Previous Session Recap

Trading volume at PSX floor increased by 89.45 million shares or 65.95% on DoD basis, whereas the benchmark KSE100 index opened at 33,861.59, posted a day high of 34,016.55 and a day low of 33,715.97 points during last trading session while session suspended at 33,797.51 points with net change of -64.08 points and net trading volume of 135.10 million shares. Daily trading volume of KSE100 listed companies increased by 43.91 million shares or 48.16% on DoD basis.

Foreign Investors remained in net selling positions of 17.36 million shares and net value of Foreign Inflow dropped by 0.06 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net selling positions of 15.78 and 1.61 million shares but Foreign Individual investors remained in net buying positions of 0.03 million shares. While on the other side Local Individuals, Companies, NBFCs and Mutual Fund remained in net buying positions of 133, 4.44, 0.08 and 14.26 million shares respectively but Banks, Brokers and Insurance Companies remained in net selling positions of 1.56, 1.14 and 0.19 million shares respectively.

Analytical Review

Japan retail sales rise most since 2014, but outlook murky

Japanese retail sales grew at the strongest pace in 5-1/2 years in September as consumers rushed to buy big-ticket items to beat a rise in the country’s sales tax, raising concerns spending could pull back sharply in the coming months.The increase in national sales tax to 10% from 8% on Oct. 1 is seen as crucial for fixing the industrial world’s heaviest public debt at more than twice the size of Japan’s economy. But some analysts worry the twice-delayed tax hike could tip the world’s third-largest economy into recession, underscoring the challenge for the central bank to sustain growth and accelerate inflation towards its 2% inflation target. Wednesday’s data is among key indicators to be scrutinized by the Bank of Japan, which holds its two-day policy review that ends on Thursday when it issues its quarterly projections of economy and prices.

Power Division seeks to release LNG plants from fuel offtake commitments

In a major move, the Power Division is seeking an end to the existing minimum guaranteed annual Liquefied Natural Gas (LNG) offtake to facilitate privatisation of $2 billion power plants in Punjab amid strong resistance from state-owned oil and gas companies. Top government officials confirmed to Dawn that three major oil and gas suppliers — Sui Northern Gas Pipelines Ltd (SNGPL), Sui Southern Gas Company Ltd (SSGC) and Pakistan State Oil (PSO) — have put on record in recent meetings that they would not remain financially viable entities as their entire LNG supply chain from Qatar to end consumers was based on guaranteed offtakes. This comes after an estimated investment of about $7bn on the LNG supply chain infrastructure. The basic premise of LNG imports over the past decade had been to reduce import bill through substitution of expensive furnace oil, increase power sector efficiencies and lower carbon emissions.

After talks failure, traders down shutters across country

The trader community observed a shutterdown strike throughout the country on Tuesday to protest measures in the budget designed to document their transactions, with wide swathes of urban markets heeding the strike call. During the day talks between the government and the trader community broke down, ending hopes of an early end to the strike. The markets are expected to largely remain closed on Wednesday (today) too, as a cluster of five traders’ associations has called for a two-day protest against the recently introduced measures aimed at widening the tax net and ensuring that retailers pay their taxes. The strike coincided with the launch of the anti-government ‘Azadi march’ by the Jamiat Ulema-i-Islam-Fazl.

Govt moving in right direction: IMF

The International Monetary Fund (IMF) on Tuesday said that government is moving in right direction as it reduced the fiscal deficit and also the volatility in the exchange rate in last few months. The IMF has appreciated the positive results being produced by the policies and strategies put in place by the government to remove imbalances in the economy. “The volatility in the exchange rate had been reduced while successes have also been achieved in other areas, especially on the fiscal front, which indicated the government was moving in the right direction,” the ministry of finance quoted the IMF Mission chief Ramirez Rigo Ernesto.

