Previous Session Recap

Trading volume at PSX floor dropped by 9.95 million shares or 5.87% on DoD basis, whereas the benchmark KSE100 index opened at 28,109.57, posted a day high of 28,114.10 and a day low of 27,467.35 points during last trading session while session suspended at 28,023.39 points with net change of -86.18 points and net trading volume of 127.65 million shares. Daily trading volume of KSE100 listed companies also dropped by 14.33 million shares or 10.09% on DoD basis.

Foreign Investors remained in net selling positions of 2.10 million shares and value of Foreign Inflow dropped by 2.97 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani remained in net long positions of 0.03 and 6.30 million shares respectively but Foreign Corporate remained in net selling positions of 8.44 million shares respectively. While on the other side Local Individuals, Banks, Mutual Fund, Brokers and Insurance Companies remained in net long positions of 17.04, 2.00, 2.12 and 2.20 million shares but Local Companies and Brokers remained in net selling positions of 15.66 and 5.16 million shares respectively.

Analytical Review

Asia shares edge up, China factories show flicker of life

Asian shares managed a tentative rally on Tuesday as factory data from China held out the hope of a rebound in activity even as other countries across the globe all but shut down. China’s official manufacturing purchasing managers’ index (PMI) bounced to 52.0 in March, up from a record-low 35.7 in February and topping forecasts of 45.0. Analysts cautioned the index could overstate the true improvement as it measures the net balance of firms reporting an expansion or contraction in activity. If a company merely resumed working after a forced stoppage, it would read as an expansion without saying much about the overall level of activity.

ECC approves Rs534bn relief package

A special meeting of the Economic Coordination Committee (ECC) of the cabinet on Monday struggled to put in place mechanisms for disbursement of various elements of the federal government’s Rs534 billion relief package announced for mitigating the impact of the coronavirus outbreak on the country’s poor people and economy. Informed sources said that the ECC meeting, presided over by Adviser to the Prime Minister on Finance & Revenue Dr Abdul Hafeez Shaikh, approved in principle summaries that could be put up by ministries involving a total amount of about Rs534bn.

Trade officers to work on export order cancellations

Textile exporters are not impressed with the commerce ministry’s offer to use the offices of Pakistan’s trade officers posted in embassies to help dissuade foreign buyers from cancelling their orders. The offer was made by Commerce Secretary Ahmed Nawaz Sukhera in a tweet on Monday. In response to that, trade officers from Pakistani missions in New York and The Hague tweeted their phone numbers and email addresses, inviting exporters to get in touch.

CDWP approves position papers of six projects worth Rs133.466b

Central Development Working Party (CDWP) meeting on Monday approved the position papers of six projects worth Rs133.466 billion. Central Development Working Party (CDWP) presided over by Planning Commission Deputy Chairman Mohammad Jehanzeb Khan, approved two Position Papers worth Rs466.264 million and recommended four Position Papers worth Rs133 billion to Executive Committee of National Economic Council (ECNEC) for consideration. Planning Secretary Zafar Hasan, senior officials from federal and provincial governments were also participated in the meeting while representatives from provincial governments participated through videoconference. Projects related to Health, Physical Planning & Housing, Transport & Communication and Water Resources were considered during the meeting.

ADB approves $2m grant for Pakistan to fight against COVID-19

The Asian Development Bank (ADB) has approved a further $2 million grant to support the Government of Pakistan’s efforts to combat the coronavirus (COVID-19) pandemic in the country. The grant, financed from the Asia Pacific Disaster Response Fund, will help fund the immediate purchase of emergency medical supplies, personal protective equipment, diagnostic and laboratory supplies, and other equipment. It supplements an initial $500,000 approved by ADB on 20 March which is already being deployed to support Pakistan’s procurement of emergency supplies through UNICEF. Taken together, this $2.5 million in approved funding represents ADB’s immediate response for Pakistan, with further support to follow.

Asian shares managed a tentative rally on Tuesday as factory data from China held out the hope of a rebound in activity even as other countries across the globe all but shut down. China’s official manufacturing purchasing managers’ index (PMI) bounced to 52.0 in March, up from a record-low 35.7 in February and topping forecasts of 45.0. Analysts cautioned the index could overstate the true improvement as it measures the net balance of firms reporting an expansion or contraction in activity. If a company merely resumed working after a forced stoppage, it would read as an expansion without saying much about the overall level of activity.

A special meeting of the Economic Coordination Committee (ECC) of the cabinet on Monday struggled to put in place mechanisms for disbursement of various elements of the federal government’s Rs534 billion relief package announced for mitigating the impact of the coronavirus outbreak on the country’s poor people and economy. Informed sources said that the ECC meeting, presided over by Adviser to the Prime Minister on Finance & Revenue Dr Abdul Hafeez Shaikh, approved in principle summaries that could be put up by ministries involving a total amount of about Rs534bn.

Textile exporters are not impressed with the commerce ministry’s offer to use the offices of Pakistan’s trade officers posted in embassies to help dissuade foreign buyers from cancelling their orders. The offer was made by Commerce Secretary Ahmed Nawaz Sukhera in a tweet on Monday. In response to that, trade officers from Pakistani missions in New York and The Hague tweeted their phone numbers and email addresses, inviting exporters to get in touch.

