Previous Session Recap

Trading volume at PSX floor increased by 32.18 million shares or 13.97% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 45,624.13, posted a day high of 45,771.40 and a day low of 45,413.69 during last trading session. The session suspended at 45,741.43 with net change of 181.13 and net trading volume of 128.18 million shares. Daily trading volume of KSE100 listed companies increased by 18.96 million shares or 17.35% on DoD basis.

Foreign Investors remained in net selling position of 2.17 million shares and net value of Foreign Inflow dropped by 2.01 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani investors remained in net selling positions of 0.02, 1.34 and 0.82 million shares respectively. While on the other side Local Individuals, NBFCs and Insurance Companies remained in net buying positions of 22.54, 1.66 and 0.7 million shares respectively but Local Companies, Banks, Mutual Funds and Brokers remained in net selling positions of 10.8, 2.7, 0.69 and 7.04 million shares respectively.

Analytical Review

Stocks slide, yen rises in flight to safety on trade war anxiety

Asian stocks extended a global selloff and the yen rose on Tuesday as investors fled for safety as an escalating trade spat between the United States and China and a renewed slump in tech shares such as Amazon.com sapped investor confidence. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.28 percent pressured by the tech sector. Japan’s Nikkei slipped 1.1 percent while South Korea’s KOSPI index skidded about 1 percent with Samsung Electronics down more than 1 percent. Australian shares were off 0.3 percent. The losses in tech shares came after U.S. President Donald Trump attacked Amazon.com over the pricing of its deliveries through the United States Postal Service and promised unspecified changes.

Pak-China FTA II talks remain indecisive

Pakistan and China on Monday failed to reach a breakthrough on second phase of Free Trade Agreement (FTA) in Islamabad as talks between two countries ended inconclusively. The 10th round on China-Pakistan Free Trade Agreement (CPFTA) phase II was held in Islamabad. Secretary Commerce M Younus Dagha and Chinese Vice Commerce Minister Wang Shouwen co-chaired the negotiations. However, sources informed that there was no major breakthrough during the talks. "The talks between Pakistan and China remained inconclusive, as both the countries have not signed the minutes of the meeting, which were supposed to sign if the talks completed conclusive," said an official of the Ministry of Commerce wishing not to be named. Earlier, the government was planning to finalize the remaining issues so that a formal announcement can be made during the prime minister's visit to China in April, 2018. The Ministry of Commerce has not issued any statement on the talks.

Pak-Iran rice trade via Dubai continues despite PTA

The Pakistan and Iran bilateral trade can reach the level of $10 billion mark within very short period from the present volume of less than $800 million, as both the countries have been doing their most of trade including rice via Dubai despite inking Preferential Trade Agreement (PTA) since 2006. The Rice Exporters Association of Pakistan chairman Ch Samee Ullah Naeem said that Iran is a nation of rice eaters where the average per capita consumption of rice is 46kg. "The Iranian brothers are very fond of Pakistani super basmati rice due to its taste, aroma, length, and cooking ability. We request the Iranian government that the access of super basmati rice be facilitated through rational trade measures and technical barriers must be removed," he said. Addressing a ceremony, the REAP chairman requested Iran to impose lower duty regime on imports of Pakistani rice in Iran under PTA.

Number of labourers going to Saudi Arabia drops

The number of Pakistani labourers recruited by Saudi Arabian employers dropped by 11 per cent to 460,000 in 2016 despite the fact that the kingdom has remained the busiest corridor for Pakistani migrants higher than in any year since 2005. Nonetheless, in 2017, Bangladesh appears to have replaced Pakistan as the main source of labour force to Saudi Arabia, the Asian Development Bank (ADB) says in a new report, ‘Labour Migration in Asia’. This downward trend is likely to continue since partial figures up to October 2017 indicate only 450,000 departures for overseas employment from Pakistan. The increase in Bangladeshi workers going to Saudi Arabia can be attributed to the end of a six-year ban on recruitment, which was lifted in mid-2016.

