Previous Session Recap

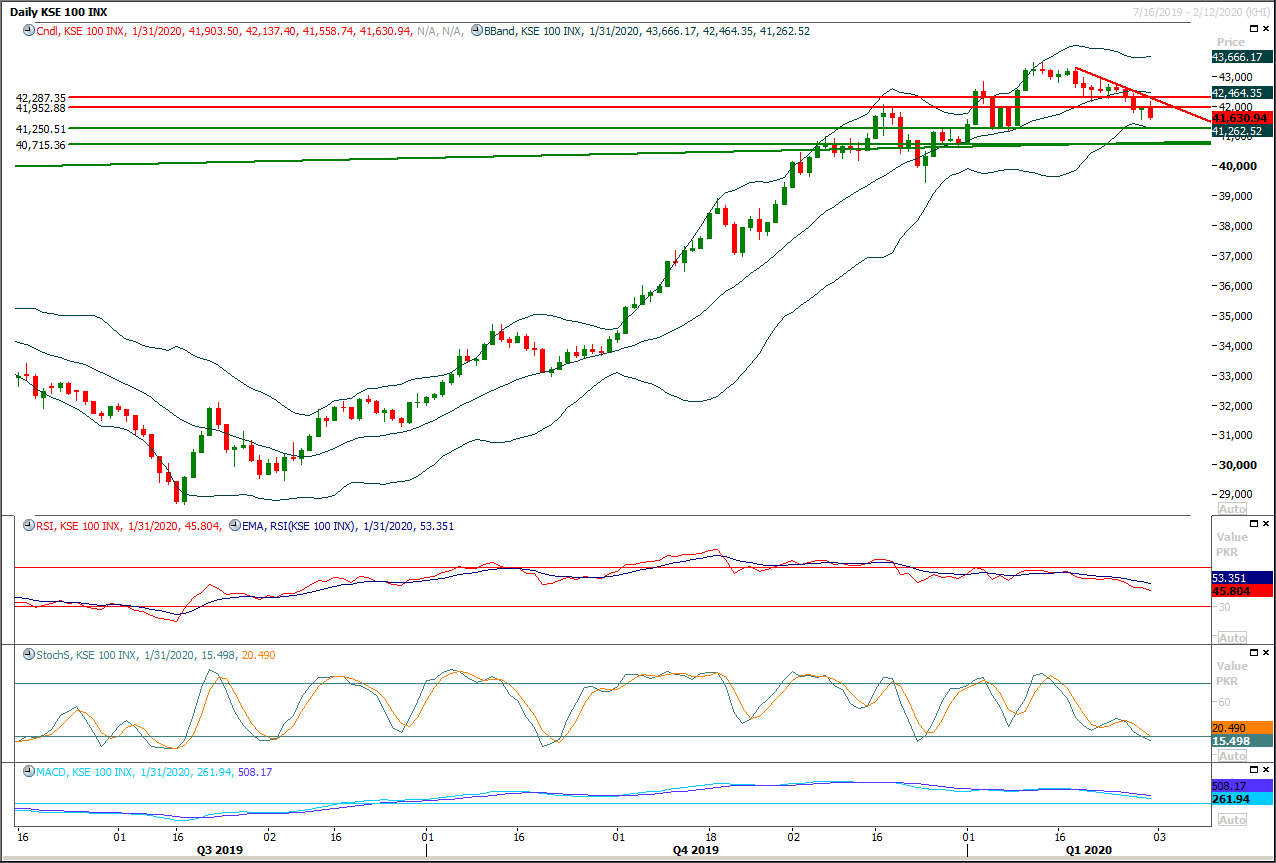

Trading volume at PSX floor increased by 31.63 million shares or 19.49% on DoD basis, whereas the benchmark KSE100 index opened at 41,903.50, posted a day high of 42,137.40 and a day low of 41,558.74 points during last trading session while session suspended at 41,630.94 points with net change of -272.56 points and net trading volume of 140.34 million shares. Daily trading volume of KSE100 listed companies also increased by 31.95 million shares or 29.47% on DoD basis.

