Previous Session Recap

Trading volume at PSX floor dropped by 56.73 million shares or 42.08% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,261.61, posted a day high of 42,271.61 and a day low of 41,659.27 during last trading session. The session suspended at 41,863.52 with net change of -385.92 and net trading volume of 85.93 million shares. Daily trading volume of KSE100 listed companies dropped by 27.21 million shares or 46.34% on DoD basis.

Foreign Investors remain in net selling positions of 6.67 million shares and net value of Foreign Inflow dropped by 3.03 million US Dollars. Categorically Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.02 and 0.81 million shares but Foreign Corporate investors remained in net selling positions of 7.49 million shares. While on the other side Local Individuals, NBFCs, Brokers and Insurance Companies remained in net buying positions of 10.50, 1.23, 2.15 and 3.31 million shares respectively but Local Companies, Banks and Mutual Fund and remained in net selling positions of 0.74, 2.40 and 7.62 million shares.

Analytical Review

Asian stocks bruised by Trump's trade war threats

Asian shares came under renewed pressure on Friday as a report U.S. President Donald Trump was preparing to step up a trade war with Beijing sent Chinese stocks lower and partially erased gains made in this week’s global rally. Many emerging market currencies were also frail after Argentina’s peso sank on Thursday despite the central bank’s interest rate hike. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dropped 0.8 percent, for monthly drop of 1.6 percent. The index has underperformed MSCI ACWI .MIWD00000PUS, a gauge of the world’s 47 markets, for four months in a row as Sino-U.S. trade worries hit Chinese shares.

ECC moved for 30 percent hike in gas prices

The Ministry of Energy has moved a proposal to the Economic Coordination Committee (ECC) of the Cabinet for seeking 30 percent increase in gas prices for all categories and 186 percent for domestic consumers of SNGPL to bridge the gas company''s revenue shortfall of Rs 102 billion.

Forex reserves decline by $38 million

The country's liquid foreign reserves declined by $38 million during the last week. According to State Bank of Pakistan's (SBP) weekly report issued on Thursday, the country's totalled liquid foreign exchange reserves stood at $16.685 billion as on Aug 24, 2018 compared to $16.723 billion as on Aug 17, 2018. During the week under review, SBP's reserves decreased by $8 million to $10.227 billion down from $10.235 billion. Reserves held by the banks also declined by $30 million to $6.458 billion end of the last week.

KP businessmen plan to move court against GIDC

A and Industry (KPCCI) will share a roadmap with federal and provincial governments to resolve the issues of business community, said KPCCI President Zahidullah Shinwari. Presiding over a meeting here at the Chamber House on Thursday, he said that the body would also raise the community’s issues before the Standing Committees of National Assembly and Senate. Shinwari floated the proposal for using legal option against levy of Gas Infrastructure Development Cess (GIDC). He said that new gas connections and load-related issues were being faced, so it is necessary to move the court. In this regard, he sought the support of the provincial government. He urged the Prime Minister Imran Khan, Speaker National Assembly Asad Qaiser, and federal ministers to hold an immediate meeting at the chamber level and letters had also written to them in this regard.

NBP profit increases by 46pc

Meeting of the BoD of National Bank of Pakistan was held in which the BoD approved the financial statements of the Bank for half year ended June 30, 2018. The Bank recorded a pre-tax profit of Rs. 17.16 billion being 26% higher than the Rs. 13.61 billion earned during the corresponding six months period of 2017. The after-tax profit for the period amounted to Rs. 12.49 billion i.e. 46% higher than the Rs. 8.55 billion for the corresponding period of 2017. This translates into earnings per share of Rs 5.87 as against Rs. 4.02 for the corresponding period last year.

Asian shares came under renewed pressure on Friday as a report U.S. President Donald Trump was preparing to step up a trade war with Beijing sent Chinese stocks lower and partially erased gains made in this week’s global rally. Many emerging market currencies were also frail after Argentina’s peso sank on Thursday despite the central bank’s interest rate hike. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dropped 0.8 percent, for monthly drop of 1.6 percent. The index has underperformed MSCI ACWI .MIWD00000PUS, a gauge of the world’s 47 markets, for four months in a row as Sino-U.S. trade worries hit Chinese shares.

The Ministry of Energy has moved a proposal to the Economic Coordination Committee (ECC) of the Cabinet for seeking 30 percent increase in gas prices for all categories and 186 percent for domestic consumers of SNGPL to bridge the gas company''s revenue shortfall of Rs 102 billion.

The country's liquid foreign reserves declined by $38 million during the last week. According to State Bank of Pakistan's (SBP) weekly report issued on Thursday, the country's totalled liquid foreign exchange reserves stood at $16.685 billion as on Aug 24, 2018 compared to $16.723 billion as on Aug 17, 2018. During the week under review, SBP's reserves decreased by $8 million to $10.227 billion down from $10.235 billion. Reserves held by the banks also declined by $30 million to $6.458 billion end of the last week.

