Previous Session Recap

Trading volume at PSX floor increased by 117.94 million shares or 60.96% on DoD basis, whereas the benchmark KSE100 index opened at 29,505.57, posted a day high of 30,842.00 and a day low of 29,460.38 points during last trading session while session suspended at 30,782.66 points with net change of 1277.09 points and net trading volume of 226.57 million shares. Daily trading volume of KSE100 listed companies also increased by 69.49 million shares or 44.24% on DoD basis.

Foreign Investors remained in net selling positions of 19.09 million shares and value of Foreign Inflow dropped by 11.26 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani remained in net selling positions of 17.17 and 2.47 million shares but Foreign Individuals remained in net long positions of 0.57 million shares respectively. While on the other side Local Individuals, Companies, NBFCs, Mutual Fund and Insurance Companies remained in net long positions of 17.28, 1.12, 0.08, 1.71 and 2.30 million shares but Banks and Brokers remained in net selling positions of 0.56 and 2.41 million shares respectively.

Analytical Review

Oil, shares slip on doubts over Saudi-Russia deal

Oil prices retreated on Friday after massive gains, while stocks in Asia edged down, as doubts grew over an oil price deal between Saudi Arabia and Russia that U.S. President Donald Trump said he had brokered. With the coronavirus pandemic raising the risk of a prolonged global downturn, investors continued to seek the safety of the U.S. dollar and government bonds, pushing U.S. Treasuries yield near their lowest in three weeks. U.S. West Texas Intermediate (WTI) crude lost $1.14, or 4.5% to $24.18 a barrel in early Asian trade after having surged a record 24.7% on Thursday. Brent futures dropped $0.70, or 2.67% to $29.24. Trump said on Thursday he had spoken to Saudi Crown Prince Mohammed bin Salman, and expects Saudi Arabia and Russia to cut oil output by as much as 10 million to 15 million barrels, as the two countries signalled willingness to make a deal.

Huddle in Q Block over shape of industry bailout

The business community on Wednesday asked the government to encourage the State Bank of Pakistan to purchase assets and goods of depressed industries and further reduce the discount rate besides speedy clearance of tax refunds to address liquidity challenges and help mitigate adverse impact of Covid-19 pandemic. At a meeting with a ministerial team, the leading businessmen also advised the government to allow courier services and online businesses to resume their activities and extend maximum support to small and medium enterprises (SMEs) to pass through challenging times. Adviser to the Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh chaired the meeting via video link with the business community. Adviser to PM on Commerce and Industry, Abdul Razzak Dawood also attended.

Moody’s sees Pakistan growth rates sliding to 2pc

Moody’s Investors Service on Thursday estimated Pakistan’s growth rate could further slide to two per cent during the current fiscal year owing to Covid-19 outbreak and believed recent steps by the State Bank of Pakistan (SBP) would soften the impact of the pandemic on the country’s banks. On March 17, the Moody’s had formally reduced its forecast for Pakistan GDP growth rate to 2.5pc from its earlier estimate of 2.9pc in December citing mostly external growth factors in the region. On Thursday, however, the New York-based agency hinted at even lower growth prospects for Pakistan. “We expect Pakistan’s real GDP growth to slow to 2.0pc-2.5pc for fiscal 2020 (which ends 30 June 2020), lower than our earlier forecast of 2.9pc, reflecting the impact of the coronavirus pandemic,” the agency said in a statement.

PM wants resumption of construction, CPEC work

Prime Minister Imran Khan on Thursday ordered a relief package specifically for the construction industry and directed resumption of all China-Pakistan Economic Corridor (CPEC) related infrastructure and energy projects. The package for construction industry will be unveiled today (Friday). The premier also directed formation of a Codal Research Committee (CRC) for devising an action plan that would allow the centre and provinces to jointly deal with Covid-19’s brunt on the country’s economy. The decisions were taken in two separate meetings held to assess the impact of the pandemic on economy and common man.

