Previous Session Recap

The Benchmark KSE100 Index Opened at 50086.60 with a positive gap of 114 points but could not maintain positive momentum and dropped back in first hour after posting day high of 50339.93 towards day low of 48836.50 during last trading session. The session suspended at 48972.24 with net change of -991.76 points and net trading volume of 184.15 million shares. Daily trading volume of KSE100 listed companies dropped by 200.35 million shares or 52.11% on DOD bases.

Foreign Investors turned back to selling again and they remained in net selling position of 6.82 million shares but net value of Foreign Inflow increased by 4.64 million US Dollars. Categorically Foreign Individuals, Corporate and Overseas Pakistani Investors remained in net selling position of 0.062, 3.54 and 3.22 million shares respectively. While on the other hand, Local Individuals, Banks, NBFCs and Mutual Funds remained in net buying position of 11.2, 2.48, 1.16 and 3.26 million shares respectivley but Local Companies and Brokers remained in net selling position of 3.71 and 8.37 million shares respectively.

Analytical Review

Asian shares were on the defensive on Tuesday as stringent curbs on travel to the U.S. ordered by President Donald Trump brought home to investors that he is serious about putting his radical campaign pledges into action. Global stocks posted their biggest loss in six weeks after Trump signed an executive order on Friday to bar Syrian refugees indefinitely and suspend travel to the United States from seven Muslim-majority countries, sparking widespread protests. The move drew criticism from some U.S. policymakers and business leaders, including the chief executives of Goldman Sachs Group (GS.N) and Ford Motor Co (F.N), and irked many foreign leaders. His stance is really inward-looking, making investors nervous about his moderateness, said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.3 percent while Japanese Nikkei .N225 dropped 1.1 percent.

The rupee has been appreciating against all major international currencies, except the dollar, making it harder for exporters to keep their products globally competitive. The Monetary Policy Information Compendium for January issued by the State Bank of Pakistan (SBP) reveals that the Pakistani currency appreciated against global currencies during the first seven months (July-Jan) of the current fiscal year. According to the report, the rupee appreciated 3.63 per cent against the euro during the period under review. The European currency matters significantly for Pakistan because exports to the European Union have a sizeable volume.

The development work is in full swing on two mega nuclear power projects (KANUPP II and III) with total capacity of producing 2200 megawatts of electricity in Karachi. According to Radio Pakistan these power projects will start producing electricity by 2020. The power plants are being constructed in cooperation with China-Pakistan Economic Corridor (CPEC) at the cost of US $ 9.59 billion.

Exports to the European Union (EU) soared 37 percent during the last three years on the back of generalised scheme of preferences (GSP) plus status, the Commerce Minister has revealed. The GSP status offers huge potential for enhancing mutual trade between Pakistan and EU, Federal Commerce Minister Khurram Dastgir said in a statement received from Brussels here on Saturday and carried in the Gulf Today (Internews) on Monday. Dastgir, in a meeting with member of the committee on international trade in the European parliament Jan Zahradil, said export of machinery, chemicals and dyes from Europe to Pakistan also rose 14 percent. These products were required to meet the growing demand of Pakistani products, particularly textiles and garments in the European markets.

Fish and fish preparations worth of $183.451 million exported from the country during first half of current financial year as against the exports $166.286 million of the corresponding period of last year. Seafood exports from the country during the period from July- December, 2016-17 witnessed 10.32 percent increase as compared to same period of last year, according the latest data of Pakistan Bureau of Statistics. About 58,519 metric tons of fish and fish products exported in last six months as against 63,114 metric tons exported during the same period of last financial year (2015-16), it added. On month on month basis, about 10,644 metric tons of fish and fish products exported in December, 2016, which was recorded at 13,397 metric tons of same month last years, hence showing decline of 18.11 percent.

Technical Analysis

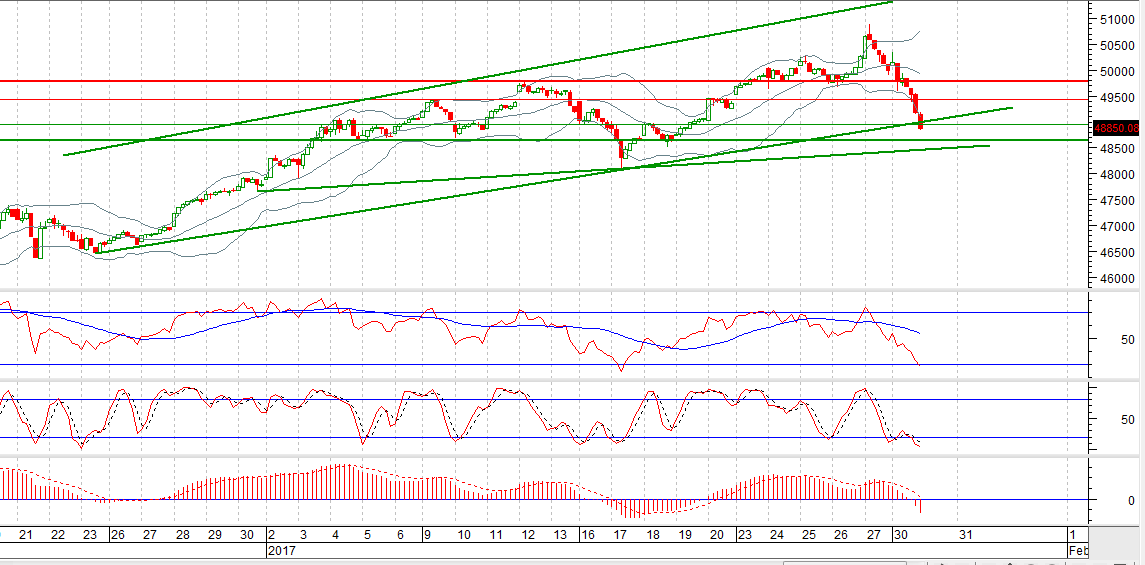

The Benchmark KSE100 Index is moving in an upward price channel on hourly chart and right now it is trying to get support from supportive trend line of said channel and 100% expansion of its last bearish correction. It is capped by a resistant trend line at correction levels of its last 2000 points bearish rally and major resistant regions stands at 49426 and 49770, it may continue its bearish momentum until it closes above 49770. For current trading session, it may try to bounce back from 48632 but momentum will remain bearish as ultimate target on charts seems 48105. If it is able to bounce back from its supportive region then a new history high would be witnessed while completing its 5th wave of Elliot wave but trading with strict stop loss is recommended until index closes above 49770.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.