Previous Session Recap

Trading volume at PSX floor increased by 81.61 million shares or 24.68% on DoD basis, whereas the benchmark KSE100 index opened at 41,400.00, posted a day high of 42,543.73 and a day low of 41,400.00 points during last trading session while session suspended at 42,480.76 points with net change of 1080.76 points and net trading volume of 282.93 million shares. Daily trading volume of KSE100 listed companies increased by 44.91 million shares or 18.87% on DoD basis.

Foreign Investors remained in net selling positions of 3.87 million shares and value of Foreign Inflow dropped by 1.00 million US Dollars. Categorically, Foreign Individuals and Foreign Corporate remained in net selling positions of 0.28 and 4.74 million shares but Overseas Pakistanis remained in net buying positions of 1.16 million shares. While on the other side Local Individuals, Companies and Insurance Companies remained in net selling positions of 18.55, 21.50 and 1.80 million shares but Banks, NBFCs, Mutual Fund and Brokers remained in net buying positions of 23.09, 0.81, 19.60 and 5.06 million shares respectively.

Analytical Review

Wall Street starts 2020 with new records on China stimulus, trade hopes

Wall Street’s major indexes notched record highs to open the new year on Thursday, as fresh economic stimulus from China added to optimism fueled by easing trade tensions and an improving global outlook. China’s central bank said on Wednesday it would cut the amount of cash that all banks must hold as reserves, the eighth such cut since early 2018. The move to inject fresh stimulus into the Chinese economy boosted equity markets around the globe. The benchmark S&P 500 hit its 11th record high in 14 sessions and posted its largest daily percentage gain in three weeks. The Dow registered its biggest such gain in almost four weeks, and the Nasdaq its greatest in nearly three months. Economic stimulus in China, along with the easing of trade tensions between Washington and Beijing, has bolstered optimism that the global economy will accelerate in 2020.

Govt to evaluate Etisalat's proposal for settlement of $800m payment

UAE telecom company Etisalat has submitted a framework of settlement to the government for the long-outstanding payment of $800 million against shares of the Pakistan Telecommunication Company Limited (PTCL). Etisalat had, on June 18, 2005, acquired 1.36 billion shares or a 26 per cent stake in PTCL for $2.598 billion. The government has a 62 per cent stake in PTCL. Etisalat's proposal as well as the outstanding payment came up during an inter-ministerial meeting chaired by Adviser to Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh in Islamabad on Thursday. Minister for Information Technology Khalid Maqbool Siddiqui was also present at the meeting.

Govt to give Rs204bn Sukkur-Hyderabad Motorway to private sector on BOT basis

The government on Thursday decided to handover Rs204 billion worth of Sukkur-Hyderabad Motorway to the private sector to finance, build and operate it for 25 years and sought expedited mineral development through coordinated guidance to the provinces. The decisions were taken at two separate meetings presided over by Minister for Planning, Development and Special Initiatives Asad Umar. Under the decision, the “private party will finance construction of the project, operate it for a defined concession period and transfer it back to National Highway Authority (NHA), at no cost at the end of concession period of 25 years,” a senior government official said who attended a meeting of the board of directors of Public Private Partnership Authority (PPPA).

LNG supplies increase

Despite system constraints, the Liquefied Natural Gas (LNG) supplies into the system increased by almost 14 per cent during calendar 2019 over the preceding year and reduced gas shortfall by 20-25pc. The two LNG terminals operating in the country reported to have pumped more than 393.6 billion cubic feet (BCF) of gas into the national gas distribution network in 2019 compared to 345.6 BCF of 2018, showing an increase of 14pc, a Petroleum Division official said. He said the lower economic growth rate coupled with higher prices restricted the key consumer groups from taking full advantage of the available terminal capacity. In 2019 the country imported 7.57 million tonnes of LNG through these terminals which handled 123 LNG cargo ships from Qatar, Australia and other European countries.

