Previous Session Recap

Trading volume at PSX floor increased by 125.54 million shares or 29.07% on DoD basis, whereas the benchmark KSE100 index opened at 38,287.65, posted a day high of 40,144.12 and a day low of 39,287.65 points during last trading session while session suspended at 40,124.22 points with net change of 836.57 points and net trading volume of 361.66 million shares. Daily trading volume of KSE100 listed companies increased by 99.91 million shares or 38.17% on DoD basis.

Foreign Investors remained in net buying positions of 4.73 million shares but net value of Foreign Inflow increased by 1.64 million US Dollars. Categorically, Foreign Individual and Overseas Pakistanis remained in net selling positions of 0.066 and 1.03 million shares but Foreign Corporate Investors remained in net buying positions of 5.83 million shares. While on the other side Local Individuals, Companies, NBFCs and Brokers remained in net buying positions of 3.67, 8.45, 0.94 and 8.15 million shares but Banks, Mutual Fund and Insurance Companies remained in net selling positions of 19.47, 3.18 and 3.10 million shares respectively.

Analytical Review

Stocks drop as Trump's Latin American tariffs revive trade angst

Asian shares skidded on Tuesday after U.S. President Donald Trump stunned markets with tariffs against Brazil and Argentina, recharging fears about global trade tensions, while weak U.S. factory data added to the investor gloom. MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.45% in early trade, with Australian shares dropping nearly 2%, on track for their worst day in two months. Japan’s Nikkei shed 1.1%. In tweets on Monday, Trump said he would impose tariffs on steel and aluminum imports from Brazil and Argentina, attacking what he saw as both countries’ “massive devaluation of their currencies.” Contrary to his remarks, both Brazil and Argentina have been trying to strengthen their respective currencies against the dollar.

Trade deficit contracts further in November

The trade deficit continued to shrink in November, with the pace of the declines accelerating, according to data tweeted by Commerce Adviser Abdul Razak Dawood on Sunday.The country’s trade deficit during the July-November period fell to $9.496 billion from $14.47bn in the same period last fiscal year. The widening trade gap has been at the heart of the deterioration of economy’s external stability and falling foreign exchange reserves. It’s decline takes pressure off the external account. The exports during the period increased by 4.8 per cent to $9.55bn compared to $9.11bn whereas imports – which have been on the declining trend during the fiscal year – fell by 19.27pc to $19.04bn from $23.59bn last year.

Egyptian firm keen to build low-cost housing units

An Egyptian company on Tuesday offered to provide financial and technical assistance to Pakistan for building housing units in the federal capital to accommodate slum dwellers living in four Katchi Abadis. This is one of the key areas that came under discussion during a meeting between Prime Minister Imran Khan and Executive Chairman Orascom Telecom Media and Technology Naguib Sawiris here, PM’s Special Adviser on Overseas Pakistanis Sayed Zulfikar Abbas Bukhari told media persons. He said Sawiris would hold meetings with the officials of housing ministry and other relevant stakeholders to materialise this initiative as soon as possible. The government would construct flats or high-rise buildings for one Katchi Abadi in the first phase to solicit other slum dwellers’ trust, he added.

Dues, faulty design delay CPEC work

The much-awaited western route of China-Pakistan Economic Corridor (CPEC), which was supposed to be completed by this month, remains a victim of official neglect as non-payment of dues and some technical reasons have stalled work on the Rs110 billion project, the Senate Standing Committee on Communications was informed on Monday. The National Highway Authority (NHA), which is an executing agency of the project, complained that the government had not released all the fund allocated under the Public Sector Development Programme, as the finance ministry slashed it to recover interest on Rs1.5 trillion loans obtained by the authority for infrastructure and development projects.