Foreign Investors remained in net selling positions of 8.88 million shares and net value of Foreign Inflow dropped by 1.72 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling positions of 0.10, 6.93 and 1.85 million shares respectively. While on the other side Local Individuals, Mutual Fund, Brokers and Insurance Companies remained in net long positions of 4.59, 0.28, 4.64 and 2.20 million shares but Local Companies, Banks and NBFCs remained in net selling positions of 1.45, 1.74 and 0.01 million shares respectively.

Analytical Review

Asian shares drop, commodities sink on virus fears after Lunar New Year break

Asian shares stumbled on Monday, oil skidded and commodities on Chinese exchanges plunged on their first trading day after a long break on fears the coronavirus epidemic will hit demand in the world’s second-largest economy Aiming to head off any panic, the Chinese government took a range of steps to shore up an economy hit by travel curbs and business shut-downs because of the epidemic, including cutting its key interest rate. Despite the measures, MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.4%, on track for its eighth straight day of losses. Chinese shares slumped at the open with the blue-chip index down about 7%. Japan’s Nikkei stumbled 0.9% while Australia’s benchmark index skidded 1.2%, while New Zealand shares dropped 1.5%.

Wapda to contribute Rs271bn to hydro projects from its revenue

The Water and Power Development Authority (Wapda) will contribute Rs271 billion as equity for three mega hydropower projects, it has emerged. This followed after the authority completed three previous much-delayed hydropower projects under a fast-track policy and generated nearly Rs80bn in revenue. “For the last few years, we introduced a multi-pronged strategy to arrange funds for the completion of various important projects. So far, we have implemented this strategy well on Neelum-Jhelum, Tarbela 4th extension and Golen Gol hydropower projects. These projects helped us earn Rs80bn, increasing our own financial resources and contribution (equity) for three mega projects — Diamer-Bhasha, Dasu and Mohmand dams,” said Wapda Chairman retired Lt Gen Muzammil Hussain. “When any work is finished on the dot, it saves money, energy and time. But if it is delayed, several issues come up, including cost escalation,” he told Dawn.

Fumigation declared must for pre-loved items coming from China

The directorate of central health establishment, Islamabad, has instructed the Model Collectorate of Customs (Appraisement) to not to clear import of pre-loved clothing/used shoes and other second-hand items without fumigation in view of coronavirus outbreak in China. The health establishment further expressed its objection to clearing other consignments. On Jan 27, 2020, Port Health Establishment had informed Model Collectorate that cargoes (human and animal origin) imported from the affected areas over the past 15 days were not to be cleared without fumigation under the supervision of Port Health Establishment in larger national interest.

SBP’s traditional response to high inflation

The State Bank of Pakistan (SBP) insists its monetary policy stance “is appropriate to bring inflation down to the medium-term target (in the) range of 5-7 per cent over the next six to eight quarters”. On Jan 28, the central bank decided to keep its policy rate unchanged — for the third time — at 13.25pc for the next two months. In 2018-19, the SBP jacked up its policy rate from 6.5pc to 12.25pc — in instalments. Despite that, annual consumer inflation rose to 7.3pc from 3.9pc in 2017-18. At the beginning of this fiscal year, the SBP increased the rate once again by a full percentage point to 13.25pc — before putting brakes on interest rate tightening. But in the first half of 2019-20, CPI inflation rose 11.1pc year-on-year. The increase in inflation in December alone was even sharper — 12.6pc.

IMF mission arrives to review performance under bailout package

A staff mission of the International Monetary Fund (IMF) is in town for an 11-day second review of Pakistan performance under the $6 billion bailout package signed in July last year amid a massive revenue shortfall in the first seven months of the current fiscal year. The completion of the review against a significantly modified 39-month programme in November last year would determine if the government would secure disbursement in March of another tranche of about $450 million direly needed to build market confidence and foreign exchange reserves. Pakistan has so far secured about $1.44bn through an upfront release of about $991m in July and first installment of about $452m in December last year.