PM’s aide directs FBR to raise revenue collection

In the wake of massive shortfalls in revenue collection, Adviser to the Prime Minister on Finance and Revenue Dr Hafeez Shaikh on Wednesday held a detailed meeting with top tax officials and expressed his displeasure over Federal Board of Revenue’s (FBR) performance in the first half of the current fiscal year. During his first visit to the FBR headquarters after assuming charge on April 20, 2019, the adviser asked FBR officials to take extraordinary measures to increase revenue collection to a level close to the revised target of Rs5.23 trillion.

Wall Street’s major indexes notched record highs to open the new year on Thursday, as fresh economic stimulus from China added to optimism fueled by easing trade tensions and an improving global outlook. China’s central bank said on Wednesday it would cut the amount of cash that all banks must hold as reserves, the eighth such cut since early 2018. The move to inject fresh stimulus into the Chinese economy boosted equity markets around the globe. The benchmark S&P 500 hit its 11th record high in 14 sessions and posted its largest daily percentage gain in three weeks. The Dow registered its biggest such gain in almost four weeks, and the Nasdaq its greatest in nearly three months. Economic stimulus in China, along with the easing of trade tensions between Washington and Beijing, has bolstered optimism that the global economy will accelerate in 2020.

UAE telecom company Etisalat has submitted a framework of settlement to the government for the long-outstanding payment of $800 million against shares of the Pakistan Telecommunication Company Limited (PTCL). Etisalat had, on June 18, 2005, acquired 1.36 billion shares or a 26 per cent stake in PTCL for $2.598 billion. The government has a 62 per cent stake in PTCL. Etisalat's proposal as well as the outstanding payment came up during an inter-ministerial meeting chaired by Adviser to Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh in Islamabad on Thursday. Minister for Information Technology Khalid Maqbool Siddiqui was also present at the meeting.

The government on Thursday decided to handover Rs204 billion worth of Sukkur-Hyderabad Motorway to the private sector to finance, build and operate it for 25 years and sought expedited mineral development through coordinated guidance to the provinces. The decisions were taken at two separate meetings presided over by Minister for Planning, Development and Special Initiatives Asad Umar. Under the decision, the “private party will finance construction of the project, operate it for a defined concession period and transfer it back to National Highway Authority (NHA), at no cost at the end of concession period of 25 years,” a senior government official said who attended a meeting of the board of directors of Public Private Partnership Authority (PPPA).

Despite system constraints, the Liquefied Natural Gas (LNG) supplies into the system increased by almost 14 per cent during calendar 2019 over the preceding year and reduced gas shortfall by 20-25pc. The two LNG terminals operating in the country reported to have pumped more than 393.6 billion cubic feet (BCF) of gas into the national gas distribution network in 2019 compared to 345.6 BCF of 2018, showing an increase of 14pc, a Petroleum Division official said. He said the lower economic growth rate coupled with higher prices restricted the key consumer groups from taking full advantage of the available terminal capacity. In 2019 the country imported 7.57 million tonnes of LNG through these terminals which handled 123 LNG cargo ships from Qatar, Australia and other European countries.

In the wake of massive shortfalls in revenue collection, Adviser to the Prime Minister on Finance and Revenue Dr Hafeez Shaikh on Wednesday held a detailed meeting with top tax officials and expressed his displeasure over Federal Board of Revenue’s (FBR) performance in the first half of the current fiscal year. During his first visit to the FBR headquarters after assuming charge on April 20, 2019, the adviser asked FBR officials to take extraordinary measures to increase revenue collection to a level close to the revised target of Rs5.23 trillion.

Market is expected to remain volatile during current trading session.