Govt releases Rs 297 billion under PSDP 2019-20

The federal government has so far released Rs297.278 billion for various ongoing and new social sector uplift projects under its Public Sector Development Programme (PSDP) 2019-20, as against the total allocation of Rs701 billion. Under its development programme, the government has released an amount of Rs134.762 billion for federal ministries, Rs100.56 billion for corporations and Rs21.52 billion for special areas, according to a data released by Ministry of Planning, Development and Reform. Out of these allocations, the government released Rs26.78 billion for security enhancement in the country for which the government had allocated Rs 32.5 billion during the year 2019-20.

Asian shares skidded on Tuesday after U.S. President Donald Trump stunned markets with tariffs against Brazil and Argentina, recharging fears about global trade tensions, while weak U.S. factory data added to the investor gloom. MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.45% in early trade, with Australian shares dropping nearly 2%, on track for their worst day in two months. Japan’s Nikkei shed 1.1%. In tweets on Monday, Trump said he would impose tariffs on steel and aluminum imports from Brazil and Argentina, attacking what he saw as both countries’ “massive devaluation of their currencies.” Contrary to his remarks, both Brazil and Argentina have been trying to strengthen their respective currencies against the dollar.

The trade deficit continued to shrink in November, with the pace of the declines accelerating, according to data tweeted by Commerce Adviser Abdul Razak Dawood on Sunday.The country’s trade deficit during the July-November period fell to $9.496 billion from $14.47bn in the same period last fiscal year. The widening trade gap has been at the heart of the deterioration of economy’s external stability and falling foreign exchange reserves. It’s decline takes pressure off the external account. The exports during the period increased by 4.8 per cent to $9.55bn compared to $9.11bn whereas imports – which have been on the declining trend during the fiscal year – fell by 19.27pc to $19.04bn from $23.59bn last year.

An Egyptian company on Tuesday offered to provide financial and technical assistance to Pakistan for building housing units in the federal capital to accommodate slum dwellers living in four Katchi Abadis. This is one of the key areas that came under discussion during a meeting between Prime Minister Imran Khan and Executive Chairman Orascom Telecom Media and Technology Naguib Sawiris here, PM’s Special Adviser on Overseas Pakistanis Sayed Zulfikar Abbas Bukhari told media persons. He said Sawiris would hold meetings with the officials of housing ministry and other relevant stakeholders to materialise this initiative as soon as possible. The government would construct flats or high-rise buildings for one Katchi Abadi in the first phase to solicit other slum dwellers’ trust, he added.

The much-awaited western route of China-Pakistan Economic Corridor (CPEC), which was supposed to be completed by this month, remains a victim of official neglect as non-payment of dues and some technical reasons have stalled work on the Rs110 billion project, the Senate Standing Committee on Communications was informed on Monday. The National Highway Authority (NHA), which is an executing agency of the project, complained that the government had not released all the fund allocated under the Public Sector Development Programme, as the finance ministry slashed it to recover interest on Rs1.5 trillion loans obtained by the authority for infrastructure and development projects.

The federal government has so far released Rs297.278 billion for various ongoing and new social sector uplift projects under its Public Sector Development Programme (PSDP) 2019-20, as against the total allocation of Rs701 billion. Under its development programme, the government has released an amount of Rs134.762 billion for federal ministries, Rs100.56 billion for corporations and Rs21.52 billion for special areas, according to a data released by Ministry of Planning, Development and Reform. Out of these allocations, the government released Rs26.78 billion for security enhancement in the country for which the government had allocated Rs 32.5 billion during the year 2019-20.

Market is expected to remain volatile during current trading session.

