Previous Session Recap

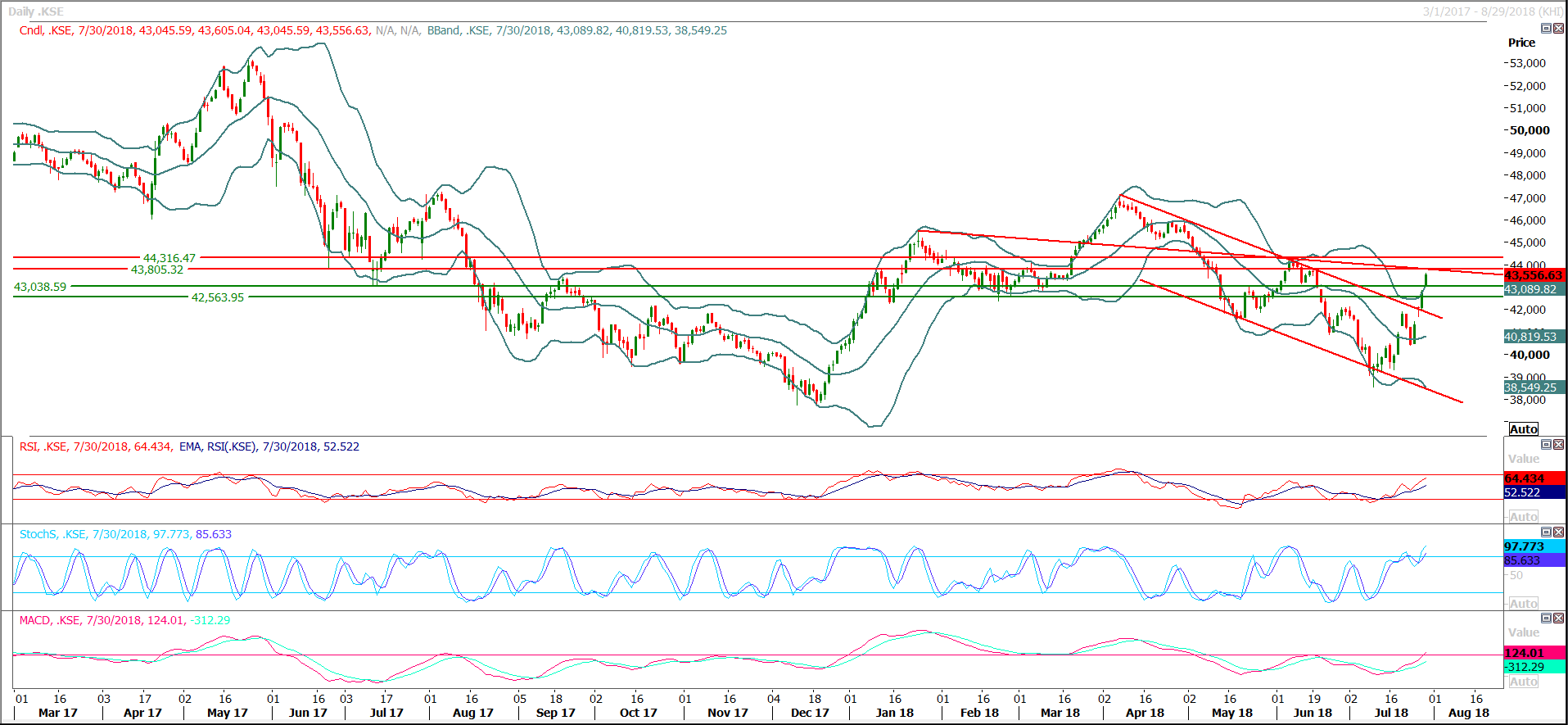

Trading volume at PSX floor dropped by 7.56 million shares or 1.96% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 43,045.59, posted a day high of 43,604.01 and a day low of 43,045.59 during last trading session. The session suspended at 43,556.63 with net change of 770.18 and net trading volume of 176.41 million shares. Daily trading volume of KSE100 listed companies dropped by 11.13 million shares or 5.93% on DoD basis.

Foreign Investors remained in net selling position of 15.36 million shares and net value of Foreign Inflow dropped by 3.05 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.04 and 4.92 million shares but Foreign Corporate investors remained in net selling positions of 20.31 million shares. While on the other side Local Individuals and NBFCs remained in net buying positions of 49.24 and 0.03 million shares but Local Companies, Banks, Mutual Fund, Brokers and Insurance Companies remained in net selling positions of 6.02, 6.00, 5.32, 11.57 and 6.09 million shares respectively.

