Previous Session Recap

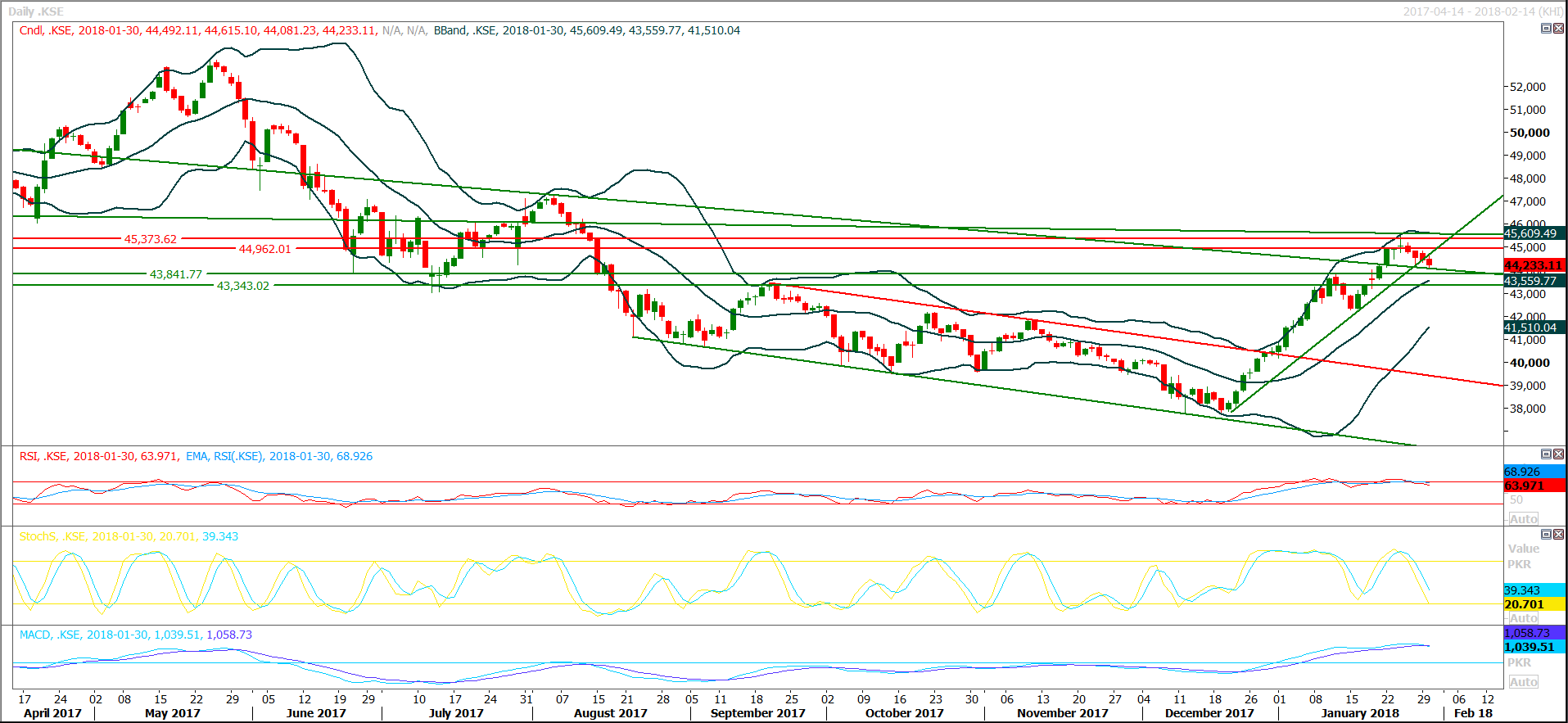

Trading volume at PSX floor increased by 90.15 million shares or 46.87% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 44492.11, posted a day high of 44615.10 and a day low of 44081.23 during last trading session. The session suspended at 44233.11 with net change of -224.19 and net trading volume of 71.9 million shares. Daily trading volume of KSE100 listed companies dropped by 15.24 million shares or 17.49% on DoD basis.