SCCI voices concern on electricity outages on business premises

Sarhad Chamber of Commerce and Industry (SCCI) President Engr Maqsood Anwar Pervaiz Tuesday expressed concern over 3 to 4 hours electricity loadsheding in business premises and residential areas situated on section of Ring Road from Charsadda-Grand trunk road. The reservations were conveyed by a group of traders of markets, shopping plaza and business premises located on section of Ring Road from Charsadda-Grand trunk road during a meeting with SCCI president Engr Maqsood Anwar Pervaiz here.

Japanese retail sales grew at the strongest pace in 5-1/2 years in September as consumers rushed to buy big-ticket items to beat a rise in the country’s sales tax, raising concerns spending could pull back sharply in the coming months.The increase in national sales tax to 10% from 8% on Oct. 1 is seen as crucial for fixing the industrial world’s heaviest public debt at more than twice the size of Japan’s economy. But some analysts worry the twice-delayed tax hike could tip the world’s third-largest economy into recession, underscoring the challenge for the central bank to sustain growth and accelerate inflation towards its 2% inflation target. Wednesday’s data is among key indicators to be scrutinized by the Bank of Japan, which holds its two-day policy review that ends on Thursday when it issues its quarterly projections of economy and prices.

In a major move, the Power Division is seeking an end to the existing minimum guaranteed annual Liquefied Natural Gas (LNG) offtake to facilitate privatisation of $2 billion power plants in Punjab amid strong resistance from state-owned oil and gas companies. Top government officials confirmed to Dawn that three major oil and gas suppliers — Sui Northern Gas Pipelines Ltd (SNGPL), Sui Southern Gas Company Ltd (SSGC) and Pakistan State Oil (PSO) — have put on record in recent meetings that they would not remain financially viable entities as their entire LNG supply chain from Qatar to end consumers was based on guaranteed offtakes. This comes after an estimated investment of about $7bn on the LNG supply chain infrastructure. The basic premise of LNG imports over the past decade had been to reduce import bill through substitution of expensive furnace oil, increase power sector efficiencies and lower carbon emissions.

The trader community observed a shutterdown strike throughout the country on Tuesday to protest measures in the budget designed to document their transactions, with wide swathes of urban markets heeding the strike call. During the day talks between the government and the trader community broke down, ending hopes of an early end to the strike. The markets are expected to largely remain closed on Wednesday (today) too, as a cluster of five traders’ associations has called for a two-day protest against the recently introduced measures aimed at widening the tax net and ensuring that retailers pay their taxes. The strike coincided with the launch of the anti-government ‘Azadi march’ by the Jamiat Ulema-i-Islam-Fazl.

The International Monetary Fund (IMF) on Tuesday said that government is moving in right direction as it reduced the fiscal deficit and also the volatility in the exchange rate in last few months. The IMF has appreciated the positive results being produced by the policies and strategies put in place by the government to remove imbalances in the economy. “The volatility in the exchange rate had been reduced while successes have also been achieved in other areas, especially on the fiscal front, which indicated the government was moving in the right direction,” the ministry of finance quoted the IMF Mission chief Ramirez Rigo Ernesto.

Sarhad Chamber of Commerce and Industry (SCCI) President Engr Maqsood Anwar Pervaiz Tuesday expressed concern over 3 to 4 hours electricity loadsheding in business premises and residential areas situated on section of Ring Road from Charsadda-Grand trunk road. The reservations were conveyed by a group of traders of markets, shopping plaza and business premises located on section of Ring Road from Charsadda-Grand trunk road during a meeting with SCCI president Engr Maqsood Anwar Pervaiz here.

Market is expected to remain volatile during current trading session.

