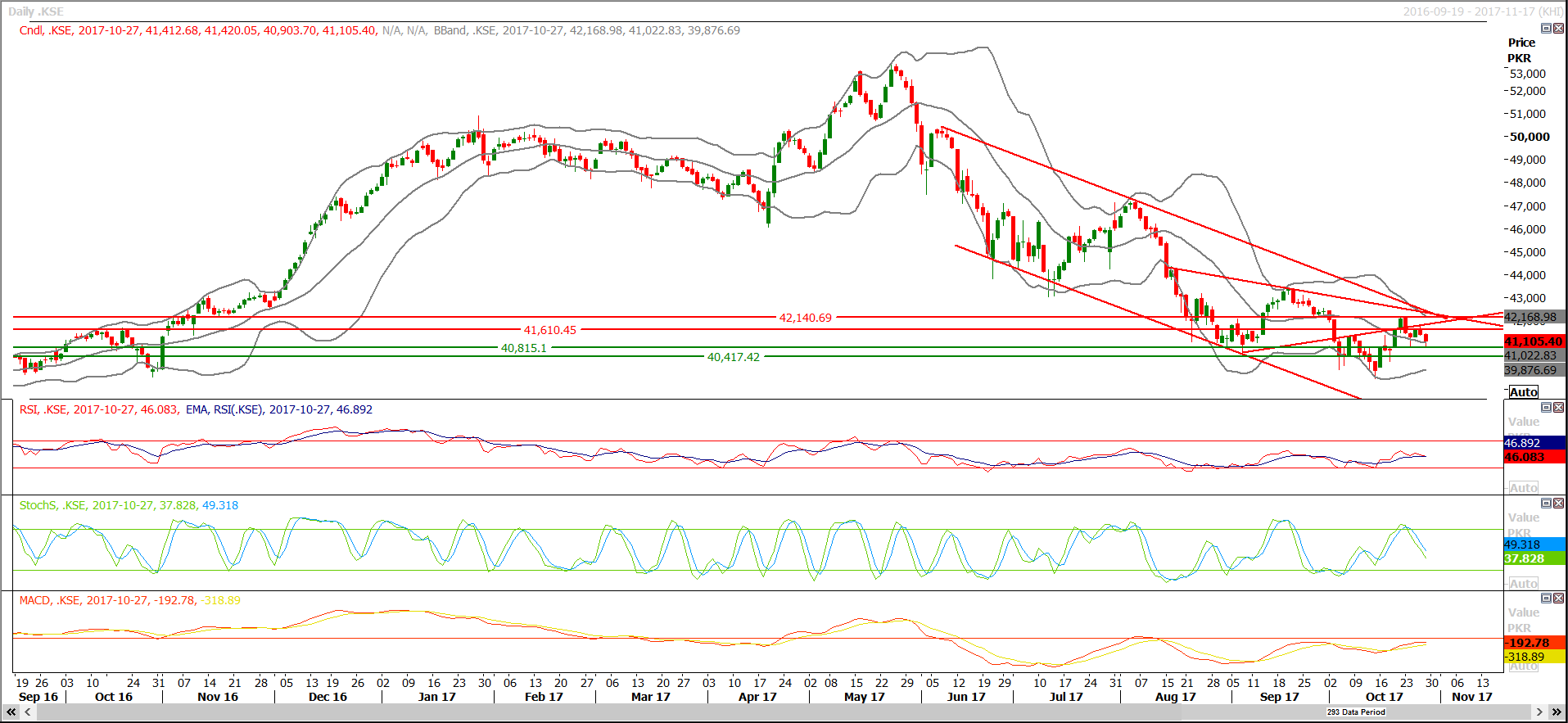

TThe benchmark KSE100 has formatted a double bottom at its 61.8% correction on the daily chart and it is trying to reverse from its supportive region of 40900 as hourly stochastic has generated a bullish crossover and MAORSI is almost ready for a bullish crossover which indicates a reversal on intraday basis. For the current trading session index has resistance around 41340 and penetration of that level might call for 41460 and 41700 whereas supportive regions are standing at 40815 and 40500. For the current trading session buying on dip and selling on strength is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.