Central Development Working Party (CDWP) meeting on Monday approved the position papers of six projects worth Rs133.466 billion. Central Development Working Party (CDWP) presided over by Planning Commission Deputy Chairman Mohammad Jehanzeb Khan, approved two Position Papers worth Rs466.264 million and recommended four Position Papers worth Rs133 billion to Executive Committee of National Economic Council (ECNEC) for consideration. Planning Secretary Zafar Hasan, senior officials from federal and provincial governments were also participated in the meeting while representatives from provincial governments participated through videoconference. Projects related to Health, Physical Planning & Housing, Transport & Communication and Water Resources were considered during the meeting.

The Asian Development Bank (ADB) has approved a further $2 million grant to support the Government of Pakistan’s efforts to combat the coronavirus (COVID-19) pandemic in the country. The grant, financed from the Asia Pacific Disaster Response Fund, will help fund the immediate purchase of emergency medical supplies, personal protective equipment, diagnostic and laboratory supplies, and other equipment. It supplements an initial $500,000 approved by ADB on 20 March which is already being deployed to support Pakistan’s procurement of emergency supplies through UNICEF. Taken together, this $2.5 million in approved funding represents ADB’s immediate response for Pakistan, with further support to follow.

Market is expected to remain volatile during current trading session.

Technical Analysis

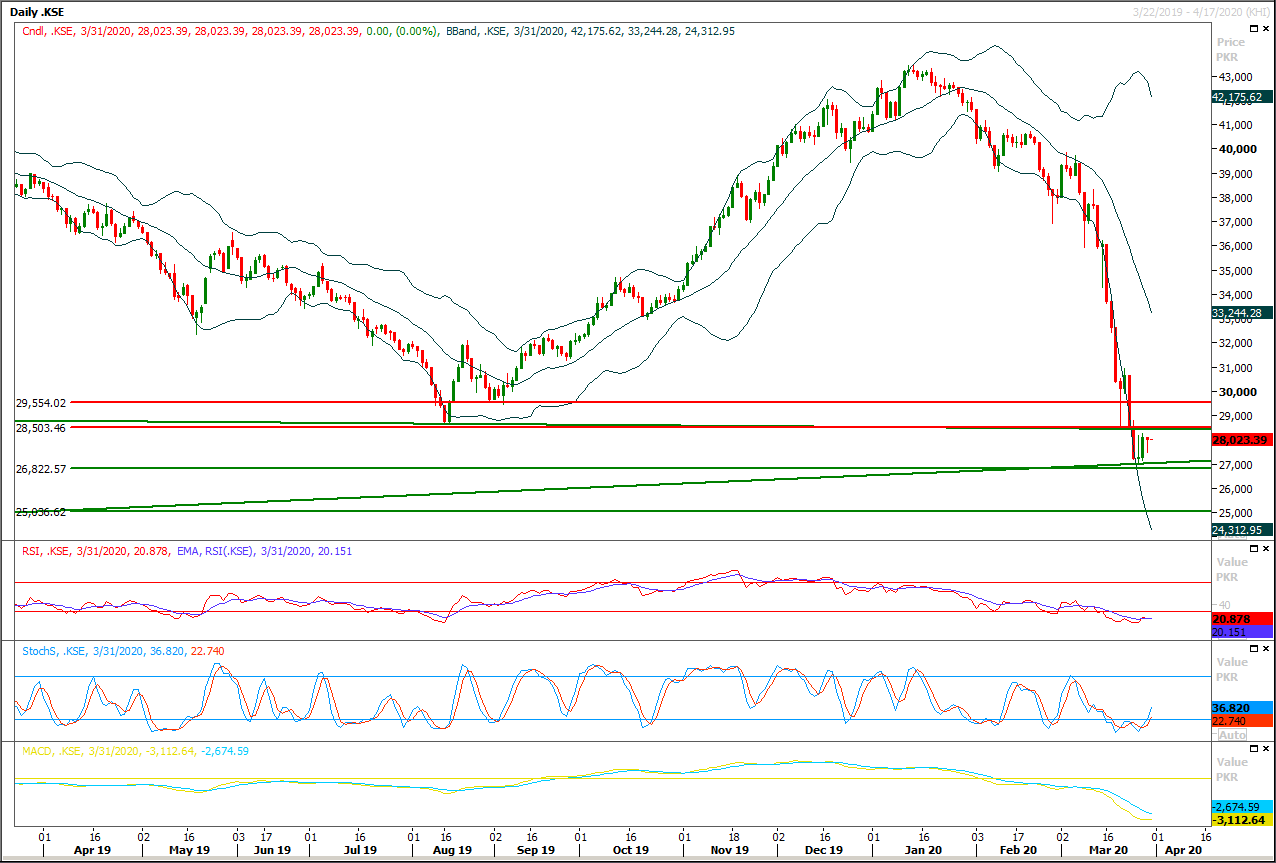

The Benchmark KSE100 index have tried to honor its morning star instead of sever bearish pressure during last trading session and it's expected that index would try to rally towards its major resistant region because its fifth consecutive trading session and index is trying to maintain above its supportive region of 27,000pts therefore now it have to move upward to retest its resistant regions at 28,500pts. If index would succeed in closing above 28,500pts then in coming days its initial targets would be 29,000pts and 29,500pts. It's recommended to stay cautious and start buying on dip for day trading while for short term basis buying is not recommended yet until unless index would not succeed in closing above 30,500pts. Daily or weekly closing above 30,500pts would push index further upward to retest 32,500pts but index would remain bearish until it would succeed in closing above that level.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.