Previous Session Recap

Trading volume at PSX floor increased by 1.95 million shares or 1.50%, DoD basis, whereas, the benchmark KSE100 opened at 41233.08, posted a day high of 41558 and a day low of 41046.65 while the session suspended at 41323.65 points with a net change of 90.57 points and a net trading volume of 69.28 million shares. Daily trading volume of KSE100 listed companies dropped by 0.36 million shares or 0.52%, DoD basis.

Foreign Investors remained in a net selling position of 4.67 million shares and the net value of Foreign Inflow dropped by 6.42 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistanis remained in net selling positions of 4.38 and 0.27 million shares. While on the other side, Local Individuals and Mutual Funds remained in net selling positions of 3.61, 1 million shares but Local Companies, Banks and Brokers remained in net buying positions of 4.37, 0.89 and 1.99 million shares, respectively.

Analytical Review

Investors rediscovered a taste for the dollar and Asian shares on Thursday as upbeat Chinese and U.S. economic news whetted appetite for riskier assets globally, even as tensions over North Korea simmered in the background. Oil prices were upended as flooding and damage from Tropical Storm Harvey shut nearly a quarter of U.S. refinery capacity, curbing demand for crude. The resulting risk of fuel shortages sent U.S. gasoline futures RBc1 up 6.4 percent in Asian trading to their highest in over two years. Prices have surged more than 20 percent in the past week. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS edged up 0.2 percent, leaving it a modest 0.7 percent firmer for the month so far. Japan's Nikkei .N225 rose 0.6 percent to its best level in two weeks, helped by a pullback in the yen. The index was still down 1.5 percent on the month, however. Wall Street got a boost on Wednesday when data showed the U.S. economy grew at an upwardly revised 3 percent annualized pace in the second quarter, courtesy of robust consumer spending and strong business investment.

The Ministry of Energy and Power Division on Wednesday inked a memorandum of understanding (MoU) with Japan International Cooperation Agency (JICA) on energy conservation. On the occasion, Minister of State for Water and Power Abid Sher Ali said the government had established National Energy Efficiency and Conservation Authority, which had introduced energy labelling regime aiming at production of the most efficient electrical home appliances. He said that under the programme, JICA would extend support through their experts for developing an effective phasing out strategy of inefficient appliances ensuring mandatory Pakistan Energy Labelling Regime and for the study of upgrading National Power System Expansion plan.

Oil and Gas Regulatory Authority (Ogra) has recommended the government to increase price of Motor Spirit (Petrol) by Rs2.24 per litre and High speed Diesel (HSD) by 70 paisas per litre for September 2017. The Ogra also proposed an increase of Rs15 per litre in price of kerosene oil and Rs12 per liter increase in Light Diesel Oil (LDO). According to a working paper moved to the Ministry of Petroleum and Natural Resources and the Ministry of Finance, the Ogra has proposed to increase petrol by 3.220 percent or Rs2.24 per litre and High Speed Diesel by 0.90 percent or Rs0.70 per litre. Similarly, the Ogra also recommended an increase of 39.09 percent or Rs15 per litre in the price of Kerosene oil and 27.27 percent or Rs12 per litre increase in the price of Light Diesel Oil (LDO).The government will announce its decision regarding the Ogra’s recommendation on Thursday.

Federal Minister for Commerce Mohammad Pervaiz Malik has said that economic and social indicators are on the rise in Pakistan and Pakistan offers a lucrative market for investment. Talking to UK High Commissioner, Thomas Drew who called on him here on Wednesday, Pervaiz Malik said that UK has been a great supporter of enhanced market access for Pakistani products in the EU. The meeting was also attended by Secretary Commerce, Mohammad Younus Dagha. He welcomed the British High Commissioner and said that United Kingdom is Pakistan’s biggest trade partner in Europe with bilateral trade amounting to 2.08 billion Euros in 2016. Pervaiz Malik said that it is a matter of satisfaction for both sides that bilateral trade between the two countries has been increasing over a period of time. “Pakistan’s inclusion in EU’s “Special Incentive Arrangement for Good Governance and Sustainable Development” has been the major catalyst for promoting bilateral trade”, he added.

Ali J. Siddiqui has been appointed as a special assistant to Prime Minister Shahid Khaqan Abbasi with immediate effect, according to a Cabinet Division notification issued Wednesday. Siddiqui, chairman of JS Bank Ltd and JS Private Equity Management, is the son of Jahangir Siddiqui, a businessman and philanthropist. Siddiqui, who was named in the Panama Papers leaks in 2016 enjoys the status of state minister under his new appointment, but is yet be assigned a portfolio, DawnNews reported. He also holds a directorship at Airblue and the Mahvash and Jahangir Siddiqui Foundation, and has previously served as executive director at JS Investments Ltd and as director at Crosby. He holds a BA in Economics from Cornell University.

