Previous Session Recap

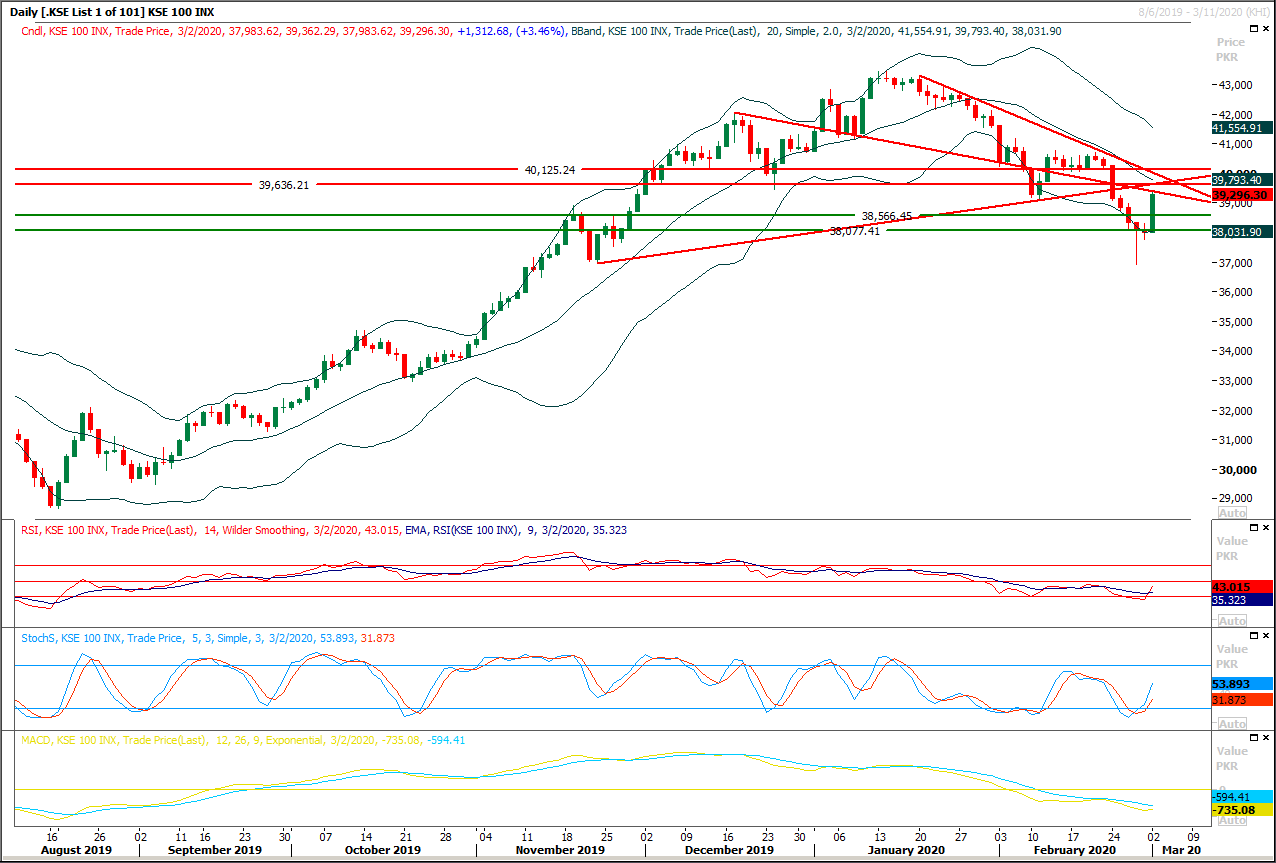

Trading volume at PSX floor increased by 13.07 million shares or 6.47% on DoD basis, whereas the benchmark KSE100 index opened at 38,077.30, posted a day high of 39,362.29 and a day low of 38,077.30 points during last trading session while session suspended at 39,296.30 points with net change of 1312.68 points and net trading volume of 157.90 million shares. Daily trading volume of KSE100 listed companies also dropped by 5.30 million shares or 3.25% on DoD basis.