Asian shares stumbled on Monday, oil skidded and commodities on Chinese exchanges plunged on their first trading day after a long break on fears the coronavirus epidemic will hit demand in the world’s second-largest economy Aiming to head off any panic, the Chinese government took a range of steps to shore up an economy hit by travel curbs and business shut-downs because of the epidemic, including cutting its key interest rate. Despite the measures, MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.4%, on track for its eighth straight day of losses. Chinese shares slumped at the open with the blue-chip index down about 7%. Japan’s Nikkei stumbled 0.9% while Australia’s benchmark index skidded 1.2%, while New Zealand shares dropped 1.5%.

The Water and Power Development Authority (Wapda) will contribute Rs271 billion as equity for three mega hydropower projects, it has emerged. This followed after the authority completed three previous much-delayed hydropower projects under a fast-track policy and generated nearly Rs80bn in revenue. “For the last few years, we introduced a multi-pronged strategy to arrange funds for the completion of various important projects. So far, we have implemented this strategy well on Neelum-Jhelum, Tarbela 4th extension and Golen Gol hydropower projects. These projects helped us earn Rs80bn, increasing our own financial resources and contribution (equity) for three mega projects — Diamer-Bhasha, Dasu and Mohmand dams,” said Wapda Chairman retired Lt Gen Muzammil Hussain. “When any work is finished on the dot, it saves money, energy and time. But if it is delayed, several issues come up, including cost escalation,” he told Dawn.

The directorate of central health establishment, Islamabad, has instructed the Model Collectorate of Customs (Appraisement) to not to clear import of pre-loved clothing/used shoes and other second-hand items without fumigation in view of coronavirus outbreak in China. The health establishment further expressed its objection to clearing other consignments. On Jan 27, 2020, Port Health Establishment had informed Model Collectorate that cargoes (human and animal origin) imported from the affected areas over the past 15 days were not to be cleared without fumigation under the supervision of Port Health Establishment in larger national interest.

The State Bank of Pakistan (SBP) insists its monetary policy stance “is appropriate to bring inflation down to the medium-term target (in the) range of 5-7 per cent over the next six to eight quarters”. On Jan 28, the central bank decided to keep its policy rate unchanged — for the third time — at 13.25pc for the next two months. In 2018-19, the SBP jacked up its policy rate from 6.5pc to 12.25pc — in instalments. Despite that, annual consumer inflation rose to 7.3pc from 3.9pc in 2017-18. At the beginning of this fiscal year, the SBP increased the rate once again by a full percentage point to 13.25pc — before putting brakes on interest rate tightening. But in the first half of 2019-20, CPI inflation rose 11.1pc year-on-year. The increase in inflation in December alone was even sharper — 12.6pc.

A staff mission of the International Monetary Fund (IMF) is in town for an 11-day second review of Pakistan performance under the $6 billion bailout package signed in July last year amid a massive revenue shortfall in the first seven months of the current fiscal year. The completion of the review against a significantly modified 39-month programme in November last year would determine if the government would secure disbursement in March of another tranche of about $450 million direly needed to build market confidence and foreign exchange reserves. Pakistan has so far secured about $1.44bn through an upfront release of about $991m in July and first installment of about $452m in December last year.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index have formatted a continuity pattern below a strong supportive region of 42,000 points and now daily and weekly momentum indicators are strongly bearish therefore it's expected that index would continue its bearish journey towards 41,250 points where it would try to find some ground from a strong horizontal supportive region but breakout below that region would call for 40,700 points in coming days. In case of reversal from 41,250 region index would face strong resistances at 41,950 and 42,300 points therefore it's recommended to post trailing stop losses on existing short positions and it's also recommended to wait for confirmation below 41,250 points or near 42,000 points before initiating new positions. Index would remain bearish until it would not succeed in closing above 42,500 points initially.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.