The market is expected to remain volatile today. We advise traders to exercise caution, buying on gains and booking gains on strength is recommended.

Technical Analysis

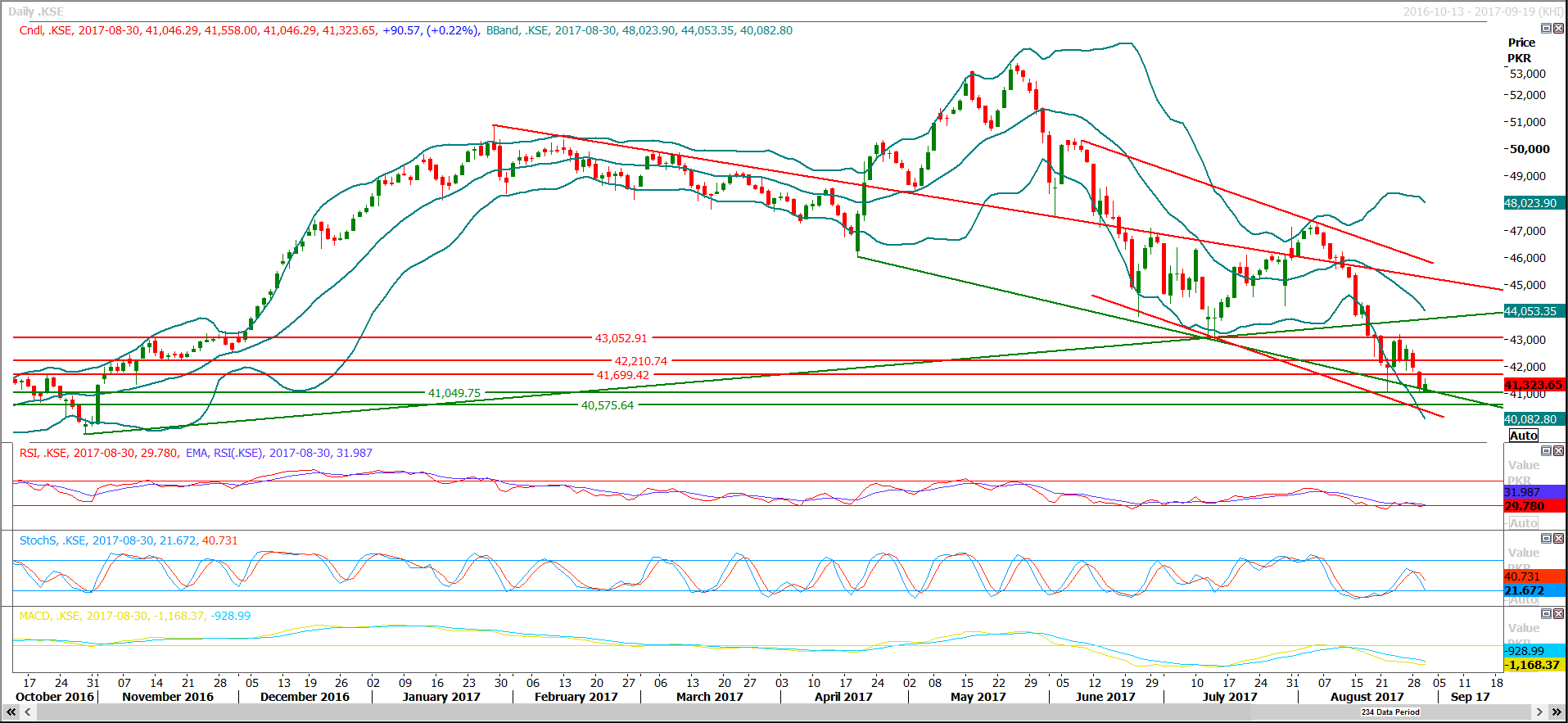

The Benchmark KSE100 Index formed a triple bottom after finding support from a horizontal line on daily chart during the last trading session. However, daily Stochastic and MAORSI are still in bearish direction therefore an intraday pullback could be expected but short term reversal is not on the cards. The Index is capped by two major horizontal resistant regions at 41700 and 42200 which would attempt to push the index back again in bearish direction but closing above these two levels would call for a correction of current bearish rally which would form the fourth primary wave of current bearish elliot wave. Trading with strict stop loss is recommended for the current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.