A and Industry (KPCCI) will share a roadmap with federal and provincial governments to resolve the issues of business community, said KPCCI President Zahidullah Shinwari. Presiding over a meeting here at the Chamber House on Thursday, he said that the body would also raise the community’s issues before the Standing Committees of National Assembly and Senate. Shinwari floated the proposal for using legal option against levy of Gas Infrastructure Development Cess (GIDC). He said that new gas connections and load-related issues were being faced, so it is necessary to move the court. In this regard, he sought the support of the provincial government. He urged the Prime Minister Imran Khan, Speaker National Assembly Asad Qaiser, and federal ministers to hold an immediate meeting at the chamber level and letters had also written to them in this regard.

Meeting of the BoD of National Bank of Pakistan was held in which the BoD approved the financial statements of the Bank for half year ended June 30, 2018. The Bank recorded a pre-tax profit of Rs. 17.16 billion being 26% higher than the Rs. 13.61 billion earned during the corresponding six months period of 2017. The after-tax profit for the period amounted to Rs. 12.49 billion i.e. 46% higher than the Rs. 8.55 billion for the corresponding period of 2017. This translates into earnings per share of Rs 5.87 as against Rs. 4.02 for the corresponding period last year.

Market is expected to remain volatile therefore its recommended to trade cautiously.

Technical Analysis

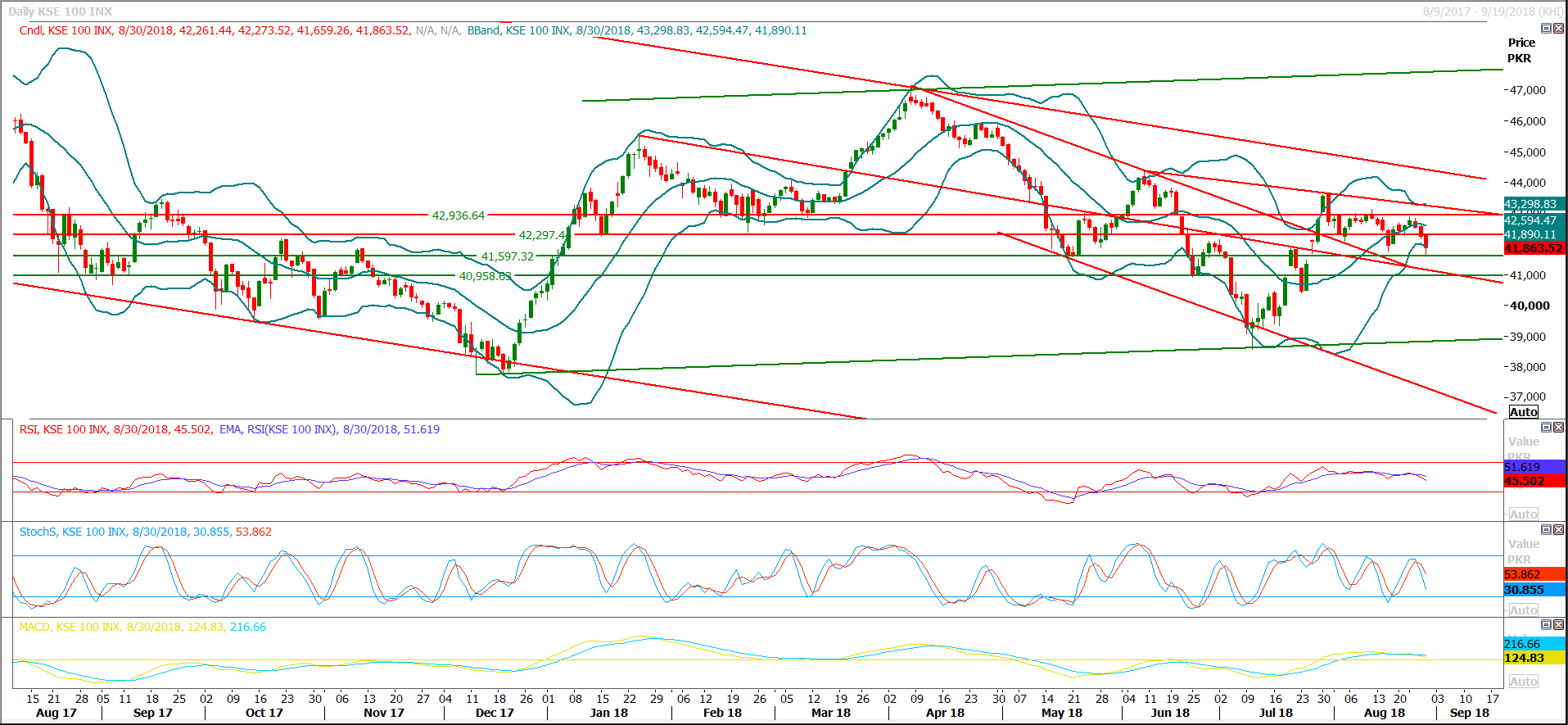

The Benchmark KSE100 Index had tried to find support from a horizontal supportive region at secondary support level after penetration of its major supportive region of 42,089 points but it had closed in danger zone because after penetration of 42,000 points now index have supports around 41,500 and today it would try to penetrate that region also. Daily Bollinger band is trying to be widened after squeezing but this time direction is bearish, daily and weekly stochastic and maorsi are in bearish mode therefore they would try to lead index on further bearish side in coming days. Today is last session of this week therefore it’s expected that index would try to pull back to close above 42,000 points but it’s not recommended to initiate buying at prices, for new buying its recommended to wait for a dip otherwise selling on strength would be preferable.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.