Analytical Review

Asian shares slip on tech rout, focus shifts to BOJ

Asian share markets weakened on Tuesday, taking cues from the rout in global technology shares while the yen edged higher ahead of the Bank of Japan’s rate review, at which it could flag a shift away from its massive monetary stimulus. Japan’s Nikkei fell 0.5 percent. South Korea’s Kospi index dipped 0.1 percent despite solid second-quarter results from Samsung Electronics which posted a 5.7 percent rise in profit. MSCI’s broadest index of Asia-Pacific shares outside Japan was mostly unchanged at 543.23 as were Australian shares. Overnight in Wall Street, the Dow and the S&P 500 each lost 0.6 percent and the Nasdaq skidded 1.4 percent. The technology index crumbled 1.8 percent overnight as disappointing results from Facebook, Twitter and Netflix spurred concerns about future growth for a sector that has led U.S. equities to record highs. “U.S. equities took another leg lower overnight but sentiment towards risk looks more upbeat across other asset classes,” analysts at JP Morgan said in a note. “The BoJ decision today is the main focus,” they added.

Export of goods to China rises

The country's export of goods to China increased by 7.3percent during July-May (2017-18) to $1.6 billion against the export of goods worth $1.5 billion in same period of the preceding year. The import of goods from China also witnessed an increase of 11.8 percent as it rose to $9.3 billion in 11 months of previous fiscal year from $8.3 billion in July-May (2016-17), according to latest data shared by SBP. On yearly basis, the export increased to $152.5 million in May 2018, against the exports worth of $125.5 million in same month of previous year, showing an increase of 21.5 percent. The imports also witnessed an increase of 19.2 percent as it rose to $1.01 billion in May 2018 against the imports worth of $846.4 million in same month of last year. The export of services to China during the period under review, however declined by 11.8 percent to $184.5 million during July-May (2017-18) against export of services worth $209.38 million during same period of last year. Total import of services from China during the corresponding year increased to $990.27 million from $857.19 million.

Iraqi farmers fight to save cattle from drought

Iraqi farmer Sayyed Sattar knows he'll soon have to let some of his buffalo go as he surveys the herd bathing in a dwindling pond close to the holy city of Najaf. As southern Iraq suffers through a punishing drought, desperate cattle breeders are having to sell off animals to keep others alive. Sattar, 52, has already seen some of his buffalo die of thirst. Now, in a bid to stop any others being lost, he's being forced to say goodbye to some of his prized beasts. "With the money, we will be able to buy water and hay for the rest of the herd," he tells AFP, his head covered with a traditional black and white keffiyeh scarf. Sattar is far from the only farmer hit by the drought.

Discos fail to reduce losses: Nepra

The National Electric Power Regulatory Authority (NEPRA) has noted that Discos have failed to show any improvement in reducing Transmission and Distribution losses as their overall losses have been recorded as 17.95percent for 2016-17. On the recovery Nepra said that apart from Hesco, Pesco and Iesco which improved upon their recovery position, none of the other Discos was able to improve its position over the previous year, said the State of the Industry Report 2017, released by Nepra here. The report said that Lesco managed to stay at the same level of good recovery ratio in the FY 2016-17, whereas Fesco, Mepco and Gepco could not match their performance of the last year as their recovery dropped by approximately 3percent during the FY 2016-17. Qesco’s recovery position deteriorated drastically during the FY 2016-17 as only 43.55percent of the amount billed was recovered.

Oil prices rise on tighter supply outlook

Oil prices rose on Monday, as traders kept the focus on supply disruptions and the possible hit to crude output from U.S. sanctions on Iran. October Brent crude futures were up 76 cents at $75.52 a barrel by 11:57 a.m. EDT (1557 GMT). The September contract expires on Tuesday. U.S. crude futures rose $1.51 at $70.21 a barrel. The market held gains even after a Reuters survey showed OPEC increased production in July. The Organization of the Petroleum Exporting Countries hiked production 70,000 bpd to 32.64 million bpd, a 2018 high. Further gains could offset production outages and pressure prices. Prices remain buoyed by a tight supply outlook, with global inventories down from record highs in 2017 and U.S. inventories at a three-year low, said Gene McGillian, vice president of market research at Tradition Energy in Stamford, Connecticut.

