Previous Session Recap

Trading volume at PSX floor increased by 13.43 million shares or 11.16% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,667.17, posted a day high of 42,763.35 and a day low of 42,339.31 during last trading session. The session suspended at 42,546.48 with net change of -76.26 and net trading volume of 84.02 million shares. Daily trading volume of KSE100 listed companies increased by 16.48 million shares or 24.41% on DoD basis.

Foreign Investors remained in net selling position of 4.98 million shares and net value of Foreign Inflow dropped by 4.67 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying position of 0.02 and 1.65 million shares but Foreign Corporate investors remained in net selling positions of 6.65 million shares. While on the other side Local Individuals, NBFCs, Mutual Funds and Insurance Companies remained in net buying positions of 0.46, 0.20, 1.80 and 10.78 million shares but Local Companies, Banks and Brokers remained in net selling positions of 2.30, 4.93 and 2.44 million shares respectively.

Analytical Review

Asia stocks bounce, euro pulls off lows as Italy anxiety ebbs

Asian stocks rebounded from a two-month trough on Thursday, while the euro enjoyed a respite after sinking to its lowest in 10 months as political turmoil in Italy that had roiled global financial markets showed signs of easing. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS tacked on 0.3 percent having slumped to its weakest since the start of April on Wednesday. South Korea's KOSPI .KS11 added 0.6 percent and Japan's Nikkei .N225 advanced 0.5 percent. Overnight, the Dow .DJI rose 1.25 percent and the S&P 500 .SPX climbed 1.27 percent. Global stocks were battered, safe-haven government bond yields fell sharply and the euro tumbled earlier in the week after Italy’s two anti-establishment parties scrapped plans to form a coalition, stoking fears of a general election that could be a referendum on the country’s euro membership. A degree of calm, however, returned, with the two anti-establishment parties renewing efforts to form a coalition government rather than force Italy into holding elections for the second time this year.

Govt extends export package of Rs195b for 3 years

The government on Wednesday has extended the export package worth of Rs195 billion for next three years to increase the exports. The Economic Coordination Committee (ECC) of the Cabinet, which met with Prime Minister Shahid Khaqan Abbasi in the chair, has extended the PM Export Package for the next three years i.e. upto 30th June 2021. The package aims at improving the competitiveness of the textile and non-textile export sector to continue the export growth in the coming financial years. The package was initially approved in January 2017 for a period of 18 months i.e. till June 2018. The package has vitally contributed towards the turnaround in exports in FY 2018 which had been continuously declining since FY2014.

NJHP unit 2 starts power generation

After the completion of its mechanical-run tests, unit no 2 of Neelum Jhelum Hydropower Project has also been successfully synchronized Wednesday with the national grid. The unit has generated up to 185 MW electricity on trial basis. The unit will gradually attain its maximum generation capacity i.e. 242.25 MW in due course of time. The unit no 2 will also undergo reliability test and reliability period in accordance with the contractual obligations. It is worth mentioning here that unit no 3, currently in its 30-day reliability period since May 18, has also been contributing 242.25 MW power to its full capacity to the national grid.

Fruits export up 4.7pc in 10 months

Export of fruits from the country increased by 4.74pc during first 10 months of current fiscal year as compared to same period of the preceding fiscal year. The fruits export during the period under review rose to $358.23m from $342.01m in July-April 2016-17, according to latest data revealed by Pakistan Bureau of Statistics (PBS) Wednesday. On year-on-year basis, the fruits export also witnessed an increase of 16.62pc as it soared to $18.54m in April 2018 from $15.89m in same month of last year. On monthly basis, however the export of fruits declined by 58pc as $44.7m worth of export was recorded in March 2018.–APP

13 permits ‘given’ to export drugs of controlled substances

The government has issued 13 permits to different pharmaceutical companies to export drugs containing controlled substances during last and present year. Minister for National Health Services, Regulations and Coordination Saira Afzal Tarar told the National Assembly on Wednesday that export authorisations or permits were issued to different pharmaceutical manufacturers having valid drug manufacturing licence and drug registration of the finished pharmaceutical products. The controlled substances included psychotropic substances narcotic drugs and precursor chemicals as active pharmaceutical ingredients. She said permits were issued to export to countries including Afghanistan, Kenya, France and Philippines.