Foreign Investors remained in net selling positions of 11.77 million shares and value of Foreign Inflow dropped by 2.45 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani remained in net long positions of 0.08 and 0.21 million shares but Foreign Corporate remained in net selling positions of 12.06 million shares respectively. While on the other side Local Companies, Mutual Fund and Insurance Companies remained in net long positions of 3.38, 16.03 and 6.52 million shares but Local Individuals, Banks, NBFCs and Brokers remained in net selling positions of 8.29, 2.28, 0.33 and 3.83 million shares respectively.

Analytical Review

Global shares extend rebound on hopes of G7 support

Global shares and oil prices extended their rebound on Tuesday on mounting speculation policymakers around the world would move to ease the economic fallout from the spreading coronavirus, ahead of a conference call by Group of Seven heads. Finance ministers from the group are expected to hold a conference call on Tuesday (1200 GMT), sources said, to discuss measures to deal with the economic impact of the coronavirus outbreak. “There are hopes that G7 countries will take some sort of coordinated actions to fight the virus, possibly including fiscal spending,” said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui DS Asset Management. The European Central Bank on Monday joined the chorus of central banks signalling a readiness to deal with the growing threats from the outbreak. Earlier messages from the U.S. Federal Reserve that it was prepared to act weighed on the greenback against many other major currencies.

Inflation eases to 12.4pc in February

The inflation rate fell to 12.4 per cent in February from 14.6pc the previous month because of various measures taken by the government to contain inflation, the Pakistan Bureau of Statistics (PBS) stated on Monday. For the first time since July 2019, inflation measured by the Consumer Price Index (CPI) has seen downward trend owing to a combination of measures, including improvement in supply of essential kitchen items and State Bank’s tight monetary policy. Prime Minister Imran Khan took to Twitter to appreciate cabinet’s decisions that led to reduction in inflation, including subsidy on products through utility stores. “We will continue pursuing measures to bring down inflation and reduce burden on citizens,” he said.

Unbudgeted subsidy ruined economy, says minister

Minister for Energy Omar Ayub Khan has accused the previous Pakistan Muslim League-Nawaz (PML-N) government of destroying the country’s economy, revealing that it had given an unbudgeted subsidy of Rs115 billion to the energy sector in its last year in power. Winding up the discussion on a motion about rising inflation in the Senate on Monday, he said the circular debt increased by Rs450bn in a single year when the PML-N government chose not to raise the power tariff for two years preceding the general elections for political expediency. He said the PML-N government had left a circular debt of Rs250bn in the gas sector.

Pakistan, UK trade volume in 2019 remained £2,043m

The trade volume between Pakistan and the United Kingdom (UK) during the calendar year, January-December 2019, remained £2,043 Million showing an increase of six percent as compared to the corresponding period last year (2018), High Commission sources said. Trade and Investment Wing of Pakistan High Commission London Head Shafiq A Shahzad told APP that the UK is an important trading partner of Pakistan. He said that in fact, the UK is also the 3rd largest destination of the Pakistani exports globally and the top destination within (European Union (EU). Shahzad said within EU, UK is also main source of Foreign Direct Investment (FDI) in Pakistan. Pakistan, he said, is also one of the largest beneficiaries of funding through British Department for International Development (DFID) programme. “All these facts prove the commercial importance of UK for Pakistan”, he remarked.

Exports jump 13.6pc in February

Pakistan’s merchandise exports posted double-digit growth during February reversing the declining trend. Trade analysts believe the growth is due to global diversion of orders from China owing to the spread of coronavirus in the country. The drop in exports’ proceeds had started since December 2019 when it fell by 3.8 per cent while a similar quantum of decline was seen in January. The February figures showed a 13.6pc growth over the last year, data released by the Commerce Division showed on Monday. The Pakistan Bureau of Statistics usually releases official figures at the end of first week of every month. However, the Adviser to PM on Commerce Razak Dawood shared provisional data of customs only on Monday.

