Previous Session Recap

Trading Volume at PSX floor increased by 31.51 million shares 15.51%, DoD basis, whereas KSE100 Index opened at 52138.90, posted a day high of 52476.18 and a day low of 51278.93 during the last trading session, while the session suspended at 52453.16 with a net change of -685.74 points and a net trading volume of 86.44 million shares. Daily trading volume of KSE100 listed companies increased by 23.1 million shares or 36.47% on, DoD basis.

Foreign Investors turned back to buying and they remained in a net buying position of 4.66 million shares but the net value of Foreign Inflow dropped by 20.89 million US Dollars. Categorically, Foreign Individual and Overseas Pakistani investors remained in net buying positions of 0.028 and 13.91 million shares but Foreign Corporate investors remained in a net selling position of 9.28 million shares. While on the other side, Local Individuals, Banks and NBFCs remain in net buying positions of 6.53, 4.9 and 0.22 million shares but Local Companies, Mutual Funds and Brokers remained in net selling positions of 15.21, 3.23 and 0.93 million shares, respectively.

Analytical Review

Asian stocks climbed on Wednesday, capping a fifth consecutive month of gains, as data showed Chinese factory activity grew at a steady clip this month, bucking expectations of a slowdown. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.2 percent on Wednesday, with Chinese stocks .SSEC .SZSC leading the region higher as investors returned from a long holiday break. Japanese Nikkei .N225 dipped 0.1 percent.

Prime Minister Nawaz Sharif on Tuesday ordered a special audit of fresh circular debt claims of Rs480 billion and third-party analysis of the power demand-and-supply situation on the basis of projects that are coming up for commercial operations. While presiding over a meeting of the cabinet committee on energy, the prime minister directly asked former water and power secretary Younus Dagha questions about the rosy days he had promised last year.

The inflow of dollars from foreign countries rose 15 per cent in the first two days of Ramazan, according to a foreign exchange dealer. This suggests the country may achieve the last fiscal year level of remittances by the end of 2016-17. Traditionally, monthly remittances more than double in Ramazan every year. Inflows increase because overseas Pakistanis send charity and Zakat funds in the holy month. In addition, overseas Pakistanis also increase remittances ahead of Eid.

The government has enhanced regulatory duty to a maximum of 25 per cent on imports of essential eatables. The move may cause higher than anticipated import-led inflation in the next fiscal year. The projected inflation target is set at 6pc for 2017-18. For curbing the rising consumption of imported fish, the Federal Board of Revenue (FBR) has increased the regulatory duty to 25pc from existing 10pc on various kinds of fish.

The Oil and Gas Regulatory Authority (Ogra) on Tuesday recommended a Rs3.20 and Rs2.30 per litre cut in the prices of high speed diesel (HSD) and petrol, respectively, from June 1. On the other hand, Ogra recommended a Rs11.60 and Rs9.50 per litre increase in the prices of kerosene and light diesel oil respectively. In a summary sent to the government, the regulator said the adjustment in diesel and petrol prices was required to pass on the impact of drop in the international prices during May as benchmark crude oil eased to $50-52 per barrel.

The Private Power and Infrastructure Board (PPIB) on Tuesday issued a Letter of Interest (LoI) to China Communications Construction Company (CCCC) for the development of 300-megawatts imported coal-fired power project in Gwadar at a cost of Rs55 billion. The project is part of the China-Pakistan Economic Corridor (CPEC). PPIB Managing Director Shah Jahan Mirza and CCCC Vice President Xu Jun signed the document. CCCC will develop the 300MW power project by utilising imported coal in Gwadar.

Today POWERR, PSO, SNGP and TRG may lead the market in the positive direction.

Technical Analysis

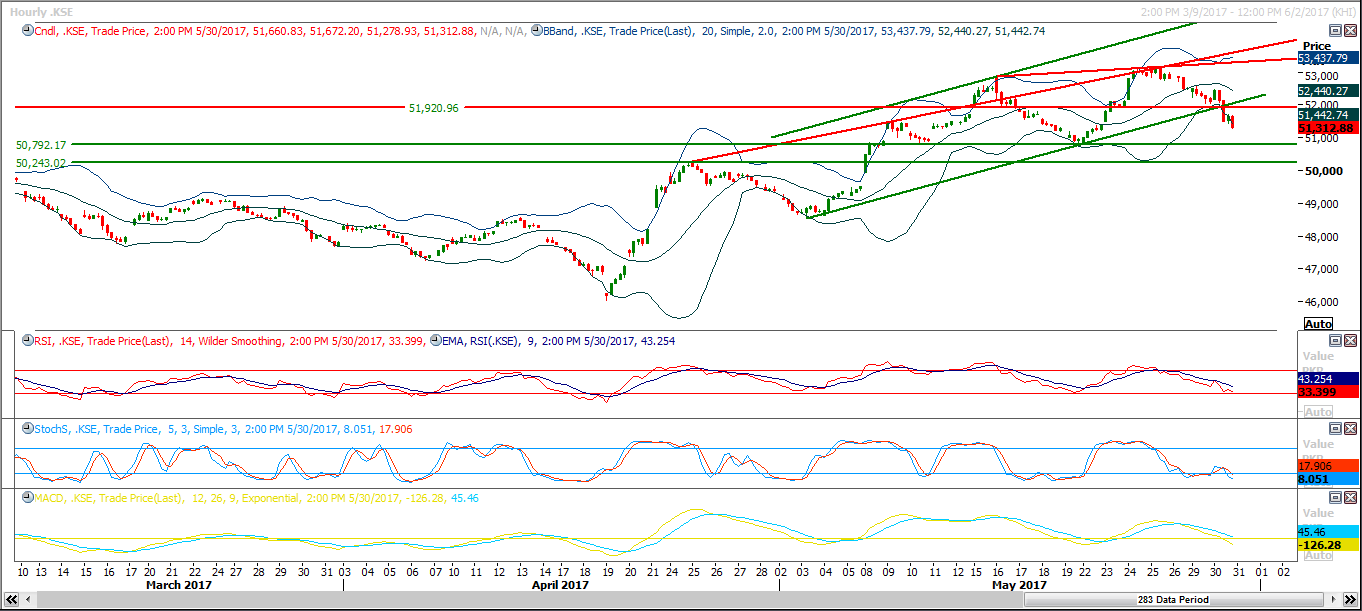

The Benchmark KSE100 Index penetrated its bullish trend channel in bearish direction and tested its 74.6% bullish correction on daily chart. For the current trading session, Daily and hourly Stochastic and MAORSI are not supporting bullish momentum as they have created bearish crossovers during the last trading session and this bearish momentum could push index towards 50922 and 50800 levels. Trading with strict stop loss of 50800 is recommended for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.