Moody’s expects Pakistan’s real GDP growth to slow to 2-2.5pc

Moody’s Investors Service has downward revised Pakistan’s gross domestic product (GDP) to 2 – 2.5 percent for the current fiscal year (2020) from earlier forecast of 2.9 percent due to the coronavirus pandemic. “We expect Pakistan’s real GDP growth to slow to 2.0%-2.5% for fiscal 2020 (which ends 30 June 2020), lower than our earlier forecast of 2.9%, reflecting the impact of the coronavirus pandemic,” Moody’s stated in a statement on Thursday. Consumption of services, which has underpinned growth in recent years, will be adversely affected by the movement restrictions. The textile sector, the country’s key manufacturing sector which accounts for around 60 percent of exports, has also been hit by supply-chain disruptions and a decline or postponement of orders. Manufacturing loans (mainly to the textile and food sectors) accounted for 62 percent of private-sector loans as of 29 February 2020.

Oil prices retreated on Friday after massive gains, while stocks in Asia edged down, as doubts grew over an oil price deal between Saudi Arabia and Russia that U.S. President Donald Trump said he had brokered. With the coronavirus pandemic raising the risk of a prolonged global downturn, investors continued to seek the safety of the U.S. dollar and government bonds, pushing U.S. Treasuries yield near their lowest in three weeks. U.S. West Texas Intermediate (WTI) crude lost $1.14, or 4.5% to $24.18 a barrel in early Asian trade after having surged a record 24.7% on Thursday. Brent futures dropped $0.70, or 2.67% to $29.24. Trump said on Thursday he had spoken to Saudi Crown Prince Mohammed bin Salman, and expects Saudi Arabia and Russia to cut oil output by as much as 10 million to 15 million barrels, as the two countries signalled willingness to make a deal.

The business community on Wednesday asked the government to encourage the State Bank of Pakistan to purchase assets and goods of depressed industries and further reduce the discount rate besides speedy clearance of tax refunds to address liquidity challenges and help mitigate adverse impact of Covid-19 pandemic. At a meeting with a ministerial team, the leading businessmen also advised the government to allow courier services and online businesses to resume their activities and extend maximum support to small and medium enterprises (SMEs) to pass through challenging times. Adviser to the Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh chaired the meeting via video link with the business community. Adviser to PM on Commerce and Industry, Abdul Razzak Dawood also attended.

Moody’s Investors Service on Thursday estimated Pakistan’s growth rate could further slide to two per cent during the current fiscal year owing to Covid-19 outbreak and believed recent steps by the State Bank of Pakistan (SBP) would soften the impact of the pandemic on the country’s banks. On March 17, the Moody’s had formally reduced its forecast for Pakistan GDP growth rate to 2.5pc from its earlier estimate of 2.9pc in December citing mostly external growth factors in the region. On Thursday, however, the New York-based agency hinted at even lower growth prospects for Pakistan. “We expect Pakistan’s real GDP growth to slow to 2.0pc-2.5pc for fiscal 2020 (which ends 30 June 2020), lower than our earlier forecast of 2.9pc, reflecting the impact of the coronavirus pandemic,” the agency said in a statement.

Prime Minister Imran Khan on Thursday ordered a relief package specifically for the construction industry and directed resumption of all China-Pakistan Economic Corridor (CPEC) related infrastructure and energy projects. The package for construction industry will be unveiled today (Friday). The premier also directed formation of a Codal Research Committee (CRC) for devising an action plan that would allow the centre and provinces to jointly deal with Covid-19’s brunt on the country’s economy. The decisions were taken in two separate meetings held to assess the impact of the pandemic on economy and common man.

Moody’s Investors Service has downward revised Pakistan’s gross domestic product (GDP) to 2 – 2.5 percent for the current fiscal year (2020) from earlier forecast of 2.9 percent due to the coronavirus pandemic. “We expect Pakistan’s real GDP growth to slow to 2.0%-2.5% for fiscal 2020 (which ends 30 June 2020), lower than our earlier forecast of 2.9%, reflecting the impact of the coronavirus pandemic,” Moody’s stated in a statement on Thursday. Consumption of services, which has underpinned growth in recent years, will be adversely affected by the movement restrictions. The textile sector, the country’s key manufacturing sector which accounts for around 60 percent of exports, has also been hit by supply-chain disruptions and a decline or postponement of orders. Manufacturing loans (mainly to the textile and food sectors) accounted for 62 percent of private-sector loans as of 29 February 2020.

Market is expected to remain volatile during current trading session.