Asian stocks rebounded from a two-month trough on Thursday, while the euro enjoyed a respite after sinking to its lowest in 10 months as political turmoil in Italy that had roiled global financial markets showed signs of easing. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS tacked on 0.3 percent having slumped to its weakest since the start of April on Wednesday. South Korea's KOSPI .KS11 added 0.6 percent and Japan's Nikkei .N225 advanced 0.5 percent. Overnight, the Dow .DJI rose 1.25 percent and the S&P 500 .SPX climbed 1.27 percent. Global stocks were battered, safe-haven government bond yields fell sharply and the euro tumbled earlier in the week after Italy’s two anti-establishment parties scrapped plans to form a coalition, stoking fears of a general election that could be a referendum on the country’s euro membership. A degree of calm, however, returned, with the two anti-establishment parties renewing efforts to form a coalition government rather than force Italy into holding elections for the second time this year.

The government on Wednesday has extended the export package worth of Rs195 billion for next three years to increase the exports. The Economic Coordination Committee (ECC) of the Cabinet, which met with Prime Minister Shahid Khaqan Abbasi in the chair, has extended the PM Export Package for the next three years i.e. upto 30th June 2021. The package aims at improving the competitiveness of the textile and non-textile export sector to continue the export growth in the coming financial years. The package was initially approved in January 2017 for a period of 18 months i.e. till June 2018. The package has vitally contributed towards the turnaround in exports in FY 2018 which had been continuously declining since FY2014.

After the completion of its mechanical-run tests, unit no 2 of Neelum Jhelum Hydropower Project has also been successfully synchronized Wednesday with the national grid. The unit has generated up to 185 MW electricity on trial basis. The unit will gradually attain its maximum generation capacity i.e. 242.25 MW in due course of time. The unit no 2 will also undergo reliability test and reliability period in accordance with the contractual obligations. It is worth mentioning here that unit no 3, currently in its 30-day reliability period since May 18, has also been contributing 242.25 MW power to its full capacity to the national grid.

Export of fruits from the country increased by 4.74pc during first 10 months of current fiscal year as compared to same period of the preceding fiscal year. The fruits export during the period under review rose to $358.23m from $342.01m in July-April 2016-17, according to latest data revealed by Pakistan Bureau of Statistics (PBS) Wednesday. On year-on-year basis, the fruits export also witnessed an increase of 16.62pc as it soared to $18.54m in April 2018 from $15.89m in same month of last year. On monthly basis, however the export of fruits declined by 58pc as $44.7m worth of export was recorded in March 2018.–APP

The government has issued 13 permits to different pharmaceutical companies to export drugs containing controlled substances during last and present year. Minister for National Health Services, Regulations and Coordination Saira Afzal Tarar told the National Assembly on Wednesday that export authorisations or permits were issued to different pharmaceutical manufacturers having valid drug manufacturing licence and drug registration of the finished pharmaceutical products. The controlled substances included psychotropic substances narcotic drugs and precursor chemicals as active pharmaceutical ingredients. She said permits were issued to export to countries including Afghanistan, Kenya, France and Philippines.

Market is expected to remain volatile therefore it'ss recommended to stay cautious while trading today.