Technical Analysis

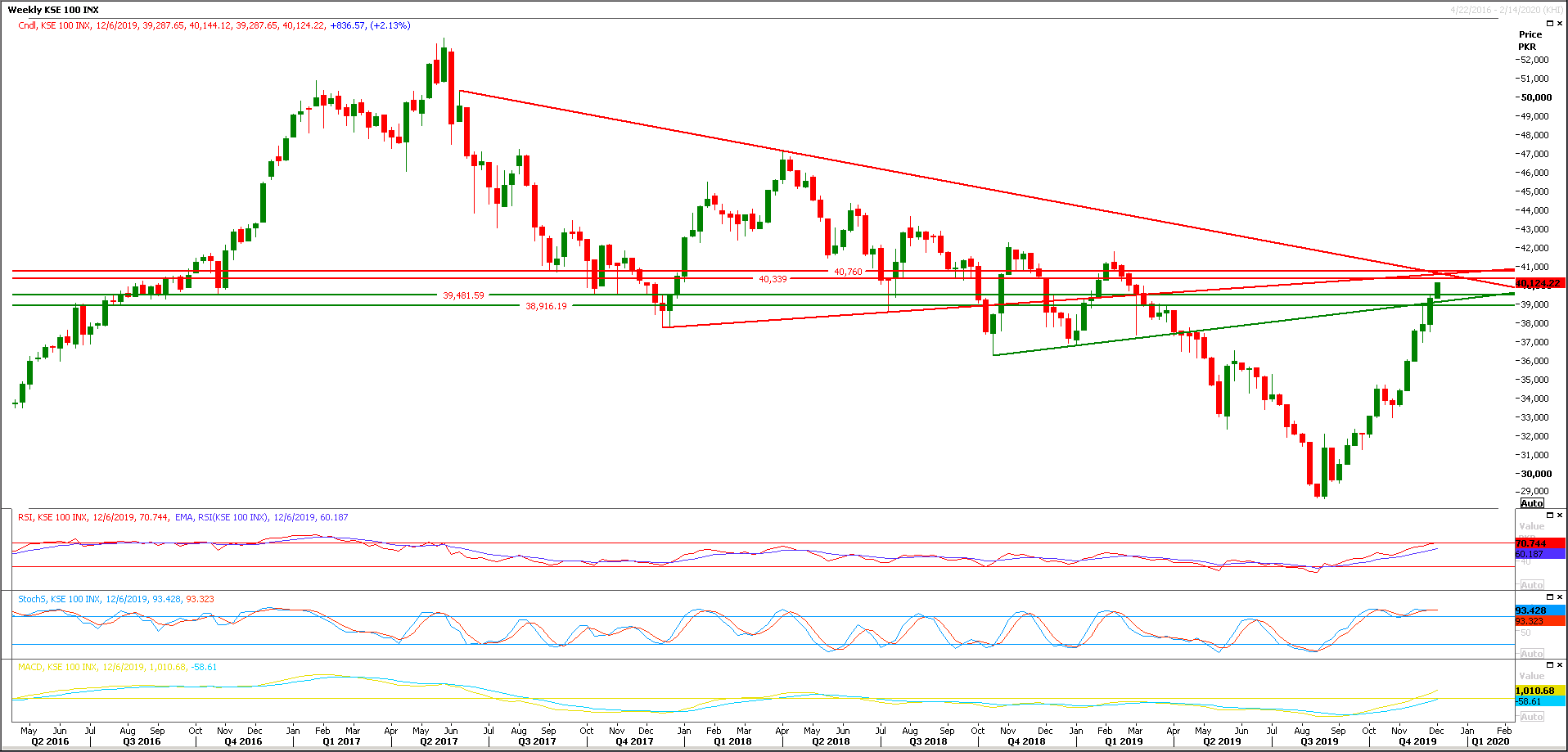

The Benchmark KSE100 index is going to face strong resistance at 40,325 and 40,760 points in coming days where strong horizontal resistances along with a descending trend line would try to push it downward for a correction. It's expected that index would not succeed in closing above 40,760 points on weekly basis and it would start sliding downward for a correction and initially would try to slide downward till 39,480 and then 39,000 points. It's recommended to post trailing stop loss on existing long positions and adopt cut and reverse strategy in case of rejection. While on flip side if index would succeed in closing above 40,760 points on weekly bases then it would try to target 42,000 points in coming days.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.