Technical Analysis

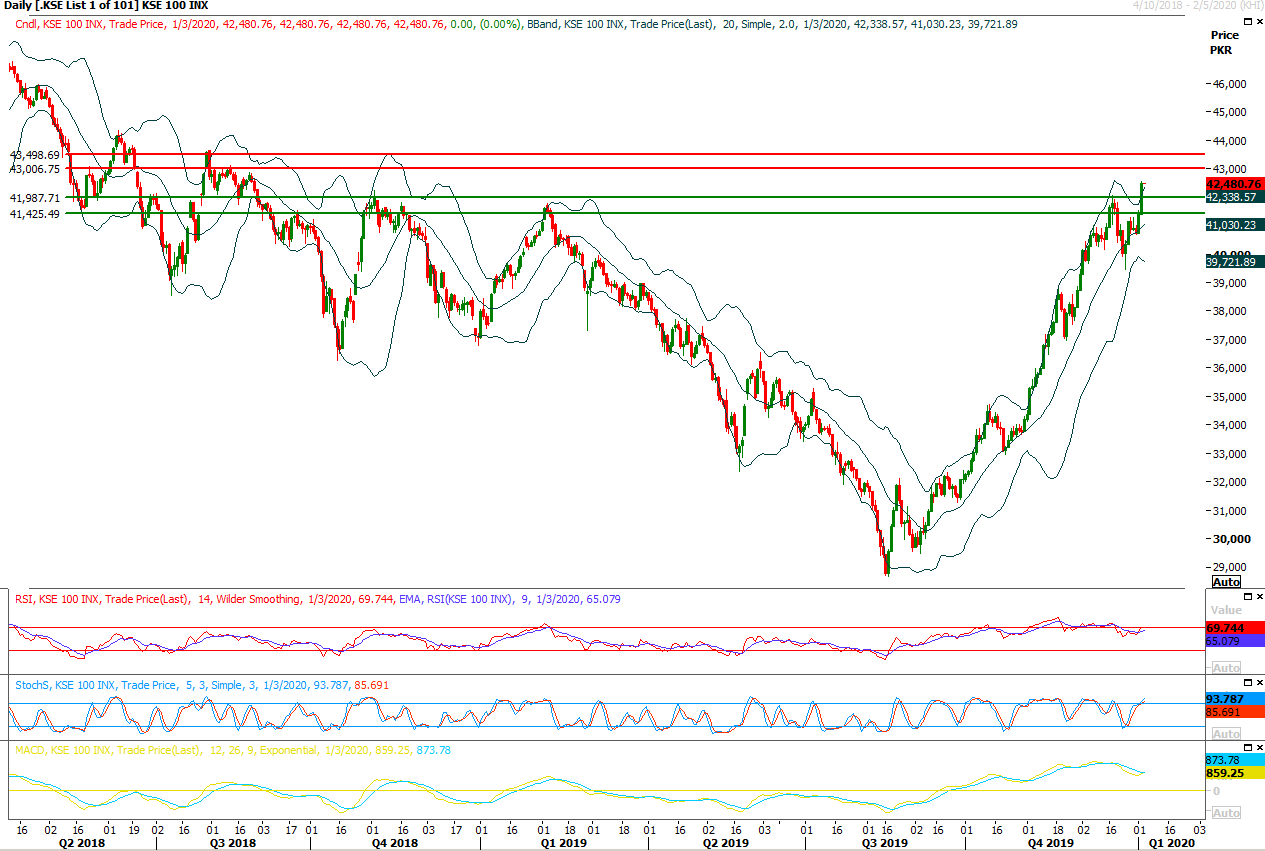

The Benchmark KSE100 index have succeed in penetration above its major resistant regions during last two trading session and now those regions would react as strong supports. As of now index would try to target 43,000 points where it could face a slight resistance meanwhile in case of any pressure index would have supportive regions standing at 41,900 points. It's recommended to stay cautious and wait for today's closing before initiating new positions. Index is trying to overcome uncertainty which was prevailing since last month and it would try to target 43,600 and 43,800 points if it would succeed in closing above 43,000 points on daily chart.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.