Technical Analysis

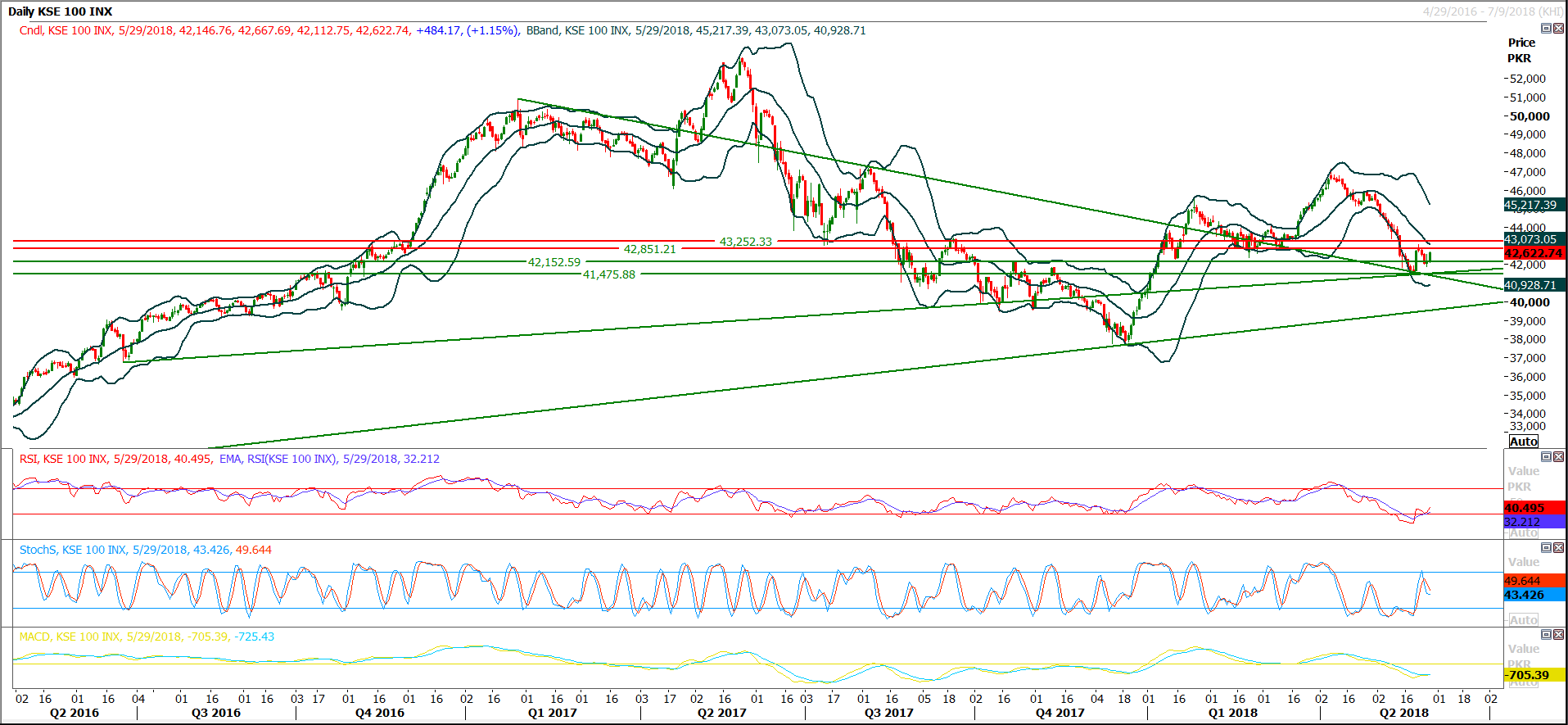

The Benchmark KSE100 Index have created a morning shooting star on daily chart and its heading towards its major resistant region of 42,860 points after maintaining its supportive region at a horizontal support and two supportive trend llines. If Index would not succeed in closing above its resistances this time then some extra ordinary pressure could be witnessed. Intraday and daily momentum indicators are in bearish mode because hourly and daily stochastic have generated bearish crossovers while daily and hourly MAORSI are standing at edge of a bearish crossover. But weekly stochastic is trying to generate a hope for bulls by creating a bullish crossover and its being supported by an expected weekly triple bottom at a supportive region. If this week index would not become able close below 41,400 points then this bullish expectation would be strengthened. For current trading session index have supportive regions at 41,860 and 41,450 points, while resistant regions are standing at 42,860 and 43,250 points. It’s recommended to wait for a clear breakout of either side before initiating trades for short or mid terms, but for current trading session its recommended to selling on strength with strict stop loss.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.