India pushes state banks to find own funding sources after $32bn bailout

A massive $32 billion bailout package for India’s dominant state-run banks will not happen again and lenders will have to find their own funding by selling non-core assets and merging with each other, a senior government official said on Monday. Twenty-one banks, majority owned by New Delhi, account for more than two-thirds of the banking assets in Asia’s third-biggest economy. These lenders also account for close to 90 per cent of soured loans in the banking sector. Last October, the finance ministry announced a state-bank rescue plan worth 2.11 trillion rupees ($32.41bn) - $14bn of which it is in the process of injecting as a first tranche - to help banks set aside enough for their bad loans and boost credit growth in an economy where banks are the main source of funding.

Market is expected to remain volatile therfore its recommended to stay cautious while trading today.

Asian stocks extended a global selloff and the yen rose on Tuesday as investors fled for safety as an escalating trade spat between the United States and China and a renewed slump in tech shares such as Amazon.com sapped investor confidence. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.28 percent pressured by the tech sector. Japan’s Nikkei slipped 1.1 percent while South Korea’s KOSPI index skidded about 1 percent with Samsung Electronics down more than 1 percent. Australian shares were off 0.3 percent. The losses in tech shares came after U.S. President Donald Trump attacked Amazon.com over the pricing of its deliveries through the United States Postal Service and promised unspecified changes.

Pakistan and China on Monday failed to reach a breakthrough on second phase of Free Trade Agreement (FTA) in Islamabad as talks between two countries ended inconclusively. The 10th round on China-Pakistan Free Trade Agreement (CPFTA) phase II was held in Islamabad. Secretary Commerce M Younus Dagha and Chinese Vice Commerce Minister Wang Shouwen co-chaired the negotiations. However, sources informed that there was no major breakthrough during the talks. "The talks between Pakistan and China remained inconclusive, as both the countries have not signed the minutes of the meeting, which were supposed to sign if the talks completed conclusive," said an official of the Ministry of Commerce wishing not to be named. Earlier, the government was planning to finalize the remaining issues so that a formal announcement can be made during the prime minister's visit to China in April, 2018. The Ministry of Commerce has not issued any statement on the talks.

The Pakistan and Iran bilateral trade can reach the level of $10 billion mark within very short period from the present volume of less than $800 million, as both the countries have been doing their most of trade including rice via Dubai despite inking Preferential Trade Agreement (PTA) since 2006. The Rice Exporters Association of Pakistan chairman Ch Samee Ullah Naeem said that Iran is a nation of rice eaters where the average per capita consumption of rice is 46kg. "The Iranian brothers are very fond of Pakistani super basmati rice due to its taste, aroma, length, and cooking ability. We request the Iranian government that the access of super basmati rice be facilitated through rational trade measures and technical barriers must be removed," he said. Addressing a ceremony, the REAP chairman requested Iran to impose lower duty regime on imports of Pakistani rice in Iran under PTA.

The number of Pakistani labourers recruited by Saudi Arabian employers dropped by 11 per cent to 460,000 in 2016 despite the fact that the kingdom has remained the busiest corridor for Pakistani migrants higher than in any year since 2005. Nonetheless, in 2017, Bangladesh appears to have replaced Pakistan as the main source of labour force to Saudi Arabia, the Asian Development Bank (ADB) says in a new report, ‘Labour Migration in Asia’. This downward trend is likely to continue since partial figures up to October 2017 indicate only 450,000 departures for overseas employment from Pakistan. The increase in Bangladeshi workers going to Saudi Arabia can be attributed to the end of a six-year ban on recruitment, which was lifted in mid-2016.

A massive $32 billion bailout package for India’s dominant state-run banks will not happen again and lenders will have to find their own funding by selling non-core assets and merging with each other, a senior government official said on Monday. Twenty-one banks, majority owned by New Delhi, account for more than two-thirds of the banking assets in Asia’s third-biggest economy. These lenders also account for close to 90 per cent of soured loans in the banking sector. Last October, the finance ministry announced a state-bank rescue plan worth 2.11 trillion rupees ($32.41bn) - $14bn of which it is in the process of injecting as a first tranche - to help banks set aside enough for their bad loans and boost credit growth in an economy where banks are the main source of funding.