Global shares and oil prices extended their rebound on Tuesday on mounting speculation policymakers around the world would move to ease the economic fallout from the spreading coronavirus, ahead of a conference call by Group of Seven heads. Finance ministers from the group are expected to hold a conference call on Tuesday (1200 GMT), sources said, to discuss measures to deal with the economic impact of the coronavirus outbreak. “There are hopes that G7 countries will take some sort of coordinated actions to fight the virus, possibly including fiscal spending,” said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui DS Asset Management. The European Central Bank on Monday joined the chorus of central banks signalling a readiness to deal with the growing threats from the outbreak. Earlier messages from the U.S. Federal Reserve that it was prepared to act weighed on the greenback against many other major currencies.

The inflation rate fell to 12.4 per cent in February from 14.6pc the previous month because of various measures taken by the government to contain inflation, the Pakistan Bureau of Statistics (PBS) stated on Monday. For the first time since July 2019, inflation measured by the Consumer Price Index (CPI) has seen downward trend owing to a combination of measures, including improvement in supply of essential kitchen items and State Bank’s tight monetary policy. Prime Minister Imran Khan took to Twitter to appreciate cabinet’s decisions that led to reduction in inflation, including subsidy on products through utility stores. “We will continue pursuing measures to bring down inflation and reduce burden on citizens,” he said.

Minister for Energy Omar Ayub Khan has accused the previous Pakistan Muslim League-Nawaz (PML-N) government of destroying the country’s economy, revealing that it had given an unbudgeted subsidy of Rs115 billion to the energy sector in its last year in power. Winding up the discussion on a motion about rising inflation in the Senate on Monday, he said the circular debt increased by Rs450bn in a single year when the PML-N government chose not to raise the power tariff for two years preceding the general elections for political expediency. He said the PML-N government had left a circular debt of Rs250bn in the gas sector.

The trade volume between Pakistan and the United Kingdom (UK) during the calendar year, January-December 2019, remained £2,043 Million showing an increase of six percent as compared to the corresponding period last year (2018), High Commission sources said. Trade and Investment Wing of Pakistan High Commission London Head Shafiq A Shahzad told APP that the UK is an important trading partner of Pakistan. He said that in fact, the UK is also the 3rd largest destination of the Pakistani exports globally and the top destination within (European Union (EU). Shahzad said within EU, UK is also main source of Foreign Direct Investment (FDI) in Pakistan. Pakistan, he said, is also one of the largest beneficiaries of funding through British Department for International Development (DFID) programme. “All these facts prove the commercial importance of UK for Pakistan”, he remarked.

Pakistan’s merchandise exports posted double-digit growth during February reversing the declining trend. Trade analysts believe the growth is due to global diversion of orders from China owing to the spread of coronavirus in the country. The drop in exports’ proceeds had started since December 2019 when it fell by 3.8 per cent while a similar quantum of decline was seen in January. The February figures showed a 13.6pc growth over the last year, data released by the Commerce Division showed on Monday. The Pakistan Bureau of Statistics usually releases official figures at the end of first week of every month. However, the Adviser to PM on Commerce Razak Dawood shared provisional data of customs only on Monday.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index had succeeded in finding support at 37,000 points for a short term basis after generating an evening shooting star on monthly chart. As of now it's expected that index would try to take an intraday spike to retest its resistant region which fall on supportive trend line of its descending wedge. Initially index seems to target 39,700 points where it would face major resistant but breakout above that region would call for 40,000 points and 40,200 points. It's recommended to trade with strict stop loss and swing trading could be beneficial between 37,000 points and 40,200 points. Overall momentum would remain bearish and index would continue its bearish journey after a small correction therefore it's recommended to avoid initiating long positions for longer run.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.