Previous Session Recap

Trading volume at PSX floor dropped by 34.9 million shares or 17.7% on DoD basis, whereas the benchmark KSE100 index opened at 41,898.70, posted a day high of 41,982.70 and a day low of 41,548.04 points during last trading session while session suspended at 41,903.51 points with net change of 4.81 points and net trading volume of 108.39 million shares. Daily trading volume of KSE100 listed companies also dropped by 18.72 million shares or 14.73% on DoD basis.

Foreign Investors remained in net selling positions of 8.0 million shares and net value of Foreign Inflow dropped by 1.81 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling positions of 0.05, 5.77 and 2.18 million shares respectively. While on the other side Local Individuals and Banks remained in net long positions of 11.35 and 1.75 million shares but Local Companies, Mutual Funds, Brokers and Insurance Companies remained in net selling positions of 1.71, 3.55, 1.64 and 0.25 million shares respectively.

Analytical Review

Asia shares fight for footing after turbulent week

Asian share markets battled to regain their footing on Friday as investors clutched at hopes China could contain the coronavirus, even as headlines spoke of ever more cases and mounting deaths. MSCI’s broadest index of Asia-Pacific shares outside Japan edged up 0.3%, but was still down almost 4% on the week so far. Its 2.3% dive on Thursday had been the sharpest one-day loss in six months. Japan’s Nikkei bounced 1.3%, recouping almost half of its weekly loss. E-Mini futures for the S&P 500 firmed 0.1%, having rebounded 0.5% late on Thursday. European bourses looked set to open firmer with EUROSTOXX 50 futures up 0.9% and the FTSE 0.7%.

ADB okays $15m loan for urban development planning in Punjab

The Asian Development Bank (ADB) has approved a $15 million loan that will help seven cities in Punjab province in Pakistan design comprehensive investment and public service delivery plans in preparation for upcoming urban development projects. The loan will fund the preparation of spatial master plans, detailed engineering designs, and operational business plans for proposed projects in the cities of Bahawalpur, Dera Ghazi Khan, Multan, Muzaffargarh, Rahim Yar Khan, Rawalpindi, and Sargodha.

Pakistan to double bilateral trade with African countries: Razak Dawood

Advisor to Prime Minister on Commerce, Industries and Investment Abdul Razak Dawood Thursday said that Pakistan wants to double its trade with Africa countries in the next five years to increasing the bilateral trade and economic cooperation. The advisor said the trade volume between Pakistan and Africa has been far below potential, which need to be increased, the advisor said this while addressing to “Pak-Africa Trade Development Conference was held in Nairobi (Kenya),organised by Ministry of Commerce, said a press release issued by Ministry of Commerce here .

Thar coal based power generation project achieves financial close

Thar Coal based power generation project has Thursday achieved financial close and now the project is likely to be ready by March 2021. The Financial Closing documents for the 330 MW mine mouth lignite coal power project at Thar Block-II were signed by Shah Jahan Mirza, Managing Director PPIB and Saleemullah Memon, Chief Executive Officer of M/s Thar Energy Limited. The signing ceremony for the financial close was witnessed by the Minister for Power, Omar Ayub Khan, with other senior officials of Power Division, PPIB and the company.

Pak Suzuki to shut production for three days

Pak Suzuki Motor Company (PSMC) will observe three non-production days (NPDs) in February, the company said in a notification issued on Thursday. The company did not declare any reason for the NPDs but said production of automobile segment would remain closed on Feb 3, 4 and 10. The PSMC did not observe any NPDs during the first of current fiscal year. But in January, it shut down production for four days to rationalise inventory. The company on Thursday increased prices of Suzuki Cultus VXL and AGS models by Rs10,000 to Rs1,865,000 and Rs1,985,000 respectively.

Asian share markets battled to regain their footing on Friday as investors clutched at hopes China could contain the coronavirus, even as headlines spoke of ever more cases and mounting deaths. MSCI’s broadest index of Asia-Pacific shares outside Japan edged up 0.3%, but was still down almost 4% on the week so far. Its 2.3% dive on Thursday had been the sharpest one-day loss in six months. Japan’s Nikkei bounced 1.3%, recouping almost half of its weekly loss. E-Mini futures for the S&P 500 firmed 0.1%, having rebounded 0.5% late on Thursday. European bourses looked set to open firmer with EUROSTOXX 50 futures up 0.9% and the FTSE 0.7%.

The Asian Development Bank (ADB) has approved a $15 million loan that will help seven cities in Punjab province in Pakistan design comprehensive investment and public service delivery plans in preparation for upcoming urban development projects. The loan will fund the preparation of spatial master plans, detailed engineering designs, and operational business plans for proposed projects in the cities of Bahawalpur, Dera Ghazi Khan, Multan, Muzaffargarh, Rahim Yar Khan, Rawalpindi, and Sargodha.

Advisor to Prime Minister on Commerce, Industries and Investment Abdul Razak Dawood Thursday said that Pakistan wants to double its trade with Africa countries in the next five years to increasing the bilateral trade and economic cooperation. The advisor said the trade volume between Pakistan and Africa has been far below potential, which need to be increased, the advisor said this while addressing to “Pak-Africa Trade Development Conference was held in Nairobi (Kenya),organised by Ministry of Commerce, said a press release issued by Ministry of Commerce here .