Technical Analysis

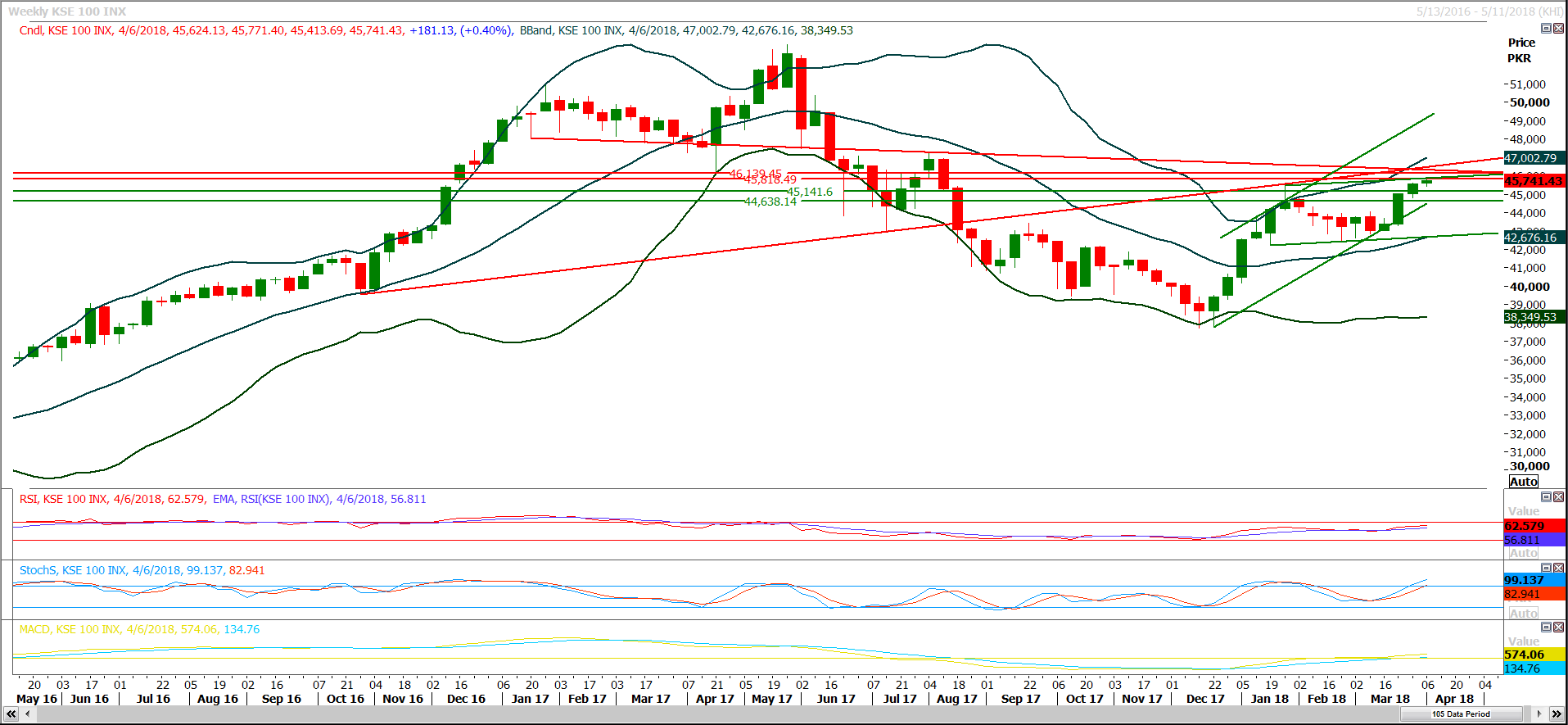

The Benchmark KSE100 Index is capped by multiple resistances ahead and it would face a tough time before posting a high of 46,500 in this rally, immediately it would face a resistance from resistant trend line of its daily channel which falls on completion of expansion of its triangle and then two major horizontal resistant regions would try to cap current bull run at 45,860 and 46,140 points. The ultimate resistance region falls at 46500 which fall on 61.8% correction of its last bearish rally on weekly chart and that resistant region would be strengthen by two resistant trend lines. On supportive side index have supportive regions around 45,140 and 44,640 points and these both regions would try to support index against any bearish pressure in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.