Foreign Investors remained in net buying position of 5.56 million shares but net value of Foreign Inflow dropped by 0.67 million US Dollars. Categorically, Foreign Individual and Overseas Pakistani investors remained in net buying positions of 0.18 and 5.71 million shares but Foreign Corporate Investors remained in net selling of 0.33 million shares. While on the other side Local Individuals, Companies, Banks, NBFCs and Mutual Funds remained in selling positions of 8.48, 1.59, 2.15, 0.13 and 5.04 million shares respectively but Brokers and Insurance Companies remained in net buying positions of 9.72 and 0.74 million shares.

Analytical Review

Asia stocks eased on Wednesday, pulling further back from record highs, as the recent rise in global bond yields weighed on equities. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS added to the previous day’s losses and dipped 0.1 percent, after reaching a record high on Monday. Australian stocks shed 0.4 percent, South Korea's KOSPI .KS11 lost 0.3 percent and Japan's Nikkei .N225 dropped 0.3 percent. Wall Street, which has recently hit a succession of record peaks, has led a global equities rally over the past year thanks to strong world growth fuelling higher corporate earnings and stock valuations. But the recent surge in U.S. long-term bond yields to near four-year highs have poured cold water on the rally.

Prices of major oil products are set to pass beyond three-year high, with diesel crossing Rs100 per litre mark – highest since November 2014 – amid rising international prices and falling rupee value. However, the government has the cushion to absorb the estimated increase partly by bringing down the 31 per cent general sales tax rate on high-speed diesel (HSD) in view of its direct psychological impact on inflation and transportation costs, an official explained. Currently, the government is charging 31pc GST on HSD and 17pc on other products in addition to Rs8 per litre petroleum levy on HSD, Rs10 per litre on petrol and Rs6 and Rs3 per litre on kerosene and light diesel oil (LDO) respectively.

The Senate’s Standing Committee on Privatisation has opposed the plan to privatise the Pakistan International Airlines (PIA) before the government’s term expires in May. Divesting PIA in haste would create problems for the next government to implement the decision, Mohsin Aziz, head of committee, advised the government on Tuesday. Saleem Mandviwalla of the PPP bitterly criticised the government’s plan and said his party would strongly resist the privatisation of the national flag carrier at this stage when the government is approaching the end of its term.

The International Monetary Fund (IMF) has asked Pakistan to consider drastic changes to the next National Finance Commission (NFC) award due to the serious pressure it is placing on the federal government finances, as well as the macroeconomic imbalances that are arising from its implementation. In 2009, the PPP government passed the 7th NFC award that devolved the highest ever proportion of the funds in the federal divisible pool to the provinces. Ever since, the centre has struggled to keep the fiscal deficit within established bounds.

The Senate Sub Committee on PIA, probing the sale of air bus 310 to a German firm in violation of rules, was informed on Tuesday that the name of former CEO , a German national, was removed from Exit Control List (ECL) on the order of the then interior minister on a letter from the Foreign Office. The committee with Senator Farhatullah Babar in the chair met at the office of Secretary Civil Aviation Division in the PIA complex and attended by and senators Nauman Wazir, Tahir Hussain Mashhadi, secretary Civil Aviation besides officials of PIA, interior , defence, FIA and others. The meeting was also informed that under directions of the Public Accounts Committee of the National Assembly the case has since been referred to the NAB for inquiry. Besides the FIA has also taken notice and started its own investigations.

Its recommended to practice caution as market is expected to remain volatile.

Technical Analysis

The Benchmark KSE100 Index is getting support from a decending trend line since last three days on daily chart and today it also have supports ahead at 44100 and 43840 from said trend line along with a horizontal supportive region. On hourly chart its also not becoming able to close below a decending trend line. Closing below 43800 would change market trend to downward but till that region its very crucial situation and its recommended to stay side line until breakout of that region or breakout of 44960 in upward direction.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.