Thar Coal based power generation project has Thursday achieved financial close and now the project is likely to be ready by March 2021. The Financial Closing documents for the 330 MW mine mouth lignite coal power project at Thar Block-II were signed by Shah Jahan Mirza, Managing Director PPIB and Saleemullah Memon, Chief Executive Officer of M/s Thar Energy Limited. The signing ceremony for the financial close was witnessed by the Minister for Power, Omar Ayub Khan, with other senior officials of Power Division, PPIB and the company.

Pak Suzuki Motor Company (PSMC) will observe three non-production days (NPDs) in February, the company said in a notification issued on Thursday. The company did not declare any reason for the NPDs but said production of automobile segment would remain closed on Feb 3, 4 and 10. The PSMC did not observe any NPDs during the first of current fiscal year. But in January, it shut down production for four days to rationalise inventory. The company on Thursday increased prices of Suzuki Cultus VXL and AGS models by Rs10,000 to Rs1,865,000 and Rs1,985,000 respectively.

Market is expected to remain volatile during current trading session.

Technical Analysis

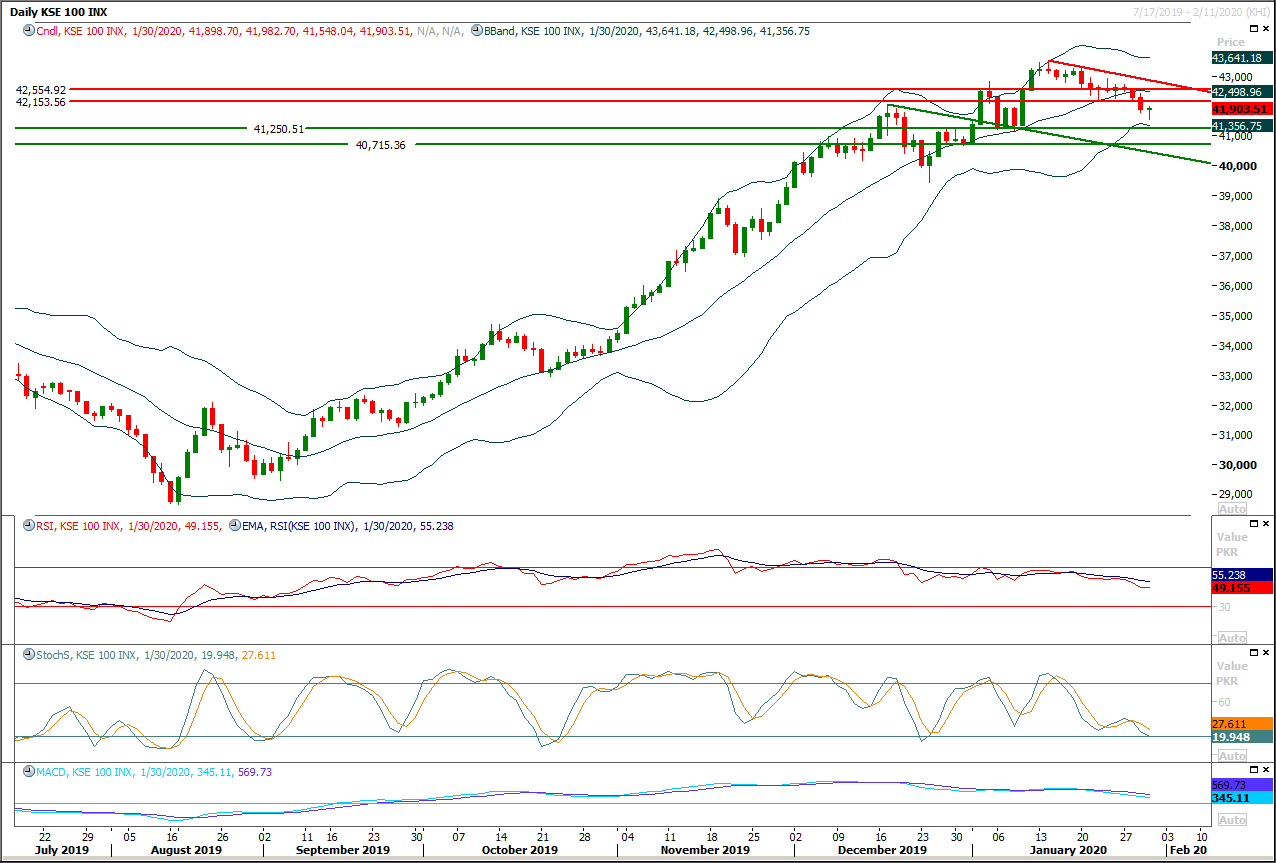

The Benchmark KSE100 index is trying to generate a continuation pattern on weekly chart and confirmation of its weekly evening shooting star. As of now index have supportive regions standing at 41,250 points where it would try to find some ground against bearish pressure. As of now index would try to take a spike toward 42,150 points on intraday basis and if it would face rejection from that region then previous low would be amended before day end today and index would slide towards 41,500 points and 41,250 points. Daily momentum indicators would enter into bearish zone once index would start bearish trend from these regions and weekly trend is already bearish therefore it's recommended to start selling on strength with strict stop loss. In case index would succeed in closing above 42,550 points then it would try to retest its resistant regions at 42,860 points and 43,000 points but index would remain range bound until either it would close below 41,500 points or above 43,200 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.