Technical Analysis

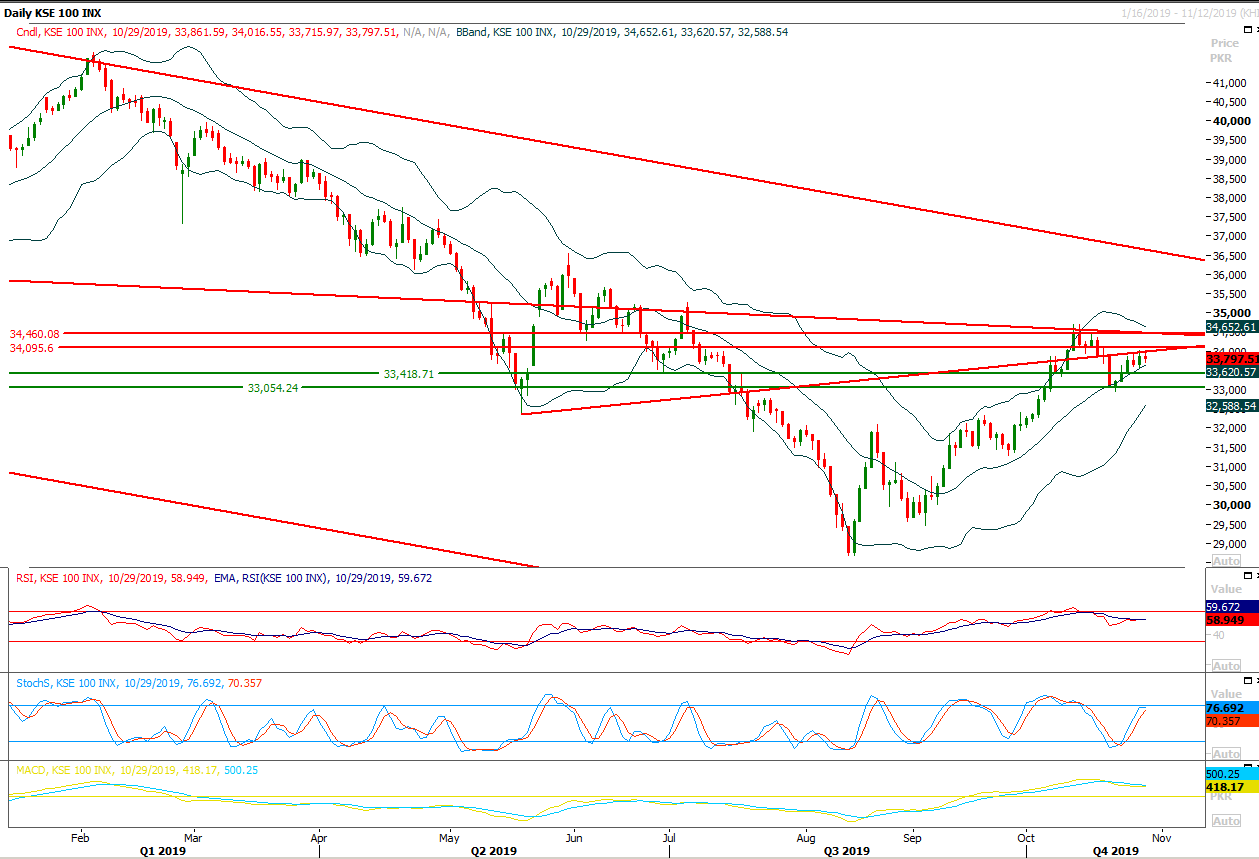

The Benchmark KSE100 have succeeded in engulfing previous daily candle during second last trading session but it still could not succeed penetration above its major resistant trend line during last trading session. As of now index would again face major resistances from 34,000 points and in case it would succeed in penetration above said region then next resistant region which would try to cap current bullish sentiment falls at 34,250 points. As of now it's recommended to start selling on strength with strict stop loss of 34,250 points because if index would not succeed in penetration above 34,000 points on daily closing basis then a downward dip would be witnessed which would push index towards 33,500 and 33,041 points. Index would remain range bound between 34,250 points and 32,700 points until unless a clear breakout of either side would take place. Breakout of either side would push index for further 500-700 points in respective direction.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.