Technical Analysis

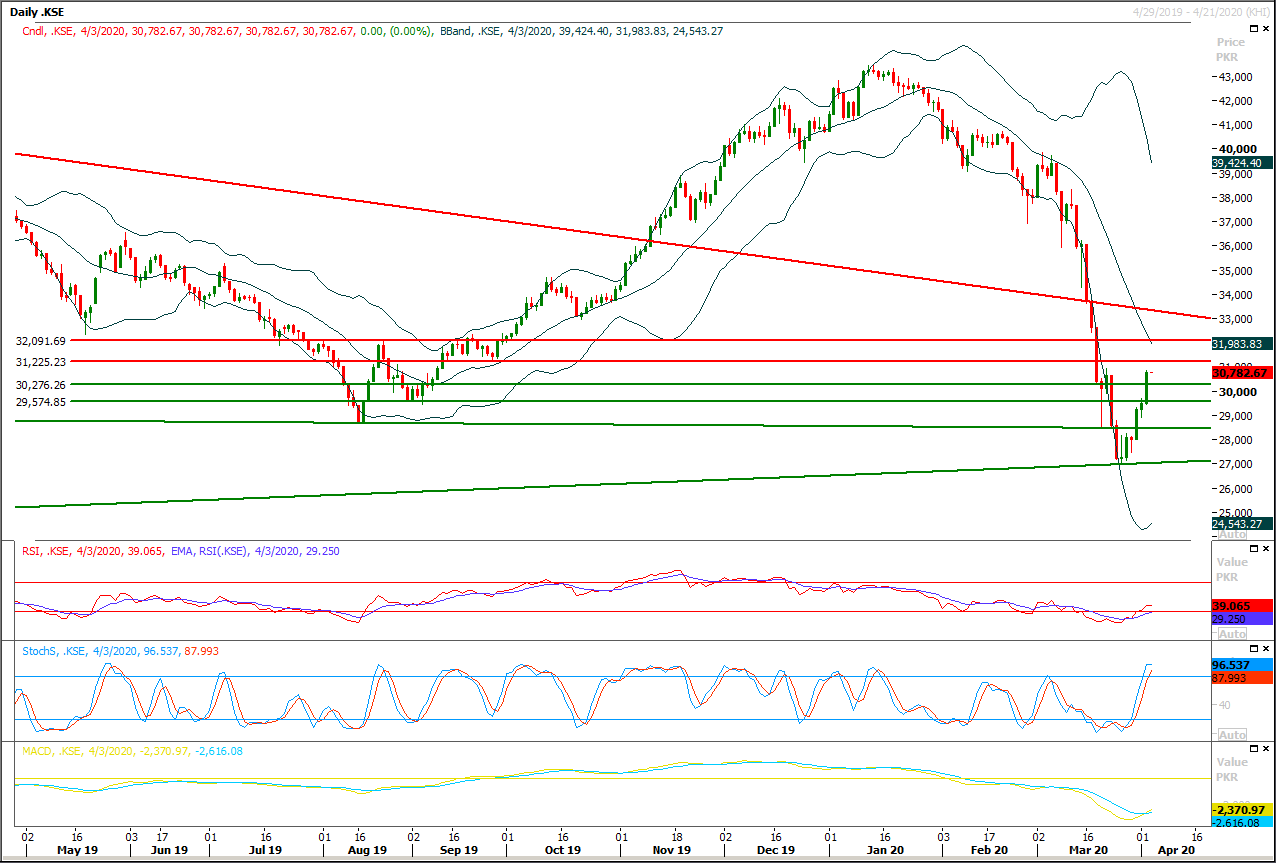

The Benchmark KSE100 index have continued its pull back above its second major resistant region and it's expected that index would change its short term trend if it would succeed in closing above 30,500pts during current trading session because a weekly bullish engulfing pattern would take place in this scenario. But it's recommended to stay cautious because index have major resistant regions ahead at 31,200pts and 31,700pts where two strong horizontal resistant regions would try to cap current bullish sentiment. Meanwhile index would remain bearish on short to mid-term basis until index would not succeed in closing above 32,500pts on weekly chart.

In case of rejection from its resistant regions index would start sliding downward and would find its initial supportive region at 30,200pts and breakout below that region would 29,500pts and 28,500pts. It's also expected that if index would not succeed in closing above 32,500pts in next week then a cheat pattern would take place in response of current weekly bullish engulfing pattern.

In case of rejection from its resistant regions index would start sliding downward and would find its initial supportive region at 30,200pts and breakout below that region would 29,500pts and 28,500pts. It's also expected that if index would not succeed in closing above 32,500pts in next week then a cheat pattern would take place in response of current weekly bullish engulfing pattern.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.