Asian share markets weakened on Tuesday, taking cues from the rout in global technology shares while the yen edged higher ahead of the Bank of Japan’s rate review, at which it could flag a shift away from its massive monetary stimulus. Japan’s Nikkei fell 0.5 percent. South Korea’s Kospi index dipped 0.1 percent despite solid second-quarter results from Samsung Electronics which posted a 5.7 percent rise in profit. MSCI’s broadest index of Asia-Pacific shares outside Japan was mostly unchanged at 543.23 as were Australian shares. Overnight in Wall Street, the Dow and the S&P 500 each lost 0.6 percent and the Nasdaq skidded 1.4 percent. The technology index crumbled 1.8 percent overnight as disappointing results from Facebook, Twitter and Netflix spurred concerns about future growth for a sector that has led U.S. equities to record highs. “U.S. equities took another leg lower overnight but sentiment towards risk looks more upbeat across other asset classes,” analysts at JP Morgan said in a note. “The BoJ decision today is the main focus,” they added.

The country's export of goods to China increased by 7.3percent during July-May (2017-18) to $1.6 billion against the export of goods worth $1.5 billion in same period of the preceding year. The import of goods from China also witnessed an increase of 11.8 percent as it rose to $9.3 billion in 11 months of previous fiscal year from $8.3 billion in July-May (2016-17), according to latest data shared by SBP. On yearly basis, the export increased to $152.5 million in May 2018, against the exports worth of $125.5 million in same month of previous year, showing an increase of 21.5 percent. The imports also witnessed an increase of 19.2 percent as it rose to $1.01 billion in May 2018 against the imports worth of $846.4 million in same month of last year. The export of services to China during the period under review, however declined by 11.8 percent to $184.5 million during July-May (2017-18) against export of services worth $209.38 million during same period of last year. Total import of services from China during the corresponding year increased to $990.27 million from $857.19 million.

Iraqi farmer Sayyed Sattar knows he'll soon have to let some of his buffalo go as he surveys the herd bathing in a dwindling pond close to the holy city of Najaf. As southern Iraq suffers through a punishing drought, desperate cattle breeders are having to sell off animals to keep others alive. Sattar, 52, has already seen some of his buffalo die of thirst. Now, in a bid to stop any others being lost, he's being forced to say goodbye to some of his prized beasts. "With the money, we will be able to buy water and hay for the rest of the herd," he tells AFP, his head covered with a traditional black and white keffiyeh scarf. Sattar is far from the only farmer hit by the drought.

The National Electric Power Regulatory Authority (NEPRA) has noted that Discos have failed to show any improvement in reducing Transmission and Distribution losses as their overall losses have been recorded as 17.95percent for 2016-17. On the recovery Nepra said that apart from Hesco, Pesco and Iesco which improved upon their recovery position, none of the other Discos was able to improve its position over the previous year, said the State of the Industry Report 2017, released by Nepra here. The report said that Lesco managed to stay at the same level of good recovery ratio in the FY 2016-17, whereas Fesco, Mepco and Gepco could not match their performance of the last year as their recovery dropped by approximately 3percent during the FY 2016-17. Qesco’s recovery position deteriorated drastically during the FY 2016-17 as only 43.55percent of the amount billed was recovered.

Oil prices rose on Monday, as traders kept the focus on supply disruptions and the possible hit to crude output from U.S. sanctions on Iran. October Brent crude futures were up 76 cents at $75.52 a barrel by 11:57 a.m. EDT (1557 GMT). The September contract expires on Tuesday. U.S. crude futures rose $1.51 at $70.21 a barrel. The market held gains even after a Reuters survey showed OPEC increased production in July. The Organization of the Petroleum Exporting Countries hiked production 70,000 bpd to 32.64 million bpd, a 2018 high. Further gains could offset production outages and pressure prices. Prices remain buoyed by a tight supply outlook, with global inventories down from record highs in 2017 and U.S. inventories at a three-year low, said Gene McGillian, vice president of market research at Tradition Energy in Stamford, Connecticut.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

The Benchmark KSE100 Index have reached weekly double top and right now it’s going to face a strong resistance at 43,825 points and in case of breakout of that region index would try to target 44,300 points where it would complete its half moon which would try to react as a strong resistant region. Its recommended to stay cautious while trading today because today is last trading day of month and index would have to settle its monthly closing levels therefore higher volatility could be witnessed during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.